*** Proof of Product ***

Exploring the Essential Features of “Applied Fixed Income – Andrew Loo – CFI Education”

Applied Fixed Income

Build on your fixed-income fundamentals by diving deeper into government-issued debt, zero-coupon bonds, floaters, linkers, callables, and putables.

- Master government, agency, and sovereign/supranational bonds

- Understand the difference between specialized fixed income instruments like zeroes, floaters, and linkers

- Learn how to price callable and puttable bonds

Overview

Applied Fixed Income Course Overview

This Applied Fixed Income course builds on the fixed income fundamentals and delves deeper into government & agency-issued debt, zeroes, floaters & linkers, and callables & putables. It provides knowledge on how they are priced with industry-relevant examples of each type of debt. You will work through practice examples of certain types of debt and learn how to identify critical information on Refinitiv Workspace. By the end of this course, you will have an enhanced understanding of fixed-income products, which will prepare you for learning advanced fixed-income courses.

We will explore the following:

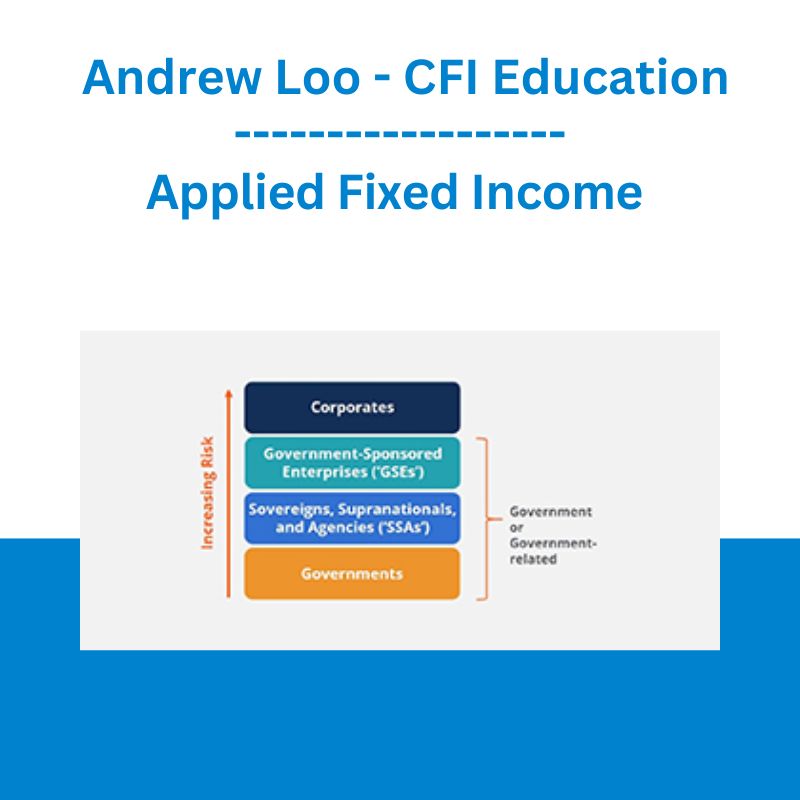

- Government, GSE, and SSA Debt

- Zeroes, Floaters, and Linkers

- Callables and Putables

Applied Fixed Income Learning Objectives

Upon completing this course, you will be able to:

- Describe the different types of fixed-income products, their issuers, and investors

- Understand in-depth their pricing, duration, and convexity

- Understand how to calculate bond yields from Bloomberg

Who should take this course?

This Applied Fixed Income course is perfect for anyone who wants to build up their understanding of fixed-income products. This course is designed to equip anyone who desires to begin a career in the capital markets on the fixed income desk.

What you’ll learn

- Government, GSE, and SSA

Introduction to the Course

Downloadable Files

US Government Debt Market

Bloomberg PX1 – draft

Issuance Process

US Treasury Grey Market

Key US Treasury Auction Statistics

Buybacks

Interactive Exercise 1

Importance of Yield Curves

Carry and Roll

Coupons, Maturities, and Butterflies

Drivers of US Treasuries

European Government Bonds

Interactive Exercise 2

German Government Curve Actives

5-Year On-The-Run OAT

2-Year On-The-Run GILT

Supranationals

Interactive Exercise 3

Case Study – World Bank

IBRD Debt

Issuing Supranational Bonds

IBRD Bond Issuance

IBRD Bond Example

New Issue Distribution

Secondary Trading IBRD Bond

Sovereign Agencies

Sovereign Agencies Yield Curves and Differences

Sovereign Agency – New Issuance

Why Do Investors Buy SSA Debt

Interactive Exercise 4

GSE Debt

GSE Debt Market

Fannie Mae and Freddie Mac

FHLB, FAMC and FFCB

Interactive Exercise 5

FHLB Bond Example

Domestic Bond Markets

International Bond Markets

Sample Shelf and Pricing Supplement - Zeros, Floaters, and Linkers Overview

Zero-Coupon Bonds

PV of a Zero-Coupon Bond

Duration and Convexity of a Zero-Coupon Bond

Excel Example – Duration and Convexity of a Zero-Coupon Bond

Downloadable files

STRIPS

STRIPS Investors and FRNs

FRNs

Interactive Exercise 6

Sample FRNs

Yield of an FRN

Pricing FRNs

Duration of an FRN

Linkers

Interactive Exercises 7

Mechanics of TIPS

TIPS Duration and Breakeven Inflation

Interactive Exercise 8 - Callables and Putables

Introduction to Callables and Putables

Callables and Putables – Payouts and Issuer

Make-whole Call

GSE Callable Bonds

Binomial Interest Rate Tree

Downloadable files

Excel Example – Binomial Interest Rate Tree

Yield To Call

Yield To Worst

Option Adjusted Spread

Duration and Convexity of a Callable Bond

Interactive Exercise 9

Putable Bond

Interest Rate Tree and Price-Yield Relationship

Downloadable Files

YTP Effective Duration and Convexity for Putables

Course Summary - Qualified Assessment

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/