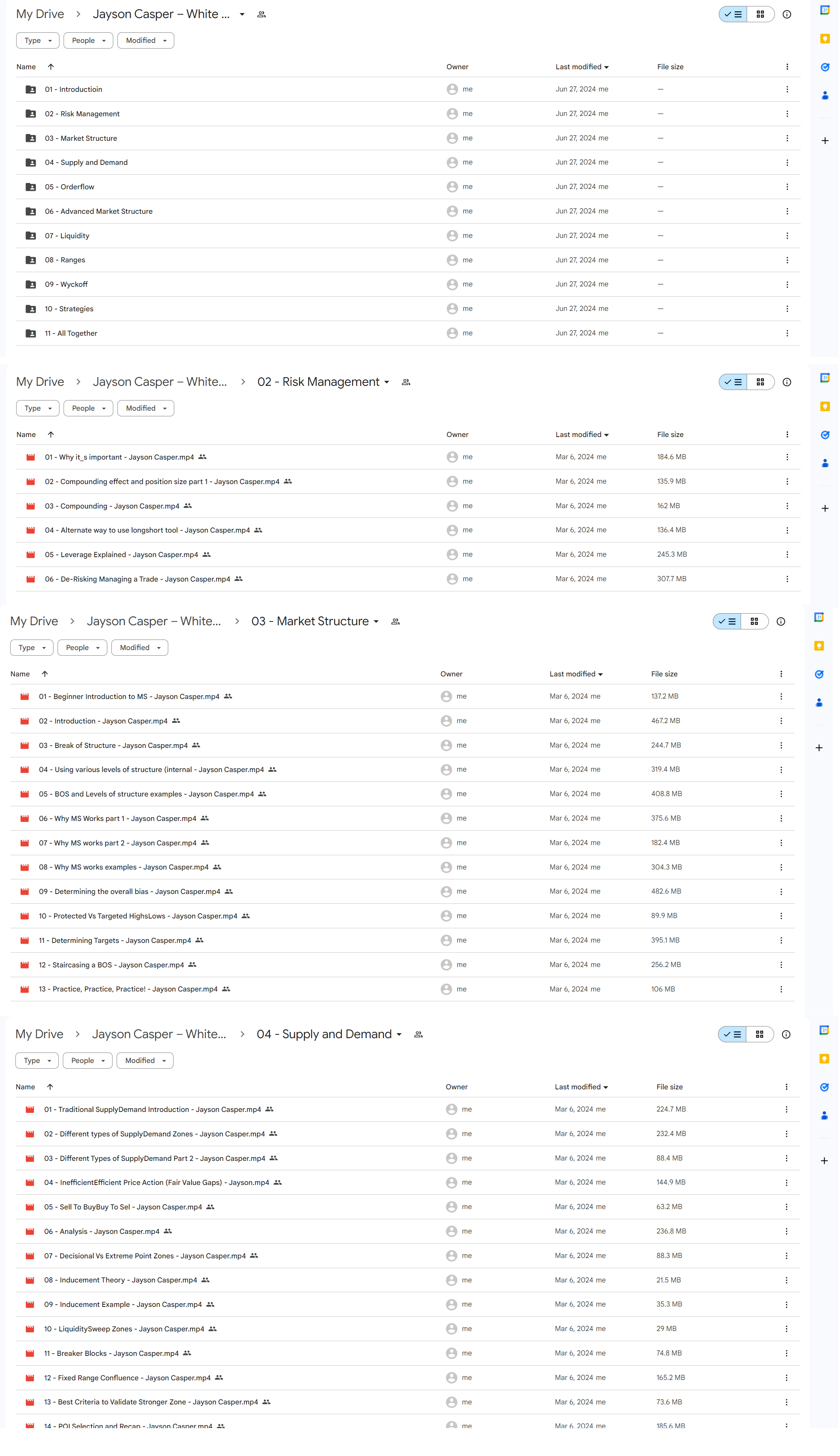

*** Proof of Product ***

Exploring the Essential Features of “Jayson Casper – White Phoenix – The Smart Money Approach to Trading”

Unlock the secrets of the “smart money” and enhance your trading skills with this in-depth course. Gain powerful insights into how institutional investors and other sophisticated market players operate. Understanding their behavior and strategies will give you a critical trading edge. With this knowledge, you can look behind the scenes to better anticipate when big moves and reversals are likely to happen. Implement high-probability setups across any market by trading in alignment with smart money. This jam-packed course covers essential trading principles like risk management, market structure analysis, supply and demand dynamics, and more. Whether you are a beginner looking to build a solid foundation or a seasoned trader wanting to take your skills to the next level, this in-depth training provides the ultimate smart money toolkit to make you a savvier, more efficient trader. The time-tested wisdom of smart money is now at your fingertips.

