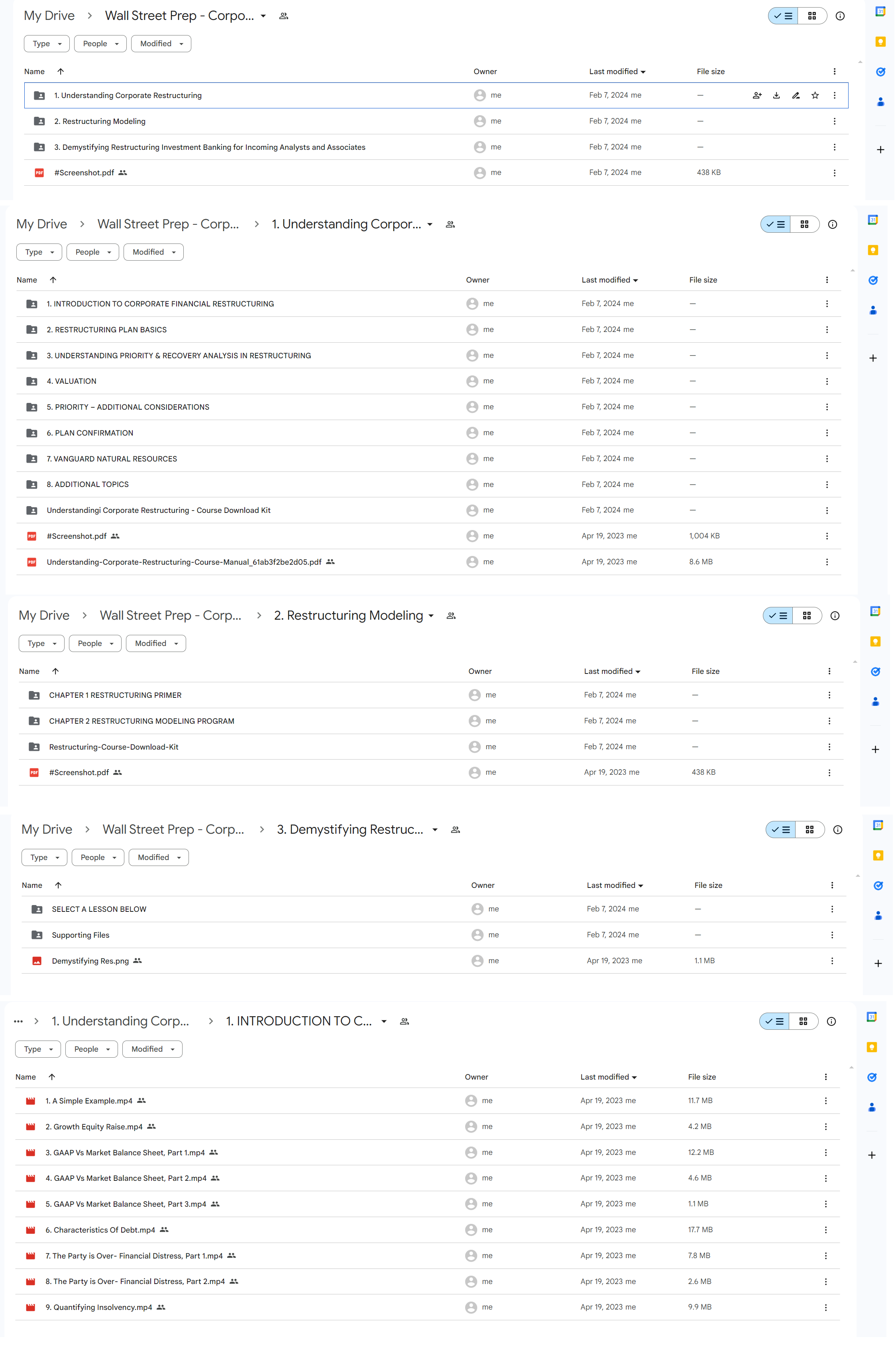

*** Proof of Product ***

Exploring the Essential Features of “Wall Street Prep – Corporate Restructuring“

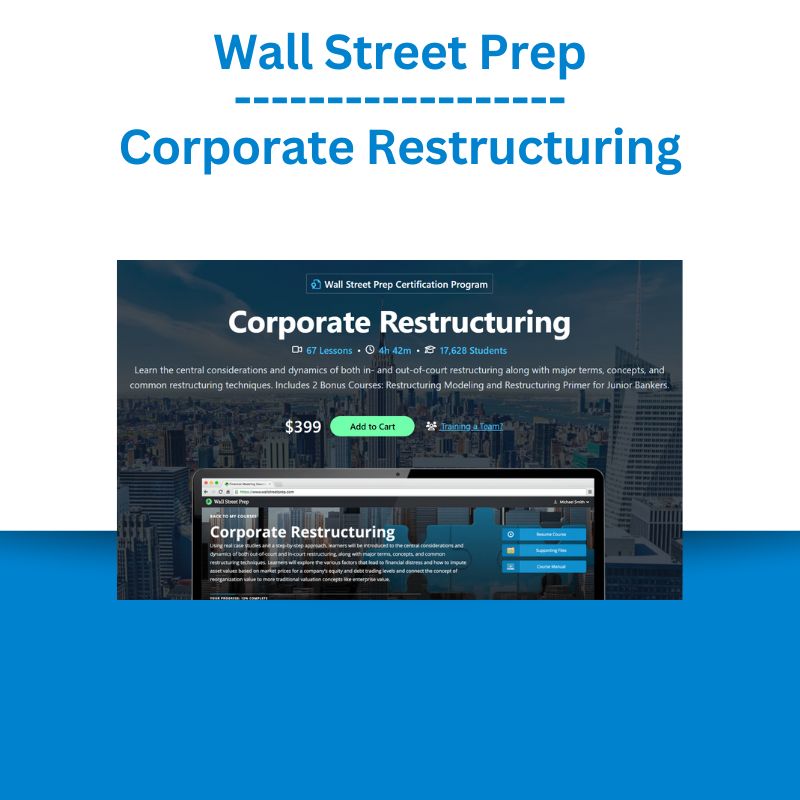

Learn the central considerations and dynamics of both in- and out-of-court restructuring along with major terms, concepts, and common restructuring techniques. Includes 2 Bonus Courses: Restructuring Modeling and Restructuring Primer for Junior Bankers.

Understand the Restructuring and Bankruptcy Process

Step-by-Step Video and Real Case Studies

Using real case studies and a step-by-step approach, you will learn the central considerations and dynamics of both out-of-court and in-court restructuring, along with major terms, concepts, and common restructuring techniques.

Taught by Experienced Restructuring Instructor-Practitioners

This is the same training program Wall Street Prep delivers to restructuring groups at some of the world’s top investment banks. It is taught by former investment bankers who have worked on high-profile corporate restructuring deals.

What You Will Learn

COURSE 1: UNDERSTANDING CORPORATE RESTRUCTURING

The Restructuring & Bankruptcy Framework

- Explore the various factors that lead to financial distress.

- Learn how to impute asset values based on market prices for a company’s equity and debt trading levels.

- Connect the concept of reorganization value to more traditional valuation concepts like enterprise value.

- Understand priority of claims.

- Learn how inter-creditor agreements, secured vs unsecured, maturity and corporate structure all play a role in restructuring outcomes.

- Explore how the competing motivations and interests of the stakeholders in restructuring all impact the process.

Valuation & Recovery Analysis and Distressed M&A

