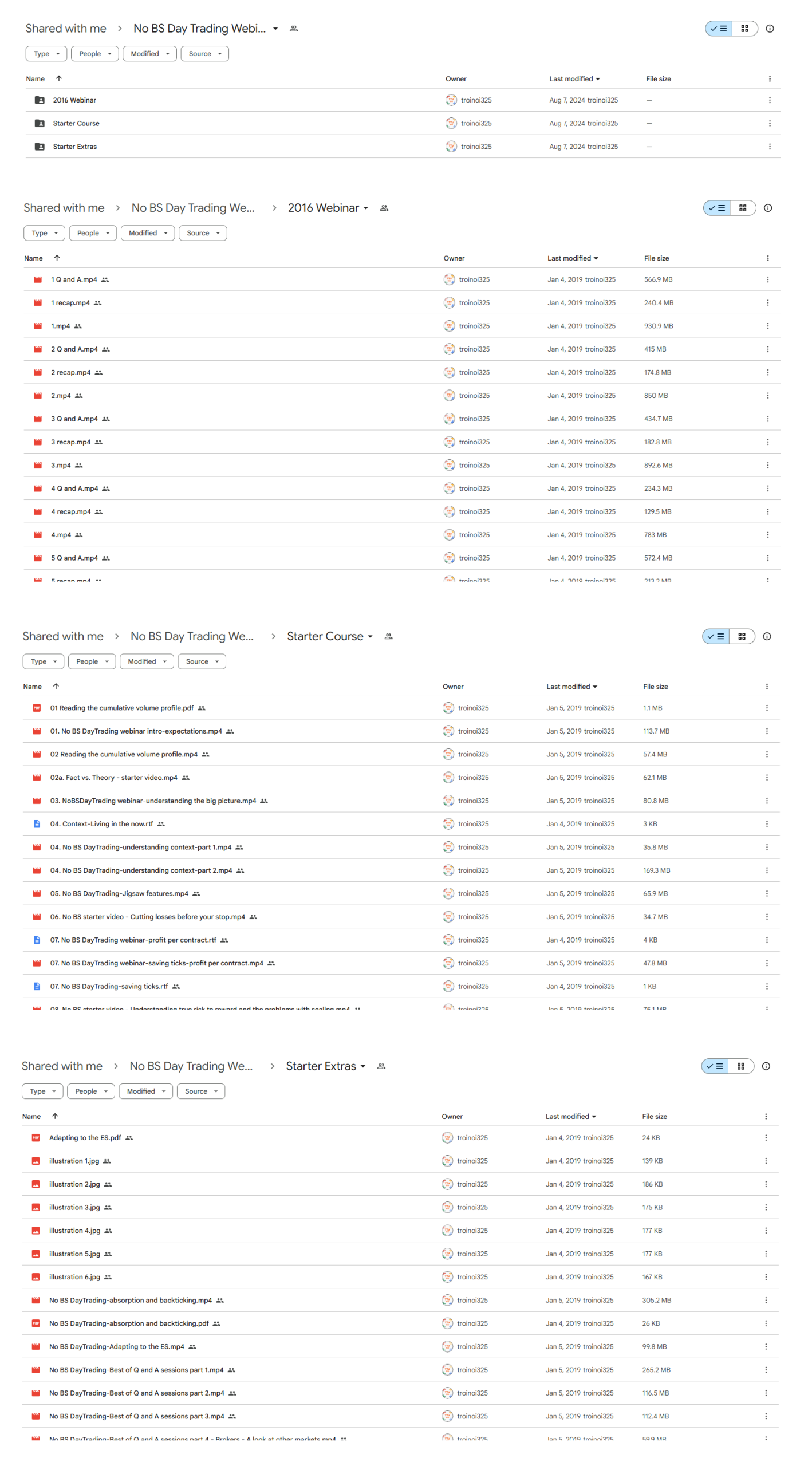

*** Proof of Product ***

Exploring the Essential Features of “John Grady – No BS Day Trading Webinar and Starter Course”

The webinars are structured to accommodate both new and experienced traders and are comprised of two parts.

The first part is a set of primer videos which you receive before the live sessions begin. This set of advanced tutorial videos lays the groundwork and are a crucial part of the instruction. They cover nearly every aspect of trading for a living. The first group of videos explain all the details of how the game is played as well as things like understanding how to properly assess risk to reward, preserving your bankroll, knowing when to press and when to cut back on size, spreading, understanding context, etc. NOTE: These primer videos are not the videos from the basic and intermediate courses. They are a completely separate set of videos.

