*** Proof of Product ***

Exploring the Essential Features of “Cash Flow Cycles and Analysis – Tim Vipond – CFI Education”

What keeps businesses going and owners up at night? Cash flow! Learn to talk and understand cash flow, and you’ll get your prospects’ and borrowers’ attention

- Learn how businesses manage working capital and investment objectives

- Determine the working capital funding gap, investment payback, and ROI metrics

- Produce a cash flow statement to forecast, optimize, and outline strategies to support and enhance cash flow

Overview

Cash Flow Cycles and Analysis Course Overview

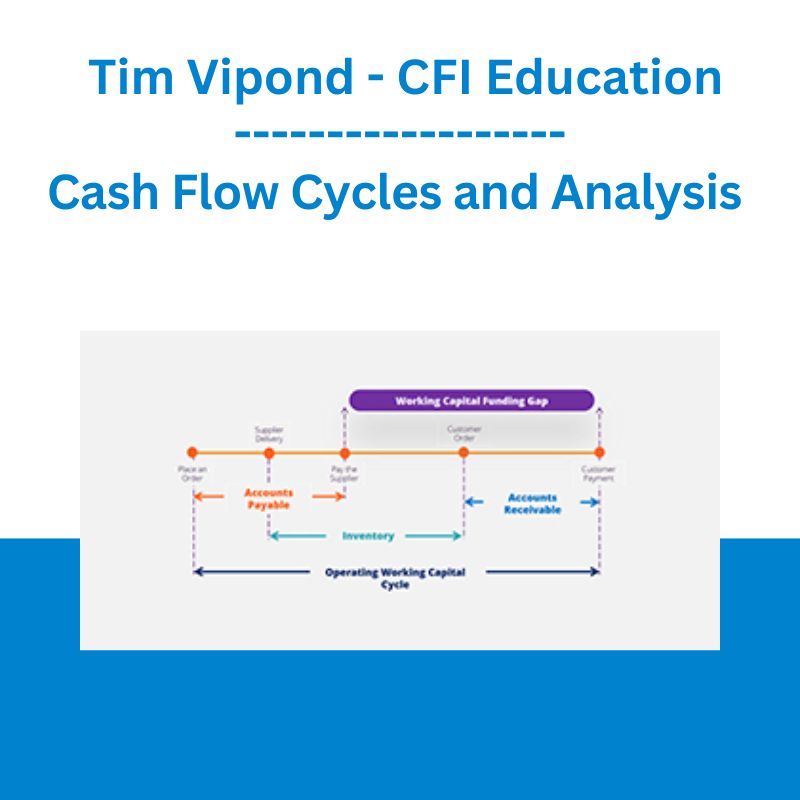

In this Cash Flow Cycles and Analysis course, we look at how companies manage their cash flow. We will explore both the operating cash flow cycle and the investing cash flow cycle. We use real-world examples to calculate a company’s working capital funding gap. Then we will go over important strategies companies can use to optimize their working capital accounts.

From there we will look at the longer-term investments such as sustaining or expansionary capital expenditures. We will assess the payback time on a project and look at the return on investment. In the end, we’ll combine what we learned and produce a cash flow statement to compare key metrics such as net income, EBITDA, cash flow from operations, and free cash flow.

Throughout the course, we’ll be looking at things from both the lender’s perspective and the borrower’s perspective so you’ll have a full picture as a complete credit analyst of how to forecast and optimize cash flow for a business.

Cash Flow Cycles and Analysis Learning Objectives

Upon completing this course, you will be able to:

- Discuss the difference between a company’s short-term operating cash flow and long-term investing cash flow

- Compare working capital objectives and capital investment objectives

- Calculate working capital funding gap, investment payback and return on investment

- Use a company’s financial statement to conduct a cash flow analysis and compare key metrics

Who should take this course?

This Cash Flow Cycles and Analysis course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.

What you’ll learn

Introduction

Introduction

Downloadable Files

The Importance of Cash

Why Businesses Fail at Cash Management

Short Term vs. Long Term Cash Flow

Interactive Exercise 1

Operating Cash Flow Cycle

Operating Cash Flow Cycles Overview

Total Working Capital and Operating Working Capital

Inventory

Accounts Receivable

Accounts Payable

Interactive Exercise 2

Working Capital Cycle

Working Capital Funding Gap

Funding Gap and Operating Line Calculator Overview

Calculate Receivable Days, Inventory Days, and Payable Days

Calculate Operating Line Required and Allowed

Download Completed Funding Gap and Operating Line Calculation

Improving the Working Capital Cycle – Accounts Payable

Improving the Working Capital Cycle – Accounts Receivable

Improving the Working Capital Cycle – Inventory

Working Capital Objectives

Streamline Efficiency

Optimize Liquidity

Interactive Exercise 3

Investing Cash Flow Cycle

Working Capital vs. Investing Capital

Capital Investment (Capex)

Types of Capital Investments

Long-term Capital Investment Cycle

Payback and Return on Investment

Download Completed Payback and ROI Calculation

Making Capital Investments Work for You

Capital Investment Objectives

Interactive Exercise 4

Cash Flow Cycles and Analysis in Excel

Case Study Overview

Balance Sheet

Cash Flow from Operating Activities

Investing Activities

Financing Activities

End of Year Cash and Equivalents

Cash Flow Analysis

Download Completed Cash Flow Cycles Demonstration

Conclusion

Summary

Qualified Assessment

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Atlas API Training - API 570 Exam Prep Training Course

Atlas API Training - API 570 Exam Prep Training Course  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  George Fontanills & Tom Gentile - Optionetics Wealth Without Worry Course

George Fontanills & Tom Gentile - Optionetics Wealth Without Worry Course  The Daily Traders – Exclusive Trading Mentorship Group

The Daily Traders – Exclusive Trading Mentorship Group