*** Proof of Product ***

Exploring the Essential Features of “Market Fluidity”

MARKET FLUIDITY IS DESIGNED FOR THE AVERAGE TRADER

WHAT IS COVERED IN MARKET FLUIDITY ?

It is only rocket science, if you make it as such.

Trading Plan

As a new trader, this is the MOST over looked part of trading. Creating a trading plan is just as important as navigating through a GPS to get to your destination.

During the Market Fluidity course, we will focus on creating a trading plan well suited to your current lifestyle. Before signing up, it will advised to AT LEAST have some sort of a rough plan on hand so we know what and where we need to work on.

A trading plan should include a couple few things:

1. A specific pair you would want to focus on

2. Time of day you have to focus on your pair

3. Your risk management and your daily, weekly and monthly goals

When we talk about goals, of course, everyone wants to retire their parents, or buy that car, or go on that vacation, but at the same time we have to be really realistic on what sort of a goal setting we are doing. This will affect the way we trade 100%. Sometimes people want to achieve 10% a day or 50% a week. You have to understand that banks offer a MAXIMUM of 5% a YEAR! So even if you are focused on 3% a day, and constantly hit 10% a week or 15% to 20% a month, you have set yourself up for longevity in this game. The ONLY issue people have is capital! When you have funding issues like, the only thing that should keep you going is self-belief and KNOWING that the process maybe slow, but in a year form now, it WILL pay off.

Once you enroll in Market Fluidity, you will then slowly understand the importance of having a SOLID trading plan and how it will ultimately help you where you want to be in this tough and lonely game of risk

Market Sessions

Did you know you ONLY have to focus on just ONE market session to make this trading thing work ? Every session comes with its own volatility and different nuances that affect the market. Most traders tend to focus on all 3 sessions (Asian, NY and London). Now this may seem like a good idea, since more sessions = more chart time right ? WRONG ! Once you choose a session you will be focusing on, you will put all efforts in MASTERING that session.

As a trader you have to realize that the forex market has its cycles of high volatility and low volatility. Its very important to be aware of the time that you will be trading the market. Lets say, you start to look at the charts around 2pm EST, when London session is closed, Asian is closed, NY is about to close, so just ask yourself; no matter how good a setup looks in THAT instance, do you think there will be volume at that time ? Do you think there will be volatility at that time when Asian and London is closed, and NY is about to close ? Do you think that makes sense ? The problem here is that our brain says, “No it makes no sense at all”, but our heart says “The setup is there mate, makes perfect sense!”. This is where the 90% of the loosing traders sit. Below is a simple break down of the RECOMMENDED hours to trade:

Now fundamentally if you look at this, and if you keep in mind that during these few hours of the market, there is ALOT of volume being thrown around. As a scalper and a day trader, these times are crucial in trading; and understanding the movements of price during these times will really benefit you in your ability to survive in this harsh game.

Why Candles Matter

Candle sticks have been primarily ignored for the most part. You must have heard or read about, WAIT FOR CANDLES TO CLOSE. The reason why that has been said is because candle closes will let you know whether the zones will be respected or rejected, whether wicks will be filled or the wick will act as a exhaustion etc. With “Market Fluidity” we HEAVILY rely on candles, because think about it, all we see is a candle stick chart from a micro perspective. Thats it. We dont know what institutions are doing, what banks are doing, I mean, we have an IDEA but not entirely sure. So focusing on CANDLES and PRICE ACTION is the KEY !

Break & Retests / Fakeouts

So from the example above and below you can see from annotations how easy it can get to tell stories on the charts by simply waiting for candles to close. When we talk about break & retests, technically they are pretty easy to spot AFTER the price has already moved, but it is a completely different thing to call it out as its happening.

Similarly same thing happens when you see a fakeout. A fakeout is just a failed breakout trade where the candle skips the retest and just closes back in the range. As you can see from the example above, looking at candle closes at 1h and 4h levels, it is pretty easy to tell a story and as to what the price is expected to do next.

Those were some of the things that are covered in great detail in Market Fluidity. The aim is to provide you with the ability to read the candles accurately by being patient and ultimately becoming truly fluid in the markets.

