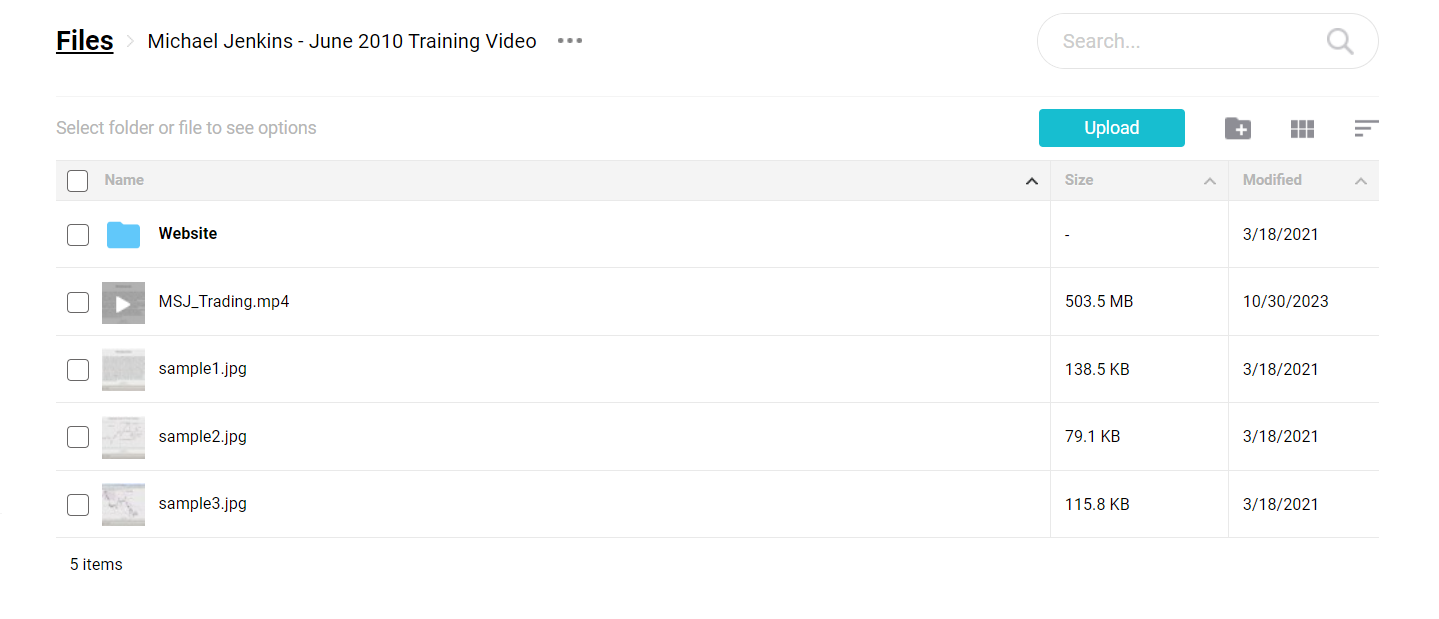

*** Proof of Product ***

Exploring the Essential Features of “Michael Jenkins – Trading Course“

Unlock the secrets of trading success with Michael S. Jenkins’ June 2010 Trading Video. This comprehensive training resource, with a runtime of 6 to 7 hours, is meticulously designed for both novice and experienced traders. The video offers an in-depth exploration of trading strategies and principles, essential for developing instinctive trading habits.

Key Features:

Sequential Learning: The initial hours focus on fundamental principles crucial for building a strong trading foundation. Watching the video sequentially ensures a complete understanding of advanced concepts and invaluable tips dispersed throughout the training.

Avoid Skipping: Every section contains critical observations and insights, making it essential to watch the entire video without skipping.

Consistent Viewing: For the best learning experience, watch at least an hour at a time, making note of the elapsed time to efficiently pause and resume.

Core Principles Covered:

Identifying the Trend:

- Bull Trend Pattern: Identify higher bottoms and higher tops.

- Bear Trend Pattern: Recognize lower lows and lower highs.

- Angle Analysis: Utilize 1×1 or 2×1 angles to assess trend strength.

- Time Frame Application: Apply these patterns across all time frames for consistent analysis.

Determining Trend Start:

- Signal Reversal Bars: Detect trend reversals on weekly, daily, and intraday charts.

- Angle Shift: Identify changes from downward to upward angles as potential trend reversals.

- Pattern Reversal: Combine angle shifts with pattern reversals for clearer signals.

Predicting Trend End Points:

- Measured Moves: Calculate likely end points using measured moves.

- Reversal Bar Doubling: Observe the doubling length of reversal bars.

- Natural Ratio Lines: Utilize natural ratio lines and arcs for trend culmination predictions.

- Moving Averages: Monitor culminations above or below moving averages.

- Weekly Reversal Bars: Use weekly chart reversal bars as indicators.

- Grid Patterns: Recognize the end of grid patterns as potential end points.

Stop Loss Strategies:

- Max Percentage Loss: Define a maximum percentage loss to protect capital.

- Trailing Stops: Implement trailing stops based on 2-3 bars or the length of the reversal bar.

- Pre-Reversal Bar: Set stops at the bar before the reversal bar.

- Moving Average Stops: Use moving averages as dynamic stop levels.

Entry and Exit Strategies:

- Signal Bar Reversals: Enter trades on signal bar reversals with higher bottoms.

- Angle Overcoming: Ensure angles from the last top are overcome for confirmation.

- Regaining Stair Steps: Look for the regaining of prior ‘stair steps.’

- Swing Recovery: Use the 50% last swing recovery as an entry point.

- Time Frame Alignment: Validate entry or exit points by ensuring all time frames are turning.

Learning Outcomes:

By the end of the video, traders will be able to:

- Instinctively identify and act on support and resistance levels.

- Develop quick reaction times for trading decisions.

- Build sound trading habits through repeated practice and adherence to proven principles.

- Implement effective stop-loss and entry/exit strategies to maximize trading success.

Conclusion:

Michael S. Jenkins’ June 2010 Trading Video is an invaluable resource for traders at all levels. Dedicating time to thoroughly understand and practice the techniques presented will enhance your trading skills and improve your chances of success in the market. The structured approach to trend identification, entry and exit strategies, and risk management is designed to instill confidence and precision in your trading activities.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Trade Like Mike - The TLM Playbook 2022

Trade Like Mike - The TLM Playbook 2022  Matthew Kratter - Trader University

Matthew Kratter - Trader University  Enlightened Audio - Etherea - Complete Collection

Enlightened Audio - Etherea - Complete Collection  Enlightened Audio - Constellation - 60min

Enlightened Audio - Constellation - 60min  Enlightened Audio - Astral Voices - Complete Collection

Enlightened Audio - Astral Voices - Complete Collection  Dave Landry - Stock Selection Course

Dave Landry - Stock Selection Course