- Dive deeper into common analyses, including valuation based on management projections, liquidity analysis, a recovery waterfall, and potential equity value post emergence.

- Learn how restructuring fits within a variety of strategic alternatives for firms under distress.

- Understand the mechanics of credit bidding and 363 sales

- Model valuation and capital structure scenarios and the impact on recoveries to the various creditors.

BONUS COURSE: RESTRUCTURING MODELING

Model some of the most challenging aspects of a bankruptcy, including:

- Working capital reclassifications such as critical vendors/AP.

- DIP financing, borrowing base and availability calculations, adequate protection payments.

- Balance sheet roll-forward schedules that maintain a consistent link structure to the cash flow statement and increase transparency.

- Fees, rejection claims and CODI.

- Model recoveries at various operating scenarios.

- Construction of a recovery waterfall that can accommodate scenarios that deviate from the absolute priority rule.

- Using conditional formatting and Excel’s native date formulas to sensitize for different filing and emergence date scenarios.

- Avoiding circular references in the model while maintaining model integrity.

- Incorporating best practices for error-proofing, auditing, and model efficiency.

- Understanding how Fresh Start Accounting affects the model.

BONUS COURSE: DEMYSTIFYING RESTRUCTURING INVESTMENT BANKING

- For incoming restructuring bankers and current bankers looking to further their restructuring or distressed debt knowledge.

- Restructuring IB process overview.

- Learn the skills you’ll need early in your IB career.

- Walk through the analyses and modeling-related techniques used by early-career IB analysts and associates using a case-study.

- Assumes little to no prior knowledge of restructuring.

Who is This Program For?

