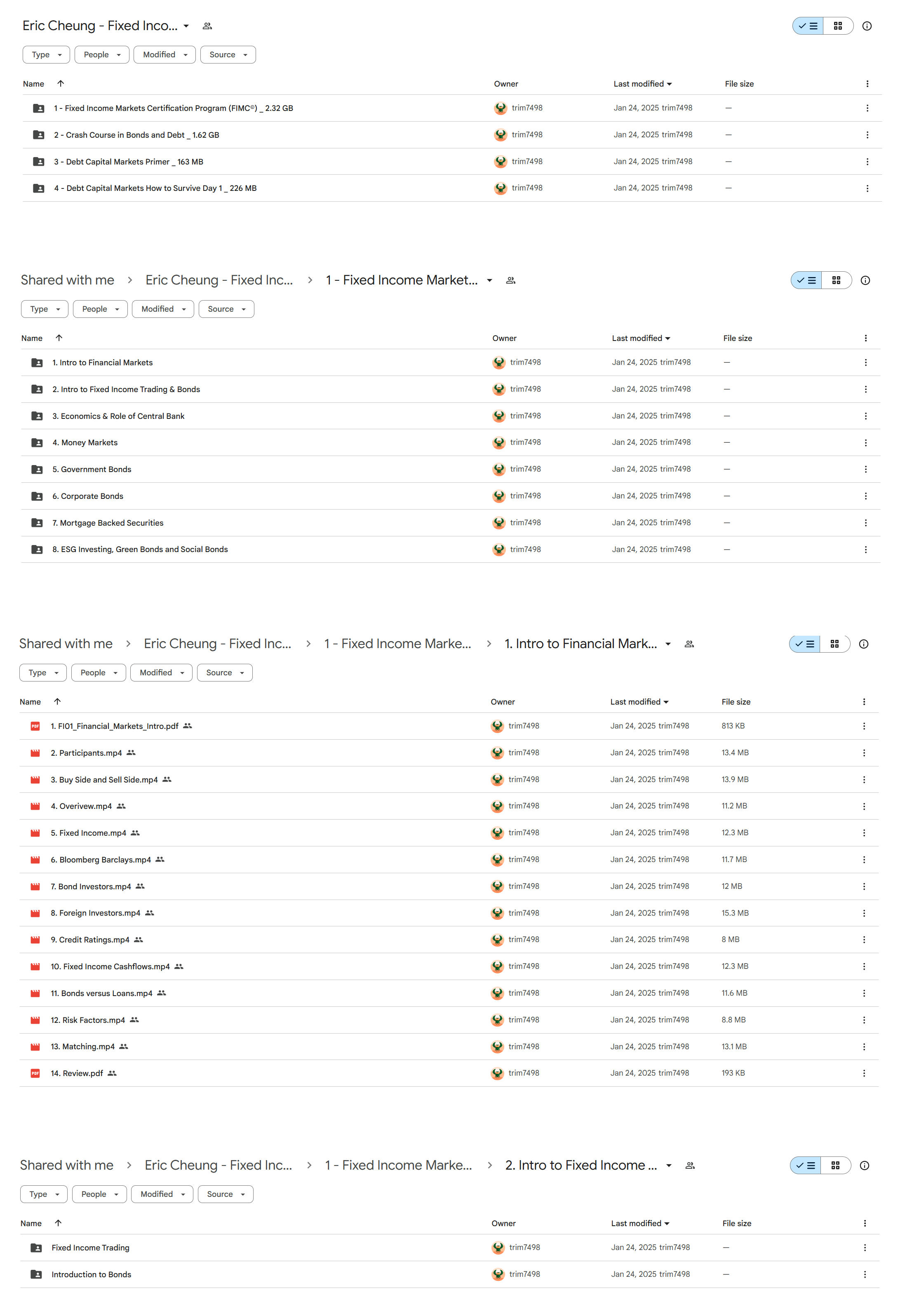

*** Proof of Product ***

Exploring the Essential Features of “Eric Cheung – Fixed Income Markets Certification – Bundle”

11-COURSE CERTIFICATION PROGRAM

Fixed Income Markets Certification (FIMC©)

11 Courses

24h 36m

16,089 Students

Our globally recognized fixed income certification program prepares you with the skills you need to succeed as a fixed income trader on both the buy side or sell side

Earn a verified certification

Shareable on LinkedIn and in resumes

Finish in 1 month

Recommended pace 6 hours/week

Globally Recognized

The same rigorous training program used by salespeople and traders at top global investment banks

About this Fixed Income Markets Certification Program

While other Fixed Income courses add formulas and complexity to hide the lack of real-world experience, Wall Street Prep’s Fixed Income Markets Certification was created by former sales and trading professionals focused on what interns, new hires and early career analysts need to know on the job.

Designed following extensive discussion with hiring managers at major investment banks, we built our Fixed Income program around practical requirements like Bloomberg, with Excel exercises to demystify how Bloomberg calculates Yield and Duration on a bond.

9+ Hours of Video Instruction.

Acquire expertise taught from an insider’s perspective. Master how to use the Bloomberg terminal to analyze bonds, yields and cashflows.

A Comprehensive Program.

Designed with input from the largest global investment banks on what Fixed Income salespeople and traders need to know.

Meaningful, Shareable Certification.

Graduates will receive a blockchain-verified, shareable certification that can easily be added to LinkedIn and resumes.

Your Path to Certification

This fixed income markets certification course is career-focused. We begin with an overview of the Fixed Income Market, sell-side investment banks and buy-side investors; move on to exploring how central banks impact bond yields; and discuss the yield curve. We demystify different fixed income products and build a basis for bond math. Using money markets, we learn about single cashflow investments and government bonds. Finally, we look at corporate bonds, discuss credit analysis, and take a look at the impact of seniority and collateral.

