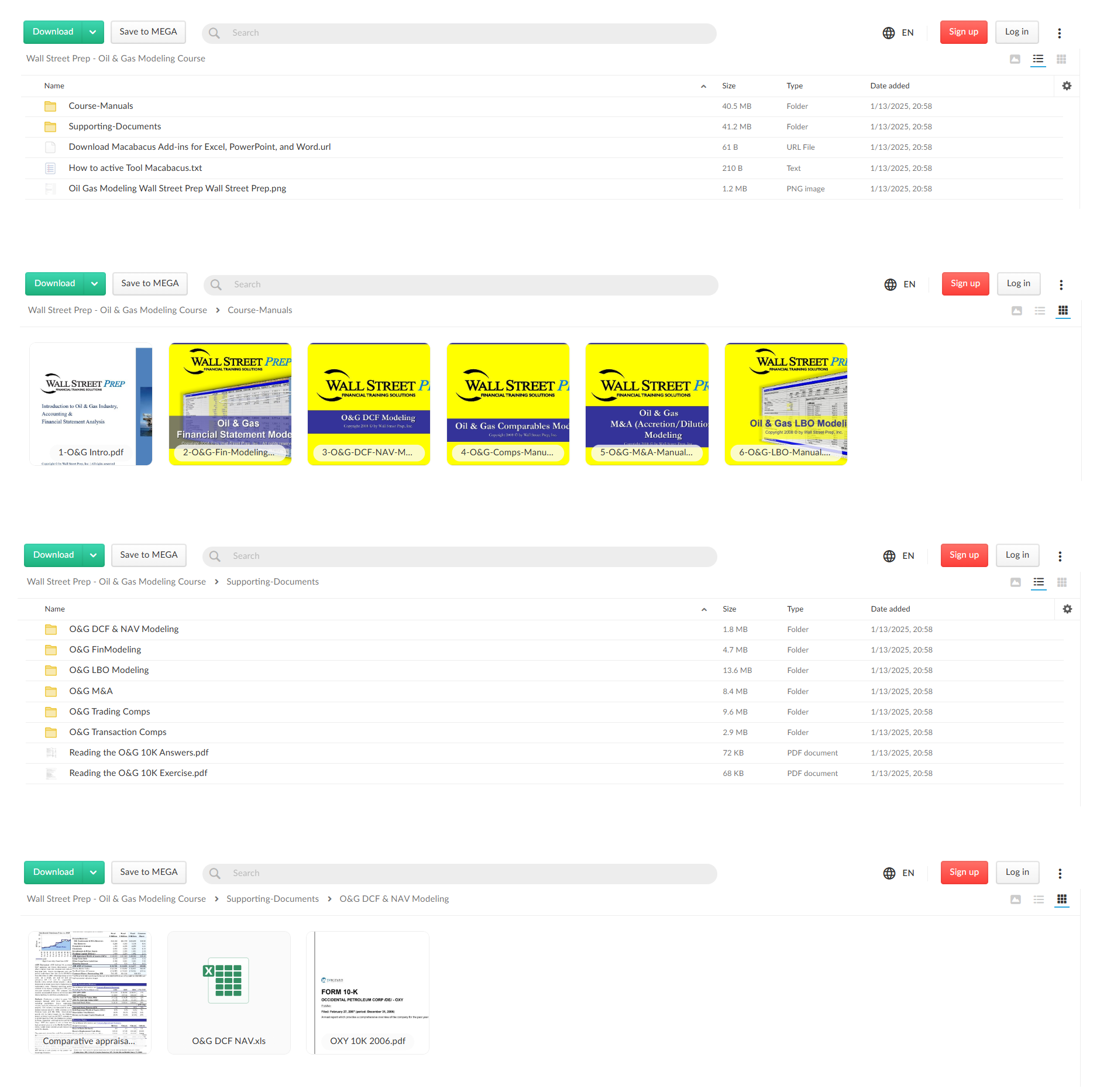

*** Proof of Product ***

Exploring the Essential Features of “Wall Street Prep – Oil & Gas Modeling Course”

Oil & Gas Modeling Course

Designed for finance professionals pursuing Oil & Gas careers, this course provides an in-depth look at the industry, including O&G accounting and financial statement analysis, O&G projection drivers and Net Asset Value modeling. Please note, this Oil and Gas Modeling course is sold as a PDF E-book and no video component.

