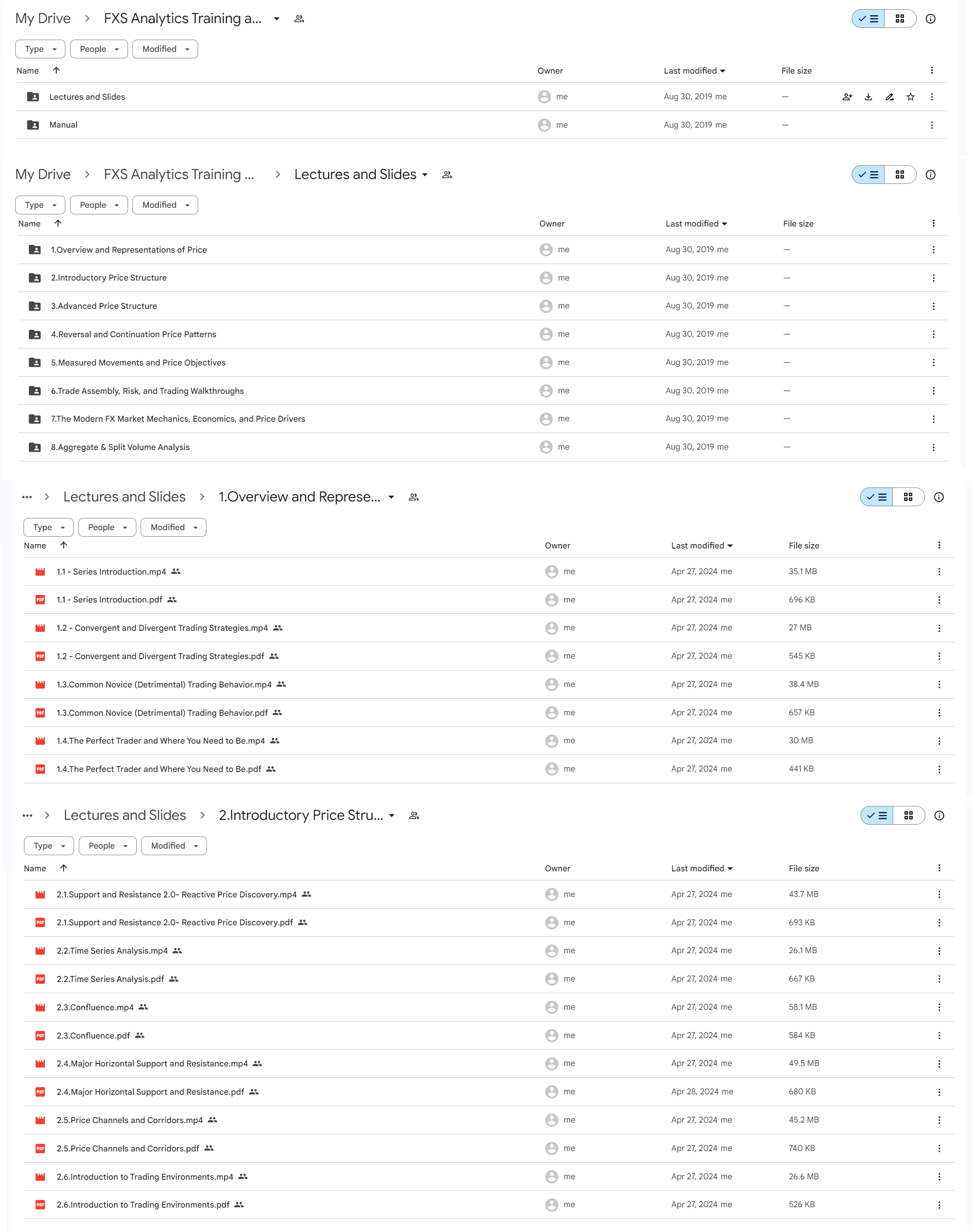

*** Proof of Product ***

Exploring the Essential Features of “FXS Analytics Training Course”

Price Action, Volume and Behavioral Analysis.

Process, Planning and Routine.

FXS is an in-depth and structured training platform, providing a breadth of learning materials and ad hoc resources.

A framework designed to bring structure and clarity to virtually any trading strategy.

Traders are often inundated with a range of strategies that are either ineffective as a standalone or benefit from the integration of other methods. The program is designed to adapt to a spectrum of market behavior by dissecting prices at their root, and understand how they move from a basic sense that has not and will not change. Armed with an understanding of price action and volumes allows you to be flexible, active and exercise good reward to risk.

The approach is unique and cannot be found anywhere else. A range of methods that can be used as a standalone or in conjunction with other strategies are utilized. And if you need more, just request it. Our resources are vast and experience deep.

CHART LITERACY

Chart literacy opens the gates to a wide range of possibilities in trading. Whether you are trading price action or volumes as a standalone strategy, implementing 3rd party strategies or using a rule-based system, having a unique knowledge of movements is a truly valuable asset. FXS covers a wide range of market movements, explained in a manner that is easy to comprehend and put to use when needed. It is a scalable approach which places emphasis not only on what to do with prices, but much more importantly, how they are generated in the first place.

EASE OF COMPREHENSION

The study of prices and volumes can either be considered very simple or very complex, depending on the trader. We take a intermediate approach which highlights the trading environment first, and use basic structures and volume for precise entry. Trend following is emphasized as we realize it is a commonly misunderstood and difficult task to master. Execution behaviors, patterns and environments are grouped into digestable forms in order to stay on top of the market and obtain realistic expectations towards the movement of markets.

FX MECHANICS AND LANDSCAPE

The modern FX market has a very different appearance than it did 10 years ago. Price matching technology has advanced and access to liquidity has become better than ever. In addition to covering liquidity mechanics and current structure, a breakdown of the fundamental drivers are included in this series, should you choose FX as an instrument to trade.

Structure and Features

A lecture series is at the heart of this program with other features to enhance development. It is designed to emphasize chart literacy and the ease of navigation for most instruments.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Dave Landry - Stock Selection Course

Dave Landry - Stock Selection Course