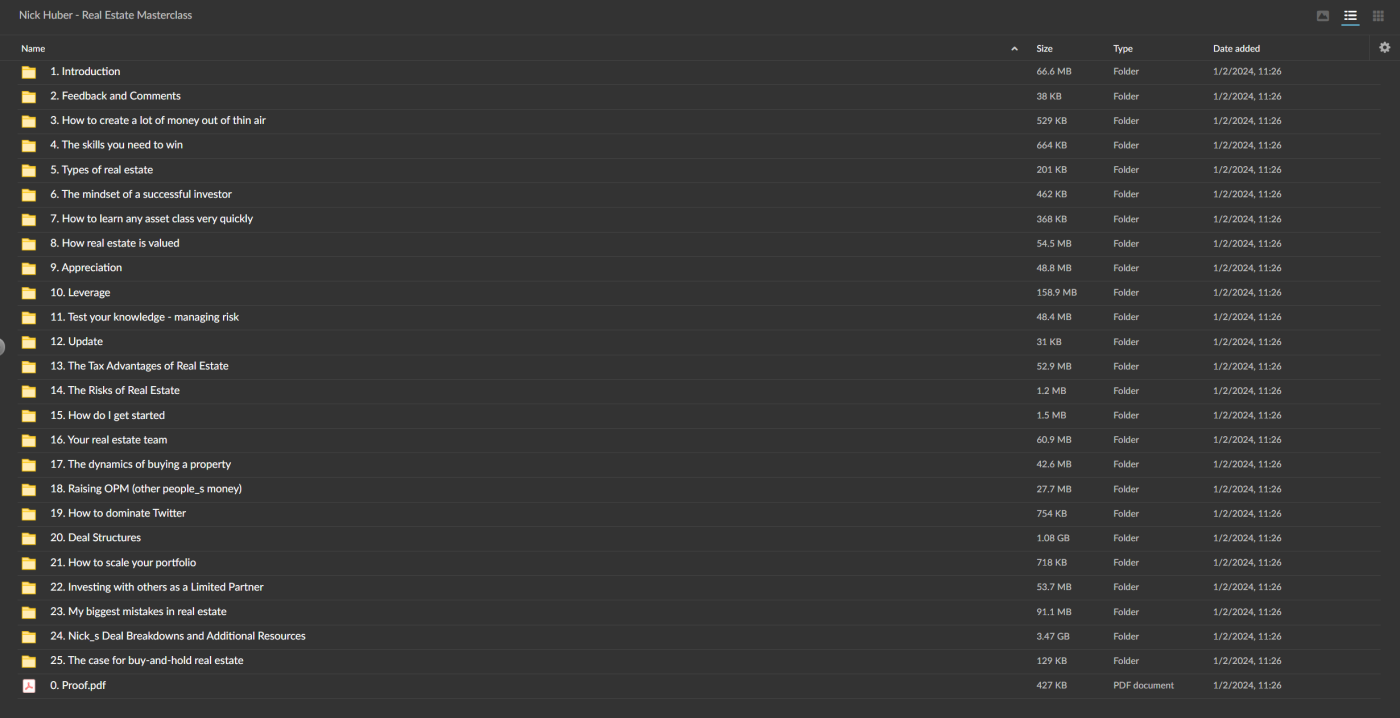

*** Proof of Product ***

Welcome to Nick Huber’s Real Estate Masterclass, where you’ll embark on a comprehensive journey into the world of real estate. In this course, you’ll gain valuable insights, strategies, and knowledge that will empower you to excel in the dynamic realm of real estate investment and entrepreneurship.

Exploring the Essential Features of “Nick Huber – Real Estate Masterclass“

A deep dive into real estate. How deals are measured, structured, financed, and operated. The risk factors, how to gain a competitive advantage, and more.

Buy now

Why this course exists

This is what I wish I knew about real estate when I was 25 years old with some cash in my pocket, about to do my first deal. This is what I’ve learned over the past several years of being a real estate professional building a portfolio of $150MM worth of self-storage assets we own and operate.

This is what real estate entrepreneurs teach their children around the dinner table. These are the concepts I will work to instill in my children so they can enter the field and succeed.

The Real Estate Masterclass is the very best of 400+ hours of concentrated work, over 90,000 words, dozens of deal breakdowns, videos, quizzes, and more. If you ever wanted an honest, in-depth look at real estate as a career or investment option, I promise you won’t find a more complete course than this one.

I promise even experienced real estate investors will get nuggets of wisdom and learn something new. It is more practical and valuable than any college real estate course.

What you’ll learn in the Masterclass

These are only a few of the key lessons and strategies you’ll learn in the masterclass. For a complete table of contents, scroll to the bottom of the page!

- How Real Estate is Valued & the Skills You Need to Succeed

- Real Estate Appreciation, Leverage, Debt, Risk, and NOI

- Deal Structure, Raising OPM, Negotiating, Scaling a Portfolio

- Behind the Scenes Deal Breakdowns and Scenarios

- How to use Twitter to expand your network & portfolio

- The Mindset of Successful Investors and Operators

Who I made the Masterclass for…

I’ll be clear → anyone can benefit from these lessons. Everything in this course will help you become more informed, prepared, and confident to start or scale your real estate career. But there are 4 types of people it can help most…

1. Beginners ready to turn Pro

You’ve done your research. You’ve been devouring information online. You’re starting to make connections in the real estate world. You’re asking the right questions. You can see your future in real estate — you just want to make sure you’re on the right path. Well, you’ve come to the right place! I made this course to share a clear and highly detailed picture of how to build a career in real estate — with real-life examples. I’ll give you an unfiltered look at what I did and how I did it — what works, and what doesn’t.

