*** Proof of Product ***

Exploring the Essential Features of “Kyle Peterdy – Commercial Mortgages – CFI Education”

Commercial Mortgages

Step into the shoes of a commercial mortgage underwriter to unpack the key analysis criteria used in commercial mortgage lending

- Dive into property valuation metrics

- Explore the important property characteristics and how they influence loan structure

- Work through an example mortgage request, including risk rating and pricing

Overview

Commercial Mortgages Course Overview

This Commercial Mortgages course explores the elements determining loan details for income-producing investment properties. Commercial mortgages are used to fund real estate investment ventures. They are important for any credit analyst who wishes to understand issues relevant to real estate financing or would like to specialize in the real estate sector. In this course, we examine key metrics of the real estate lending process and dive into the key underwriting parameters for commercial mortgages. We also work through a realistic client example to understand the inner workings of a commercial mortgage deal. In this case study, we examine a rent roll analysis, risk rating, and the pricing of the loan.

Commercial Mortgages Learning Objectives

Upon completing this course, you will be able to:

- Examine key property valuation metrics like net operating income (NOI) and capitalization rates, and understand how they relate to the credit analysis process

- Review key property parameters and how they inform the underwriting process

- Work through an example property to see the end-to-end underwriting process

- Understand how key variables drive loan amount, risk rating, credit terms, and mortgage pricing

Who should take this course?

This Commercial Mortgages course is designed for current and aspiring commercial banking professionals in the real estate industry. This course is also a great resource for real estate analysts and commercial mortgage brokers who wish to better understand the real estate underwriting process. This course provides a valuable perspective on a real estate lender’s considerations when structuring a commercial mortgage deal which is vital for lenders, brokers, and advisors.

What you’ll learn

Introduction

Introduction

Learning Objectives

Download Course Files

Commercial Mortgages

Commercial Mortgages

Commercial Mortgage Organizational Chart

Types of Commercial Mortgage Transactions

Types of Commercial Mortgage Lenders

Interactive Exercise 1

Net Operating Income

Net Operating Income

Sensitization – Hypothetical Expenses

Sensitization – Non-Controllable Expenses

Sensitization – Controllable Expenses

Sensitization – Non-Cash Expenses

Net Operating Income – Perspective

Interactive Exercise 2

Cap Rates & Valuation

Capitalization Rates (Cap Rate)

Cap Rates and Valuation

Normalizing the Income Statement

Normalization Example

Cap Rate Direction

Cap Rate Compression

The Impact of Cap Rates

Interactive Exercise 3

Key Underwriting Parameters

Mid-Way Check-In

Key Underwriting Parameters

Model Overview

Environmental Risk

Property Type

Property Type – Test Cap Rate

Property Type – Minimum DSC

Property Type – Test Vacancy

Property Type – Amortization

Tenant Quality

Lease Maturity Profile

Interactive Exercise 4

Building Condition

Building Condition – Amortization

Building Condition – Pricing

Building Condition – Loan Amount

Location

Cash Flow

Guarantees and Access to Capital

Interactive Exercise 5

Pricing & Profitability

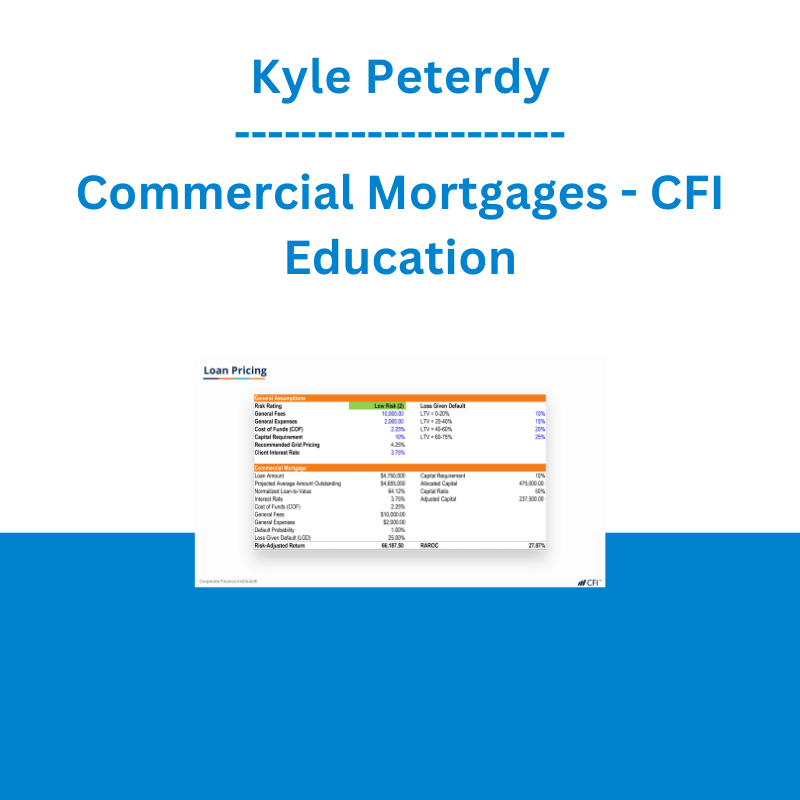

Loan Pricing

Risk Rating

Loss Given Default (LGD)

Pricing and Profitability

Interactive Exercise 6

Example Client Case Study

Example Client Case Study

Property Description

Assumptions and Calculations

Tenant Analysis

Risk Rating Tab

Pricing Tab

Summary

Conclusion

Conclusion

Qualified Assessments

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

SMB - Options Training

SMB - Options Training  Greg Loehr - Advanced Option Trading With Broken Wing Butterflies

Greg Loehr - Advanced Option Trading With Broken Wing Butterflies