*** Proof of Product ***

Exploring the Essential Features of “Orderflows Inner Circle Video Club“

My 5 Secrets To Trading Success

Secret 1) There are no get-rich-quick schemes involved with order flow. Great earning potential, steady and reliable income are all possible.

Secret 2) Treat trading as a business. Be serious about it and always try to improve yourself.

Secret 3) Don’t get caught up in the excitement, leave your emotions at the door and keep focused and calm. Easier said than done, but many people start seeing results, get carried away and lose their focus. Don’t be a victim of your emotions.

Secret 4) At the end of the trading session, give yourself and your trading actions a review of your success and failures. Analyze what you did and why, so you are more aware of your own actions as they happen next time. This will help avoid the same mistakes.

Secret 5) Motivation is the key to long-term success. Forget about winning or losing. This clouds your judgment. Instead, focus on the process. By doing so, you allow success to come as a result of your trading.

Why Did I Create An Inner Circle?

I almost wish I could have one of those ‘interesting’ stories about how I lived in my parent’s basement, was flat broke and struggling trading until I found the “Holy Grail,” but the honest truth is that’s not what happened. I came from an upper-middle-class family. Growing up, some of my friends’ dads were traders at the CME and CBOT. I had always dreamed of being a trader. While in college, I worked full-time in a grocery store. After graduating college with a degree in Economics, I took the summer off until I ran out of money. A former colleague from working in the grocery store recommended me as a management trainee with a big national grocery chain. After a year, I was already a manager, making decent money and on a career track. It was a solid job, I mean everyone has to eat so they have to buy groceries. But I knew deep down that working in a grocery store was not what I wanted to do with my life. I wanted to be a trader. I had friends working on the CME floor and telling me about the excitement of first walking onto the trading floor. I was fortunate to get an introduction to the CME floor manager for Dean Witter who hired me.

When I got into the Futures industry, I started at the bottom – I worked as a runner on the CME floor for Dean Witter earning the princely sum of $6.25 an hour, which for a runner on the CME floor in the early 1990s was on the high side. I worked hard to learn anything and everything I could from everyone who would talk to me. I was like a sponge. Some people may say that I was in the right place at the right time, but what I did was position myself to be in the right position through hard work.

I worked my way up and eventually off the CME floor with Dean Witter, then moving to EDF Man, Commerzbank, Cargill, and finally JP Morgan. In 2013, 3 months after the birth of my daughter, I decided to leave JP Morgan. It was a life-changing decision. Going from a cushy job at one of the biggest investment banks to trading for myself in a home office. But that is what trading offers – financial freedom. Big money can be made, but at the same time, life savings can be lost just as easily. You only hear the success stories in trading; you don’t hear the failures, and there have been some spectacular failures of individual fortunes lost. But I can’t stress it enough, you can lose everything trading. In some cases, I have seen people lose more than money. I am talking about families and even their own lives.

But I digress… In 2015, I started Orderflows.com to help bring my way of trading order flow to the public. Along the way, I have met some very great retail traders. I have also watched people struggle over and over and have come to realize that traders can go further with a bit of extra help and guidance to get better results. I’m also aware that for a lot of people, the cost of hiring a one-on-one personal trading coach is prohibitively expensive. I want to help your trading but I am not trying to become your personal trading coach; instead, I want to get you on the right track. I am always happy to discuss the markets and order flow with anyone, but I realize there are some who view order flow as some get-rich-quick scheme and there are those who are more serious and see it as the right way to trade. If the former describes you then the Inner Circle will benefit you.

To me, order flow is the only way to trade. After using a footprint chart for the first time I never wanted to look at a normal bar chart again. I still look at bar charts; the only difference is they have volume footprints wrapped around them.

First of all, I want to stress that with the Orderflows Trader you have everything you need to look at the markets in a way that puts you head and shoulders above the trading crowd. But what if you want advanced order flow and trading knowledge? Where are you going to get that knowledge? A trading forum from some anonymous kid posting under the name biglips69? Does he have the background? Who knows. Does he have the experience? Doubtful. Has he ever traded?

