*** Proof of Product ***

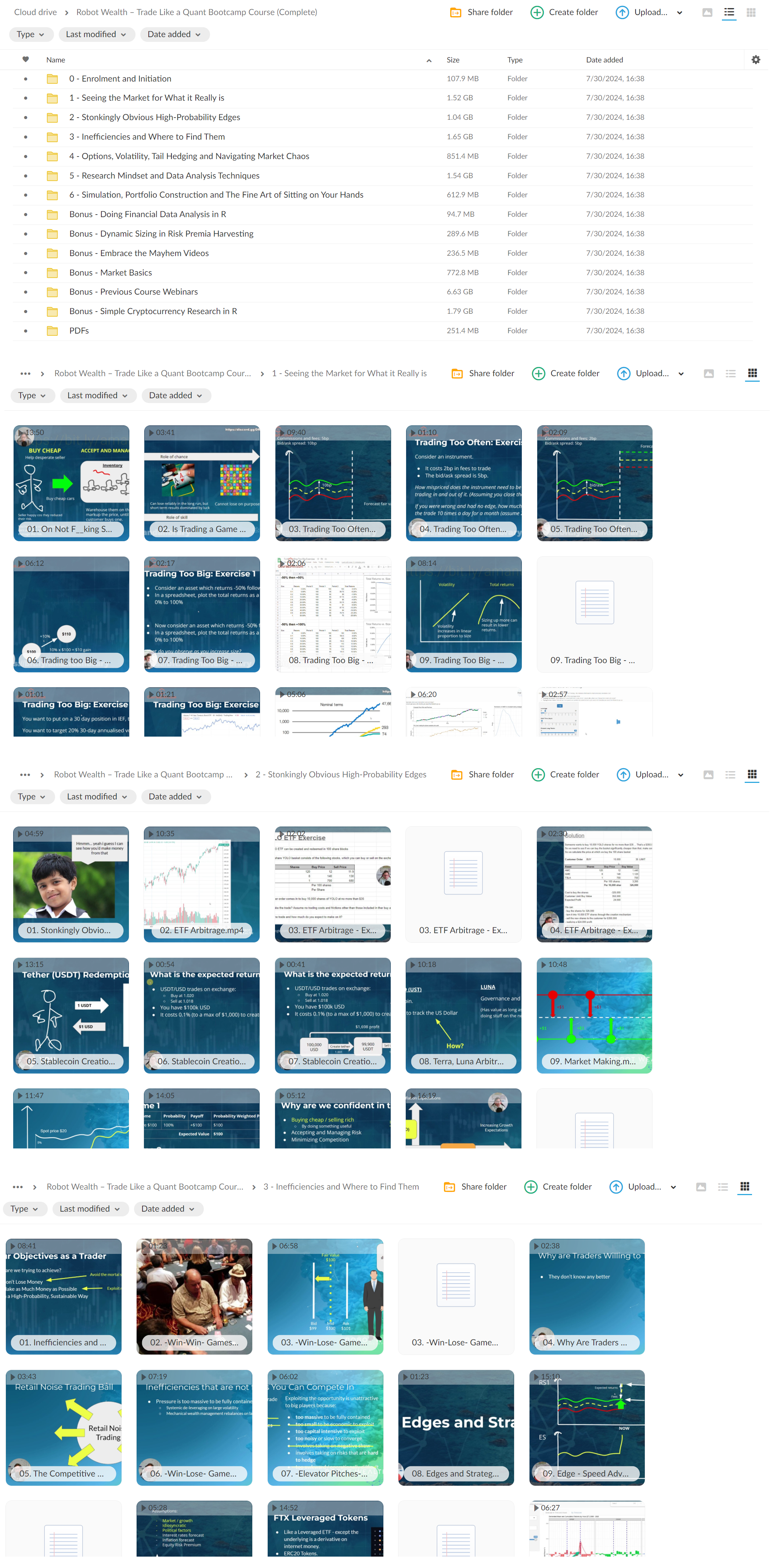

Exploring the Essential Features of “RobotWealth – Trade Like A Quant Bootcamp“

0 – Enrolment and Initiation3 Topics

- Lesson Content

3 Steps

Welcome to Trade like a Quant

Logistics – Where Does it All Happen?

Welcome from James – What Do I want You to Get out of the Course? - 1 – Seeing the Market for What it Really is

Lesson Content

31 Steps

On Not F**king Spiders

Is Trading a Game We Can Lose?

Trading Too Often – Every time you trade you lose money

Trading Too Often – Exercise

Trading Too Often – Exercise Solution

Trading too Big – Don’t get Rekt

Trading Too Big – Exercise 1

Trading Too Big – Exercise 1 Solution

Trading Too Big – Sizing and Volatility Trade-Offs

Trading Too Big – Exercise 2

Trading Too Big – Exercise 2 Discussion

Trying to be a Hero

Try to Lose at Trading!

