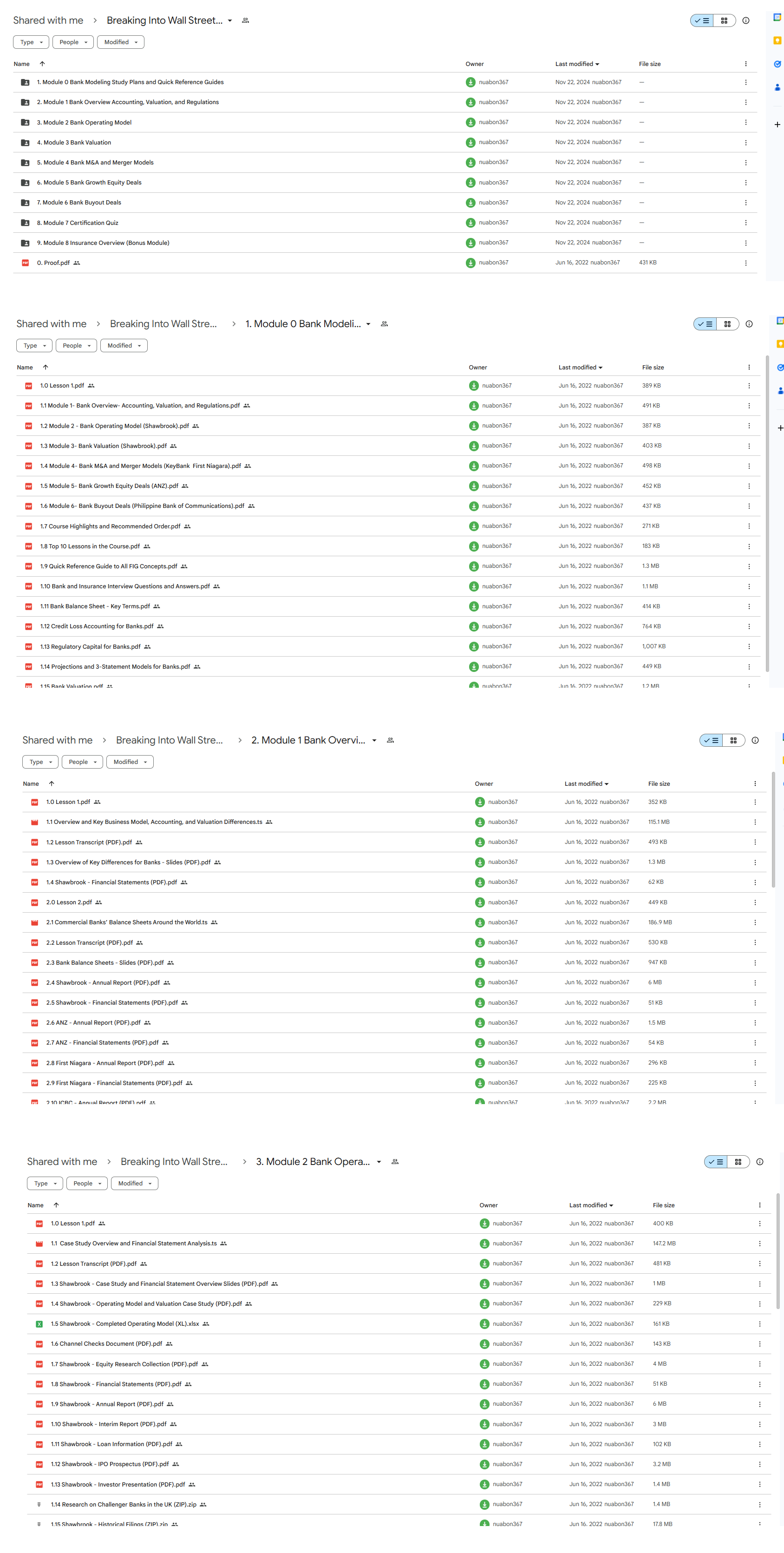

*** Proof of Product ***

Exploring the Essential Features of “Breaking Into Wall Street – BIWS Bank & Financial Institution Modeling”