Today, I’ve decided to open up the Inner Circle for a few traders who want to take their trading to the next level, who want to learn more, who want to expand their thoughts and who are tired of all of the B.S. out there. The point of the inner circle is to get you to think, not to say “you have to trade this way.” As a trader, you undergo your own journey of self-discovery, finding what works and doesn’t work for you. My job is to help you on your trading journey.

Join the Inner Circle, and I’ll pull back the curtain.

What Will You Learn?

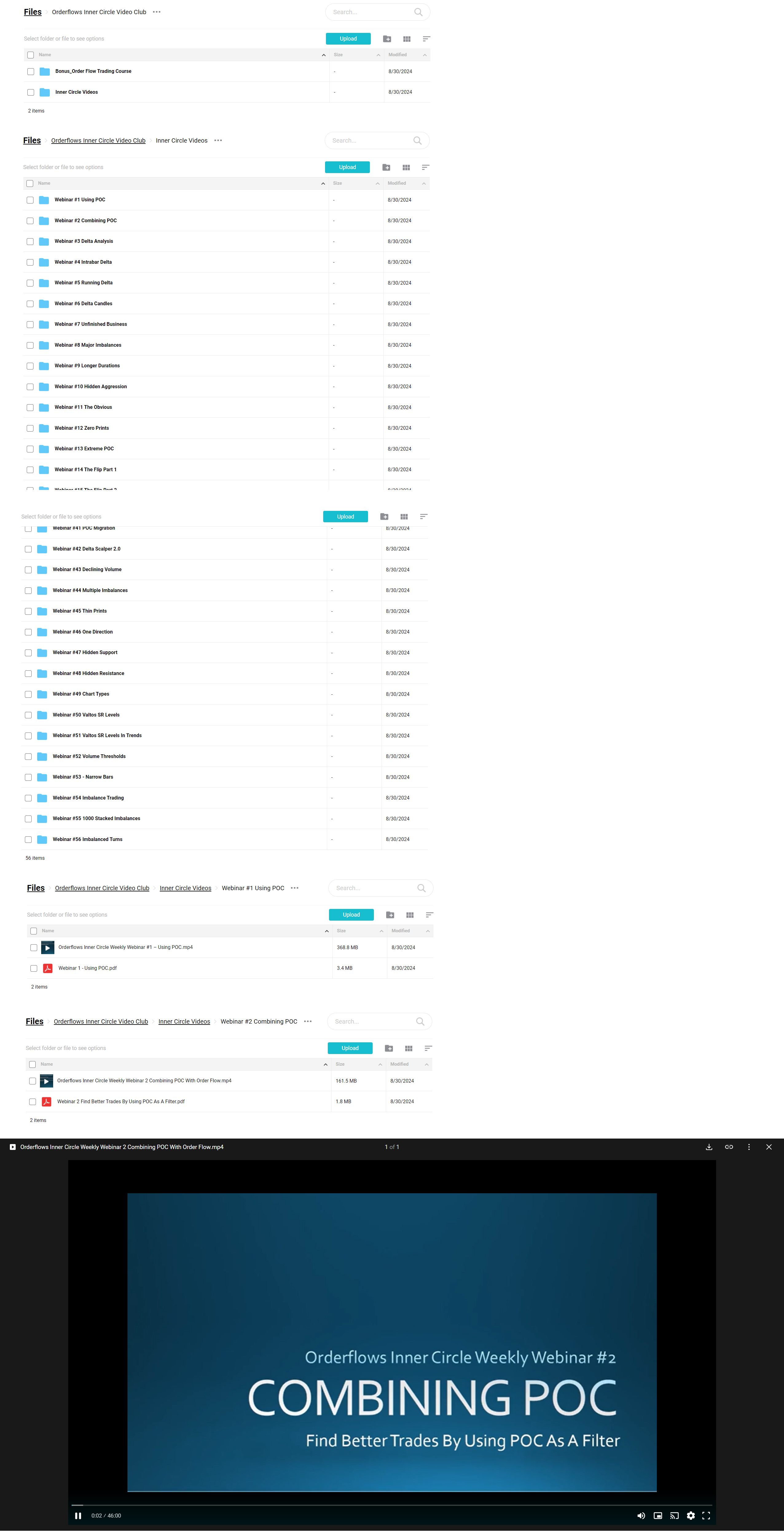

Currently, there are 56 recorded webinar trainings (new ones will be added as well):

