Introduction

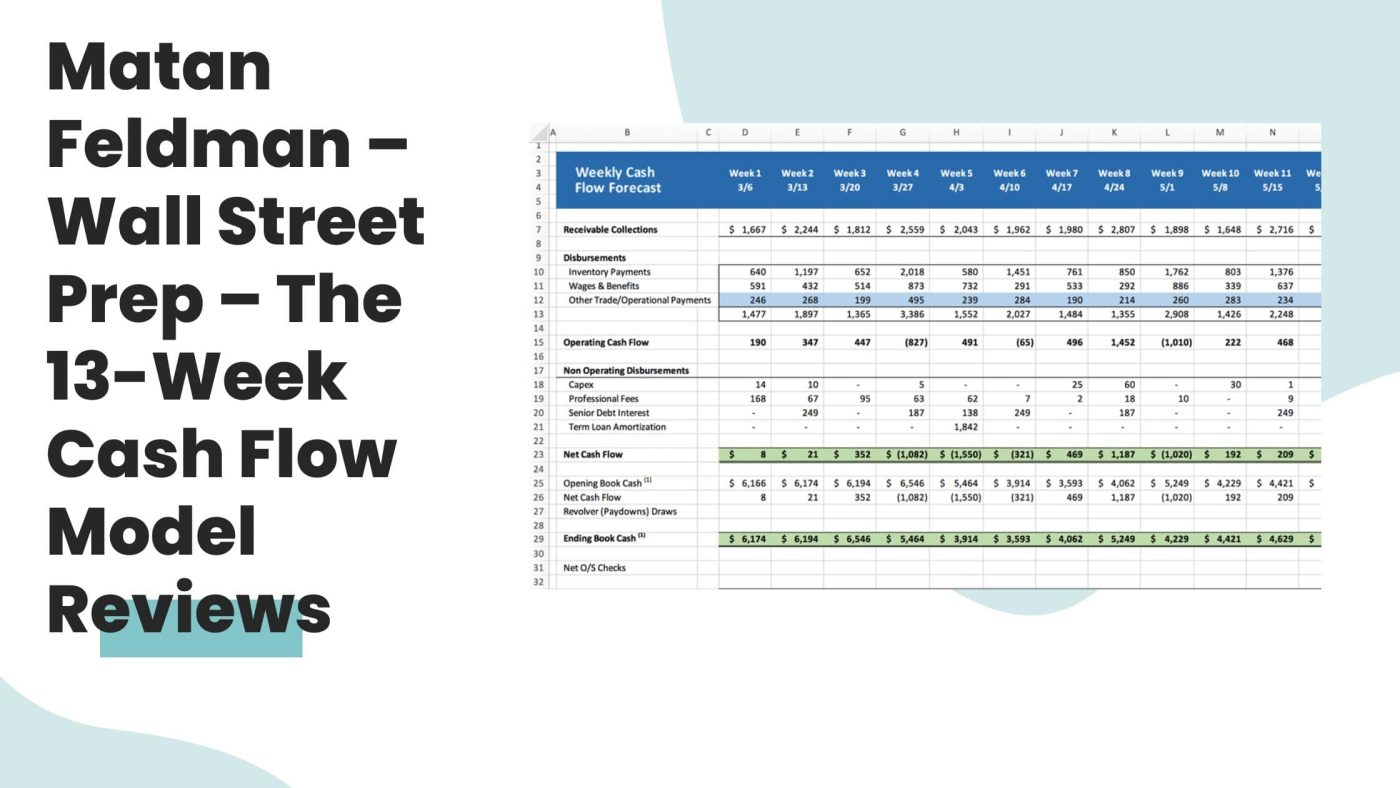

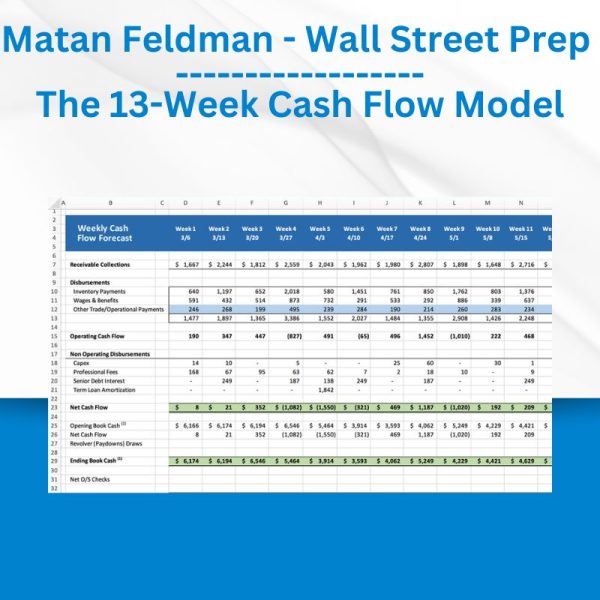

In the realm of finance, the ability to construct accurate and insightful financial models is a skill that holds immense value. Wall Street Prep’s “The 13-Week Cash Flow Model” course stands as a testament to this importance. This course offers a comprehensive journey through the creation of an integrated 13-week cash flow model, providing participants with hands-on experience in dealing with real-world financial scenarios.

This blog introduces you to the essence of the “The 13-Week Cash Flow Model” course. We will delve into its key features, learning objectives, and its unique approach to equipping individuals with the tools to handle intricate financial challenges. From mastering cash flow modeling intricacies to understanding stakeholder motivations during financial turnarounds, this course offers a pathway to practical expertise highly sought after in the finance industry.

Matan Feldman – The 13-Week Cash Flow Modeling – Wall Street Prep

About the Author: Matan Feldman

The mastermind behind the “The 13-Week Cash Flow Model” course is none other than Matan Feldman. With a wealth of experience and expertise in the finance domain, Matan has carved a name for himself as a trusted authority in financial modeling and restructuring.

Matan’s background encompasses a profound understanding of finance, combined with practical knowledge gained from hands-on experience in the field. His proficiency in financial modeling, valuation, and turnaround strategies shines through in the course’s comprehensive content and practical approach.

As the visionary behind this course, Matan Feldman brings his unique insights into the art and science of financial modeling, ensuring that participants not only grasp the theoretical concepts but also gain the skills to apply them in real-world scenarios. With Matan at the helm, “The 13-Week Cash Flow Model” course becomes an opportunity for learners to tap into the mind of a seasoned finance professional and enhance their own financial expertise.

Key Benefits

- Comprehensive 13-Week Cash Flow Training: This course offers a systematic and in-depth exploration of building an integrated 13-week cash flow model. The step-by-step approach ensures that participants grasp the nuances of constructing and analyzing complex financial models effectively.