How to Master Bank and Financial Institution Valuation and Financial Modeling, Dominate Your Investment Banking Interviews, and Succeed On The Job

The Breaking Into Wall Street Bank & Financial Institution Modeling Course is hands-down the fastest way to master real-world bank modeling and valuation, with step-by-step video tutorials, 4 detailed, global case studies, a stock pitch and equity research reporta and an IB pitch book

Master the fundamentals and nuances of bank and financial institution accounting, valuation, and financial modeling with detailed, step-by-step video training. You’ll gain skills that are NOT taught in undergraduate or MBA programs… but which any FIG team at a bank or any financials-focused private equity firm or hedge fund will expect you to know.

Quickly grasp the concepts and skills via 4 detailed case studies: The first case study teaches you how to build an operating model and valuation for Shawbrook, a U.K.-based “challenger bank,” and how to use those models to make an investment recommendation for the company. The second case study covers KeyCorp’s $4.1 billion acquisition of First Niagara and how bank M&A deals are different, and the last two case studies are private equity/growth equity-related – for ANZ (one of the Big 4 Banks in Australia) and the Philippine Bank of Communications.

Dominate your interviews. For your convenience, we provide 13 Overview videos, along with written notes and slides, on the topics most likely to come up in interviews. If you’re short on time, you can get up to speed with these in under an hour and review all the concepts in short order – even if your interview is tomorrow and you just found out about it 5 minutes ago.

Learn how to write hedge fund stock pitches, equity research reports, and IB pitch books for banks. Most financial modeling training programs teach you the formulas; we teach you how to use the Excel models in real life to make money and advise clients. The Shawbrook case study builds up to a 32-page stock pitch, a 13-page equity research report, and a 48-slide investment banking pitch book where you make an investment recommendation and advise the company on its best options.

Overview lessons cover a bank’s financial statements, regulatory capital under Basel III, loan loss accounting, and a simplified 3-statement projection model and valuation you can use in time-pressured case studies. You’ll also learn about regional differences by analyzing banks’ financial statements across the 6 inhabited continents. This module concludes with an overview of Dodd-Frank, CRD IV, and U.S./E.U. stress testing.

Overview lessons cover a bank’s financial statements, regulatory capital under Basel III, loan loss accounting, and a simplified 3-statement projection model and valuation you can use in time-pressured case studies. You’ll also learn about regional differences by analyzing banks’ financial statements across the 6 inhabited continents. This module concludes with an overview of Dodd-Frank, CRD IV, and U.S./E.U. stress testing.

Valuation Module covers public comps and precedent transactions for a bank, a regression analysis, and a multi-stage dividend discount model and residual income (excess returns) model. You’ll learn how to adjust for non-recurring charges and excess or deficit capital, and you’ll use the output of this analysis to make an investment recommendation and to advise the company as if it were a client.

M&A Module teaches you how to model the acquisition of a commercial bank, including bank-specific features such as loan marks, deposit divestitures, core deposit intangibles, and the write-down of the Allowance for Loan Losses. You’ll get both a simplified bank merger model and a full, complex one for KeyCorp and First Niagara, and you’ll use both models to answer case study questionsand recommend for or against these deals.

Bank Buyout and Growth Equity Lesssons are based on case studies of ANZ and the Philippine Bank of Communications; you’ll learn how private equity firms invest in the financial services sector, how minority-stake deals differ from control deals, and how to analyze the returns to equity investors in different cases. You’ll also learn how NPL divestitures and funding raised to boost a bank’s Net Stable Funding Ratio work in a private equity context.

Bonus Insurance Lessons provide an introduction to the insurance industry, including how accounting, the financial statements, and valuation differ. We walk through an introductory 3-statement insurance model for a new firm and explain how to value both a property & casualty (P&C) insurance company and a life insurance firm.

What You Get… And What the BIWS Bank & Financial Institution Modeling Course Will Do For You…

This course provides advanced training for both new and experienced professionals. The Bank & Financial Institution Modeling course is perfect for you if:

- You already know the fundamentals of accounting, valuation, and financial modeling, and now you want to learn how commercial banks, insurance firms, and other financial institutions work in-depth.

