*** Proof of Product ***

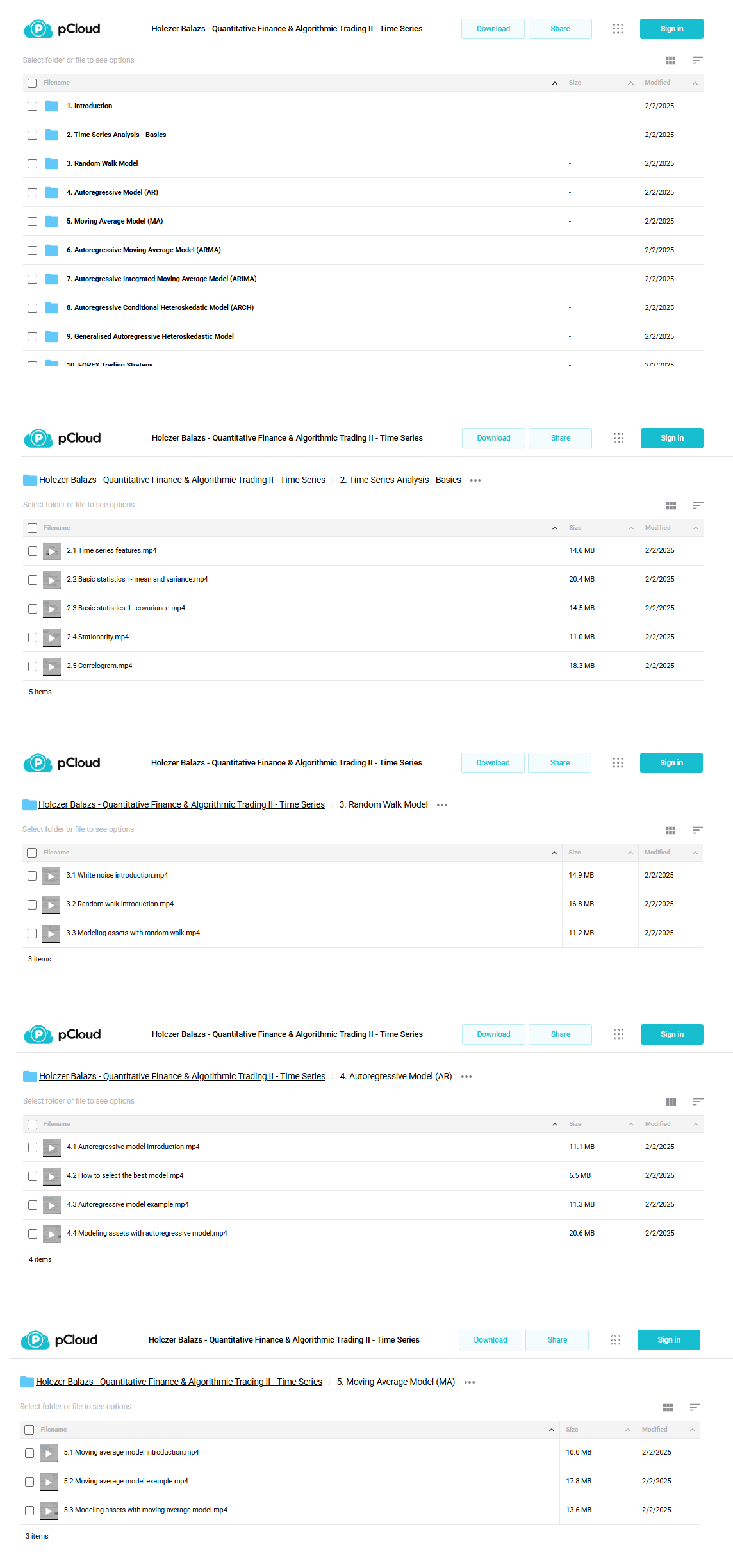

Exploring the Essential Features of “Holczer Balazs – Quantitative Finance & Algorithmic Trading II – Time Series”

Random walk, autoregressive model, moving average model, arima model, arch and garch model

This course is about time series analyses. You will use R as the programming language and RStudio as the integrated developement environment.

IMPORTANT: only take this course, if you are interested in statistics and mathematics !!!

The aim of the course is to construct a model capable of forecasting future stock prices. You will learn about the most important time series related concepts:

- white noise

- moving average model

- autoregressive model

- conditional heteroskedastic models

In the last chapter you will implement a model (combining ARIMA and GARCH models) from scratch that is able to outperform the buy&hold; (so long term investing) strategy!

Your Instructor

Holczer Balazs

My name is Balazs Holczer. I am from Budapest, Hungary. I am qualified as a physicist and later on I decided to get a master degree in applied mathematics. At the moment I am working as a simulation engineer at a multinational company. I have been interested in algorithms and data structures and its implementations especially in Java since university. Later on I got acquainted with machine learning techniques, artificial intelligence, numerical methods and recipes such as solving differential equations, linear algebra, interpolation and extrapolation. These things may prove to be very very important in several fields: software engineering, research and development or investment banking. I have a special addiction to quantitative models such as the Black-Scholes model, or the Merton-model. Quantitative analysts use these algorithms and numerical techniques on daily basis so in my opinion these topics are definitely worth learning.

Course Curriculum

- Introduction

Introduction (1:20)

Intsalling RStudio (1:02) - Time Series Analysis – Basics

Time series features (5:55)

Basic statistics I – mean and variance (7:19)

Basic statistics II – covariance (6:03)

Stationarity (6:55)

Correlogram (8:26) - Random Walk Model

White noise introduction (6:04)

Random walk introduction (6:57)

Modeling assets with random walk (3:51) - Autoregressive Model (AR)

Autoregressive model introduction (7:02)

How to select the best model? (2:25)

Autoregressive model example (3:59)

Modeling assets with autoregressive model (6:27) - Moving Average Model (MA)

Moving average model introduction (4:18)

Moving average model example (6:40)

Modeling assets with moving average model (4:12) - Autoregressive Moving Average Model (ARMA)

Autoregressive moving average model introduction (2:21)

Ljung-Box test (2:50)

Autoregressive moving average model example (3:42)

Autoregressive moving average model example II (5:41)

Modeling assets with ARMA model (6:34) - Autoregressive Integrated Moving Average Model (ARIMA)

ARIMA model introduction (3:33)

ARIMA model example (2:59)

Modeling assets with ARIMA model (5:09) - Autoregressive Conditional Heteroskedatic Model (ARCH)

Heteroskedasticity in finance (3:44)

ARCH model introduction (7:26) - Generalised Autoregressive Heteroskedastic Model

GARCH model introduction (2:12)

GARCH model example (5:14)

Modeling assets with GARCH model (5:28) - FOREX Trading Strategy

FOREX trading strategy implementation I (2:29)

FOREX trading strategy implementation II (4:48)

FOREX trading strategy implementation III (5:46)

FOREX trading strategy implementation IV (6:23)

FOREX trading strategy implementation V (3:54)

FOREX trading strategy implementation VI (2:53) - Stock Market Trading Strategy

Stock market trading strategy implementation I (1:28)

Stock market trading strategy implementation II (3:09) - Course Material

Source code & slides

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

SMB - Options Training

SMB - Options Training