Understanding the Mortal Sins

Is Trading a Game We Can Win?

Edge, Expectation and Luck

Competition

Price Discovery – The Balancing of Supply and Demand

Price Discovery Examples

Price Discovery Examples: The Limit Order Book

Price Discovery Examples: The Batch Auction

Price Discovery Examples: Auction Exercise

Price Discovery Examples: Auction Exercise Discussion

Price Discovery Examples: The Regular Trading Session

Price Discovery Examples: The Constant Product Automated Market Maker

Price Discovery: The Competition for Alpha!

The Problems of Non-Stationarity and Adverse Selection

Understanding the Mayhem: Experimenting with Random Data

A High-Level Business Plan for Your Trading - 2 – Stonkingly Obvious High-Probability Edges

Lesson Content

23 Steps

Stonkingly Obvious High-Probability Edges

ETF Arbitrage

ETF Arbitrage: Exercise

ETF Arbitrage: Exercise Solution

Stablecoin Creation / Redemption Arbitrage

Stablecoin Creation / Redemption Arbitrage: Exercise

Stablecoin Creation / Redemption Arbitrage: Exercise Solution

Terra / Luna Arbitrage

Market Making

Commodity Carry (in the past)

Risk Premia Harvesting

Risk Premia Harvesting: Why are we confident in it?

Risk Premia Harvesting: Strategy Implementation

Risk Premia Harvesting: Strategic Sizing

Risk Premia Harvesting: Rebalancing

Risk Premia Harvesting Exercise: Design your Strategy

Risk Premia Harvesting: How you’re gonna screw it up

Risk Premia Harvesting in 2022: What happened?

Pairs Trading in Equities

Crypto Stablecoin Lending, Basis Effects and Other Yield Plays

Crypto Basis Arbitrage in Perpetual Futures

Summary: What Do These Approaches Have in Common? - 3 – Inefficiencies and Where to Find Them

Lesson Content

30 Steps

Inefficiencies and Where to Find Them

“Win-Win” Games

“Win-Lose” Games

Why Are Traders Prepared to Trade at Inopportune Prices?

The Competitive Market for Dumb Money Alpha

“Win-Lose” Games You Might Be Able to Compete At

“Elevator Pitches” for Inefficiencies

Edges and Strategies

Edge: Speed Advantage: HFT Latency Arb and AMM Arbitrage

Edge: Information Advantage: Discretionary Equity Investment

Edge: Front Runnin’ Flows: The FTX Leveraged Token Rebalance

Edge: Front Runnin’ Flows: Seasonal Regularities in FX, Stocks and Volatility

Edge: Dispersin’ Dislocations: Spreading, Curve Trades, Vol Arb, Liquidations

Edge: Positioning Imbalances: Trading Futures Rolls. Short Squeezes

Edge: Exploiting Mistakes: Corporate actions, Derivatives Pricing Mistakes

Edge: Behavioural / Structural Effects: PEAD and Crypto Trend

Exercise: Specify a Crypto Trend Strategy

Some Turn-of-the Month Flow Games

The Rebalancing Game

The Window Dressing Game

Looking for Evidence in the Data

The Window Dressing Game – Data Analysis

The Window Dressing Game Summary – Strategy Rules

The Rebalance Game – Elevator Pitch

The Rebalance Game – Data Analysis

The Rebalance Game – Strategy Rules

Explore the Flow Effects App

Exercise: Define your own strategy rules - —Consolidation—

Lesson Content

2 Steps

Interlude: Pair Trading and Statistical Arbitrage Lecture - 4 – Working with Financial Data

Lesson Content

12 Steps

Working with financial data

What data do you REALLY need?

Understanding how your data maps to the real world

Downloading daily price data from yahoo finance

Using ChatGPT to write code to pull data from free APIs

Very gentle introduction to running R in google colab

Validating Price Data

Dealing with daily log returns

Looking at seasonality effects over the whole data set

Looking at date subsets

Exercise: do we see this same effect for different, similar assets?

Summary: Working with Financial Data - 5 – Research Mindset and Data Analysis Techniques

Lesson Content

9 Steps

Data Analysis – Mindset and Techniques

Real-time research Example: Analysis of Equity VRP

Simple Analysis Techniques: The assumption of persistence: Lags, Leads, Overlaps and Scatterplots

Simple Analysis Techniques: Time Series Return Prediction

Simple Analysis Techniques: Cross-sectional Return Prediction

Simple Analysis Techniques: Luck and Stability

Simple Analysis Techniques “What else would explain this?”