- Restructuring Investment Banking Professionals

- Distressed Debt Investors

- FP&A and Corporate Finance

- Turnaround Consultants & Advisors

- Private Equity Professionals

- Anyone interested in corporate restructuring

What’s Included

Understanding Corporate Restructuring

Using real case studies and a step-by-step approach, learners will be introduced to the central considerations and dynamics of both out-of-court and in-court restructuring, along with major terms, concepts, and common restructuring techniques. Learners will explore the various factors that lead to financial distress and how to impute asset values based on market prices for a company’s equity and debt trading levels and connect the concept of reorganization value to more traditional valuation concepts like enterprise value.

Introduction to Corporate Financial Restructuring

1. A Simple Example

2. Course Downloads

3. Growth Equity Raise

4. GAAP Vs Market Balance Sheet, Part 1

5. GAAP Vs Market Balance Sheet, Part 2

6. GAAP Vs Market Balance Sheet, Part 3

7. Characteristics Of Debt

8. The Party is Over: Financial Distress, Part 1

9. The Party is Over: Financial Distress, Part 2

10. Quantifying Insolvency

11. Restructuring Introduction Review

Restructuring Plan Basics

12. Options Under Distress

13. In-court Vs Out-of-court Restructuring, Part 1

14. In-court Vs Out-of-court Restructuring, Part 2

15. In-court Vs Out-of-court Restructuring, Part 3

16. Out-of-court Restructuring Recovery Analysis, Part 1

17. Out-of-court Restructuring Recovery Analysis, Part 2

18. Restructuring Plan Basics Review

Understanding Priority & Recovery Analysis in Restructuring

19. Treatment Of Claims

20. Priority Of Unsecured Claims

21. DIP Financing

22. Summary – Priority Of Claims And Recovery Waterfall

23. Recovery Waterfall Scenarios, Part 1

24. Recovery Waterfall Scenarios, Part 2

25. Other Restructuring Concepts

26. Castex Recovery Waterfall Example

27. Unallowed Claims Section

28. Restructuring Plan Revisited, Part 1

29. Restructuring Plan Revisited, Part 2

30. Restructuring Plan Revisited, Part 3

31. How Stakeholders May React To The Restructuring Plan

32. Priority & Recovery Analysis Review

Valuation

33. Role Of Valuation In Restructuring

34. Recovery Analysis With Different Valuation And Debt Capacity

35. Collateral Valuation

36. Distressed Debt Investor Perspective

37. Valuation Review

Priority – Additional Considerations

38. Determinants Of Priority: Collateral

39. Determinants Of Priority: Inter-creditor Subordination

40. Determinants Of Priority: Inter-creditor Subordination Exercise

41. Determinants Of Priority: Maturity Of Claim, Part 1

42. Determinants Of Priority: Maturity Of Claim, Part 2

43. Determinants Of Priority: Open Market Purchase Of Debt

44. Determinants Of Priority: Maturity Of Claim Additional Considerations

45. Determinants Of Priority: Corporate Structure, Part 1

46. Determinants Of Priority: Corporate Structure, Part 2

47. Protection Against Structural Subordination

48. Covenants

49. Substantive Consolidation

50. Equitable Subordination

51. Priority – Additional Considerations Review

Plan Confirmation

52. Plan Of Reorganization

53. Plan Approval Must Meet 4 Tests

54. Plan Confirmation Review

Vanguard Natural Resources

55. Vanguard Background

56. Vanguard DIP, Part 1

57. Vanguard DIP, Part 2

58. Vanguard DIP, Part 3

59. Liquidation Analysis

60. Vanguard Projections And Valuation

61. Fulcrum Security

62. Proposed Plan

63. Estimated Recoveries

64. Estimated Recoveries Review

65. Plan Feasibility

Additional Topics

66. Credit Bidding And Stalking Horse10:28

67. Vanguard Resources & Additional Topics Review

Restructuring Modeling

This course is designed to teach restructuring and bankruptcy modeling to students and professionals pursuing careers in restructuring, bankruptcy and distress. Using the Borders bankruptcy as our primary case study, we begin with an overview of the restructuring and bankruptcy framework. Then we will learn to build an advanced bankruptcy model from scratch, incorporating bankruptcy specific elements like DIP financing, the creation of liabilities subject to compromise, working capital drivers, cancellation of debt income, and Fresh Start accounting. We conclude the course with valuation analysis and a recovery analysis, where we will layer various valuation scenarios onto the model to analyze possible recoveries to the various creditors.