What Will You Learn?

- How to use risk management effectively

- An in-depth knowledge of market structure and it’s mechanics

- Advanced Market Structure and Orderflow

- How to understand liquidity from an institutional standpoint and liquidity concepts

- How to effectively trade ranges for maximum profit

- Supply and demand: How to identify zones of interest. It’s mechanics, & the most effective way to use supply and demand

- How to identify and trade wyckoff schematics (Both accumulation distribution and reaccumulation and redistribution models)

- Never seen before strategies to maximize your trading account

Course Content

Introduction

Intro Video

Risk Management

Why it’s important

Compounding effect and position size part 1

Compounding

Alternate way to use long/short tool

Leverage Explained

De-Risking / Managing a Trade

Market Structure

Beginner Introduction to MS

Introduction

Break of Structure

Using various levels of structure (internal

BOS and Levels of structure examples

Why MS Works part 1

Why MS works part 2

Why MS works examples

Determining the overall bias

Protected Vs Targeted Highs/Lows

Determining Targets

Staircasing a BOS

Practice, Practice, Practice!

Supply and Demand

Traditional Supply/Demand Introduction

Different types of Supply/Demand Zones

Different Types of Supply/Demand Part 2

Inefficient/Efficient Price Action (Fair Value Gaps)

Sell To Buy/Buy To Sel

Analysis

Decisional Vs Extreme Point Zones

Inducement Theory

Inducement Example

Liquidity/Sweep Zones

Breaker Blocks

Fixed Range Confluence

Best Criteria to Validate Stronger Zone

POI Selection and Recap

Orderflow

Introduction To Orderflow

Range, Initiation, Mitigation, Continuation

Advanced Orderflow/Structure

Getting into a trade 1

Getting into a trade 2

Countertrend Trading

Countertrend Example 1

Countertrend Example 2

Advanced Market Structure

Framework

Overlapping Structure Pulls

Various Levels of MS part 1

Various Levels of MS part 2

Various levels examples part 1

Various levels examples part 2

Follow Up For Lesson 5a and 5b

Using MS To Enter a Trade

Using Advanced MS To Enter a trade BTC

Using Advanced MS To Enter a Trade Forex

Liquidity

Liquidity Introduction

Buy Side/Sell Side Liquidity

Liquidity Curves

Trading Liquidity

Trendlines / Examples part 1

Trendlines / Examples part 2

Trendlines / Examples Recap

Ranges

Introduction To Ranges

Premium Vs Discount Pricing

Deviations

Insignificant/Significant Ranges

Finding Range Trades

Ranges Recap

Wyckoff

Introduction To Wyckoff (Fundamental Approach)

Accumulation Schematics 1/2 (Traditional)

Phases of Wyckoff Explained

Distributions

Simplifying Wyckoff

Accumulation Model 1

Accumulation Model 2

Distribution Model 1

Distribution Model 2

Wyckoff Within Wyckoff POV

Redistribution/Reaccumulation Basics

Power of 3 (Re – distribution/Re – Accumulation)

Backtesting Wyckoff Models

Strategies

Phoenix Deviation Technique

Phoenix Deviation Strategy Examples

Phoenix Range Reversal Models

Phoenix BB Range Strategy

Theory Supply/Demand Flips

S2D/D2S Theorical Example

D2S Flip Example

S2D Flip Example

All Together With Flips

S2D/D2S Example 2

S2D/D2S Example 3/4

S2D/D2S Example 5/6

S2D/D2S Example 7

S2D/D2S Example 8

All Together

Introduction Video

Trade 1 Step 1

Trade 1 Step 2

Trade 1 Step 3

Trade 1 Step 4

Trade 1 Step 5

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/