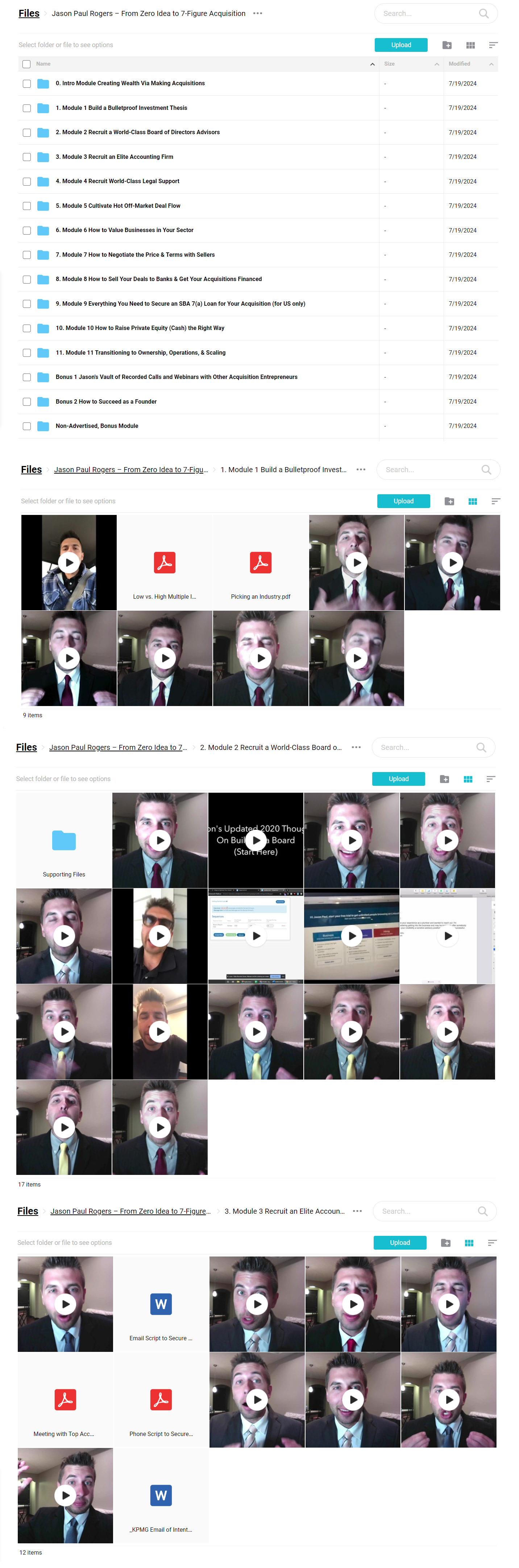

** Proof of Product ***

Exploring the Essential Features of “Jason Paul Rogers – From Zero Idea To 7 Figure Acquisitions“

Not Needed: a top business school degree, impressive business experience, or your own down payment/equity [we’ll raise equity from investors]

Jason’s method saves you from wasting free founder’s equity on too many advisory board members, while increasing the quality of your M&A deal team

Tax deductible once you legally form your company

Monthly Zoom calls w/ Jason & a private FB mastermind group for more Q&A

In-depth program walking you through how to buy your first 7-figure company with stable cashflow

Jason is an active acquisition entrepreneur who bought two companies worth in 15 months

Schedule a Free M&A Consultation with Jason’s Associate

Jason’s trusted associate deeply understands the M&A process will try to give you as much advice as possible in 30 minutes. We want to provide real value to you specifically on this call. If we can’t help you or we aren’t a fit to work together in the future, we’ll certainly direct you to someone who can better help you.

What Makes Jason’s Program Different From All the Rest?

Let me say this first: Other instructors in this space of small cap M&A (deals under $50M) focus on the wrong things. Although, some of them are better than others. But, some of them have never bought a 7-figure company themselves. We blow everyone else out of the water with our program for a multitude of reasons. We are 10X more honest, we have a slightly lower investment cost, we have WAY better information, we have better support such as monthly Zoom calls and a members-only mastermind group, and more (some things are hard to explain on a webpage, especially if you are inexperienced with M&A).

Notably, our program has two key differences from ALL the rest:

Difference 1 – We Show You How To Build an M&A Deal Team That Will:

- Save you a ton of time (our process is very quick, as it should be). You aren’t looking to get married. You are looking for effective people who can do a job, nothing else.

- Prevent you from having to pay unnecessary fees to people you can’t really trust.

- Save you from giving away more free founder’s equity than you need to (you do not want a traditional board of directors that sits around and twiddles their thumbs all day. that is why we call it a “M&A deal team”).

Difference 2 – We Focus on Buying Companies That are Diamonds in the Rough and Cash Flow on Autopilot, Even if That Means Doing Slightly Fewer Deals:

- Hardly anyone talks about this either. NO other program knows what I know on this topic. NONE.

- Anyone can do a mediocre deal. But, this program is about getting rich, and mediocre deals won’t get you rich.

- Every other program is just focused on getting deals done. This program focuses on getting deals done too, but we also focus on getting GREAT DEALS DONE. Deals that cash flow consistently and on autopilot.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/