*** Proof of Product ***

Exploring the Essential Features of “”Jigsaw – Order Flow Training Course“

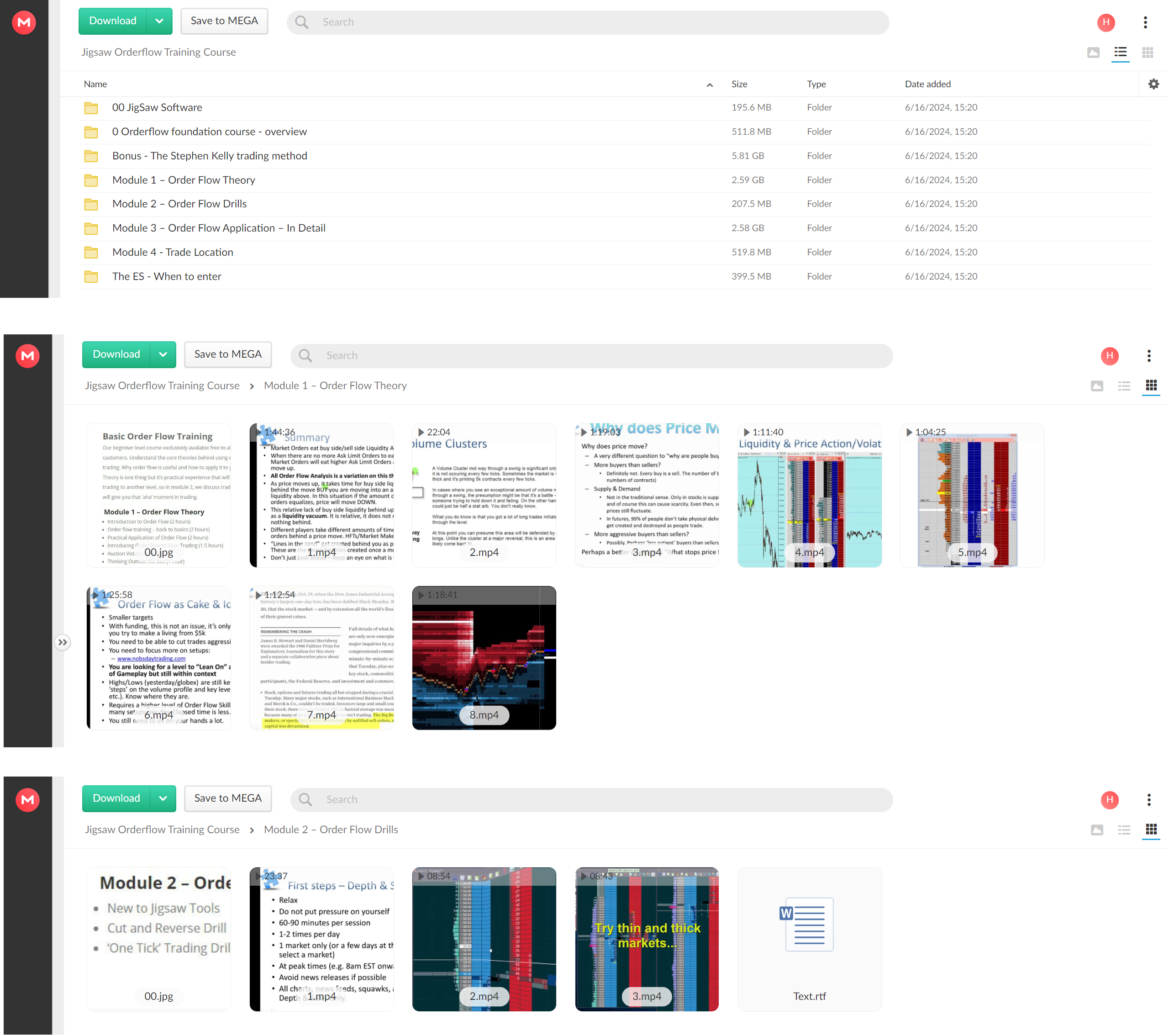

Basic Order Flow Training

Our beginner level course exclusively available free to all Jigsaw customers. Understand the core theories behind using order flow in trading. Why order flow is useful and how to apply it to your trading. Theory is one thing but it’s practical experience that will take your trading to another level, so in module 2, we discuss trading drills that will give you that ‘aha’ moment in trading.

Module 1 – Order Flow Theory

- Introduction to Order Flow (2 hours)

- Order flow training – back to basics (2 hours)

- Practical Application of Order Flow (2 hours)

- Introducing Order Flow to Your Trading (1.5 hours)

- Auction Vista (1.5 hours)

- Thinking Outside the Box (1 hour)

Module 2 – Order Flow Drills

- New to Jigsaw Tools

- Cut and Reverse Drill

- ‘One Tick’ Trading Drill

Advanced Order Flow Training

Trading with Order Flow does not just mean defining and refining market entry points. In the advanced modules, we discuss specific aspects of trading that can be enhanced with Order Flow. Managing your trades, trading in different market conditions, reading reversals and trading without price charts (which is what most prop firms do) and scalping are all aspects of trading that can be massively improved with the use of Order Flow. In module 4, we take a look at trade location, what exactly it is you are trying to acheive as a trader (many have never given this much thought) and developing your own style as a trader.

Module 3 – Order Flow Application – In Detail

- Trade Management with Order Flow/Correlated Markets (1 hour)

- Day Trading Without Charts (1 hour)

- Using Order Flow to read turns/reversals in the market (1 hour)

- Ultra-short term trading (scalping) techniques (1 hour)

- Trading slow, choppy, holiday markets (1.5 hours)

- Trading the opening minutes (1 hour)

- Trading thinner markets like Crude, Dax (40 mins)

Module 4 Trade Location

- Day Trading for Dummies – What it is you are trying to achieve (20 mins)

- Developing your own trading style (1.5 hours)

- Using Swing Charts (20 mins)

Institutional ‘Trading with Price and Order Flow Strategies’

Proprietary trading firms recruit intern traders, usually with no prior trading experience (no bad habits to ‘unlearn’). They teach them how to trade and then give them money to trade and split the profits with them. In partnership with London based proprietary trading firm AXIA, we bring you a training course straight from their trader internship program. This course is exactly what they teach their traders to get them to profit. The course contains videos and a set of valuable exercises to perform on recent days action so that you get a feel for trading certain types of events such as economic news releases. These exercises are performed with the Jigsaw tools.

Beginner

- Objectives, outcomes & methodology

- Introduction

- What the ladder tells you that the charts don’

Intermediate

- Market Participants with Algorithms & HFTs

- Auctioning Exchange and Market Velocity

- Order Flow Price Patterns

- Large Orders

- Replay Skill Development & Test

Advanced

- Trend Reversal Order Flow Patterns

- Replay Skill Development & Test

- Momentum Breakout Order Flow Patterns

- Replay Skill Development & Test

- Practice: Confluence of Order Flow Strategies

Knowledge Share

- Evolution of Order Flow and Price Patterns

- What makes an Elite Order Flow Trader

- Interviews with Elite Order Flow Traders

- Bonus – Advanced Replay Drills and Practice

- Community Learning – Strategy Video sharing

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/