These are my personal trading strategies and tips. This is my proprietary information. While I tried to share as much as possible I realized that there is quite a bit I didn’t cover. Even in the Order Flow Trading Course, I shared more and more, but still there were many things I just didn’t have the time to put in as their concepts are more advanced.

Webinar 1 – POC POC is an overlooked tool by many traders, but it reveals a lot about the market. Look for POC at certain locations at extremes of bars when a move has been made. If longer-term money is involved in a move, then it is probably more serious, and you will see POC migrating up in a move up as POC acts as support or POC migrating lower in a move down as POC acts as resistance. This wave-like action, with the POC moving up and up, is often a sign of institutional activity.

Webinar 2 – Combining POC How to use POC Trader to find better, more profitable trades. When you use POC Trader as a filter or trigger, in combination with order flow, you can get rid of bad trades. That is what you want to do as a trader is cut out the losing trades altogether.

Webinar 3 – Delta Analysis The best-kept secret of order flow trading. Very few traders understand how to use delta analysis in their trading. I know a handful of very successful traders relying on order flow delta as the cornerstone of their trading methodology. I do several webinars digging deeper into delta so that you can get a better, more solid understanding of delta and how to apply it to your own style of trading.

Webinar 4 – Intra-bar Delta Catching Internal Shifts In A Bar As They Happen. If there was just one aspect of order flow that you can use to improve your trading use delta. I am a big user of delta. In this presentation I explain the importance of Max Delta and Min Delta which not many people use or understand. Delta is not a holy grail, but a very useful and effective tool in trading and with it you will be able to make much better trading decisions.

Webinar 5 – Running Delta Running Delta – Identifying Waves Of Aggressive Activity. Buying and selling often comes in waves and if you can identify when it happens you can often find good trading opportunities as it can be the start of a move. They always say do what the big traders do, but they don’t tell you how to see what the big traders are doing, by reading the “Running Delta” you can. I find myself being opportunistic at times and applying the running delta idea I can easily identify areas for low-risk trades. Will every trade be a winner? Of course not. But what you want to find is areas where you can have low-risk entries with good upside potential.

Webinar 6 – Delta Candles (Indicator This Webinar Based On NOT included) Delta Candles are bar delta transformed into Japanese Candlestick-style bar. So instead of having to analyze a number, the delta number, a trader can visually see what is happening in the delta based on a candlestick. It’s a different way to view delta. If you have any experience with Japanese Candlestick analysis you know there are certain candles and candle formations that you look for during the course of trading. Delta Candles are similar in that respect. You are looking for certain candles and candle formations to appear. One of the key elements of candlestick trading that makes them useful in warning of potential reversals is the occurrence of long wicks. Long wicks suggest price rejection and a potential failure of the market to continue in the same direction. When used with order flow, these candlestick patterns can be extremely effective signals.

Webinar 7 – Unfinished Business When there is volume on the bid side and offer side at the extreme of a bar, that is called unfinished business. There are different reasons why unfinished business may occur. But the common consensus is that the price level should be revisited. I am not a fan of unfinished business and in this presentation I explain why.

Webinar 8 – Major Imbalances A Major Imbalance is an imbalance occurring at a very high percentage, for example 1000%, as opposed to the more common, almost industry standard, 400%. Major Imbalances highlight to you what the major players are doing or who is in control of the market, you can miss the next move or get caught on the wrong side of the market. Order flow, through major imbalances, reveals the big player’s activity, and therefore, their commitment in the market. Because large players cannot execute size orders instantly at favorable prices, the order flow reveals their entry into the market and gives you time to trade accordingly. This telegraphed information gives you almost the same advantages possessed by the initiating player. This is a powerful advantage over most technical signals that are almost always two bars late.