- Real-World Application: Unlike many theoretical courses, “The 13-Week Cash Flow Model” emphasizes hands-on learning. Through a case study, participants have the opportunity to construct a fully integrated model, mirroring the processes they would encounter in real-world financial scenarios.

- Excel Model Templates: The course provides participants with a complete 13-Week Cash Flow Model template. This valuable resource aids in solidifying the concepts learned and serves as a reference for future financial modeling endeavors.

- Targeted Audience Inclusion: The course caters to a diverse audience, including turnaround consultants, investment banking professionals, distressed debt investors, corporate finance experts, and private equity professionals. Regardless of your finance domain, the skills acquired from this course hold immense value.

- Insights into Stakeholder Motivations: “The 13-Week Cash Flow Model” delves beyond the numbers. Participants gain a deeper understanding of the motivations driving various stakeholders during financial restructurings and turnarounds, a critical skill for effective decision-making.

- Expert Instructors: The course is taught by seasoned professionals who have extensive experience in finance and consulting. This ensures that participants receive guidance not only in technical aspects but also in practical skills like creating compelling pitchbooks and client decks.

- Adoption by Top Firms: The course’s pedigree is underscored by its adoption by leading turnaround consulting firms, investment banks, and distressed debt funds. By enrolling in this course, participants gain access to the same training employed by top industry players.

- Demystifying Complexities: The course doesn’t shy away from addressing complex scenarios and messy data. Participants are equipped with the tools to confidently navigate through these intricacies, enhancing their problem-solving abilities.

- Practical Mapping Techniques: The course covers practical techniques such as account mapping using SUMIFS, bridging the gap between theoretical concepts and their application in creating effective financial models.

- Reshaping Financial Expertise: By the end of the course, participants emerge with a comprehensive skill set that extends beyond the classroom. “The 13-Week Cash Flow Model” equips individuals with the ability to tackle intricate financial challenges and contribute meaningfully to their organizations.

