*** Proof of Product ***

Exploring the Essential Features of “Ted Thomas – Tax Lien Certificate and Tax Deed Complete Training System”

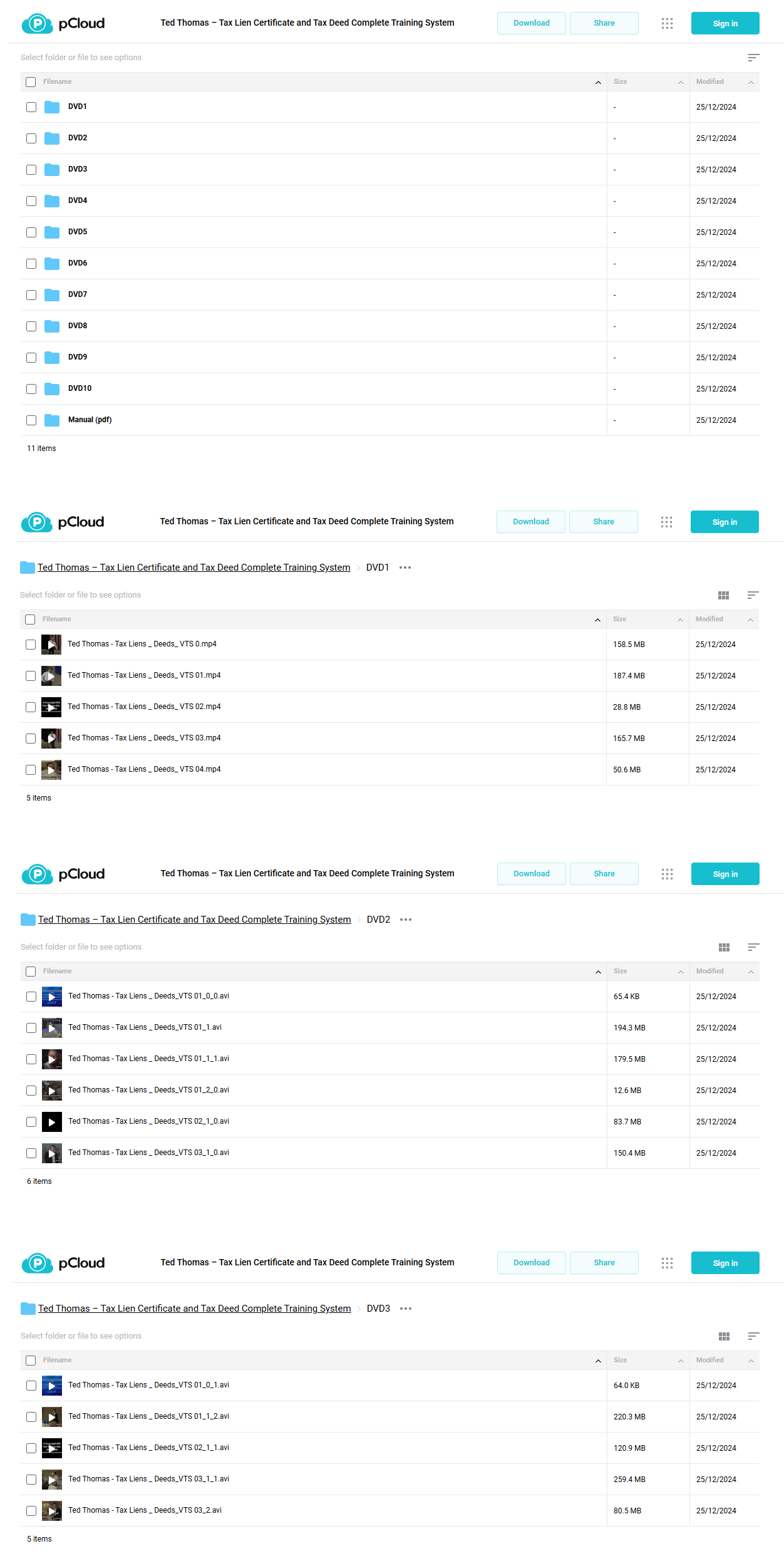

The most detailed course comprising of 10 DVD’s with four manuals that teaches you a to z about tax lien certificate and Tax Deeds.

For nearly twenty years Ted Thomas has been teaching thousands of investors how to receive safe, secure returns with government issued Tax Lien Certificates and property purchased at huge discounts at government Tax Deed Auctions.

Ted offers Tax Lien Certificate & Mortgage Free Tax Deed Online & Offline Home Study Courses to students across the United States, Canada, and even other continents. Those who follow his program of success, investing in secured government Tax Lien Certificates & Tax Deeds have made millions of dollars. This is the real deal, a program that works for the little guy and the professional investor. This system of Government Auctioned Tax Lien Certificates & Tax Deeds has been in place for hundreds of years. Ted Thomas simplified the process and made it easy for the average investor. The information that Ted offers gives his students a competitive advantage in the market over other investors due to his knowledge and insight he and his instructors offer in his training.

If you wanted to find a single, one stop source, all under one roof, proven, accurate, original Tax Lien Certificate & Tax Deed Online & Offline that will protect your money and insulate you from recession and wildly fluctuating economy…You have come to the right place.

The Exciting Opportunities In Tax Lien Investing Today

Investing in tax liens began in the United States soon after the country was established. A tax lien is simply an obligation that the local government (county, city or other local taxing authority) places on real estate if the local property taxes are not paid. A tax lien investor buys a tax line certificate from that local government for the amount of the delinquent taxes, giving the investor a return of all of the original investment plus interest when the delinquent taxes and interest are ultimately paid on the property. If those delinquent taxes are not paid the tax lien investor has a lien on the property that allows that investor, after a legal process regulated by State law is executed, to gain ownership of that property.

The end result is that when investing in tax liens you either get all your original investment returned plus interest or you get the property at a cost of the unpaid taxes and fees. In summary, every property is taxable, this property tax is due at a minimum of annually. If the property owner fails to pay the tax, the county sells a tax lien certificate to any investor who will pay the taxes.

Tax lien investing is one of the safest, most secure and predictable investments available in the USA today and can yield an interest rate of up to 36% depending upon the state where you invest. Investing in tax lien certificates is even available to foreign investors, from Canada, Europe, almost anywhere in the world. The secrets to success investing in tax liens is to only buy tax lien certificates on properties where the property that backs the tax liens are of significantly higher value than the tax lien certificate. The result is that if your goal is a high yield passive income there is a 95% or better chance that the property owner will pay the taxes and not lose the property to you for just the unpaid taxes; you get all your investment back plus interest.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/