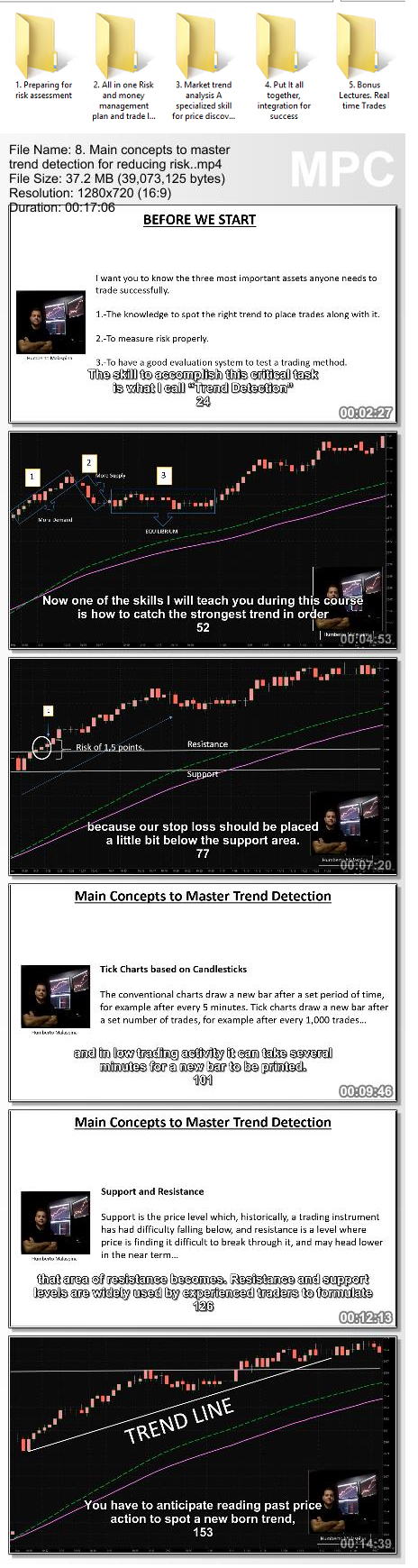

*** Proof of Product ***

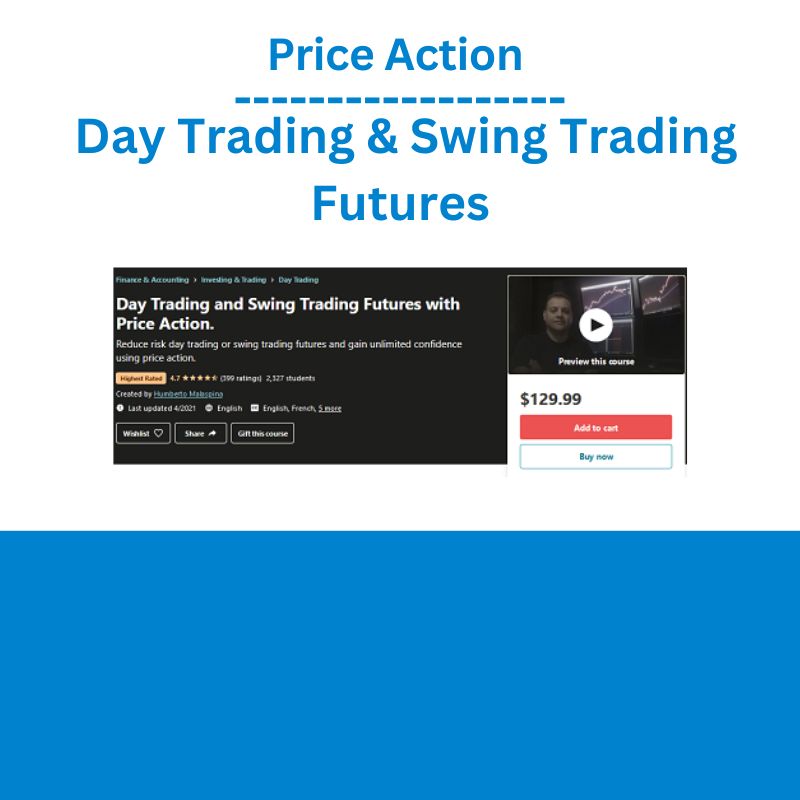

Exploring the Essential Features of “Price Action – Day Trading & Swing Trading Futures“

