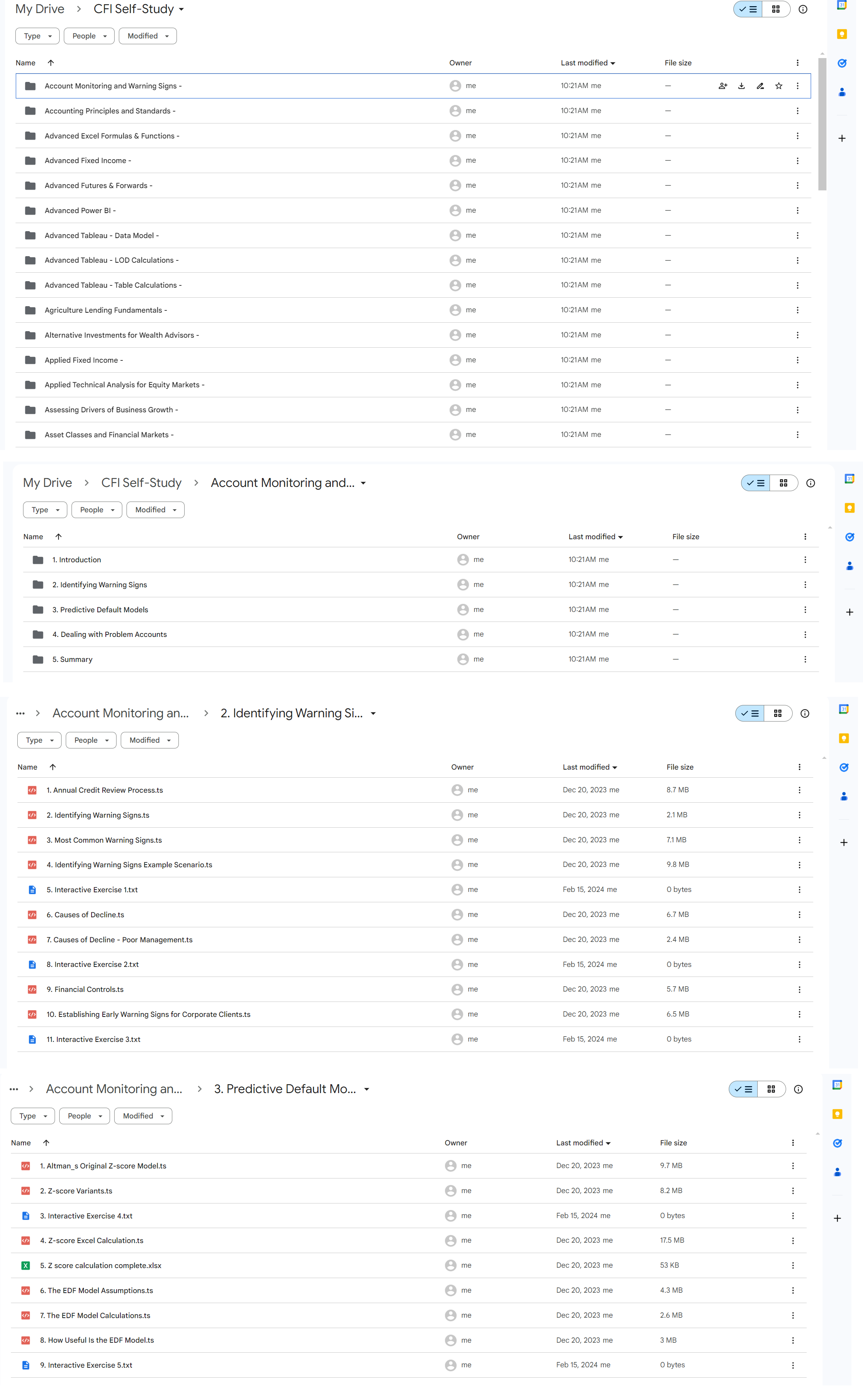

*** Proof of Product ***

Exploring the Essential Features of “Corporate Finance Institute – CFI Self-Study“

Who we are: CFI is the leading global provider of training and productivity tools for finance and banking professionals. We deliver the skills, certifications, CPE credits, and resources to help anyone—from beginner to seasoned pro—drive their career in finance & banking.

What we do: Our mission is to enhance the skills, knowledge, and productivity of finance and banking professionals. We provide practical, real-world skill development, expert-led training, interactive lessons, on-the-job tools, and resources—all on demand.

Key Features:

- Practical, on-demand training for finance and banking professionals.

- Accredited certifications.

- Hands-on lessons.

- Tools and resources created by experienced professionals.

- Expert-led training tailored to various skill levels.

- Interactive lessons for effective learning.

- Accessible on-demand, anytime, anywhere.

