*** Proof of Product ***

Exploring the Essential Features of “Mining Financial Model & Valuation – Tim Vipond – CFI Educatio”

In this course, you’ll learn how to build financial models and valuations for a natural resources companies with defined, not perpetual, life cycles.

- Learn key mining terms and definitions

- Explore the mining life cycle from start to finish

- Understand different valuation methodologies such as net asset value (NAV), P/NAV, P/CF, and total acquisition cost (TAC)

Overview

Recommended Prep Courses

These preparatory courses are optional, but we recommend you to complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:

- Building a 3 Statement Financial Model

- Business Valuation Modeling

Mining Financial Modeling & Valuation Course Overview

Master the art of building a financial model to value a mining company, complete with assumptions, financials, valuation, sensitivity analysis, and output charts. In this mining financial modeling course, we will work through a case study of a real mining valuation for an asset by pulling information from the Feasibility Study, inputting it into Excel, building a forecast, and valuing the asset.

Mining Financial Modeling & Valuation Course Objectives

By the end of this mining valuation course you will be able to:

- Understand key mining terms and definitions used in the industry and in valuation

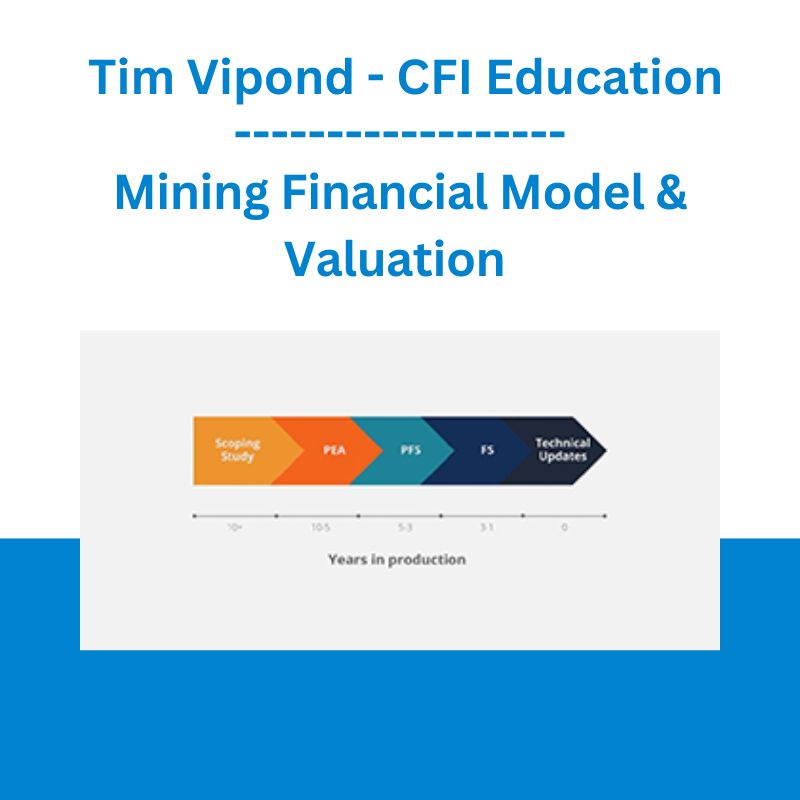

- Understand the mining life cycle from start to finish for assets, projects, and operating mines

- Read and extract the important information from a mining technical report (feasibility study)

- Input key assumptions into a financial model that will drive revenue, expenses, and cash flow in the forecast

- Calculate production statistics based on a detailed mine plan from the technical report

- Build financial statements based on the mine plan

- Perform a discounted cash flow DCF valuation of the mining asset in Excel

- Build sensitivity analysis to test for different input assumptions

- Output relevant graphs and charts to illustrate the investment opportunity

- Understand valuation methods such as Net Asset Value (NAV), P/NAV, P/CF, Total Acquisition Cost (TAC)

Who should take this mining valuation course?

Master mining valuation and learn how to value a mining company in Excel. This course is designed for professionals seeking careers in investment banking, equity research, corporate development and financial planning an analysis (FP&A). This course simulates the experience of working as a corporate development professional at a mining company evaluating an acquisition opportunity. The objective is to take all the information from the technical study, put it into Excel, and determine the net asset value (NAV) of the mine. The completed model will serve as a useful tool for testing different metal prices and other assumptions such as grade, recovery rate, unit operating costs, capital expenditures, and more.

Prep Courses

This is an advanced mining valuation course and assumes a solid understanding of the following courses:

- Excel Crash Course

- Building a Financial Model in in Excel

- Business Valuation

What you’ll learn

Introduction to the Mining Industry

Course introduction

Downloadable files

Mining life cycle – types of assets

Technical reports

Reserves and resources

Key terms and definitions

Key financial concepts

Interactive Exercise 1

Valuation Metrics

Net present value (NPV)

P/NAV ratio

P/CF ratio

EV/Resource ratio

Total acquisition cost (TAC)

Interactive Exercise 2

Financial Model – Assumptions Section

Introduction

Model layout and structure

Conversion rates

Metal prices

Production schedule

Reserve and resources

Mill capacity, royalties, and payability

Operating costs

Capital costs

Working capital and discount rate

Interactive Exercise 3

Financial Model – Mining Section

Introduction

Mining schedule

Mining schedule – continue

Milling schedule

Interactive Exercise 4

Financial Model – Financial Statement Section

Introduction

Revenue and royalties

Operating costs

Capital costs and all-in costs

Interactive Exercise 5

Operating profit

Net income

Changes in working capital

Interactive Exercise 6

Financial Model – DCF Valuation

Introduction

Free cash flow

Discount factor

NPV and IRR

Payback

Interactive Exercise 7

Sensitivity Analysis

Introduction

Break-even

IRR data table

NPV data table

Interactive Exercise 8

Summary Charts & Graphs

Free cash flow chart

Cumulative FCF / break-even chart

Production chart

Completed Model & Case Study

Model structure and design Draft

Key takeaways Draft

Completed model and extra case study

Summary

Qualified Assessment

Qualified assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/