- You’re interviewing with financial institutions groups (FIG) – at banks, PE firms, hedge funds, or other finance firms.

- You’re about to start working in a financial institutions group, or you’ve just transferred into one and you need to get up to speed quickly.

- You’re an experienced professional and you’ve worked in the commercial banking or insurance industries before – and now you’re transitioning into investment banking, private equity, or related roles.Whenever you’re interviewing for these roles at investment banks, you’ll always get a few questions over and over…

- How much do you know about accounting? Do you know how it’s different for banks and financial institutions?

- Can you walk me through how you would value a bank? What about an insurance firm? How are P&C Insurance and Life Insurance different?

- What are the key factors that drive a financial institution’s valuation?

- Can you pitch us a bank stock? What are the main catalysts and risk factors?

- How do merger models and leveraged buyout (LBO) models differ for these companies?

- How would you advise a bank on its best options in an M&A scenario?

- How would you describe your financial modeling skills?Confidently answering all these questions and showing evidence of the case studies you’ve completed will set you apart from everyone else in the interview room and put you in prime position to land lucrative internships and jobs at investment banks, private equity firms, and hedge funds.We’ve designed the course from the ground up to help you gain functional mastery of this highly specialized material in the shortest possible time.

Here’s what you’ll learn via the detailed global case studies in the course:

Module 1: Bank Overview: Accounting, Valuation, and Regulations: You’ll discover how banks operate and why you can’t rely on traditional metrics, multiples, or modeling.

Module 2: Bank Operating Model (Shawbrook): You will construct a detailed operating model for Shawbrook, including calculations for its loan portfolio, three statements, and regulatory capital under Basel III.

Module 3: Bank Valuation (Shawbrook): You will build a full-fledged valuation model for Shawbrook based on public company comparables, precedent transactions, a regression analysis, and dividend discount and residual income models. You’ll then use these to write a stock pitch, equity research report, and IB pitch book for the company.

Module 4: Bank Merger Model (KeyCorp / First Niagara): You’ll build a full merger model for KeyCorp’s $4.1 billion acquisition of First Niagara, and you’ll make a recommendation on the deal in a short presentation at the end after learning about the key differences with bank merger models.

Module 5: Bank Growth Equity Deals (ANZ): You’ll build a half-year operating model for ANZ and use it make a recommendation on a minority-stake investment in the company; you’ll also learn how a bank might use such an investment to shore up its regulatory capital ratios.

Module 6: Bank Buyout Deals (Philippine Bank of Communications): You will build a buyout model for a 100% acquisition of PBC in this module, learn how NPL divestitures work, and make a short investment recommendation at the end.

BONUS- Module 7: Insurance Overview: In this module, you’ll get a crash course in all things insurance-related, from the business model to the financial statements, projections, and valuation.

The information you’ll find is so detailed and so thorough that our regular customers come from top-ranked universities, investment banks, and business schools.

Once you’ve completed the training, here’s what you can immediately add to your resume / CV:

Bank & Financial Institution Modeling (BIWS)

Online Financial Modeling Training Program

- Completed FIG modeling and valuation training based on case studies of Shawbrook, KeyBank’s $4.1 billion acquisition of First Niagara, ANZ, and Philippine Bank of Communications; also completed insurance modeling lessons

- Built 3-statement operating model for Shawbrook based on loan market share and GDP growth, net charge-offs and provisions, and spreads on interest-earning assets and interest-bearing liabilities; projected financial statements and calculated CET 1 Ratio, Net Stable Funding Ratio, and Liquidity Coverage Ratio

- Valued Shawbrook using dividend discount model, residual income (excess returns) model, regression analysis, and public comps and precedent transactions with P / E and P / TBV multiples; concluded that company was 30-50% overvalued and made “Short” recommendation in detailed stock pitch

- Built complex merger model for KeyBank and First Niagara, including support for mark-to-market adjustments, deposit divestitures, core deposit intangibles, the write-down of the Allowance for Loan

- Losses, and synergies; valued synergies, calculated accretion / dilution and IRR, and recommended against the deal due to marginal benefits from the seller