Webinar 9 – Longer Durations Traders tend to think that order flow analysis is only for short-term charts. Like 1 minute, 3 range, 100 tick charts, etc. But its not. You can use 15 minute charts, 30 minutes charts. Personally, I don’t go beyond 30 minute charts. But it does need to be an intraday chart. I look at the same things – stacked imbalances, ratios, delta, etc. This presentation will deal with stacked imbalanced on longer duration charts. When a market generated level of support or resistance appears on a longer duration chart I tend to put a little more weight into it.

Webinar 10 – Hidden Aggression Hidden aggression occurs what seems like out of nowhere. You are sitting there watching the market and then notice a big amount trade on the offer and sell off. Or the bid getting pounded and the market rallies. What is going on? It’s what I call hidden aggression. You never know when a big order is going to come across an institutional trader’s desk. When a bank gets an order to buy 3000 ES. Or Chevron does a deal in the crude oil cash market and now has to hedge the equivalent of 1500 lots. Once you know what to look for in the order flow, spotting hidden aggression becomes easier. But sometimes it is so obvious, so clear that the market is screaming at you that you feel like an idiot if you don’t take the trade.

Webinar 11 – The Obvious How often have you looked at a chart later in the day and think “I should have bought here, it was so obvious. Every trader needs to have a series of trades that they can go back look for on a daily basis, setups that work for them and suit their trading style. There are many different ways to approach the market with order flow. I don’t expect you to apply everything 100% the way I do. What I hope you do is take away what I explain and apply it to your own trading method. Here are 4 setups that I look for on a daily basis on every chart I watch: They are: (revealed in video) I call these setups The Obvious because when you look at the move afterward you will say to yourself “It was so Obvious.

Webinar 12 – Zero Prints In this presentation I discuss a phenomena that I have not shared with the trading public before. It is what I call Zero Prints. They often occur as the market is moving fast or when the market is just about to make a big move. Zero prints happen because a trader is often sweeping the market and getting his position on. If you are not familiar with sweeping the market, it is the activity of a trader who buys through the offer or sells through the bid. Often when a big trader anticipates a big move soon they will sweep the market. It is not something that retails traders do. There are two types of zero prints that I discuss. Zero prints do not occur very often, but when they do they often lead to nice quick moves which as a trader you want. One of your trading goals should be to get in and out with your profit as fast as possible.

Webinar 13 – Extreme POC I have discussed the importance of POC before but I have been getting questions regarding what I mean by Extreme POC so I have devoted this entire presentation to explain it and answer your questions. An Extreme POC is a reversal signal. It is stopping volume in the market. It can come after a move or it can come off a bounce. Not every trader will get value of Extreme POC, if you are a short term trader you will find it a great tool to add to your trading tool box. If you are a longer term (over 5 minute chart) trader then you will not get very many signals. If you are trading a 3, 4 or 5 range chart or a 1 minute chart trader then you will want to seriously consider it in your trading.

Webinar 14 – The Flip Part 1 (Indicator This Webinar Based On NOT included) This is the first presentation about The Flip indicator. Honestly, I don’t talk about the indicator much actually, what I talk about is the guy known as The Flipper, Paul Rotter and then I discuss about spoofing in the market and how it is done. It is illegal but I do think it is done in some form. Anytime there is money to be made, there will always be that element of society that will try and skirt the rules. But the point of the presentation is to give you a back ground on how orders affect the supply and demand structure of the market. Orders going into the order book only show a trader’s intent, while actual trades show a traders commitment to the market. In retrospect I probably should have titled this presentation – Spoofing.

Webinar 15 – The Flip Part 2 (Indicator This Webinar Based On NOT included) This is the second presentation about The Flip indicator which is available for download in the members area. The Flip indicator measures acute changes in aggressive buyers/sellers through the final delta, max delta and min delta. It is designed to find the changes in direction that the market should continue in. In the Orderflows flip what it looks for 4 distinct instances of market activity. Flip A and Flip B.

- The market gets pushed down with extreme selling and then comes right back up with extreme buying. Flip A buying.