Chapter 1: Restructuring Primer

1. Course Downloads

2. Restructuring Overview, Part 1

3. Restructuring Overview, Part 2

4. Restructuring Overview, Part 3

5. Restructuring Overview, Part 4

Chapter 2: Restructuring Modeling Program

6. Introduction

7. Model Structure

8. Model Structure, Part 2

9. Inputting Historicals

10. Forecasting the Income Statement

11. Forecasting Working Capital

12. Forecasting Property, Plant, and Equipment (PP&E)

13. Forecasting Goodwill and Financing Fees

14. Forecasting Accounts Payable

15. Forecasting Accounts Payable, Part 2

16. Forecasting Accounts Payable, Part 3

17. Accrued Liabilities and Other Long Term Liabilities

18. Lease Rejection Claims and Professionals Fees

19. Cleaning up the Balance Sheet and Income Statement

20. Debt Introduction and Modeling Prepetition Term Loans

21. Modeling the Cash Flow Statement

22. Modeling the Prepetition Revolver, Part 1

23. Modeling the Prepetition Revolver, Part 2

24. Modeling the DIP Revolver

25. Referencing Debt Related Forecasts into the CFS

26. Valuation and Debt Capacity

27. Sources and Uses of Funds

28. Modeling the Priority of Claims Waterfall

29. Exit Revolver

30. Debt Reinstatement

31. Modeling the Equity

32. Completing the Model

33. Additional Topics: Fresh Start Accounting

34. Additional Topics: The Thirteen Week Cash Flow

Demystifying Restructuring Investment Banking for Incoming Analysts and Associates

This course is designed for incoming restructuring bankers and current bankers looking to further their restructuring or distressed debt knowledge. It provides an in-depth overview of restructuring and identify the skills you’ll need in the early days of your restructuring IB career. We begin by introducing the restructuring process as well as common pitchbook and financial analyses in restructuring IB. From there, we take more in-depth look at the analyses and modeling-related techniques utilized by analysts and associates early in their restructuring banking careers. This course assumes little to no prior knowledge of restructuring. Less

Demystifying Restructuring Investment Banking for Incoming Analysts and Associates

1. Introduction and Agenda

2. Overview of IB Restructuring Groups and Role of the Analyst Associate

3. Course Downloads

4. High Level Capital Structure Review

5. Overview of Absolute Priority

6. Comparison of Corporate Levered Debt Alternatives

7. Restructuring Case Study Introduction Arch Coal Industry Dynamics

8. Arch Coal Situation and Restructuring Overview

9. Arch Coal Capital Structure (Pre Bankruptcy)

10. Overview of Frequently Utilized Credit Statistics

11. Capital Structure Analyses in Excel

12. Review of Initial Discussion and Next Steps

13. Forecasting Liquidity and Building Initial Assumptions

14. Building Free Cash Flow Projections

15. Building the Debt Schedule and Credit Statistics

16. Wrap Up Free Cash Flow Projections

17. Revisiting the Arch Coal Restructuring Case

18. DIP Financing Discussion

19. Why Invest in the Arch Coal DIP

20. Excel Analysis of Arch Market Implied Asset Value Post Emergence

21. Excel Analysis of Potential First Lien Lender Recovery

22. Arch Coal Restructuring Plan

23. Sourcing Capital Structure Inputs from Public Filings

24. Sourcing Capital Structure Inputs from Market Data

25. Capital Structure Presentation

26. Using the Long Term Debt Footnote to Build the Cap Table in Excel

27. Arch’s 1st Lien Debt: Credit Facilities & Term Loan

28. Arch’s 2nd Lien Notes

29. Arch’s Unsecured Notes

30. Cap Table and Presentation Conclusion

31. Demystifying Restructuring IB Review

Course Highlights

- Used on the Street

This is the same comprehensive course our corporate clients use to prepare their analysts and associates. - Real Case Studies

This course uses actual financial filings to show how restructuring is done in the real world. - Taught by Bankers

Our instructors are former I-bankers who give lessons real-world context by connecting it to their experience on the desk.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Alphashark - The AlphaShark SV-Scalper

Alphashark - The AlphaShark SV-Scalper  Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle  Forexmentor - Recurring Forex Patterns

Forexmentor - Recurring Forex Patterns  Matthew Kratter - Trader University

Matthew Kratter - Trader University  Trade Like Mike - The TLM Playbook 2022

Trade Like Mike - The TLM Playbook 2022  Emanuele Bonanni - My Trading Way

Emanuele Bonanni - My Trading Way  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  Matan Feldman - The 13-Week Cash Flow Modeling - Wall Street Prep

Matan Feldman - The 13-Week Cash Flow Modeling - Wall Street Prep  Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025