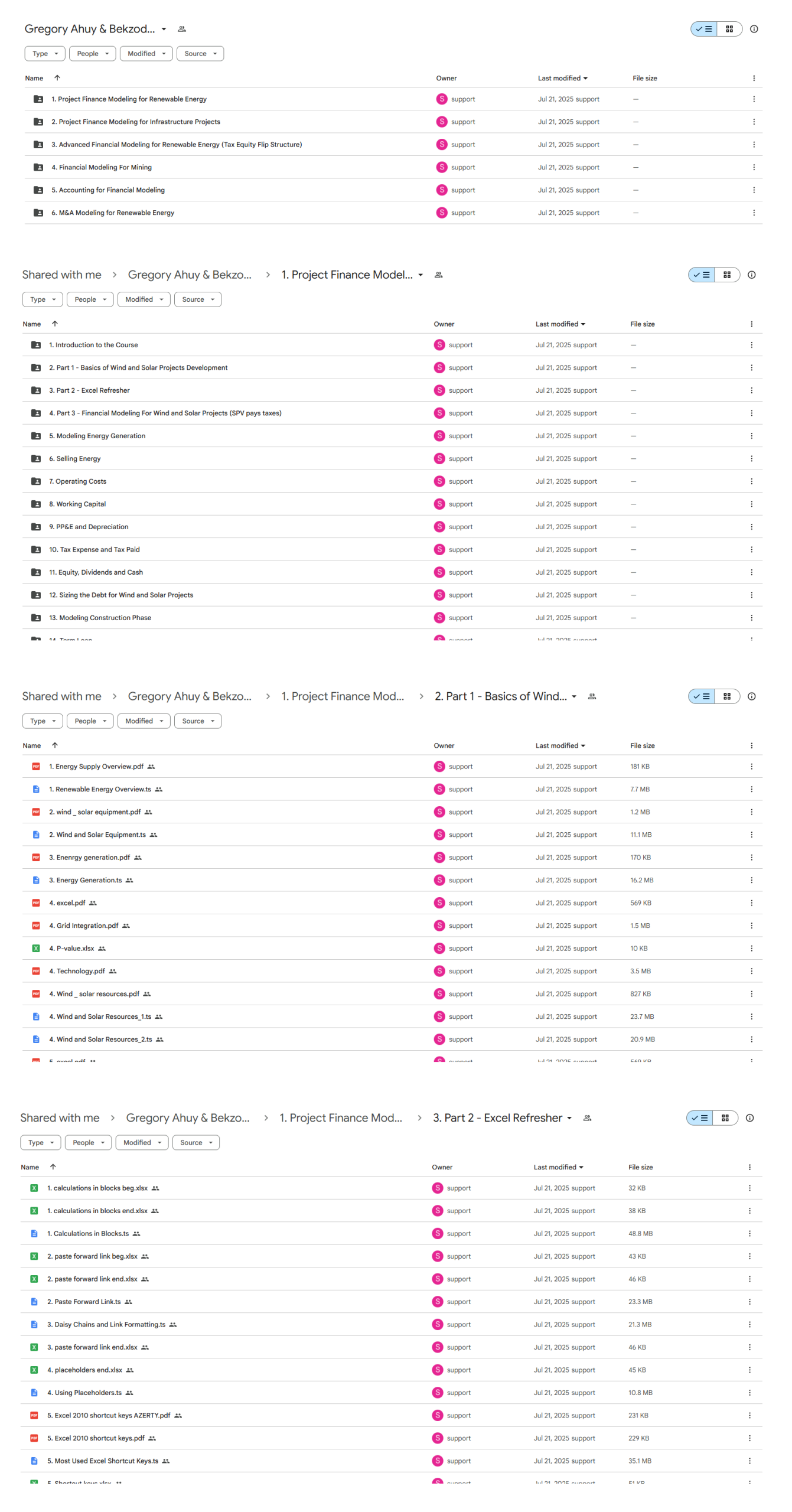

*** Proof of Product ***

Exploring the Essential Features of “Gregory Ahuy & Bekzod Kasimov – Financial Model Online – Project Finance Modeling – Premium Package”

Master Financial Modeling for Project Finance

This premium package contains 6 project finance, M&A modeling and accounting courses:

– Project Finance Modeling for Renewable Energy

– Tax Equity Flip Modeling

– M&A Modeling for Renewable Energy

– Financial Modeling For Mining

– Project Finance Modeling For Infrastructure

– Accounting for Financial Modeling

Project Finance Modeling for Renewable Energy

Project Finance Modeling for Renewable Energy course will give you the skills to develop and analyze project finance models for wind and solar projects. The course covers essential topics including debt sizing and funding, wind and solar project operations, and investment returns, and will provide you with a robust financial modeling skillset for analysis of renewable projects in the most sophisticated environments.