Live Webinars

Live webinars have now become an integral part of The Forex Family. I personally think it is really important to be fully engaged with everyone on the team. These webinars are held on the platform called ZOOM. Once inside, you have the ability to voice your concerns, give ideas to analysis, provide support, basically become a part of the session. When you actively become a part of a LIVE session, you start to enjoy the process more and more. Trust me Trading is a very lonely game, I believe with the LIVE webinars, it has now become alot of fun for most people. It is highly encouraged that you come prepared to the LIVE sessions. Everyone is welcomed to share their trading ideas with labeled charts with entries and exits. This allows us to see what you are thinking and seeing. It gives you an opportunity to have fresh eyes go over your analysis and possibly give you constructive criticism. I believe this is the BEST way you can really progress as a trader and grow. Below is what you can expect as a LIVE stream if you are a non-member.

Going through LIVE sessions everyday, you will start to understand that trading is truly a process oriented sport. There are days when the markets are rocking and rolling, it has alot of volatility in it, and then there will be days when the market will be ranging and there will barely be any volume. All of these factors when presented LIVE as its happening, it gives you a chance to see that maybe a certain day was a non trading day, or its OK to have no trades in a day, or its OK to end the day with 1 or 2 trades, or its PERFECTLY FINE to take a trade and end the day with a loosing trade. At times you will feel like this slow process is not going fast enough, and you start to make irrational decisions. Doing that puts you in the majority 90% who dont trust the process. Being patient and taking it day by day will slowly put you in the top 10% who ARE being patient, who ARE looking for 1-2 opportunities, who ARE being true to themselves and truly believe that its not the markets that they have to fight, its the demons inside them.

Trading News and Spreads

Trading news is a hot topic right now. Whenever there is a red folder at www.forexfactory.com, most retail traders will look for an opportunity to take a risk to make some sort of money. Now this is not necessarily a bad thing, but its not a good thing either. See, high news events like interest rates, Unemployment, CPI etc, they all bring very high volume into the market. Most of the times they are very volatile and its hard to predict it ca move the price. Now at times we can speculate, but truth be told, due to the volatile nature of these events, its pretty hard do to so.

So lets say you are a brave cowboy and you want to trade news. Now a brave cowboy that you are, you will try to do a market order; which is one of the ways you will trade news, other than placing pending orders. Now you got your cowboy hat on, and you have a market position placed. As the countdown starts for the magical news event, you get tensed and get ready to close the position in a HUGE profit, or maybe attempt to close it as it reaches your stoploss (I HOPE you have one). So the news comes, and all of a sudden you see that price goes the opposite way and your position is gone.. “WHAT THE FUCK” is what comes out of your mouth since you are a brave cowboy so you can use that language. As you look at your history, you find that your stoploss got slipped, by 10 pips if you are LUCKY, but you find out that it got slipped 30 fucking pips !! Now you are LIVID and angry ! You tell your group how the broker is trying to fuck you. But let me tell you what REALLY happens.

The prices you see on the chart; I will try to dumb it down for everyone in a way everyone can understand it. The prices you see on the chart, they are being given to the broker by the market, and in turn the broker presents them to you on the chart as they happen. So now lets say that you had a buy position at 110.200 and your stoploss was 110.100. So when news came, it came SOOO fast, and SOOO viciously, that the price the broker got from the market was 110.000 !!! Which means that the system never even received 110.100 in order to execute your stoploss, THEN you have to take into account the fucking spread that WIDENS by god knows how many pips. So since the broker never even say 110.100, technically it wasnt possible to execute your stoploss. Now the same thing happens to pending orders.

Lets say you had buy stops at 110.200, and the news comes, its so volatile and filled with volume that your order gets activated at 110.350 !! 15 pips ABOVE where you actuallly had it !WHAT THE FUCK right ?? Yeah, same thing happened here. The news was just too intense that the broker never even got the 110.200 to execute your order, but instead it got activated at the NEXT best price that it received; you also have to now account for the wide spreads too.

So at the end of the day. Please don’t trade news, especially if you are new. Trading the news makes NO sense at all. At The Forex Family and Market Fluidity, we make sure noone takes unnecessary risks with the news. The only reason is that we all have profitable strategies, and we want to really exploit them. So if your strategy has a high winning rate, why trade the news ? Lets not be brave cowboys, and lets all become Safe Sally; because Safe Sally, picks her trades wisely, trades 1 to 2 times a day, does not worry about news, and is over all profitable.