2. People with resources who want to use them wisely

These are people who are ready to make real estate a part of their future, but they’re not sure which way to go. They want to look at it from 1000 feet above and analyze asset classes. They are able to pick and choose their path as they either buy real estate on their own or invest.

3. Passive Investors who want to invest with confidence

These are people who earn enough money that they are looking to passively invest. They can’t move their focus away from the main money-maker, but they want to learn how to invest in real estate through sponsors. They want to partner with operators who are doing deals, analyze the deal with confidence, figure out what questions to ask, figure out where the risk is, and understand how all this works.

4. Investors and Operators who want to level up

The most important group, the one I am most aligned with and is exactly who I am. You are the person ready to buy an asset, or you own property or are ready to make real estate a big part of your work and wealth. You are ready to level up and raise outside capital, build a management company, a real estate private equity firm, and expand to make real estate a tremendous part of your life and career.

What this course is not

This is not a way to get started in real estate today with no money. It is not a way to get rich quick in real estate. It’s not a way to go from 0 to 1 and create new wealth through real estate.

This is not a guide on operating specific asset classes of real estate. This is not a complete, in-depth guide on any one aspect of real estate.

While it provides the frameworks, this is not a guide on putting together your first deal with other people’s money and jumping in head first.

Get a rock-solid foundation of real estate essentials

See a full course syllabus at the bottom of the page!

Real Estate Valuation

- Smell Tests, Speculation & Trends

- Underwriting — Determining What a Property is Worth to You

- Aspects of a Solid Cash Flow Model

- Monthly Cash Flow Model

- A Detailed Analysis of My Model

- How to Find a Model Specific to your Industry

- Deal Overview

- Due Diligence

Real Estate Fundamentals

- How Do Real Estate Investors Get Really Wealthy?

- Two Almighty Definitions: NOI and Cap Rate

- Overview of My Portfolio

- How Appreciation Works

- Ways to Force Appreciation

- The Roll-up Strategy

- Cap Rate Compression

- A Key Operational Advantage (and The Holy Grail)

- How to Use Time as the Ultimate Economic Tailwind

Leverage

- How Leverage Amplifies Gains and Losses

- Visualizing Leverage in Real Estate

- Refis and Recaps

- Debt Yield & Debt Constant

- Debt Constant: Overview, Worksheet, Quiz, Review

- Debt Yield: Overview, Table, Quiz, Review

- Glossary of Key Terms

- Alternative Financing Method: Securities Backed Line of Credit

Tax Advantages of Real Estate

- Depreciation & Bonus Depreciation

- Recapture & Capital Gains

- Interest Expense as a Deduction

- Income vs. Capital Gains

- QOZ — Qualified Opportunity Zone

- Cost Segmentation Study Examples

- IRS Depreciation FAQ

- Basis & the 1031 Exchange

- Additional Tax Loopholes

Risk

- How to Assess & Manage Risk

- How to Lose a Lot of Money Really Fast

- The Cyclical Nature of Real Estate

- How to Hedge Your Risk

- Stress Tests

- Model Walkthrough — Variables Affecting Cash on Cash, Debt Yield, and Debt Constant

- Operations, Emotions & CAPEX

Deal Structures

- How Private Equity Works

- Prefs, Promotes & Waterfalls

- How to Think about Fees

- How Should You Structure Your Deal?

- PPM and Executive Summaries

- The Straight Split Structure

- Vetting LPs and Managing Expectations

- Re-capitalizing a Deal

- Multiple Examples of Case-Specific Executive Summaries

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Morgan Gist MacDonald - Book + Bonuses

Morgan Gist MacDonald - Book + Bonuses  Morgan Gist MacDonald - Start Writing Your Book Today

Morgan Gist MacDonald - Start Writing Your Book Today  Morgan Gist MacDonald - The Complete Book-Writing Checklist

Morgan Gist MacDonald - The Complete Book-Writing Checklist  Oliver Velez - Essential Strategy Of Trade For Life

Oliver Velez - Essential Strategy Of Trade For Life  Derald Wing Sue - Multicultural Competence in Counseling & Psychotherapy

Derald Wing Sue - Multicultural Competence in Counseling & Psychotherapy  Morgan Gist MacDonald - Think Like a Professional Author

Morgan Gist MacDonald - Think Like a Professional Author  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  Hannah Dixon - The VA Starter Kit™

Hannah Dixon - The VA Starter Kit™  Sovereign Man Confidential - Renunciation Video

Sovereign Man Confidential - Renunciation Video  The Daily Traders – Exclusive Trading Mentorship Group

The Daily Traders – Exclusive Trading Mentorship Group  George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)

George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)  Racing Workshop - Complete Online Package

Racing Workshop - Complete Online Package  Akil Stokes & Jason Graystone - TierOneTrading - Trading Edge 2019

Akil Stokes & Jason Graystone - TierOneTrading - Trading Edge 2019  Dave Landry - Stock Selection Course

Dave Landry - Stock Selection Course  Combat Core - Advanced Torso Training - Chris Fanelli

Combat Core - Advanced Torso Training - Chris Fanelli