Who Is the Course For

“The 13-Week Cash Flow Model” course is tailor-made for a diverse range of professionals in the finance domain. Whether you’re looking to strengthen your financial modeling skills or gain insights into navigating complex financial scenarios, this course is designed to cater to the following individuals:

- Turnaround Consultants & Advisors: Professionals involved in turnaround consulting and advisory roles will find immense value in this course. The practical approach to constructing 13-week cash flow models, combined with insights into stakeholder motivations, equips them to make informed decisions in challenging financial situations.

- Restructuring Investment Banking Professionals: Investment bankers specializing in restructuring and turnarounds can benefit from the course’s hands-on training. The ability to create integrated cash flow models and understand the intricacies of stakeholder dynamics enhances their ability to provide valuable financial advice.

- Distressed Debt Investors: Those engaged in distressed debt investments can leverage the skills gained from the course to conduct comprehensive financial analysis. The course equips them to evaluate potential investment opportunities with a deep understanding of cash flow dynamics.

- FP&A and Corporate Finance Professionals: Professionals working in financial planning and analysis (FP&A) and corporate finance roles will find the course instrumental in refining their financial modeling expertise. The practical skills acquired can aid in accurate forecasting and strategic financial decision-making.

- Private Equity Professionals: Private equity professionals seeking to enhance their financial modeling capabilities can gain insights into constructing detailed cash flow models. This skill set is valuable for assessing potential acquisitions and managing portfolio companies.

The course’s broad applicability is a testament to its versatility. Regardless of your specific role within the finance industry, “The 13-Week Cash Flow Model” offers a pathway to practical expertise that can reshape your ability to navigate intricate financial landscapes. Whether you’re on the path of consultancy, investment, or corporate finance, this course has something valuable to offer.

Pros and Cons

Pros:

- Hands-On Learning: The course emphasizes practical application, allowing participants to construct a fully integrated 13-week cash flow model using a real-world case study. This hands-on approach ensures that theoretical concepts are translated into actionable skills.

- Realistic Scenarios: The course’s focus on turnarounds and financial restructurings exposes participants to realistic scenarios they might encounter in their finance careers. This enables them to gain insights into stakeholder motivations and make informed decisions.

- Expert Instruction: Led by experienced finance professionals, the course provides guidance from individuals who have a deep understanding of financial modeling and consulting. Learners benefit not only from technical knowledge but also practical insights.

- Excel Model Templates: The provision of a complete 13-Week Cash Flow Model template aids in understanding complex concepts and serves as a valuable reference for future projects.

- Relevance Across Finance Domains: The course’s applicability extends across various finance roles, making it valuable for turnaround consultants, investment bankers, distressed debt investors, corporate finance professionals, and private equity experts.

- Industry Recognition: The fact that the course is used by top turnaround consulting firms, investment banks, and distressed debt funds showcases its credibility and relevance in the industry.

- Complexity Handling: The course doesn’t shy away from addressing complexities such as messy data and commingled line items, equipping participants with problem-solving skills to handle challenging scenarios.

- Insight into Stakeholder Motivations: Understanding the motivations of various stakeholders during financial restructurings enhances decision-making capabilities, a crucial skill in the finance field.

Cons:

- Specific Focus: The course’s primary focus on 13-week cash flow modeling within the context of turnarounds and restructurings might limit its applicability for professionals seeking broader financial modeling knowledge.

- Case Study Limitation: While the case study provides a practical learning opportunity, it might not cover all potential scenarios that participants could encounter in their finance careers.

- Intermediate Level: The course assumes a certain level of familiarity with finance and financial modeling concepts. Beginners might find certain sections challenging without prior knowledge.

- Fast-Paced Learning: Given the comprehensive content, some participants might find the pace of the course quite intense, requiring focused attention to absorb all the details.

- Lack of Interactive Elements: The course’s learning experience might be further enhanced with interactive elements like quizzes or interactive exercises.

In conclusion, “The 13-Week Cash Flow Model” course offers a wealth of benefits for finance professionals seeking to enhance their financial modeling skills and gain insights into turnaround scenarios. While it comes with some limitations, the hands-on learning, expert instruction, and real-world relevance make it a valuable addition to the toolkit of anyone navigating the complexities of finance.

Conclusion

In the ever-evolving landscape of finance, mastery over financial modeling is a skill that sets professionals apart. “The 13-Week Cash Flow Model” course by Wall Street Prep, led by the experienced Matan Feldman, presents a unique opportunity for finance enthusiasts to delve into the intricacies of constructing integrated cash flow models within the context of turnarounds and restructurings.