Advanced Financial Modeling for Renewable Energy (Tax Equity Flip Structure)

Project finance models are used to assess the risk-reward of lending to and investing in an infrastructure project. The project’s debt capacity, valuation and financial feasibility depend on expected future cash flows generated by the project and a financial model is built to analyze this. In the tax equity flip structures, there is additional complexity related to the IRS tax rules that have to be reflected in the financial model. On top of that, we have to be able to correctly size the back-leverage debt in the downside scenario, taking into account and reflecting the tax equity’s seniority in the financial model.

Financial Modeling for Renewable Energy M&A

Financial Modeling for Renewable Energy M&A course will give you the skills to develop and analyze financial models for M&A transactions. The course covers essential topics including M&A transaction analysis, accounting, due diligence, deal structuring and financial modeling with focus on renewable energy projects. Advanced topics such as sizing debt financing, determining payment structures and carrying out investment return analysis are also covered in the course.

Financial Modeling For Mining Course

In Financial Modeling for Mining course, we will build project finance model for a gold open-pit project. The course is based on soft mini-perm debt structure with cash sweep provision and refinancing facility. Risk mitigation reserve accounts such as DSRA, MRA and Ramp-Up Cash Reserve are also included in the model. Finally, financial model will include mine decommissioning expense and decommissioning reserve fund.

Project Finance Modeling For Infrastructure

In The Project Finance Modeling For Infrastructure course, we will model complex greenfield toll road project finance transactions from scratch in Excel.

Project finance models are used to assess the risk-reward of lending to and investing in an infrastructure project. The project’s debt capacity, valuation, and financial feasibility depend on expected future cash flows generated by the project itself and a financial model is built to analyze this.

Accounting for Financial Modeling

Accounting for Financial Modeling will give you the skills to understand and analyze the financial statements of public and private companies. The course covers essential and advanced topics related to the income statement, balance sheet, and cash flow statement, and will provide you with a robust skillset for analysis of advanced accounting issues that appear often in real-world financial analysis. The focus is on the US GAAP accounting, however, whenever the US GAAP deviates from the IFRS accounting, the difference will be reviewed.

Meet Our Instructors:

Greg Ahuy

Founder / Financial Modeler

Greg started his career in investment banking as M&A analyst in London at Renaissance Capital – leading investment banking firm in Emerging Markets with offices in London, New York, Hong Kong and Johannesburg. He was responsible for some of the biggest M&A deals in mining and infrastructure sectors in emerging and frontier markets. Gregory continued his career at InfraRed Capital Partners, one of the largest infrastructure funds, focused on sourcing and executing greenfield and brownfield infrastructure projects in Eastern Europe. Later, Mr. Ahuy joined Eneco, one of the largest energy companies in the Netherlands where he led several renewable energy projects.

Bekzod Kasimov

Financial Modeler

Bekzod started his career at ABN Amro Bank as a financial analyst and was responsible for credit and risk analysis of syndicated loans. After that, he joined the merchant banking firm ECM as an investment analyst and was responsible for the origination and execution of investment opportunities in the infrastructure, oil & gas and mining industries. He continued his career at Vancouver-based mining and infrastructure company as a vice-president business development and was responsible for project acquisition and development in the US, South America and Asia. Bekzod was involved in a number of mining, power and renewable energy projects acquisitions in the US, Asia and South America.

Project Finance Modeling Premium Package

The courses included in the premium package can also be bought individually:

Project Finance Modeling for Renewable Energy

Learn Financial Modeling for Wind and Solar Projects

Advanced Financial Modeling for Renewable Energy – ( US )

Tax Equity Flip Structure

M&A Modeling for Renewable Energy

Gain in-depth understanding of the Merger and Acquisition process with focus on the renewable energy sector

Financial Modeling for Mining

Learn Project Finance Modeling for Natural Resource Projects

Project Finance Modeling for Infrastructure Projects

Learn Financial Modeling for Infrastructure Assets

Accounting for Financial Modeling

Master Accounting for Financial Modeling from Basics to Advanced based on Real World Exercises.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Sovereign Man Confidential - Renunciation Video

Sovereign Man Confidential - Renunciation Video  Erik Banks - Alternative Risk Transfer

Erik Banks - Alternative Risk Transfer  Matthew Kratter - Trader University

Matthew Kratter - Trader University  SMB - Options Training

SMB - Options Training  Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle  Racing Workshop - Complete Online Package

Racing Workshop - Complete Online Package  Atlas API Training - API 570 Exam Prep Training Course

Atlas API Training - API 570 Exam Prep Training Course  Simpler Trading - Bruce Marshall - The Options Defense Course

Simpler Trading - Bruce Marshall - The Options Defense Course  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  Greg Loehr - Advanced Option Trading With Broken Wing Butterflies

Greg Loehr - Advanced Option Trading With Broken Wing Butterflies  Trade Like Mike - The TLM Playbook 2022

Trade Like Mike - The TLM Playbook 2022  Alphashark - The AlphaShark SV-Scalper

Alphashark - The AlphaShark SV-Scalper