*** Proof of Product ***

Exploring the Essential Features of “Carter Cofield – Your Blueprint to Tax Free Living“

Learn how to maximize your money by leveraging legal tax breaks with the Tax-Free Living Course. With over two hundred meticulously outlined tax write-offs, you can jumpstart your journey to a tax-free lifestyle today!

Who is Carter Cofield?

Carter Cofield is the visionary author behind “Deduct Everything – Your Blueprint to Tax-Free Living” and the founder of Cofield Advisors, a financial services firm tailored to professionals in the entertainment, writing, and social media sectors. At Cofield Advisors, our mission is to unburden artists from financial woes and empower them to save thousands of dollars in taxes. Dive into the wealth of knowledge shared by Carter in two enlightening podcast interviews.

What You’ll Learn:

- Unlock over $100,000 in tax savings with these strategies!

- Transform your personal expenses into legitimate business costs.

- Build generational wealth by tax-efficiently distributing funds to your children.

- Harness the power of tax deductions to create a tax-deductible lifestyle.

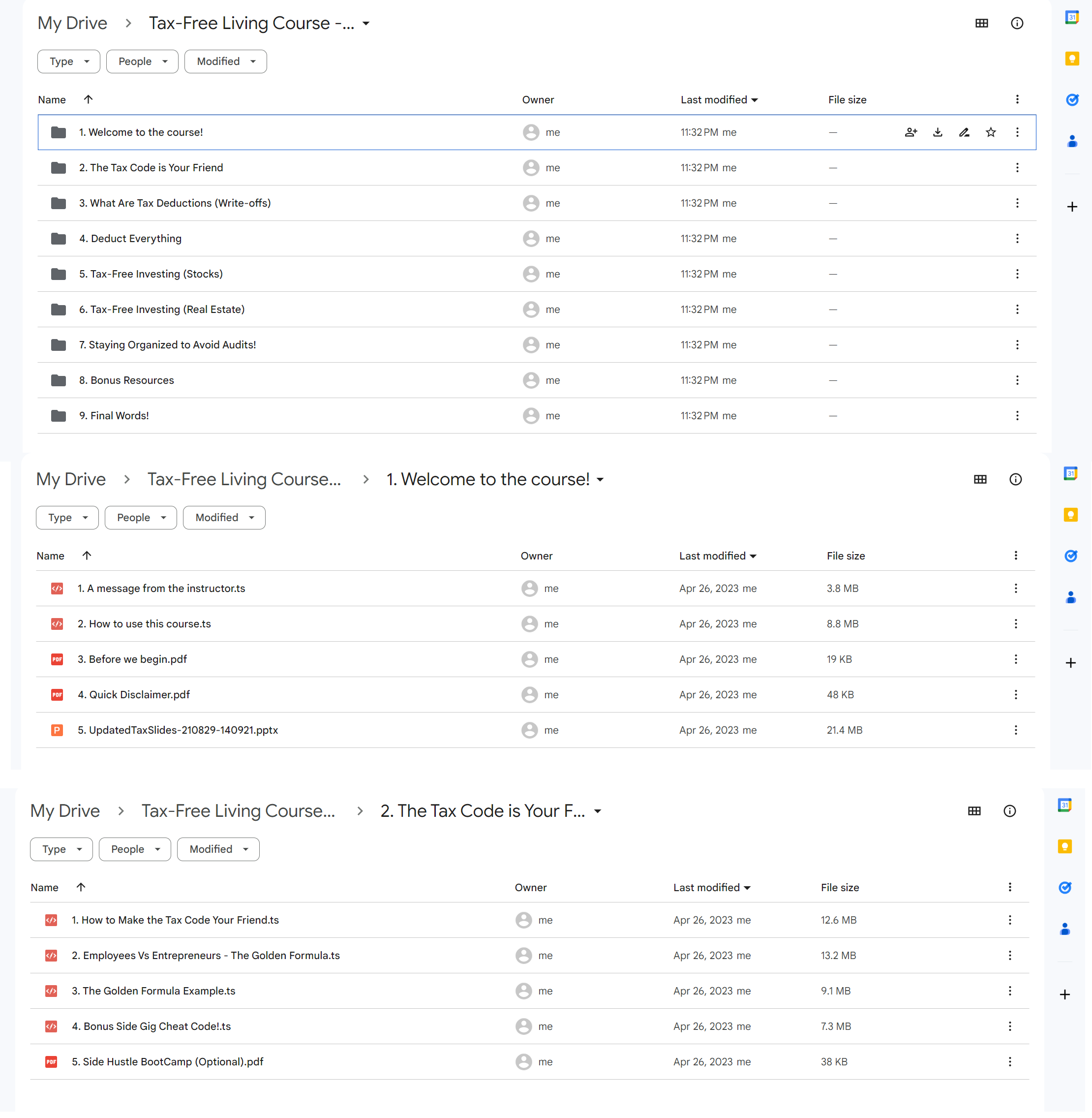

Course Outline:

First: Welcome to the Course!

- A Warm Welcome from the Instructor

- Navigating this Program

- A Few Preliminary Notes

- Important Disclaimer (Please Read)

- Access the “Subtract Everything” PowerPoint Slides

Second: The Tax Code is Your Friend

- Embracing the Tax Code as Your Ally

- Distinguishing Employees from Entrepreneurs – The Golden Formula

- Real-Life Example of The Golden Formula

- Bonus: Unlock the Side Gig Cheat Code!

- Optional Side Hustle BootCamp

Third: What Are Tax Deductions (Write-offs)

- Grasping the Basics – What Exactly Are Tax Deductions?

- Identifying Expenses Eligible for Tax Deductions

- Must-Know Common Deductions for Every Entrepreneur

- Access Downloadable Free Resources!

Fourth: Deduct Everything – Making Your Lifestyle Tax Deductible

- Converting Personal Expenses into Business Deductions

- Discover 10 Personal Expenses You Can Deduct as Business Expenses

- Walkthrough of the Ultimate Tax Deduction Calculator

- Learn How to Travel and Shop Tax-Free!

- Unveil the Side Gig Cheat Code Part 2

- Master the Art of Writing Off Luxuries, like G-Wagons and Teslas

- Explore Tax-Free Payments for Your Children

- Find Business Use for Every Toy You Own

- Gain Access to the Tax-Free Living E-Book with Over 200 Tax Deductions!

Fifth: Tax-Free Investing (Stocks)

- Distinguishing Between Long-Term and Short-Term Capital Gains

- Tax Loss Harvesting Demystified

- Explore Tax-Advantaged Investment Accounts

- Self-Employed Retirement Account Strategies

- Invest in Cryptocurrency Tax-Free with a Self-Directed IRA

- Unlock Tax Wisdom for Traders with a Handy Cheat Sheet!

Sixth: Tax-Free Investing (Real Estate)

- Understand Earning in Your Pocket versus on Paper

- Dive into the 1031 Like-Kind Exchange

Seventh: Staying Organized to Avoid Audits!

- Master the Art of Organization and Record-Keeping

- Take a Deep Dive into Bookkeeping with a Full QuickBooks Walkthrough

- Discover the Top 10 IRS Red Flags and Learn How to Dodge Audits

Eighth: Bonus Resources

- Join Our Thriving Tax-Free Living Facebook Community!

- Access Monthly Mentorship Calls

- Unearth Valuable Bonus Resources

- Attend Tax Saving Webinars, Workshops, and Interviews

- Don’t Forget Your Complimentary TAX-FREE LIVING E-BOOK Containing Over 200 DEDUCTIONS

Ninth: Final Words!

- Parting Words from the Course

- Help Us Help You!

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/