Consolidation – Review of techniques used - 6 – Simulation, Portfolio Construction and The Fine Art of Sitting on Your Hands

Lesson Content

13 Steps

Simulation

Simulation Example: RP Harvesting

Simulation Example: Window Dresssing

Simulation: Doing Statistics Even When You Suck at Math

Portfolio Zen

Get Clear on Your Objectives

Managing Strategy Volatility Contribution

The Real World: Constraints

The Real World: Not All Strategies Are Created Equal

Simple Portfolio Example

Relax and Trust The Market Gods

There Will Always Be More Trades - Guide to the Bonus Material

Lesson Content

1 Steps

Guide to the Bonus Material - Bonus Material: Embrace the Mayhem Videos

Lesson Content

11 Steps

Embrace the Mayhem Initiation Intro

(The Only) Two Ways to Make Money Trading

Collecting Risk Premia

Exploiting Market Inefficiencies

(The Only) Two Ways to Make Money Trading – Summary

Pick the Easy Games

The Easy Games – A Taxonomy of Edges and Strategies

Pick the Easy Games – Summary

Run it Like a Business

Run it Like a Business – Summary

Trade More Sh*t - Bonus Material: Options, Volatility, Tail Hedging and Navigating Market Chaos

Lesson Content

16 Steps

Introduction

Volatility Dynamics

Options and Implied Volatility

The VIX Index

VIX Futures

VIX Basis Dynamics

A Dynamic Model of the Basis

A Dynamic VIX Basis Trading Model

Volatility of Volatility as a Predictor of Volatility Returns

Putting Strategy Rules Together

Dashboard and Strategy Simulation

2022 Review and Alternative Implementations

Specifying a Time-Varying VRP Harvesting Strategy

Tail Hedging

Dealing with Chaos: A Market Crash Survival Kit - Bonus Material: Trading Strategies Covered in Previous Iterations of the Course

Lesson Content

5 Steps

Crypto Basis Arbitrage: An Introduction to Forward Contracts and Futures

Crypto Basis Arbitrage: Cryptocurrency futures on FTX

Crypto Basis Arbitrage: Perpetual Futures on FTX

Crypto Basis Arbitrage: Perpetual Futures Basis Effects

Crypto Basis Arbitrage: Homework - Bonus Material: Exploratory Data Analysis Using Excel

Lesson Content

5 Steps

Data Analysis 1: Get TLT Daily Prices from AlphaVantage API

Data Analysis 2: Calculate Day of the Month and Daily Log Returns in Excel

Data Analysis 3: Group by Day of the Month and Plot Mean Returns for Each Day

Data Analysis 4: Explore Date Subsets and Look for Consistency of the Effect

Data Analysis 5: Time Series Plots - Bonus Material: Market Basics

Lesson Content

12 Steps

Two Fundamental Concepts

The Stuff We Can Trade

Embracing the Mayhem

You’ll Never Figure It Out

The Paradox of Market Efficiency and Randomness

Embracing the Mayhem – A Practical Summary

What is the “Price” of a Stock?

The Limit Order Book

A Trading Day – Trading GE on the NYSE

The Pre-Open and Opening Auction

The Regular Trading Session

Log Returns - Bonus Material: Doing Financial Data Analysis in R

Lesson Content

3 Steps

Objects, Functions and Pipes in R

Tidy Data and Switching between Wide and Long Format

Financial Data Manipulation in dplyr for Quant Traders - Bonus Material: Examples of Real-Time, Exploratory Research

Lesson Content

5 Steps

Real World Research Examples

Research Example – Cryptocurrency Trend Effects

Research Example- Intraday Cryptocurrency Return Patterns

Research Example – Wrap-up Trend, Seasonality and Momentum Effect Research

Research Examples – Summary - Bonus Material: Simple Cryptocurrency Research in R

Lesson Content

6 Steps

An Introduction to Cryptocurrency Trading

Cryptocurrency Trading Module Logistics

Repeating Seasonal Patterns

Trend and Momentum Effects

Futures Basis Effects

Trade Execution and Idiosyncratic Effects - Bonus Material: Dynamic Sizing in Risk Premia Harvesting

Lesson Content

10 Steps

Our Stonkingly Obvious High-Probability Edge: Risk Premia Harvesting

Some Things Just Go up (If You Wait Long Enough)

Universe Selection

Equal Weight Buy and Hold

Equal Weight Rebalanced

Simple Risk Parity – Managing Volatility

Predicting Returns and Return Volatility

An Introduction to Volatility Targeting

Volatility Targeting in the Real World

Our Simple Risk Premia Harvesting Strategy

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/