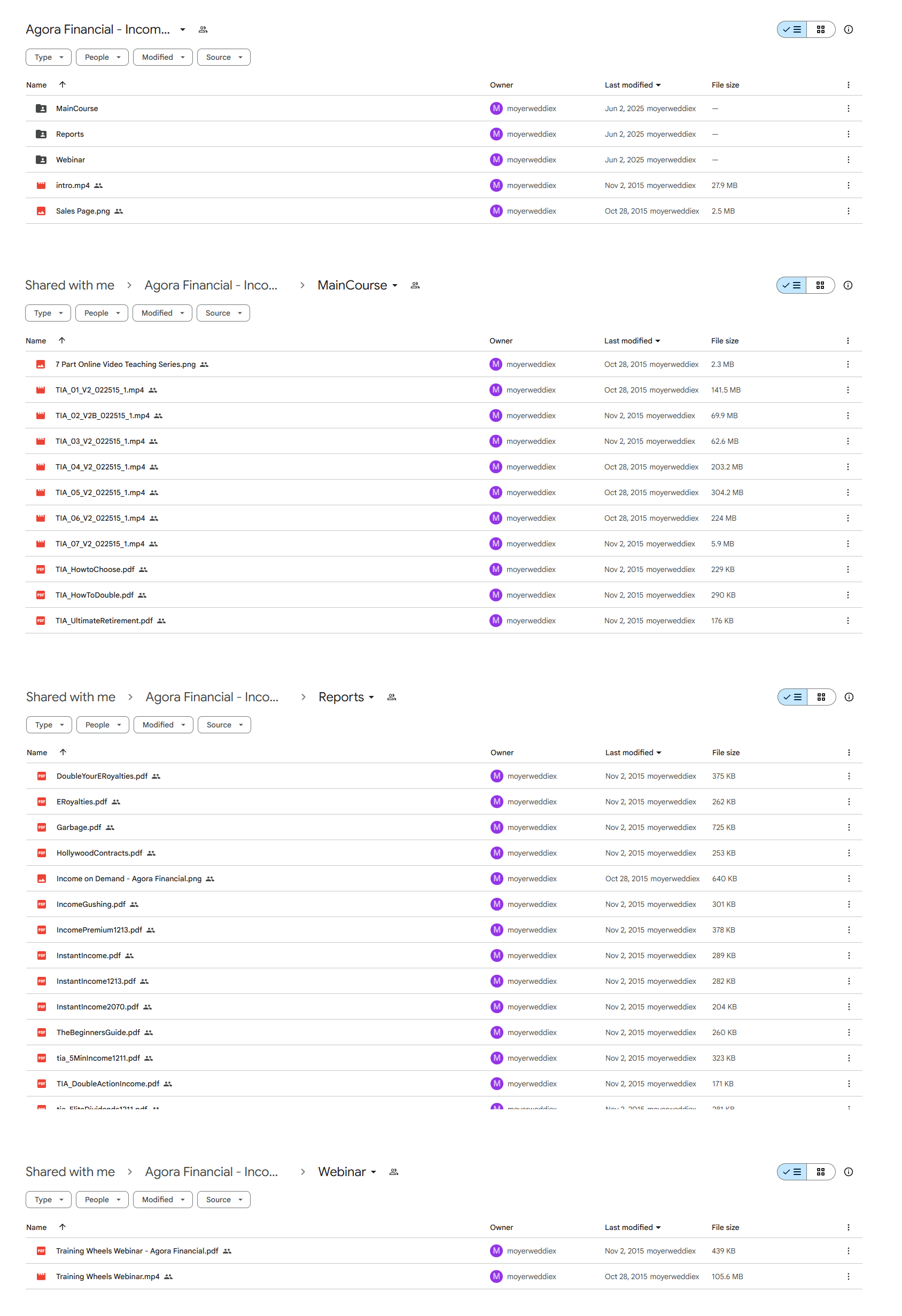

*** Proof of Product ***

Exploring the Essential Features of “Agora Financial – Income on Demand“

Course Goals

- Objectives: Learn to generate a reliable income through investment strategies.

- Outcomes: Understand key concepts and apply strategies for steady income.

Income Investing Basics

- Core Principles: Focus on investments designed to provide regular income, such as dividends, interest, and rental income.

Market Overview

- Current Trends: Explore today’s opportunities in income investments and how to leverage them.

Dividend-Paying Stocks

Stock Selection

- Criteria: Identify strong dividend-paying stocks based on financial health and performance.

Dividend Yield

- Understanding: Learn how to calculate and interpret dividend yields.

Reinvestment Strategies

- Benefits: Discover how reinvesting dividends can enhance compound growth over time.

Fixed-Income Securities

Bonds and Bond Funds

- Types: Understand government, corporate, and municipal bonds, and their respective benefits.

Interest Rates

- Impact: Learn how interest rate fluctuations affect bond investments.

Laddering Strategy

- Bond Laddering: Manage interest rate risk by creating a staggered bond portfolio.

Real Estate Investment Trusts (REITs)

REIT Basics

- Overview: Learn how REITs operate and their potential for income generation.

Types of REITs

- Equity vs. Mortgage REITs: Compare the two types and their investment characteristics.

Investment Strategies

- Management: Select and manage REITs to achieve consistent income.

Annuities and Other Income Products

Annuities

- Types: Overview of fixed, variable, and indexed annuities.

Income Funds

- Mutual Funds & ETFs: Explore funds designed for income generation.

Alternative Investments

- Peer-to-Peer Lending: Introduction to other income-generating options.

Portfolio Management

Asset Allocation

- Diversification: Balance risk and income through diverse investments.

Risk Management

- Mitigation: Identify and manage risks associated with income investments.

Performance Monitoring

- Review: Regularly assess and adjust your investment portfolio.

Tax Considerations

Tax-Efficient Investing

- Strategies: Minimize taxes on income investments.

Tax-Advantaged Accounts

- Utilization: Use IRAs, 401(k)s, and other accounts to optimize tax benefits.

Tax Reporting

- Requirements: Understand how to report various income-generating investments.

Key Features

Expert Guidance

- Instructors: Learn from seasoned financial experts.

- Guest Speakers: Gain insights from industry professionals.

Interactive Learning

- Webinars: Participate in live and recorded sessions.

- Q&A Sessions: Get personalized advice.

- Community Access: Join a network of income-focused investors.

Practical Tools

- Investment Tools: Use calculators, worksheets, and templates.

- Case Studies: Review real-world examples.

- Simulations: Practice strategies in a risk-free environment.

Benefits

Financial Stability

- Consistent Income: Develop strategies for steady income streams.

- Wealth Preservation: Learn to protect and grow your wealth.

- Long-term Security: Build a secure financial future.

Confidence in Investing

- Knowledge Gain: Acquire a thorough understanding of income investments.

- Decision-Making: Improve your ability to make informed choices.

- Risk Management: Enhance skills to manage investment risks.

Conclusion

Agora Financial’s Income Demand course provides a comprehensive framework for achieving steady income through strategic investing. With expert guidance, practical tools, and a supportive community, you’ll gain the skills and confidence needed to succeed in income investing and reach your financial goals.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/