This course’s emphasis on practical application stands out as a defining feature. Through a real-world case study, participants have the chance to roll up their sleeves and build a comprehensive 13-week cash flow model, mirroring the complexities they could face in their careers. This approach bridges the gap between theoretical concepts and their pragmatic implementation.

The course’s benefits extend beyond technical skills. Insights into stakeholder motivations, expert instruction from seasoned professionals, and the course’s recognition by leading industry players add layers of credibility to the learning experience.

Of course, no course is without its limitations. The focused nature of the course might not cater to those seeking broader financial modeling knowledge. Additionally, the fast-paced learning and intermediate level might pose challenges to beginners.

In the end, “The 13-Week Cash Flow Model” course offers a transformative experience for individuals in various finance domains. It equips participants with the skills to navigate complex financial scenarios, understand stakeholder dynamics, and contribute meaningfully to their organizations’ success. If you’re ready to immerse yourself in the world of financial modeling, armed with practical skills and real-world insights, this course could be your pathway to excellence in finance.

Frequently Asked Questions (FAQs)

1. What is “The 13-Week Cash Flow Model” course about? This course is a comprehensive exploration of building an integrated 13-week cash flow model, particularly within the context of turnarounds and financial restructurings. Led by experienced professionals, the course offers hands-on learning and insights into stakeholder motivations.

2. Who is the course designed for? The course caters to a diverse audience, including turnaround consultants, restructuring investment banking professionals, distressed debt investors, FP&A and corporate finance experts, and private equity professionals. It’s suitable for anyone seeking to enhance their financial modeling skills and understand complex financial scenarios.

3. How is the course taught? The course is taught using a step-by-step approach, guiding participants through the process of constructing an integrated cash flow model. A real-world case study is used to provide practical context, and expert instructors share their insights and experiences.

4. Are there any prerequisites for the course? While the course assumes a certain level of familiarity with finance concepts, it is designed to be accessible to intermediate-level learners. A basic understanding of financial modeling and finance terminology would be beneficial.

5. What are the key benefits of the course? The course offers hands-on learning, practical application of financial modeling, insights into stakeholder motivations, Excel model templates, expert instruction, and relevance across various finance domains. It equips participants with skills that extend beyond theoretical understanding.

6. Are there any drawbacks to the course? The course’s specific focus on 13-week cash flow modeling and its contextualization within turnarounds might limit its broader applicability. Additionally, the fast-paced learning and intermediate level could be challenging for beginners.

7. Can I apply the skills learned in the course to other finance scenarios? Yes, the skills acquired in this course, such as constructing integrated cash flow models and understanding stakeholder dynamics, have relevance in various finance domains. While the focus is on turnarounds, the principles learned can be adapted to other financial situations.

8. Is this course recognized in the industry? Absolutely. The course’s adoption by leading turnaround consulting firms, investment banks, and distressed debt funds showcases its industry recognition and credibility.

9. Will I receive any course materials? Yes, the course provides participants with a complete 13-Week Cash Flow Model template, which serves as a valuable resource and reference for future financial modeling endeavors.

10. How will the course enhance my career in finance? The course equips you with practical skills that are highly valued in the finance industry. Whether you’re a consultant, investor, banker, or analyst, the ability to construct integrated cash flow models and understand stakeholder motivations will enhance your decision-making and problem-solving capabilities.

For any further questions or clarifications, feel free to reach out to Wall Street Prep’s support or refer to their course materials.

How to get “Matan Feldman – Wall Street Prep – The 13-Week Cash Flow Model” with a Free Download or Group Buy?

In today’s digital age, the allure of free downloads is undeniable. However, it’s essential to approach such offers with caution. While there might be websites or platforms claiming to offer ““Matan Feldman – Wall Street Prep – The 13-Week Cash Flow Model” ” for free, downloading content from unauthorized sources can have several repercussions. It’s always advisable to procure such materials from reputable and authorized vendors.

Matan Feldman – The 13-Week Cash Flow Modeling – Wall Street Prep

Exploring Alternative Courses

While the ““Matan Feldman – Wall Street Prep – The 13-Week Cash Flow Model” ” offers a comprehensive educational experience, it’s always wise to consider alternative courses that might align better with your learning preferences and goals. Here, we’ll highlight a few alternative courses to help you make an informed decision: