*** Proof of Product ***

Exploring the Essential Features of “How to Analyze Multifamily Investment Opportunities – Symon He & Brandon Young”

How to Analyze Multifamily Investment Opportunities

Learn professional techniques and use investment-grade models to analyze multifamily investment deals

What you’ll learn

- Confidently evaluate multifamily investment opportunities

- Identify and address key investment considerations for multifamily deals

- Conduct proper market analysis for multifamily deals

- Conduct proper financial analysis for multifamily deals

- Understand and use key multifamily investment metrics

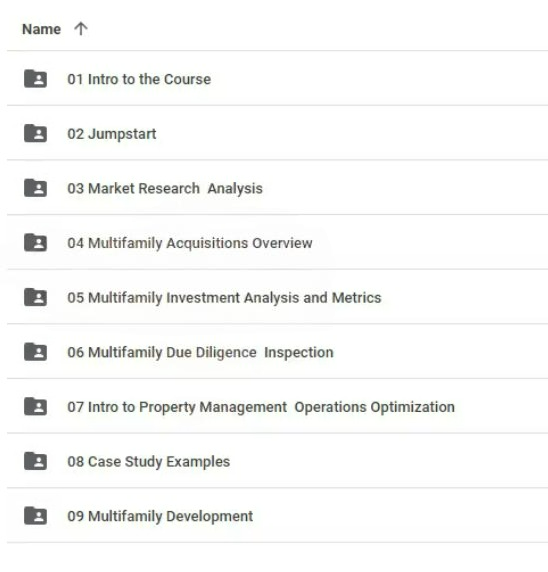

Course content

- Intro to the Course

A few reminders before we begin - Jumpstart

Jumpstart Intro

Jumpstart Market Analysis

Jumpstart Financial Analysis I

Jumpstart Financial Analysis II

Jumpstart Summary

Jumpstart Quiz - Market Research & Analysis

Intro to Market Analysis

Where to Get the Data

Regional Analysis

Neighborhood Analysis

Competitive Analysis

Market Research and Analysis Quiz - Multifamily Acquisitions Overview

Intro to the Acquisition Process

Finding Value for Value-Add Strategy

Long Term Hold & Refinancing

Multifamily Value-Add Strategies

Letter of Intent

Purchase & Sales Agreement 101

Purchase & Sales Agreement 101 Part 2

Multifamily Acquisitions Overview Quiz - Multifamily Investment Analysis and Metrics

Investment Analysis Overview

Multifamily Investment Risks

Price on Actuals, Invest for Potential

Gross Rent Multiplier

Capitalization Rate Review

Loan to Value

Debt Service Coverage Ratio

It’s All About Cash Flow

Cash on Cash Returns

Rule of 72

IRR and Equity Multiple Review

Tax Benefits

Rent Roll Analysis

True Vacancy

Analyzing Income Sources

Finding Other Income

Analyzing Expenses

Expense Ratio

Capital Expenditures

Repair Allowance

Critical Items

Hands-On With the Income Statement – Part 1

Hands-On With the Income Statement – Part 2

Joint Ventures

Carried and Promoted Interest

Hands-On With the JV Waterfall

Hands-On With the JV Waterfall (Monthly Cash Flows)

Investment Analysis Quiz - Multifamily Due Diligence & Inspection

Due Diligence for Multifamily Overview

Renovation Feasibility

Resident Profile Analysis

Property Inspections

Building Codes, Common Areas, and Zoning.

Lease File Audits

The Due Diligence Checklist

Due Diligence and Inspection Quiz - Intro to Property Management & Operations Optimization

Property Management Overview

Property Management Options

Hiring Property Managers

Staffing Plans and Costs

Property Management Fees

Causes of Low Occupancy

Finding and Securing Good Tenants

Revenue Neutral Pricing Strategies

Using a Rent Matrix

Property Management Software

Ratio Utility Billing System (RUBS) 101

Property Management and Operations Quiz - Case Study Examples

4-Plex Buy and Hold – Part 1

4-Plex Buy and Hold – Part 2

115 Unit Buy and Renovate – Part 1

115 Unit Buy and Renovate – Part 2

115 Unit Buy and Renovate – Part 3

115 Unit Buy and Renovate – Part 4

115 Unit Buy and Renovate – Part 5

115 Unit Buy and Renovate – Part 6

115 Unit Buy and Renovate – Part 7

184 Unit Reposition – Part 1

184 Unit Reposition – Part 2

184 Unit Reposition – Part 3

184 Unit Reposition – Part 4 - Multifamily Development

Multifamily Acquisitions vs. Development

Stages of Multifamily Development

Introduction to the Multifamily Development Model

Multifamily Development Quiz

Lecture Slides

Requirements

- Real Estate Investment Fundamentals

- Working Knowledge of Investment Analysis

- Discounted Cash Flow Analysis

- Intermediate Level Excel or Financial Analysis

Description

Justin Alamano – 5 Stars

“The models provided are worth many times the price of the course.”