- The market pops up with extreme buying and then comes right back down with extreme selling. Flip A selling.

- The market gets pushed down with extreme selling, pauses and then comes right back up with extreme buying. Flip B buying.

- The market pops up with extreme buying, pauses and then comes right back down with extreme selling. Flip B selling. I treat signals for Flip A and Flip B the same.

Webinar 16 – The Flip Part 3 (Indicator This Webinar Based On NOT included) In this follow-up presentation, I discuss more about the settings and what they mean and how you can experiment with them if you were to. There are more examples in this presentation using candlestick and bar charts. Also, I have uploaded a cheat sheet, which is something you should read regarding this indicator. I discuss my settings for CL, YM, FDAX, ZB, ES contracts and show the YM in actual trading when used with the POC trader on extremes.

Webinar 17 – Absorption Absorption, what it is, how to recognize it and how to trade it. If you turn on the TV you hear pundits saying the market is in “consolidation” but they never say “the market is in absorption”. Why not? I would venture to guess that those paid speaking heads don’t understand the true nature of the market. Absorption and consolidation are similar in that price movements are limited, but there is a big difference in the way they are formed, absorption occurs with normal volume, consolidation often occurs in areas with little trading occurring. When absorption occurs you want to be able to recognize it and potentially trade it as we come out of absorption. In order to do that you need to look for signs that we are coming out of absorption and in this presentation I will show you how to do that.

Webinar 18 – Bar Delta Divergence Bar Delta Divergence occurs when the price action of a bar and the delta are going in opposite directions. This often leads to quick moves with decent profit potential. Generally the price action of a bar and the delta go in the same direction, however there are instances when they go in opposite directions. Bar Delta Divergence differs from standard Order Flow delta which is negative delta at a new/equal high or positive delta at a new/equal low. Instead Bar Delta Divergence is a red candle with positive delta or a green bar with negative delta. In short go in the direction of the candle. If it is a red candle look to trade from the short side. If it is a green candle look to trade from the long side.

Webinar 19 – 2nd Slot Imbalances 2nd slot imbalances occur when traders are late getting into a move and either look for a bounce to get back in or just late to get into the move. It is good for a short term trade signal, definitely not something I would be looking to hold all day. Think of it as a an extra tool in your trading toolbox and when you see it, take advantage of it.

Webinar 20 – Valtos Transition (Indicator This Webinar Based On NOT included) My newest indicator – The Valtos Transition. What The Valtos Transition does is it looks for the areas when the market is transiting from supply driven to demand driven (a down move that changes to become an up move) or demand driven to supply driven (an up move that changes into a down move). I have said this many, many times – markets do not move based on mathematical formulas. What I mean is markets don’t move because an oscillator crossed the zero line. Markets move based on supply and demand and how can you determine supply and demand? Look at what is trading.

Webinar 21 – Aligned POC Aligned POC is market-generated support/resistance level. What I like about Aligned POC is 2 things: 1) Not many traders use POC in their analysis so it gives you an edge with information that is useful. Who wouldn’t want to trade with information that is available but not everyone is using? 2) It is a market-generated support/resistance level which just happened and is probably not yet visible to everyone else. Think of Aligned POC like running. You run a few km then stop to catch your breath, while you decide to either turn around and go home or continue on in that direction.

Webinar 22 – Hidden Gaps Hidden gaps occur during the trading day that are not immediately visible to the trading public because they are limited to their charting software. Order flow foot-print charts allow you to see the areas where price moved through quickly. Hidden gaps occur often in the normal course of trading and has significance in terms of price direction, reversal or momentum. I use the term Hidden Gaps even though there may be some small trades at a level. It is not a True Gap in the purest sense of Gap analysis. When I get into the examples you will understand what I mean. Generally, Hidden Gaps are emotionally driven events that occur largely because a big buyer (or seller) has come to the market to start buying up (selling) large quantities quickly.

