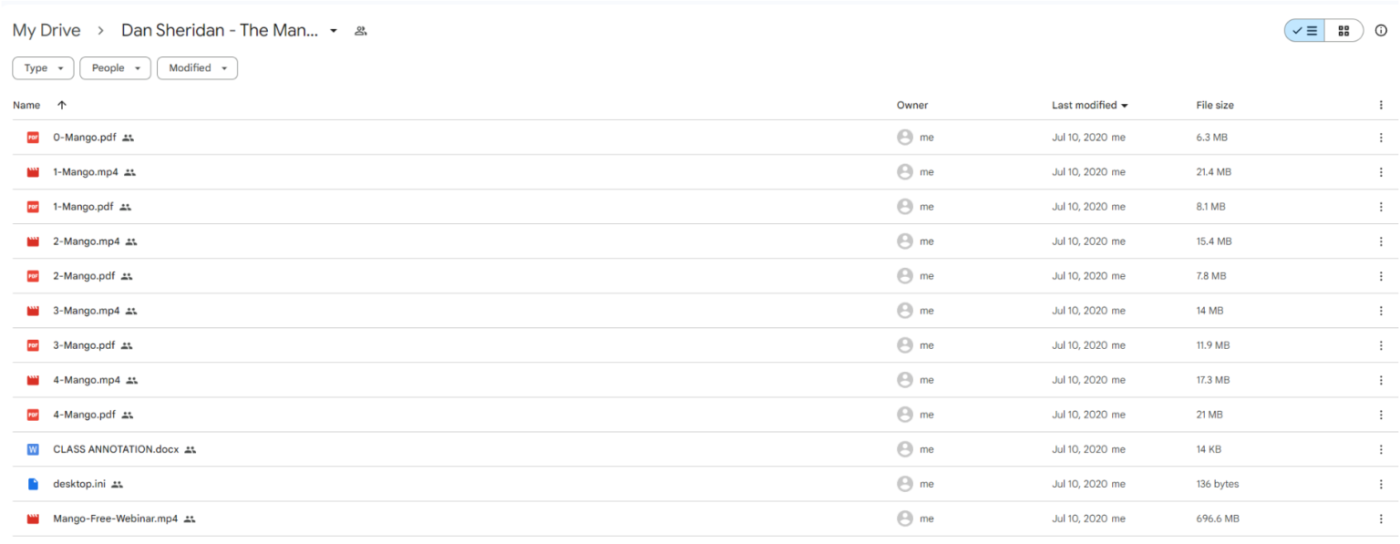

*** Proof of Product ***

Exploring the Essential Features of “Dan Sheridan – The Mango Trade“

Introduction: Dan Sheridan, a seasoned options trader and educator, is renowned for his strategic expertise. One of his most notable trades is “The Mango Trade,” a distinctive options play that showcases his strategic acumen. This trade highlights Sheridan’s ability to navigate the complexities of financial markets effectively.

Background on Dan Sheridan: To appreciate “The Mango Trade,” it’s essential to understand Dan Sheridan’s background. With extensive experience in options trading, Sheridan has built a reputation as an insightful mentor and an accomplished trader. His approach blends theoretical knowledge with practical insights, making him a sought-after figure in the trading community.

The Mango Trade Overview: “The Mango Trade” exemplifies Sheridan’s nuanced understanding of market dynamics. The intriguing name adds a unique touch to the strategy, which revolves around utilizing options contracts to capitalize on price movements while emphasizing risk management and flexibility.

Key Components of The Mango Trade:

- Options Selection: Sheridan meticulously selects options contracts, considering factors such as expiration dates and strike prices. This careful approach reflects his commitment to minimizing risk while maximizing potential returns.

- Underlying Asset Analysis: The trade involves deep analysis of the underlying asset, focusing on historical price trends, volatility, and potential catalysts. By thoroughly understanding the asset, Sheridan positions himself to make informed decisions.

- Risk Management Strategies: Integral to Sheridan’s approach is robust risk management. “The Mango Trade” is not a speculative gamble but a carefully calculated move designed to protect capital while seeking profits.

Implementation of The Mango Trade: Sheridan’s implementation of “The Mango Trade” begins with a thorough analysis of market conditions, including assessing overall market trends, identifying potential entry points, and understanding the macroeconomic landscape. Once these aspects are clear, he strategically executes the options trade, keeping a keen eye on risk exposure.

Case Study – Successful Execution: A successful example of “The Mango Trade” involves a well-timed entry during a period of heightened volatility. By leveraging options strategically, Sheridan navigated market fluctuations, allowing the trade to capitalize on price movements. The success of this case study lies not only in the profit generated but also in Sheridan’s ability to adapt the strategy to prevailing market conditions.

Learning from The Mango Trade: Sheridan’s “The Mango Trade” serves as an educational tool for traders aiming to enhance their understanding of options strategies. The emphasis on risk management, meticulous analysis, and adaptability provides valuable lessons for both novice and experienced traders. By dissecting the trade, individuals can gain insights into constructing robust trading plans.

Conclusion: Dan Sheridan’s “The Mango Trade” stands as a testament to his prowess in options trading. Through meticulous planning, in-depth analysis, and a commitment to risk management, Sheridan showcases the artistry of navigating financial markets. Aspiring traders can draw inspiration from “The Mango Trade” to develop a deeper understanding of options strategies and enhance their own trading approaches.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

The Daily Traders – Exclusive Trading Mentorship Group

The Daily Traders – Exclusive Trading Mentorship Group