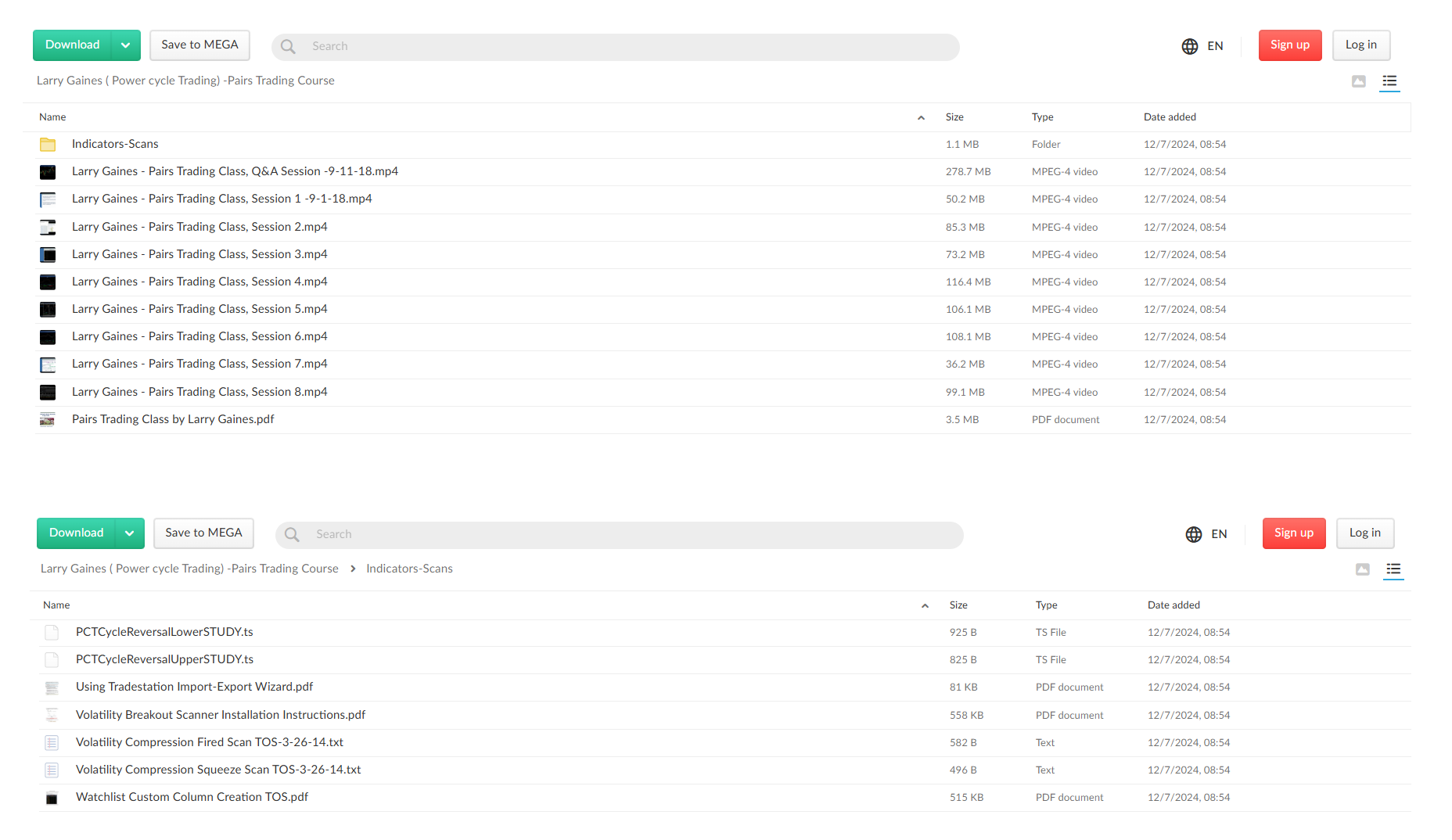

*** Proof of Product ***

Exploring the Essential Features of “Power Cycle Trading – Pairs Trading for Market Neutrality & Big Profits”

Power Cycle Trading offers an in-depth course focused on Pairs Trading, a strategy known for its ability to deliver steady profits while minimizing exposure to market fluctuations. The Pairs Trading for Market Neutrality & Big Profits course is designed to educate traders on how to leverage this advanced technique to take a market-neutral position, reducing risk while capturing profit opportunities in both stable and volatile markets. With a blend of beginner-friendly insights and advanced strategies, this course is ideal for those seeking to refine their approach to pairs trading and market neutrality.

