*** Proof of Product ***

Exploring the Essential Features of “Credit Fixed Income – Andrew Loo – CFI Education”

Learn key concepts for credit analysts, investors, and traders

- Master the various instruments in the credit fixed income space

- Learn about the pricing of credit bonds and credit derivatives

- Understand how to look at the relative value in credit instruments

Overview

Credit Fixed Income Course Overview

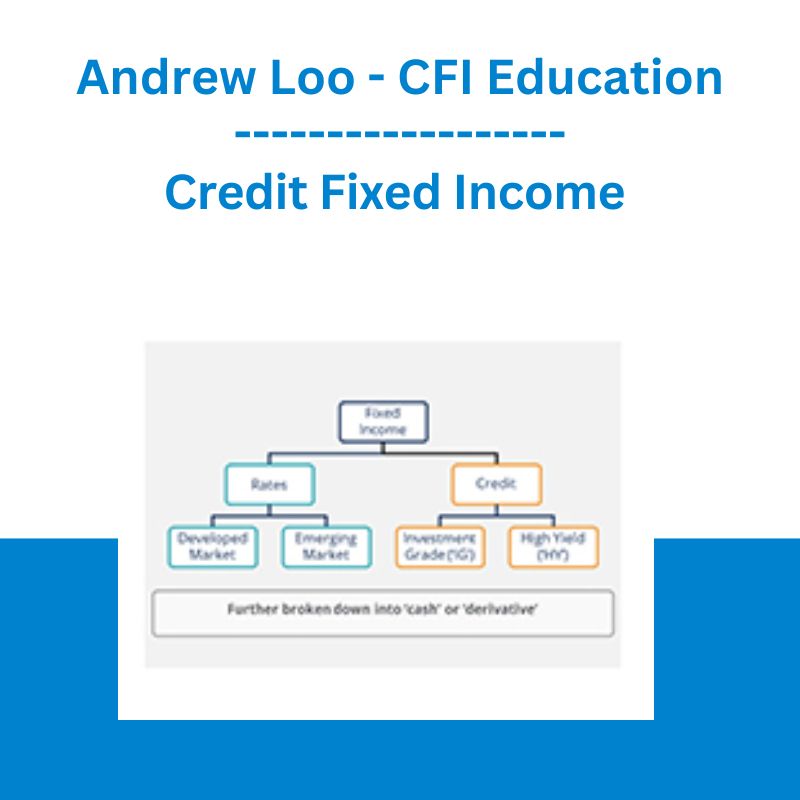

In this Credit Fixed Income course, we will introduce key concepts for credit analysts, investors, and traders. We will explore what is credit fixed income and the nuances of corporate bonds, as well as examine many of the measures of the additional yield that credit products provide. Building upon that foundation, we will look at trading corporate bonds, as well as explain asset swaps, credit default swaps, credit derivatives, credit-linked notes, and first-to-default baskets.

By the end of this course, you will have a much deeper understanding of the skills and knowledge that both buy-side and sell-side analysts need to be successful in credit markets.

Credit Fixed Income Learning Objectives

Upon completing this course, you will be able to:

- Describe key characteristics of corporate bonds, from liquidity preference and coupon type, to offering formats, and provisions

- Appreciate the corporate bond issuer landscape from a trader/investor’s perspective, being able to speak to the various industry categories and provide examples of significant market players

- Discuss the key quantitative measures (i.e. types of spreads) used in reference to bonds by industry professionals

- Understand the mechanics of credit spreads and their relationships to each other

- Identify specific credit products that can provide investors additional yield and explain why these products can provide incremental returns in relation to others (‘relative value’)

Who Should Take This Course?

This Credit Fixed Income course is perfect for anyone who would like to develop a deeper understanding of spread products in fixed income. For the individual wanting to gain more breadth in corporate bonds and credit derivative product knowledge, this course explores a diverse range of topics on spread products from bonds to credit derivatives.

This course is designed to equip anyone who desires to begin a career in the capital markets on a fixed income desk or to help prepare for career advancement from junior to more senior fixed income trading or sales positions.

What you’ll learn

Course Introduction

Introduction

Downloadable Files

What is Credit Fixed Income

What is Credit Fixed Income

Credit Stack $ Credit Rating

Yield Curve & Market Insights & Credit Spreads

Credit Fixed Income-Economic Impact

Interactive Exercise 1

Corporate Bonds

Structure of Corporate Bonds & Subordinated Debt

Coupon Types & Fixed-Rate Bonds

Floating-Rate Notes (‘FRNs’)

Zero-Coupon Bonds

Interactive Exercise 2

Domestic Markets & Provisions & Rated Bonds

Corporate Bond Issuers

Corporate Bond Issuers

Financial Issuers

Financials – Subordinated Debt

Interactive Exercise 3

Case Study on Financials Issuer Covered Bonds

Types of Bond Issuer

Interactive Exercise 4

Credit Spreads

Credit Spreads

Credit Spreads – G, I & Z Spreads

Interactive Exercise 5

Floating-Rate Notes & Option Adjusted Spread

Credit Bond Yield and Spread exercise

Investment Considerations

Trading Corporate Bonds

Interactive Exercise 6

Midway Check-in

Credit Derivatives

Types of Credit Derivatives

Asset Swap

Components of a Swap Rate

Variations of Asset Swaps

Variations of Asset Swaps Continued

Interactive Exercise 7

Credit Default Swaps – Basic Terminology

Credit Default Swaps Continued

CDS Settlement & Recovery Rate

Why Use Credit Default Swaps

Interactive Exercise 8

CDX Index

IG Bond Derivatives – CDX Index

Interactive Exercise 9

Credit-Linked Notes (‘CLNs’)

Credit-Linked Notes (‘CLNs’) Continued

First-to-Default Baskets (‘FTDs’)

First-to-Default Baskets (‘FTDs’) Continued

Interactive Exercise 10

Course Summary

Qualified Assessment

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/