*** Proof of Product ***

Exploring the Essential Features of “Frank Fabozzi, Steven Mann & Moorad Choudhry – Measuring & Controlling Interest Rate & Credit Risk (2nd Ed.)”

Measuring and Controlling Interest Rate and Credit Risk 2nd Edition

by Frank J. Fabozzi (Author), Steven V. Mann (Author), Moorad Choudhry (Author)

Measuring and Controlling Interest Rate and Credit Risk provides keys to using derivatives to control interest rate risk and credit risk, and controlling interest rate risk in a mortgage-backed securities derivative portfolio. This book includes information on measuring yield curve risk, swaps and exchange-traded options, TC options and related products, and describes how to measure and control the interest rate of risk of a bond portfolio or trading position.Measuring and Controlling Interest Rate and Credit Risk is a systematic evaluation of how to measure and control the interest rate risk and credit risk of a bond portfolio or trading position, defining key points in the process of risk management as related to financial situations. The authors construct a verbal flow chart, defining and illustrating interest rate risk and credit risk in regards to valuation, probability distributions, forecasting yield volatility, correlation and regression analyses. Hedging instruments discussed include futures contracts, interest rate swaps, exchange traded options, OTC options, and credit derivatives. The text includes calculated examples and readers will learn how to measure and control the interest rate risk and credit risk of a bond portfolio or trading position. They will discover value at risk approaches, valuation, probability distributions, yield volatility, futures, interest rate swaps, exchange traded funds; and find in-depth, up-to-date information on measuring interest rate with derivatives, quantifying the results of positions, and hedging.

Frank J. Fabozzi (New Hope, PA) is a financial consultant, the Editor of the Journal of Portfolio Management, and an Adjunct Professor of Finance at Yale University?s School of Management.

Steven V. Mann (Columbia, SC) is Professor of Finance at the Moore School of Business, University of South Carolina. Moorad Choudhry (Surrey, UK) is a Vice President with JPMorgan Chase structured finance services in London.

Moorad Choudhry (Surrey, England) is a senior Fellow at the Centre for Mathematical Trading and Finance, CASS Business School, London, and is Editor of the Journal of Bond Trading and Management. He has authored a number of books on fixed income analysis and the capital markets. Moorad began his City career with ABN Amro Hoare Govett Sterling Bonds Limited, where he worked as a gilt-edged market maker, and Hambros Bank Limited where he was a sterling proprietary trader. He is currently a vice-president in Structured Finance Services with JPMorgan Chase Bank in London.

Editorial Reviews

From the Back Cover

Measuring and Controlling Interest Rate and Credit Risk, Second Edition offers a systematic evaluation of how to measure and control the interest rate risk and credit risk of a bond portfolio or trading position under various financial conditions.Financial experts Frank Fabozzi, Steven Mann, and Moorad Choudhry clearly define and illustrate interest rate risk and credit risk using practical examples with market data. These experts also discuss various hedging instruments, including futures contracts, interest rate swaps, exchange-traded options, OTC options, and credit derivatives.

This completely revised Second Edition is filled with calculated examples and tables that will aid you in understanding numerous important issues such as:

- Measuring yield curve risk

- Controlling interest rate risk with derivatives

- Forecasting yield volatility

- Implementing Value at Risk (VaR) approaches to measure interest rate risk

- Performing credit derivative valuation

- Managing credit risk using credit derivatives and structured products

Filled with in-depth analysis and insights from recognized experts in the field, Measuring and Controlling Interest Rate and Credit Risk, Second Edition is a must-read for portfolio managers and traders who need to continually sharpen their financial skills.

About the Author

FRANK J. FABOZZI, PhD, CFA, is Editor of the Journal of Portfolio Management, the Frederick Frank Adjunct Professor of Finance at Yale Universitys School of Management, and a consultant in the fixed-income and derivatives area. Frank is a Chartered Financial Analyst and Certified Public Accountant who has edited and authored many acclaimed books in finance. He earned a doctorate in economics from the City University of New York in 1972. He is a Fellow of the International Center for Finance at Yale University.