Course Objective

Trainees develop an Oil & Gas (O&G) financial model completely from scratch, inputting historical data as well as macro– and company-specific assumptions to project out financial statements using step-by-step instruction on selecting, locating, and developing appropriate projection drivers. At completion, trainees will have developed a comprehensive O&G model using various supporting schedules. Trainees build O&G models using Excel templates and the exact way they would on the job.

What You Will Learn

- Industry Accounting & Financial Statement Analysis

- Financial Statement Modeling

- Net Asset Value (NAV) and DCF modeling

- Accretion/dilution (M&A) modeling

- Leveraged buyout (LBO) modeling

- Excel mechanics and functionality for the O&G industry

- Comparable company analysis

- Comparable transaction analysis

- Financial & valuation modeling best practices

Course Highlights

- Intuitive, Self-Paced and Comprehensive

Wall Street Prep’s Oil & Gas Financial & Valuation Modeling Self Study Program is intuitive and self-paced. You should expect to spend approximately 100 hours to complete it. The program uses approximately 700 pages of tutorial guidance and Excel model templates to teach students how to build, analyze, and interpret Oil & Gas financial and valuation models in a step-by-step fashion, at their own pace. - Real World “On the Job” Investment Banking Training

The Oil & Gas Financial & Valuation Modeling Self Study Program bridges the gap between academics and the real world to equip O&G finance and industry professionals with the practical financial skill set they need on the job. The program utilizes a case study format, as students follow their tutorial guide alongside the Excel model templates, and are directed to the appropriate external documents (SEC filings, research reports, etc.) in order to build complex O&G Financial & Valuation models the way they would on the job.

Course Agenda

Introduction to O&G accounting & financial statement analysis

- Participants will understand dynamics of the O&G industry and the factors determining crude oil and natural gas prices

- Learn the different business segments – upstream, midstream, and downstream – that make up the O&G industry

- Learn O&G terminology, units, and key terms

- Distinguish between full-cost and successful efforts accounting methods and their impact on financial statements and on financial statement analysis

- Learn the structure and layout of the O&G financial reports and filings (i.e. 10-K, 10-Q, annual report)

- Learn how to analyze and interpret O&G financial statements, footnotes, and disclosures

- Understand how to perform O&G reserves and production ratio analysis

Introduction to O&G financial modeling

- Building comprehensive O&G financial models from scratch the way it is done at major financial institutions.

- Forecasting crude oil and natural gas prices

- Understanding the role of price and volume hedges

- Standard formatting best practices.

- Excel best practices, efficient formula construction, and appropriate driver selections

- Learning to use data tables to present various sensitivities to projected financial metrics

- Balancing the balance sheet accounts, including excess cash and revolver

- Fixing circularity problems, iteration, and other common modeling troubleshooting

- Balancing sheet / cash flow statement crosschecks

Overview of O&G valuation modeling

- Relative vs. Intrinsic value

- Modeling techniques

- Calculating and interpreting multiples

- Useful Excel shortcuts and functions

- The “football field”

Building an O&G Net Asset Valuation (NAV) model

- Project cash flows for each major project and field to derive the value of E&P segment

- Learn how to value in-ground versus producing reserves

- Understanding proper valuation methodology and drivers for each major O&G business segment

- Estimating the weighted average cost of capital (WACC) and common pitfalls to avoid

- Using data tables to analyze a broad range of scenarios given different assumptions

Building an O&G trading comps model

- Set O&G evaluation benchmarks & select comparable companies

- Gather appropriate financial history and projections

- Normalizing operating results and calculating LTM operating results

- Exclude nonrecurring charges, normalize for stock option expense

- Calculate shares outstanding using the treasury stock method

- Input financial data & calculate and interpret financial and market ratios

- Presenting trading comps by structuring output schedule

- Selecting key valuation multiples using the VLOOKUP function and generating multiple tables

Building an O&G transaction comps model

- Similarly to trading comps, trainees set O&G evaluation benchmarks, select precedent O&G transactions, gather appropriate financial details, input financial data, and calculate and interpret financial and market ratios

- Calculating purchase premiums

- Understanding pricing structures (fixed vs. floating, collars, and walk-away rights)

Best practices for incorporating synergy assumptions and appropriately calculating unaffected pre-deal share prices

Building an O&G M&A modeling

- Participants will build an O&G merger model in Excel to reflect the pro forma impact of various acquisition scenarios.

- Topics covered include a quick test of accretion-dilution in all-stock deals, pricing structures (exchange ratios/collars/”walk-away” rights), purchase accounting, the step-by-step allocation of purchase price, and the derivation of important O&G metrics and ratios.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/