Course Title: Mastering Futures Trading – Day Trading and Swing Trading Strategies

Overview:

Welcome to “Mastering Futures Trading,” a comprehensive course designed to equip you with the skills and knowledge needed for successful day trading and swing trading in the financial markets. Whether you’re interested in futures, stocks, or forex, this course provides valuable insights into acquiring mastery in trading, enhancing your risk and money management plan, and upgrading your trading methodology to read price action effectively.

What You’ll Learn:

- Acquire the skills for higher levels of trading mastery.

- Improve your Risk and Money Management Plan.

- Upgrade your trading methodology to correctly interpret price action.

- Make high probability trades with minimal risk across various time frames.

Requirements:

Students should have a basic understanding of Microsoft Excel, the Law of Supply and Demand, and Candlestick Charting.

Course Description:

In this course, we’ll delve into both day trading and swing trading, comparing the nuances of each to help you make informed decisions based on your preferences and market conditions. Understanding the psychological aspects of trading, particularly fear and greed, is crucial for navigating the markets successfully. We’ll explore how to control these emotions and turn them into tools for making strategic trading decisions.

Key Questions for Consideration:

- What motivates you to take this course?

- What do you aim to accomplish through this course?

- Where are you currently in your trading journey, and where do you aspire to be?

- What challenges are you facing in your trading at the moment?

- How would having the information in this course address your current concerns?

Important Considerations Before Enrolling:

This course focuses on short to medium-term trading rather than long-term investing. If you’re new to trading, it’s recommended to start with swing trading before venturing into day trading. The course emphasizes the importance of education, practice with a demo account, and gradually transitioning to a live account once a positive expectancy is established.

Common Trading Challenges Addressed:

If you’ve been grappling with issues such as losses, premature profit-taking, fear of pulling the trigger, unclear stop-loss placement, or difficulties in understanding price action, this course aims to provide solutions and guidance.

Flexible Trading Methodology:

The course introduces a flexible trading strategy applicable to any financial instrument and time frame. It emphasizes the fractal nature of trading phenomena, allowing you to adapt the method to your preferred market and timeframe as you gain experience.

Risk Management Focus:

Understanding that predicting market behavior is nearly impossible, the course places a significant emphasis on risk reduction. By mastering risk management, you can create a mindset that controls emotions, minimizes fear, and facilitates profitable trading decisions.

Course Content:

The course covers:

- Developing the mindset for trading mastery.

- Improving Risk and Money Management Plans.

- Upgrading trading methodology for accurate price action analysis.

- Applying skills and tools to increase trade probabilities while reducing risk.

- Integrating risk control, money management, and price action for a successful trading business.

Continuous Updates:

The course will be regularly updated with any improvements to the trading methodology, ensuring you have access to the latest insights and strategies.

Final Thoughts:

If you’re serious about surviving and thriving in the challenging world of trading, this course provides essential tools to develop your trading method, manage risk effectively, and increase your chances of success. Remember, trading requires dedication, perseverance, and continuous learning.

Risk Disclosure:

Trading involves a high level of risk, and participants should only speculate with money they can afford to lose. The course provides educational content, and individuals should carefully consider their investment objectives and seek independent advice.

Who Should Take This Course:

- Anyone seeking to improve their trading plan and reduce risk.

- Traders looking to enhance their knowledge of trend detection, risk analysis, and money management.

- Students aspiring to achieve better levels of profitability in trading.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Domestic Violence: Treatment Strategies to Stop the Cycle and Heal the Pain - Joan Benz - PESI

Domestic Violence: Treatment Strategies to Stop the Cycle and Heal the Pain - Joan Benz - PESI  Teaches The Runner's Mindset - Joan Benoit Samuelson - MasterClass

Teaches The Runner's Mindset - Joan Benoit Samuelson - MasterClass  The Perfect Love Match Free Guide - Chris Jackson

The Perfect Love Match Free Guide - Chris Jackson