Recommended Path

1 Introduction to Financial MarketsWeek 1

2 Introduction to Bonds and Fixed Income TradingWeek 1

3 Economics and the Role of a Central BankWeek 1

4 Money MarketsWeek 2

5 Government BondsWeek 3

6 Corporate BondsWeek 3

7 Mortgage Backed SecuritiesWeek 4

8 ESG InvestingWeek 4

Complete in 28 Hours

The FIMC is a job-focused program that drills down on what Fixed Income Markets professionals need to know while cutting out the rest. Average completion time (coursework + exam) is 25 hours.

What You’ll Learn

- Master the Bloomberg Bond DES screen

- Learn how bond traders and investors measure returns

- Decode the pricing and trading conventions of bonds

- Learn how to chart, graph and analyze bonds and yield curves on Bloomberg

- Use the Bloomberg Bond Calculators for Discounts and Yields

- Discover the Central Bank tools that move markets

- Calculate cashflows, yields and duration of actual bonds

- Demystify the difference between G, T I and Z spreads

- Understand the pricing and valuation process of new issue corporate bond

Includes 8 core courses + 3 electives

1 Intro to Financial Markets

This course sets the foundations of the Fixed Income Markets, providing an overview of how Investors provide capital to Issuers through the Buy Side Investors and the Sell Side Investment Banks. We discuss the main Fixed Income Investors and how they are different have different objectives and risk tolerances. We introduce different Fixed Income In …

2 Intro to Fixed Income Trading & Bonds

We begin with an overview of how Bonds are Traded: Over the Counter and at an Investment Bank. We discuss the different desks are broker out by asset class and how bonds are quoted. We then proceed with an overview of Bonds, demystifying a Bloomberg DES screen and walking through the key features of a bonds. We discuss the concept of Coupons versus …

3 Economics & Role of Central Bank

Changes in Supply and Demand drive changes in Prices and Yields. We begin by taking a look at a Treasuries are auction and how shifting demand moves prices. Afterwards, we expand to a macro view and look at the tools of the Fed the can shift the overall market. We begin by analyzing the indications and data that drive Fed actions. Starting in the f …

4 Money Markets

Money Markets form a basis for the bond markets and the derivatives markets. We begin with an overview of money market investments and investors. We use Money Markets to calculate the returns of actual fixed income investments in both Excel and Bloomberg. We conclude by discussion LIBOR, the Eurodollar market, and the transition to SOFR.

5 Government Bonds

Building on the concepts in the Money Markets course, we analyze Bond Math and Bond Returns using Government Bonds. We start off by building the cashflows of two Government Bonds and valuing those bonds by discounting the cashflows using strips. We then converted our discount value to a price by adjusting for accrued interest and demystifying treas …

6 Corporate Bonds

In this course, we examine Corporate Bonds and how they are priced, valued and traded. We begin by discussing credit spreads and discussing the key credit spread (T, G, I and Z). We then discuss trading conventions and mechanics, from cashflow, price calculations, trade execution process and calculating DV01s. Next, we work through the New Issue Pr …

7 Mortgage Backed Securities

Agency Mortgage Backed Securities are the second largest asset class in Fixed Income. In this course, we provide an overview of how the Mortgage Market and how Mortgages are securitized. Prepayments in mortgages add complexity to how we value mortgages. We cover the CPR and PSA prepayment models and their impacts on Weighted Average Life, Yields an …

8 ESG Investing, Green Bonds and Social Bonds

The last decade has seen exponential growth in ESG investing worldwide. Designed for those seeking to learn about the role of Sustainable Finance at an Investment Bank, this course explores exactly how this transformation happened and how the market formalized the structure and conventions for Green Bonds and Social Bonds. It discusses both from th …

ELECTIVECrash Course in Bonds and Debt

This course will teach you all about bonds. First, we’ll take a look at the role of bonds in financing governments, corporations, households and financial institutions around the world. Next, we’ll dive into bond math. You’ll learn the various calculations and concepts required to accurately analyze the large variety of fixed income products. We’ll start slow, but will quickly …

ELECTIVEDebt Capital Markets Primer

Corporate finance bankers interact regularly with their product partners in debt capital markets, yet many have a limited understanding of the key drivers behind DCM business. This webinar begins by introducing you to the key DCM business lines, including Loan Syndication, Debt Origination, Liability Management and Risk Management. Next, it examines the ways DCM bankers interac …

ELECTIVEDebt Capital Markets: How to Survive Day 1

Designed for incoming and prospective DCM/Capital Markets analysts and interns with no prior DCM experience, this course will provide an insider’s prospective of what you”ll be doing on the job. We’ll focus on industry knowledge not taught in school and demystify industry jargon. We start with the basics: what DCM actually does, what a DCM desk looks like and how to use the tu …

Get the Fixed Income Markets Certification

Trainees are eligible to take the WSP Fixed Income Markets Certification Exam for 24 months from the date of enrollment. Those who complete the exam and score at or above 70% will receive the certification. The exam is a challenging online assessment that covers the most difficult concepts taught in the program.

MEET YOUR INSTRUCTOR

Eric Cheung

Eric is the lead instructor for Wall Street Prep’s Capital Markets and Sales & Trading programs. Eric’s financial markets career began after he was a finalist for J.P. Morgan’s Fantasy Futures trading competition. Eric worked at J.P. Morgan for 10 years across DCM, Syndicate and Sales & Trading Roles, including in the Cross Asset Sales & Structuring group with trade execution experience across all asset classes. Eric is an expert in International Markets and Cross-Border transactions with global work experience in New York, London, Hong Kong and Tokyo.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/