- Created bank growth equity model for ANZ to analyze follow-on offering that would boost the bank’s Net Stable Funding Ratio under APRA rules; calculated returns to equity investors and recommended investment due to achievement of the targeted returns across cases and minimal downside risk

- Built bank buyout model for Philippine Bank of Communications to assess a 100% control transaction for the company combined with a Nonperforming Loan (NPL) Divestiture; calculated returns to equity investors and recommended against deal due to lower-than-targeted returns in Base and Upside cases

- Built P&C insurance operating model based on GWP growth, premium rates, reinsurance, ceded premiums, loss & LAE ratio, and commissions; also learned P&C insurance valuation and Embedded Value for life insurance

MAJOR BONUS

Get a Crash-Course Overview of Insurance Modeling & Valuation With 13 Bonus Lessons on Insurance

Let’s face it: It is nearly impossible to find useful, substantial information on insurance modeling and valuation anywhere (I’ve looked many times!).

That’s why we added a set of 13 bonus lessons on introductory insurance modeling and valuation to this Bank & Financial Institution Modeling course.

It’s not a comprehensive treatment of insurance, but it is sufficient for interviews. And best of all, it’s short – only 6 hours of training, which is ideal for weekend cramming or last-minute prep before interviews.

Here’s what you get in this set of bonus lessons:

First, you’ll start with an overview of insurance modeling and how insurance companies differ from both commercial banks and “normal companies.”

Then, you’ll delve into insurance accounting: How companies record premiums and revenue, including Gross Written Premiums, Ceded and Assumed Premiums, and Net Written and Earned Premiums.

You’ll understand how the premiums are reflected in the financial statements and how they affect items such as the Unearned Premium Reserve (UEPR). You’ll also learn how the premiums “flow” from Direct Written Premiums down to Net Earned Premiums.

On the expense side, you’ll learn how Losses & LAE, Commissions, and other line items are recorded, and how insurance companies create “Loss Triangles” based on cash vs. book differences.

Next, you’ll see examples of real financial statements from a property & casualty (P&C) insurance company (Travelers Companies) and life insurance company (MetLife), and you’ll understand the key differences between them.

After these introductory lessons, we delve into a simplified 3-statement model and valuation for a new P&C insurance company, which covers:

- Premium and Loss projections, including how ceded losses flow through the statements.

- Balance Sheet and Cash Flow Statement projections, including how the reserves, Deferred Acquisition

- Costs, Cash, Investments, and Equity change.

- Statutory adjustments and key metrics and ratios, including the Combined Ratio, the Solvency Ratio, and how to calculate Statutory Net Income and the Statutory Capital & Surplus.

- Example comparable public companies, including sample selection criteria and key valuation multiples.

- A Dividend Discount Model based on a minimum Solvency Ratio, and a Net Asset Value (NAV) model.

After this 3-statement model, you’ll get an overview of embedded value, which is a key valuation methodology specific to life insurance.

Finally, we wrap up with a comparison of P&C and life insurance companies and explain the business model, financial statement, and valuation differences.

Again, this Bank Modeling course focuses on commercial banks and lending firms, so these bonus lessons do not represent a comprehensive treatment of insurance.

However, it is a very useful “crash course” that will get you through interviews and let you answer insurance-related accounting and valuation questions crisply and effectively.

By the end of this module,

you’ll be able to discuss insurance company modeling, accounting, and valuation with confidence. You’ll understand the key business model differences, how insurance firms differ from commercial banks, and how P&C differs from life insurance. And you won’t be caught off-guard when insurance-related questions come up in interviews.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Forexmentor - Recurring Forex Patterns

Forexmentor - Recurring Forex Patterns  Akil Stokes & Jason Graystone - TierOneTrading - Trading Edge 2019

Akil Stokes & Jason Graystone - TierOneTrading - Trading Edge 2019  George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)

George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)  Simpler Trading - Bruce Marshall - The Options Defense Course

Simpler Trading - Bruce Marshall - The Options Defense Course  Dave Landry - Stock Selection Course

Dave Landry - Stock Selection Course