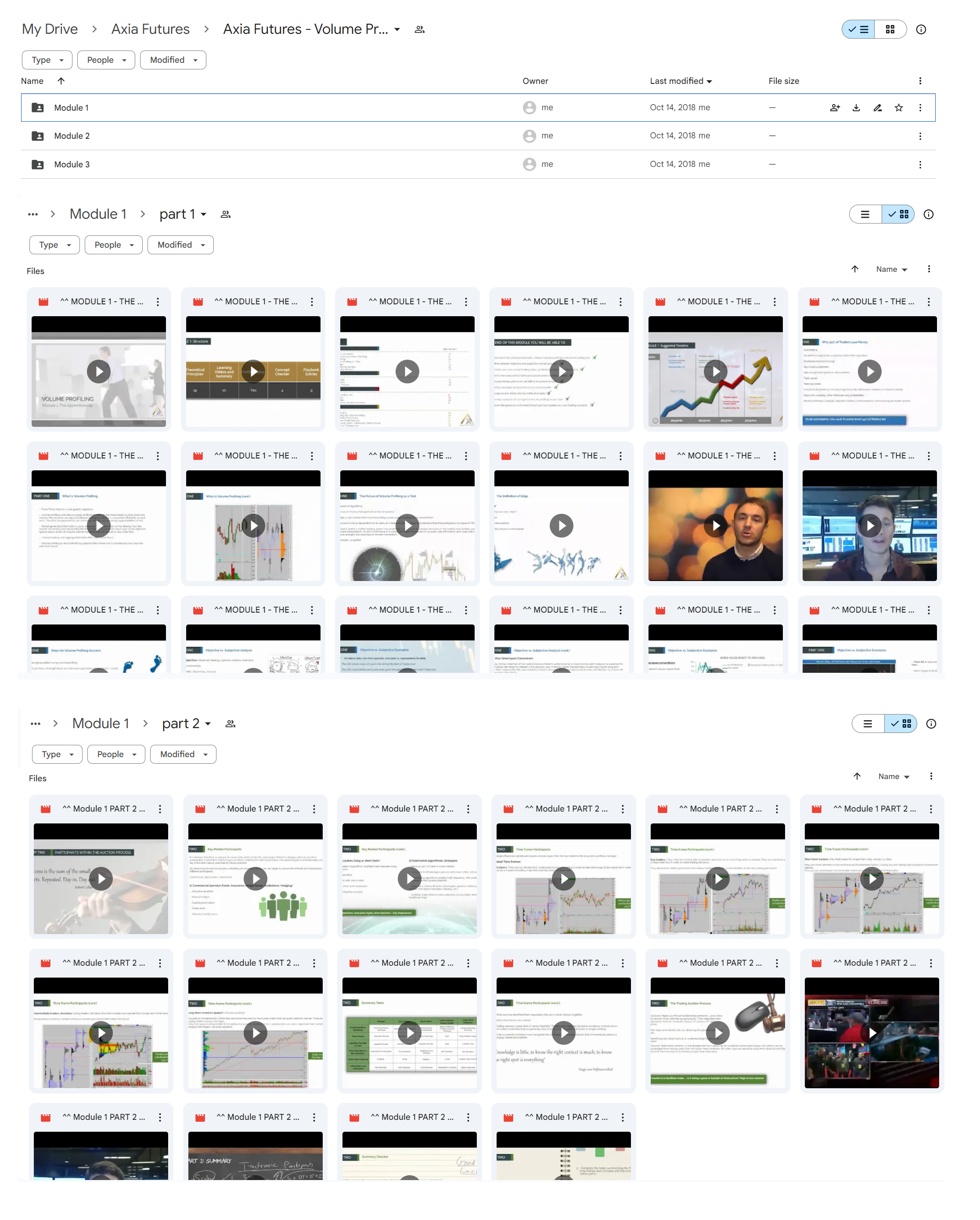

*** Proof of Product ***

Exploring the Essential Features of “Axia Futures – Volume Profiling – Strategy Development“

PART 1 – What, How and Why of Volume Profiling

PART 2 – Participants within the Auction Process

PART 3 – Volume Profiling Elements

PART 4 – Volume Profiling in Action

PART 5 – Principles: Symmetry, Day Types, Price Behaviour and Trading Process

PART 6 – Bracketing, Trending, Market Balance, Trade Location and Market Open Strategies

PART 7 – Auction Identifiers, Point of Control, Anomalies and High/Low Volume Areas

PART 8 – Control Identifiers, Profile Strategies and Volume Profiling Templating

PART 9 – Anomaly Volume Profiling Strategies

PART 10 – Momentum Volume Profiling Strategies

PART 11 – Trending Volume Profiling Strategies

PART 12 – Reversal Volume Profiling Strategies

Axia Futures started with a group of ambitious individuals who appreciate independent thinking and most importantly the value of ethics, honesty and friendship.

We are a team of traders who are also close friends that share the same ideology on how to develop trading talent. For too long, training programmes across the city have become stale and dormant by not evolving with the changing market environment.

We know that to stay ahead of market opportunity, we need a team that shares this ethos of constant reinvention and that is why we have started Axia Futures. We are not only Educators but also Traders and thus what is best for us will ensure is best for our community.

As a collective group of successful traders, with a combined experience of 50 years on our London Trading Floor, we know what is required to be successful so we ensure that all parts of our training reflect these fundamental characteristics.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/