This item includes:

- Account Monitoring and Warning Signs –

- Accounting Principles and Standards –

- Advanced Excel Formulas & Functions –

- Advanced Fixed Income –

- Advanced Futures & Forwards –

- Advanced Power BI –

- Advanced Tableau – Data Model –

- Advanced Tableau – LOD Calculations –

- Advanced Tableau – Table Calculations –

- Agriculture Lending Fundamentals –

- Alternative Investments for Wealth Advisors –

- Applied Fixed Income –

- Applied Technical Analysis for Equity Markets –

- Assessing Drivers of Business Growth –

- Asset Classes and Financial Markets –

- Asset-Based Lending & Alternative Finance –

- Bayesian Thinking –

- Behavioral Finance –

- Boss Brewing Inc. – Connecting Capital Structure & Credit Structure –

- Build Your Own InsurTech Pricer –

- Build Your Own Robo-Advisor –

- Carbon Market Fundamentals –

- Case Study – Trading Dashboard in Tableau –

- Cash Flow Cycles and Analysis –

- Cash-to-Accrual Accounting –

- Classification – Fundamentals & Practical Applications –

- Commercial Banking – Debt Modeling –

- Commercial Mortgages –

- Commodities Fundamentals –

- Communicating & Leading with Influence –

- Comparable Valuation Analysis –

- Conducting a Materiality Assessment –

- Construction Finance Fundamentals –

- Construction Loan-in-Process –

- Convertible Bonds –

- Converting Leads to Customers – Negotiation & Closing –

- Corporate & Business Strategy –

- Corporate Governance –

- Credit Administration and Documentation –

- Credit Fixed Income –

- Cryptocurrency Intermediates Altcoins, Stablecoins, CBDCs and NFTs –

- Cryptocurrency Intermediates_ Understanding Ethereum –

- Cybersecurity and RegTech Fundamentals –

- Dashboards & Data Visualization –

- Data Prep for Machine Learning in Python –

- DCF Valuation Modeling –

- Deconstructing Options –

- Derivatives Fundamentals –

- Developing an ESG Governance Structure –

- Developing ESG Policies –

- Digital Banking Fundamentals –

- Economics for Financial Advisors –

- Effective Business Writing –

- Effective Communication for Client Facing Advisors –

- Environmental Due Diligence for Credit –

- Equipment Finance –

- Equity Markets Fundamentals –

- Equity, FX, and Rate Futures –

- ESG Disclosure –

- ESG for Commercial Lenders –

- ESG Fundamentals –

- ESG Integration & Financial Analysis –

- Evaluating a Business Plan –

- Excel Fundamentals – Quick Start Guide –

- Excel VBA for Finance –

- Financial Analysis for Credit –

- Financial Analysis Fundamentals –

- Financial Planning Principles –

- Foreign Exchange – Deliverable Forwards –

- Foreign Exchange – Non-Deliverable Forwards –

- FP&A Monthly Cash Flow Forecast Model –

- Fundamentals of Data Analysis in Excel – Case Study –

- Futures Pricing and Commodity Futures –

- Giving Effective Feedback –

- Greenhouse Gas Accounting –

- Having Difficult Conversations and Managing Conflict –

- Hedge Fund Fundamentals –

- High-Yield Bonds, Subordinated Debt, and Loans –

- How to Read a Commercial Real Estate Appraisal –

- How to Read a Lease and Analyze a Rent Roll –

- Human Capital Management –

- Intermediate DAX & Time Intelligence –

- Introduction to 3-Statement Modeling –

- Introduction to Financial Planning and Wealth Management –

- Introduction to InsurTech –

- Leading High-Performing Teams –

- Leading with Emotional Intelligence and Self-Awareness –

- Lending to Complex Structures –

- Lending to Medical Professionals –

- Leveraged Buyout (LBO) Modeling –

- Loan Covenants –

- Loan Default Prediction with Machine Learning –

- Loan Pricing –

- Loan Security –

- Mastering Client Discovery –

- Math for Finance Professionals –

- Mergers & Acquisitions (M&A) Modeling –

- Mining Financial Model & Valuation –

- Mint Your Own NFT –

- Modeling Risk with Monte Carlo Simulation –

- Modeling Taxes for Different Business Structures –

- Networking, Prospecting, & Converting Leads –

- Operational Modeling –

- Options Hedging and Trading Strategies –

- Origination Fundamentals – Debt Capital Markets Perspective –

- Payment Technology Fundamentals –

- Portfolio Management for Retail Clients –

- Power BI Case Study – CFI Capital Partners –

- Power BI Financial Statements –

- Power BI Fundamentals –

- Power Pivot Fundamentals –

- Power Query Fundamentals –

- PowerPoint & Pitchbooks –

- Presentation of Financial Information –

- Pricing Options and Option Sensitivities –

- Prime Services and Securities Lending –

- Private Banking –

- Problem Loans –

- Professional Ethics –

- Python Fundamentals –

- Python Fundamentals Case Study –

- R Fundamentals –

- Reading Business Financial Information –

- Real Estate Financial Modeling –

- Real Estate Fundamentals –

- Regression Analysis – Fundamentals & Practical Applications –

- Renewable Energy – Solar Financial Modeling –

- Repo (Repurchase Agreements) By Meeyeon Park – CFI Education –

- Retail, Restaurant, & Franchise Lending –

- RockCrusher Rentals –

- Rocky Mountain Holdings Ltd. – Commercial Mortgage –

- Scenario & Sensitivity Analysis in Excel –

- Securitized Products –

- Short Duration Products –

- Spot Foreign Exchange –

- SQL Case Study – WOWI Sales Analysis –

- SQL Fundamentals –

- Startup – e-Commerce Financial Model & Valuation –

- Swaps Fundamentals –

- Syndicated Lending –

- Tableau Fundamentals –

- Tableau Fundamentals Case Study –

- Tableau Trading Dashboard –

- The Amazon Case Study (New Edition) –

- Trade Finance –

- Trading Using Technical Analysis –

- Understanding Options –

- Venture Debt –

- WealthTech Fundamentals –

- Widgets Inc. – Adjusting a Business Owner’s Net Worth –

- Woodchucks Ltd – Owner Occupied Commercial Real Estate –

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/