Course Highlights

- Market-Neutral Strategy

- Pairs trading minimizes risk by maintaining a neutral stance on the market. This strategy is perfect for traders who want to avoid the pitfalls of relying on broader market trends, allowing them to consistently profit regardless of market movements.

- Comprehensive Introduction to Pairs Trading

- The course begins with a foundational introduction to pairs trading, explaining the key concepts such as correlation, choosing pairs, and understanding price movement patterns. It’s suitable for beginners looking to grasp the fundamentals, while advanced traders can refine their strategies for better precision.

- Focus on Key Trading Indicators

- Power Cycle Trading teaches how to use vital technical indicators, including moving averages, Bollinger Bands, and correlation coefficients, to identify optimal entry and exit points. These tools help traders spot when pairs are diverging, offering profitable opportunities.

- Risk Management Techniques

- Risk management is a core component of the course, which covers strategies like stop-loss orders, scaling in and out of positions, and establishing risk-reward ratios to protect capital and minimize potential losses.

- Real-World Trading Examples and Case Studies

- The course offers practical learning through real-world case studies and live examples, showing how pairs trading strategies are applied in fluctuating market conditions. This hands-on approach helps traders recognize patterns and develop the skills needed to execute successful trades.

Key Learning Objectives

- Identify and Analyze Correlated Assets

- Learn how to select assets that have strong historical correlations. The course offers strategies for analyzing these pairs across different sectors and asset classes to find profitable trading candidates.

- Execute Trades for Market Neutrality

- Understand how to structure pairs trades that capitalize on price discrepancies between related assets, profiting from convergence or divergence while remaining unaffected by overall market movements.

- Apply Technical Analysis for Precise Entry and Exit

- Gain expertise in using technical analysis to determine the best moments to enter or exit a trade, optimizing the chances for profit through strategic decisions.

- Develop a Robust Trading Plan

- The course also covers how to create a personalized trading plan, helping traders navigate market volatility and sentiment shifts while maintaining a disciplined approach to trading.

Benefits of the Course

- Reduced Market Exposure

- Pairs trading’s market-neutral nature reduces exposure to broader market risks, allowing traders to focus on asset performance and minimize the impact of market downturns.

- Adaptability Across Market Conditions

- Whether markets are bullish, bearish, or volatile, pairs trading offers flexibility, enabling traders to profit from the relative performance of asset pairs.

- Enhanced Profit Potential

- Through the strategic use of technical indicators and well-timed entries and exits, pairs trading can increase profitability. The course teaches methods for capturing both short-term and long-term opportunities to maximize returns.

Who Should Take This Course?

- Beginner and Intermediate Traders: Those looking to deepen their understanding of pairs trading and enhance their strategies with a market-neutral approach.

- Risk-Averse Investors: Ideal for individuals focused on preserving capital with low-risk strategies that don’t rely on predicting overall market direction.

- Advanced Traders: For those seeking a structured, data-driven approach to pairs trading that combines market data and technical analysis for consistent profits.

Conclusion

Power Cycle Trading’s Pairs Trading for Market Neutrality & Big Profits offers traders a comprehensive education on pairs trading, providing both theoretical knowledge and practical tools to succeed. By teaching how to identify profitable pairs, execute trades effectively, and manage risk, this course equips traders with the skills to achieve consistent, long-term success in a variety of market conditions.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025  Forexmentor - Recurring Forex Patterns

Forexmentor - Recurring Forex Patterns  Chris Capre - Advanced Price Action Ongoing Training & Webinars

Chris Capre - Advanced Price Action Ongoing Training & Webinars  Atlas API Training - API 570 Exam Prep Training Course

Atlas API Training - API 570 Exam Prep Training Course  Fred Haug - Virtual Wholesaling Simplified

Fred Haug - Virtual Wholesaling Simplified  Toshko Raychev - Profit System + ITF Assistant

Toshko Raychev - Profit System + ITF Assistant  Trade Like Mike - The TLM Playbook 2022

Trade Like Mike - The TLM Playbook 2022  Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle  Team NFT Money - Ultimate NFT Playbook

Team NFT Money - Ultimate NFT Playbook  SMB - Options Training

SMB - Options Training  The Daily Traders – Exclusive Trading Mentorship Group

The Daily Traders – Exclusive Trading Mentorship Group  Racing Workshop - Complete Online Package

Racing Workshop - Complete Online Package  Akil Stokes & Jason Graystone - TierOneTrading - Trading Edge 2019

Akil Stokes & Jason Graystone - TierOneTrading - Trading Edge 2019  George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)

George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)  Money Miracle - George Angell - Use Other Peoples Money To Make You Rich

Money Miracle - George Angell - Use Other Peoples Money To Make You Rich