STEVEN V. MANN, PhD, is Professor of Finance at the Moore School of Business, University of South Carolina. He has coauthored three previous books and numerous articles in the area of investments, primarily fixed-income securities and derivatives. Professor Mann is an accomplished teacher, winning twenty awards for excellence in teaching. He also works as a consultant to investment/commercial banks and has conducted training programs for financial institutions throughout the United States.

MOORAD CHOUDHRY is a vice president in structured finance services with JPMorgan Chase Bank in London. Prior to this, he worked as a government bond trader and Treasury trader at ABN Amro Hoare Govett Sterling Bonds Limited, and as a sterling proprietary trader at Hambros Bank Limited. Moorad is a Fellow of the Centre for Mathematical Trading and Finance, CASS Business School, London, and is Editor of the Journal of Bond Trading and Management.

Product details

Publisher : Wiley; 2nd edition (May 16, 2003)

Language : English

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Oliver Velez - Essential Strategy Of Trade For Life

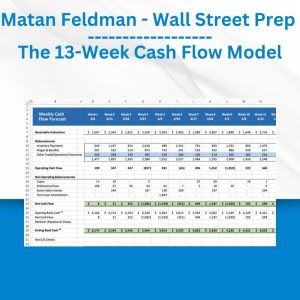

Oliver Velez - Essential Strategy Of Trade For Life  Matan Feldman - The 13-Week Cash Flow Modeling - Wall Street Prep

Matan Feldman - The 13-Week Cash Flow Modeling - Wall Street Prep  George Fontanills & Tom Gentile - Optionetics Wealth Without Worry Course

George Fontanills & Tom Gentile - Optionetics Wealth Without Worry Course  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  The Daily Traders – Exclusive Trading Mentorship Group

The Daily Traders – Exclusive Trading Mentorship Group  Toshko Raychev - Profit System + ITF Assistant

Toshko Raychev - Profit System + ITF Assistant  Sovereign Man Confidential - Renunciation Video

Sovereign Man Confidential - Renunciation Video  Racing Workshop - Complete Online Package

Racing Workshop - Complete Online Package  Simpler Trading - Bruce Marshall - The Options Defense Course

Simpler Trading - Bruce Marshall - The Options Defense Course  Fred Haug - Virtual Wholesaling Simplified

Fred Haug - Virtual Wholesaling Simplified  Greg Loehr - Advanced Option Trading With Broken Wing Butterflies

Greg Loehr - Advanced Option Trading With Broken Wing Butterflies  SMB - Options Training

SMB - Options Training  Stephen Floyd – Search Marketing Institute – The 3 Pillar System

Stephen Floyd – Search Marketing Institute – The 3 Pillar System  Chris Capre - Advanced Price Action Ongoing Training & Webinars

Chris Capre - Advanced Price Action Ongoing Training & Webinars  Money Miracle - George Angell - Use Other Peoples Money To Make You Rich

Money Miracle - George Angell - Use Other Peoples Money To Make You Rich  Jesse Livermore Trading System - Joe Marwood

Jesse Livermore Trading System - Joe Marwood  Team NFT Money - Ultimate NFT Playbook

Team NFT Money - Ultimate NFT Playbook  Shihan Richard & Linda Van Donk - Ninjutsu Ninja Black Belt Course

Shihan Richard & Linda Van Donk - Ninjutsu Ninja Black Belt Course  Designs Locker – 10 Free Designs

Designs Locker – 10 Free Designs  Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025  Thomas Murphy (Tmurph) - TikTok Mastery

Thomas Murphy (Tmurph) - TikTok Mastery  Forexmentor - Recurring Forex Patterns

Forexmentor - Recurring Forex Patterns  Chi è Simone Reali - FBA Academy - Versione Completa - Costruisci un Business di Successo e Posizionati Anni Luce Avanti agli Altri Venditori

Chi è Simone Reali - FBA Academy - Versione Completa - Costruisci un Business di Successo e Posizionati Anni Luce Avanti agli Altri Venditori  Glen Allsopp of ViperChill - The Rank & Rent Model

Glen Allsopp of ViperChill - The Rank & Rent Model