Marquez Cadet – 5 Stars

“Excellent course with fantastic resources. Instructors provided valuable detailed instruction!!!”

Gregory A. Weinstein – 5 Stars

“Course material is comprehensive, presented in an engaging manner and the modeling tools have real world applicability making this course valuable!”

Thinking about investing in multifamily apartments but not quite sure how?

This course will show you professional techniques and give you professional investment models to help you find the winners in multifamily properties.

Before we go further, please note that this is an advanced course.

This course assumes you have a working knowledge of real estate investing fundamentals and you’re comfortable working with financial models in Excel.

If you’ve never worked with financial models or aren’t comfortable working in Excel, this is not the course for you.

We also assume you understand the fundamentals of discounted cash flows and you have a working knowledge of IRR, yields, cap rates, etc…

You’ll get the most out of this if you take one of Symon’s introductory courses first, which you can find at the bottom of this page.

What’s covered in this course:

- How to conduct market analysis at the regional, neighborhood, and competitive level.

- How to conduct financial analysis for a multifamily investment.

- How to analyze and verify income sources

- How to analyze expenses

- How to look at capital expenditures

- Evaluating rent roll

- Creating tenant profiles

- Key points of negotiations for the Purchase & Sale Agreement

- What is the Gross Rent Multiplier and how to use it

- Review of key investment metrics in the multifamily context.

- Proper due diligence

- Multi-family case studies

Ivana Bunjevacki – 5 Stars

“A great course! Very detailed with in-depth explanations and analysis and above all, very practical and applicable to real life situations.”

Chris Ross – 5 Stars

“Very methodical, great pace, excellent presentation”

_______________________________________

I don’t live in the US, is the material still relevant to me?

Yes! While all of the examples in the course use US properties, ALL of the concepts taught and tools provided inside are still useful for any market around the world. In fact, I have students from over 190 countries who are learning and using the tools provided in the course to help them invest in their local area.

What if I don’t have any real estate background?

If you missed it earlier, this course assumes prior knowledge or background. Go take Symon’s Intro to Real Estate Investing course if you have ZERO background in real estate.

Why is there so much math and numbers?

You can’t properly evaluate a real estate investment without looking at its numbers. So if you hate math and don’t like numbers, this course isn’t for you. Serious real estate analysis is probably not for you either.

Why do you use Excel so much?

Good question. Analyzing real estate investments involves looking at the numbers and it’s easiest to do so with spreadsheets, which is why I use Excel extensively in this course. But the good thing is you DO NOT have to build any of the models yourself. You just need to be able to follow along and then you’ll be able to use the models I give you. For what it’s worth, these models are the same ones we built when we worked for multimillion-dollar investment funds to help them find and analyze multifamily deals.

Can you make me rich by taking your course?

No way! Not just from taking the course, at least. Anyone who promises you that is selling snake oil.

If you take my course AND apply what you’ve learned to make smarter investments in the future, then you have a chance at making some real money.

What will I be able to do after I take your course?

After taking my course, you will be able to confidently use professional real estate investment techniques to evaluate multifamily deals.

Everton Allen – 5 Stars

“The presentation is simple, clear and relevant.”

Richard Reichmann – 5 Stars

“Absolutely the best value. Everything is very well explained. Trainer speaks slowly and clearly easy to understand. Excellent course highly recommended.”

Glenn Levine – 5 Stars

“The instructor is exceptionally knowledgeable and keeps the course very informative and interesting!”

Who this course is for:

- Students with some background in real estate investing looking to explore multifamily

- Students who are comfortable working with financial models in Excel

Instructors

Symon He

Author | Investor | MBA

Symon He is the author of the Rental Property Investing QuickStart Guide, Amazon best-seller Real Estate Investing QuickStart Guide, and the co-author of Airbnb for Dummies, all available now on Amazon and in bookstores throughout North America.

He is also co-founder of LearnBNB, a leading online educational destination for all things Airbnb hosting and short-term rentals. His works have been cited or featured on the Wall Street Journal, Reuters, Forbes, CNBC, Entrepreneur, and SKIFT. Through his training and coaching programs, he has worked directly with thousands of aspiring Airbnb hosts to jumpstart their short term rental journeys. His training programs have been featured by prominent third-party partners, including a joint venture with RichDad.

As a licensed broker, Symon previously helped private real estate investors with their acquisitions and deal structuring. As an angel investor, he also advises and invests in early stage startups.

Previously, Symon worked in several corporate real estate and finance roles at large private and Fortune 80 companies, including at a private equity investment firm covering a wide range of commercial real estate acquisitions in the western USA.

Symon received dual degrees in Computer Engineering and Economics with Honors from UC Irvine and an MBA from Stanford University.

Brandon Young

Real Estate | Data Engineering | Advanced Analytics

Master’s degree in Real Estate Finance and Development from UNC Charlotte.

Master’s degree in Finance from Tulane University.

Bachelor’s degree in Management from Park University.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/