Webinar 23 – Valtos U-Turn (Indicator This Webinar Based On NOT included) The Valtos U-Turn is an indicator that reads the price action in the order flow and looks for the points where buyers or sellers have given up and the market has a tendency to reverse due to hidden supply or hidden demand. What is hidden demand and hidden supply? Hidden demand is high traded volume on the bid side. Hidden supply is high traded volume on the offer side. You hear the phrase “trapped traders” a lot these. Even though I think it is nothing more than a buzzword, there are instances when retail traders come to market late thinking it is going to go higher or lower only to run into hidden demand or hidden supply.

Webinar 24 – Trend Days I discuss trend days and more importantly how to identify trend days early in the day so to position yourself on the right side of the market and not fight it. You always hear “the trend is your friend.” or “Go with the trend.” But for most traders trying to identify when a trend is occurring is the difficult part. I show you how to use Volume Profile, POC, and value areas to determine if a trend is happening. The earlier you can identify a trend is about to happen, the more profit you can make.

Webinar 25 – Breakouts I discuss Breakouts and how to use order flow to confirm them. Every time you start making new highs you should be asking yourself, will this market keep going higher? Will there be follow-through and new highs made or is this high going to hold? Or if you are making new lows you should be asking the same question, will this low hold or are we going to keep on making new lows? I used to be a breakout trader in my younger days. One of the major problems I had was knowing when a breakout would continue or fail. There is no worse feeling than buying the high of the day, someone has to do it. But the order flow can help give you clues that the market can keep going higher (or lower). If you are just looking at a normal bar chart you won’t know what is going on in the order flow and you will suffer as a result of it by buying into weak breakouts or selling into weak breakdowns.

Webinar 26 – Candlesticks How I use order flow imbalances with candlestick analysis. The problem with trading with candlestick analysis is when patterns work they work great, but there are times when they fail as well. Of course you never hear about the failures from candlestick traders, instead you only hear of the winning trades “oh man, it was a beautiful engulfing pattern right off the low and then we rallied straight up to the highs.” Ok, well what about the times the engulfing patterns didn’t work? Radio silence. In my trading I have always found two candlestick patterns to be effective in my trading, whether it was Malaysian Palm Oil, Hang Seng or US 30-year bonds. The patterns are the shooting star and the hammer. But still there are times they failed. However, if you apply order flow analysis to the candlestick analysis I found I was able to refine my trades and increase my win percentage as a result of eliminating the patterns that often failed.

Webinar 27 – Swing Trading A decent portion of traders who want to learn order flow analysis come from a swing trading background. Swing traders trade around swing highs and swing lows which are essentially pivot levels. When you have your own levels defined, levels that you are watching in the market and you see something in the order flow that is also confirming that level then you have a very powerful potential trading opportunity. In this presentation I show how to combine swing levels with stacked imbalances in the order flow to find higher percentage trades. By combining these two methods of trading you can often catch the low or high of the day.

Webinar 28 – Negative Development

Negative Development is best described as market activity that is opposite of what is expected. One critical aspect of trading that many traders overlook is what happens after entering a trade. For a trade to move in your favor, you need more traders entering the market in the direction you anticipate. Order flow analysis helps you pick up on market dynamics and adjust your trading approach when market conditions change.

Webinar 29 – Discipline

Trading’s hardest part is often considered to be discipline. It’s not something that can be taught but must be nurtured and developed. This presentation focuses on the psychological aspect of trading, emphasizing the importance of discipline in allowing trades to work out and managing losses effectively.

Webinar 30 – Size Traders

Understanding the activities of large traders in the order flow is crucial. Following the “big money” is a common recommendation, but it can be challenging to distinguish between large trades entering the market and those liquidating positions. This webinar discusses the pros and cons of following significant market participants in both short-term and long-term trading.

Webinar 31 – Stops

Placing stops is essential for risk management, but it’s equally vital to know where to place them correctly. This presentation delves into stop placement strategies, emphasizing the importance of putting stops where the initial reason for the trade no longer exists. Keeping stops close helps limit losses while avoiding getting stopped out too frequently.

Webinar 32 – Ratio Bounds Low

Ratio Bounds Low, or stopping volume, indicates heavy volume at the bottom of up bars or the top of down bars, suggesting support or resistance. Understanding this concept can help you identify key levels in the market.

