*** Proof of Product ***

Exploring the Essential Features of “Central Banking – Secured Money Markets 201 by Joseph Wang”

The course Central Banking – Secured Money Markets 201 provides an in-depth look at the pivotal role secured money markets play in the global financial landscape, focusing on the repo market and the FX swap market. These markets are essential to financial institutions and the broader economy, especially in the post-Global Financial Crisis (GFC) era. Participants will gain a thorough understanding of transactional mechanics, market segments, key players, and the Federal Reserve’s (Fed) involvement in these markets.

Repo Market

Overview:

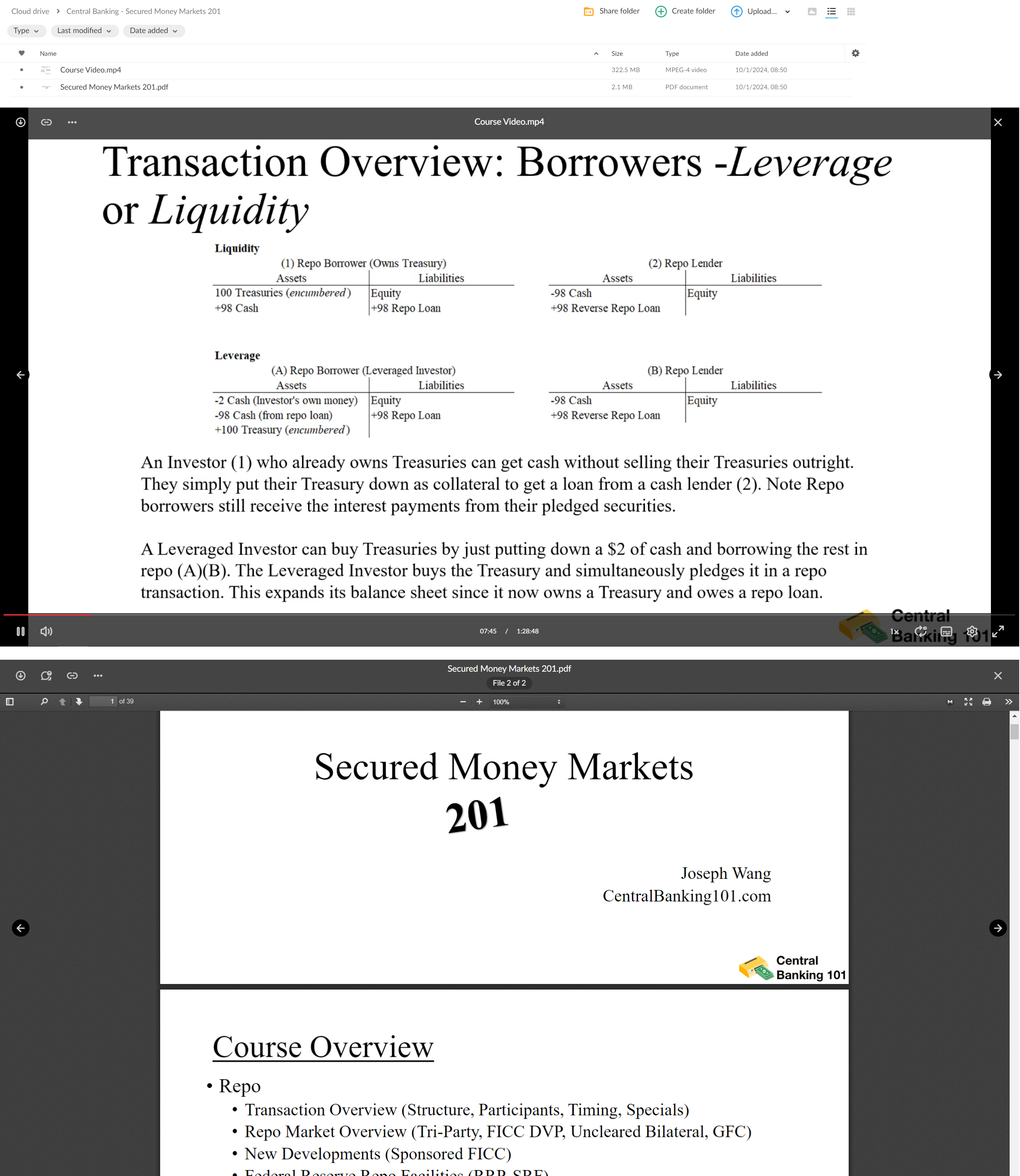

- Definition: A repurchase agreement (repo) is a short-term borrowing arrangement where one party sells securities and agrees to repurchase them later at a higher price.

- Importance: The repo market is critical for liquidity management, enabling financial institutions to meet short-term funding needs.

Transactional Mechanics:

- How it Works: The seller (borrower) temporarily transfers securities to the buyer (lender) and agrees to repurchase them at a future date and price. The difference between the selling and repurchase prices serves as the interest.

- Collateral: Government bonds or other high-quality securities are typically used to secure the transaction.

Market Segments:

- Tri-Party Repo: Involves a third party (usually a clearing bank) that facilitates the transaction and manages the collateral.

- Bilateral Repo: Direct transactions between two parties without a third-party intermediary.

- Specials vs. General Collateral (GC): Specials involve highly sought-after securities trading at lower rates, while GC involves more generic securities traded at standard rates.

Participants:

- Dealer Banks: Primary borrowers and lenders.

- Hedge Funds and Asset Managers: Use repos to finance positions.

- Central Banks: Engage in repos as part of monetary policy.

The Fed’s Involvement:

- Open Market Operations: The Fed uses repos and reverse repos to control liquidity.

- Standing Repo Facility (SRF): Provides eligible banks direct access to liquidity.

FX Swap Market

Overview:

- Definition: An FX swap involves exchanging currencies with a reverse transaction set at a future date.

- Importance: FX swaps are vital for managing currency risk and ensuring liquidity in global markets.

Transactional Mechanics:

- How it Works: Parties exchange currencies at the spot rate and reverse the exchange at a forward rate. The difference reflects the interest rate gap between the currencies.

- Purpose: Used to hedge currency risk or secure foreign currency funding.

Market Segments:

- Short-Term Swaps: Typically overnight or a few days, for immediate liquidity.

- Longer-Term Swaps: Extend up to a year, often used for hedging long-term exposures.

Participants:

- Commercial Banks: Major players managing liquidity and currency risk.

- Central Banks: Use swaps to influence exchange rates and stabilize currency markets.

- Corporates: Manage foreign currency risk in international transactions.

The Fed’s Involvement:

- Swap Lines: Established with other central banks to provide dollar liquidity during stress.

- Crisis Management: Crucial during financial crises to prevent disruptions in global funding.

Conclusion

The Central Banking – Secured Money Markets 201 course offers an essential guide to the repo and FX swap markets, key components of the financial system. By exploring market mechanics, segments, and participants, learners will gain a comprehensive understanding of these complex markets. The Fed’s role, especially in liquidity management and crisis intervention, highlights the importance of these markets in maintaining global financial stability.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Racing Workshop - Complete Online Package

Racing Workshop - Complete Online Package