The next group of videos shows real trades. I surgically dissect them and get as detailed as I can with regards to explaining the strategies. I use the pause/start/rw/ff buttons to move through sections and point out where buyers were hitting offers, where sellers were hitting bids, high and low volume areas, bids and offers stacking and pulling depending on whether they were spoofs or real orders, and so on and so forth. The real trick is understanding the context surrounding each trade because this is what helps one gain an accurate picture of the scenario. It’s not just about anticipating the direction. It’s also about anticipating all possible outcomes before one even enters a trade. What do I do if it doesn’t immediately break? What do I do if it chops back and forth longer than I think it should? What are the signals which will determine my exit strategy? I show winners, losers and break-even trades. Knowing how to properly manage a trade is one of the most difficult parts of trading so I explain what I’m watching on a moment to moment basis and how it’s affecting my read.

The last few videos bring all the pieces of the puzzle together and I explain how one goes about developing a long-term winning methodology.

The second part of the webinar consists of two weeks of live trading. Participants log into a live room where they can see my screen and interact with me via instant messenger and audio. I talk through what I am seeing in the price action and when I decide to initiate a trade, I talk through the entire thought process behind it. Participants can ask questions via instant messenger all day and I try to answer them as they come through to me. If the question is short, I can usually answer it in the moment. If it requires a more detailed explanation, I will answer it at the end of the day after I’ve finished trading. We do a Q&A session at the end of each day and I do not leave until all questions are answered. I also open the room to audio questions at the end of the day so a person with a detailed question is not required to write multiple paragraphs in the IM box.

I try to schedule these sessions during times when I think there will be decent action. I avoid rollover weeks, holiday weeks, late summer, etc. Any time periods which are usually not conducive to good trading.

I use the Jigsaw Trading platform during the webinars. The Jigsaw platform is just a fantastic teaching and learning tool. I am able to clearly demonstrate how the orders move the market and it’s very easy for attendees to identify high volume and low volume areas. I think it helps my customers learn much faster. Using Jigsaw is not required to learn the methodology but participants usually see the benefits of using it within the first day or two.

The set of primer videos for the U.S. webinar includes the following:

• The No BS methodology – The core principles of scalping.

• Fact vs. Theory – The realities of trading for a living.

• Understanding the big picture – Who are your opponents? What drives the action?

• Understanding context – Context is key. Each scenario is different. Adaptation is crucial.

• Reading the cumulative volume profile – Understanding steps in the profile as well as high and low volume areas.

• Momentum and pressure points – Scalping the fast, easy money.

• Understanding true risk to reward and scaling – How to properly assess risk to reward at all times.

• Saving ticks/Profit per contract – Every tick counts. Avoiding poor trades is as important as making winning trades.

• Cutting losses before your stop – How to identify you’re on the wrong side before your stop is hit.

• Good action vs. bad action – Is the current price action conducive to good opportunities?

• Correlations – Are there any which work?

• Spreading as it relates to scalping – Spreading explained. Adjusting strategies based on spread action.

• Putting it all together – Developing a long-term, winning methodology.

The CME webinar also includes additional primer videos which show demonstrations of scalping strategies being executed in real time with real money. I cover all details of each trade including the context for the day up to that point, the setup which gave me a bias, and what I saw in the price action which triggered my entries and exits. Some of the strategies shown include:

• As she goes setup

• Fade trade retracement setup

• The Lure

• Reversal setups

• Breaking highs and lows

• Playing a range

• Playing the bounce

• Run over by a train

• Run over by a steamroller

• Stop runs

• The Smackdown

• Hitting a wall

• When to not join an iceberg

• ES setups (breakouts and fades)

• Market madness – How to handle insane movement.

• Managing trades correctly – Determining when to hold or exit based on the developing action.

I show winning, losing and break-even trades. The intention is not to cherry pick winning trades and act like a strategy works 100% of the time. The intention is to show you how to pick trades which tend to work more often than not and explain why that’s the case. Every trade is not a 50-50 coin flip. This is convincingly demonstrated. The trick is to be very reactionary and to manage trades properly so you do not take large hits to your account.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/