Webinar 33 – Ratio Bounds High

Ratio Bounds High signifies price rejection, often seen as small volume at the tops of down bars or the bottoms of up bars. It indicates potential trend reversals or changes in market sentiment.

Webinar 34 – Bollinger Bands

This presentation discusses the combination of order flow ratios with Bollinger Bands. Trading bands, including Bollinger Bands, provide price targets and confirm price action when combined with order flow analysis.

Webinar 35 – Divergences With Ratios

Divergences occur when price and indicators provide conflicting signals. This webinar explores how to use order flow ratios to identify divergence trades, enhancing your trading opportunities.

Webinar 36 – Seeing Double

Double tops and bottoms can indicate market reversals. This presentation provides insights into recognizing and trading these patterns effectively.

Webinar 37 – Rounding

Rounding is a unique order flow phenomenon based on delta. Understanding rounding tops and rounding bottoms can help traders anticipate potential market turns.

Webinar 38 – POC Framing

POC Framing discusses consecutive migration of bar POCs, helping identify potential trend starts and turning points in the market.

Webinar 39 – References

References are market-generated levels of support and resistance. This presentation highlights their importance in structuring your view of the market and making informed trading decisions.

Webinar 40 – Delta Extremes

Delta Extremes represent sudden bursts in delta, indicating the emergence of strong buying or selling activity. Recognizing these extremes can signal the beginning of significant market moves.

Webinar 41 – POC Migration

POC Migration is similar to POC Framing but focuses on identifying turning points and the starts of trends more quickly.

Webinar 42 – Delta Scalper 2.0

This presentation discusses the updated Delta Scalper tool, explaining its features and how to use it effectively for trading.

Webinar 43 – Declining Volume

Declining volume often occurs at market highs and lows, providing valuable insights for traders. Understanding order flow allows you to interpret volume data and find trading opportunities.

Webinar 44 – Multiple Imbalances

Multiple Imbalances, similar to stacked imbalances, offer insights into market conditions. This presentation explores how to use them effectively.

Webinar 45 – Thin Prints

Thin Prints result from fast-moving markets and can signal potential explosive moves. Recognizing Thin Prints helps traders position themselves correctly.

Webinar 46 – One Direction

One Direction refers to aligned POCs and price action, indicating a temporary value area to trade around. Trading in the direction of price action and order flow is emphasized.

Webinar 47 – Hidden Support

This is the first part of a three-part series on using order flow to find hidden support levels in the market. It highlights the importance of understanding why specific levels act as support.

Webinar 48 – Hidden Resistance

The second part of the series discusses using order flow to identify hidden resistance levels, emphasizing the importance of recognizing strong passive selling.

Webinar 49 – Chart Types

This presentation helps traders choose the right chart type for their trading style, considering factors like trading method and timeframe.

Webinar 50 – Valtos SR Levels

The Valtos SR Levels indicator is introduced, explaining how it works and how traders can utilize it in their trading.

Webinar 51 – Valtos SR Levels In Trends

This presentation demonstrates how to use Valtos SR Levels in trending markets, including confirming trends and identifying second-chance entries.

Webinar 52 – Volume Thresholds

Setting volume thresholds is crucial for meaningful trades based on volume analysis. This presentation covers the importance of this aspect in trading.

Webinar 53 – Narrow Bars

Narrow bars, often seen as non-trend days, can lead to trends when understood correctly. This presentation highlights the potential of narrow bars in identifying initiating activity.

Webinar 54 – Imbalance Trading

Order flow imbalances are explored further, focusing on how to use them effectively in trading by considering various imbalance ratios.

Webinar 55 – 1000 Stacked Imbalances

This presentation discusses the use of stacked imbalances where individual imbalances exceed 1000%, offering insights into short-term trading opportunities.

Webinar 56 – Imbalanced Turns

Order flow often reveals obvious signs of potential market turns. Recognizing these signs can help traders take timely action and improve their trading outcomes.

And more to come…

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/