Support System

TheForexFamily – Market Fluidity is not just a name. Its a brand. Its a brand with one of the BEST support systems you will find anywhere. Seriously, Lets take a look at this.

All material produced is ORIGINAL. We usually do weekly webinars with everyone. The announcement is made 1-2 days in advance. Now this is worth noticing, whenever there is a webinar, there is a document shared with all members a day or two before the webinar. In that document, everyone is encouraged to write their questions or any issues they had in the week prior. This gives us a chance to see how can we make certain things from better, to the BEST. This approach is really important when it comes to developing you as a trader.

Whenever you sign up, just be prepared to work hard. As a coach, we will work with you TWICE as hard, so you don’t have to. That means we need a seemingly robust communication system. For that we have “Slack”. The reason we chose Slack, is due to how overwhelmingly organized it is.

Channels:

Now as you can see, everything is now organized. First we have the Channel called Analysis. Many times when you post an Analysis in a group, it usually gets lost in the constant bombardment of messages, and noone reads it so you begin to distant yourself from everything. Am i right ? Right ! This way, you not only have a seperate Channel for that, but it will never get ignored. Members then have the ability to start a SEPARATE conversation, ON the analysis posted. This new thread started now becomes a completely new conversation, neatly set aside from the main conversation.

Announcements: This space is kept seperate. sometimes when special announcements are made in groups, they either get lost, or are ignored by a few. Lets say there was an announcement made for a webinar. So some times there will be so many messages that the important message will be lost in the sea of other comments. So check this out.

General Chat: This space is used for general discussions. Daily zoom links are also sent in there and some important notifications are also sent. This space is usually reserved to talk about regular stuff, life, psychology, ideas etc. The ability to create different threads from a conversation is what makes this work so much better than anything else. Especially when you have large groups.

Visual References/Questions and concerns: The Visual References channel is used post info-graphics. They are all educational and are directly related to trading psychology mostly. Sometimes very important tips are posted aswell.

Notice how a separate conversation Thread is also open from the NY_session channel.

News: This channel is being updated with latest news on the GO constantly. This news channel DOES NOT STOP. Trust me, it goes on and on about what is happened. It can be customized aswell so it wont show random news. All news shows in this channel is tailored to major news events ONLY, such as, Brexit, Trump, Theresa May etc.

Session Specific Channels: All sessions have different channels. I personally think that it is very necessary. There are some people who ONLY trade London session or NY session or Asia session. As you can see, that not only in the picture below the London session channel is opened, but WITHIN the channel a separate conversation is opened on a separate trade someone took. Now look how organized it is. I mean, just looks soo beautiful.

Its tools like these that makes the overall mentorship experience better to the best ! I mean, once you have a large group, most messages start getting lost in the constant tsunami of charts, messages, banter talk etc. I think this is a very big step which has been taken, to make sure everyone gets the best out of this educational experience.

Stacking Positions – Why ?

So you know, this question i get alot. “Why do you stack positions, rather than opening just ONE big position?”.

Before we answer that, lets go into how the candles are actually formed and what type of market structure is suitable for stacking positions.

So if we look into basic anatomy of a candle, lets say we have a Bullish candle; it will

have a top wick and a bottom wick for the most part. Now lets say we are in an uptrend, and a 4h candle has closed bullish. So now the trend is bullish and you are looking for buys. If we look at the general way a candle is formed, it will have a top wick and a bottom wick. So now when the next 4h candle forms, you take an entry for buys, and for the sake of simplicity, in the example below you can see that there is a hard stop around 113.775

Now keeping this hard stop in mind, lets say that this HARD STOP 113.775 was at a 1h support, since we are looking at the 4h candle. So basically as you take a buy you are counting on the fact that the 4h candle will continue bullish. So now stacking positions mean, as the candle/price comes lower, you add another buy, and another buy BUT your stoploss stays the same at 113.775. It is VERY important to understand the risk you are adding here aswell. Lets say, you aim to use 5lots on this Buy trade. Now either you can have ONE 5lot with stoploss at 113.775 OR you can split it into 5 1lots, or 2 2.5lots at different price levels with ONE HARD STOP AT 113.775. Essentially when you are breaking up your lot size like this, you are diversifying your risk aswell.

For example, lets say that you have buys on with 3 1lots, and you plat to add another 2 1lots (making is a total of 5lots), and price keeps falling and hits your HARD STOPS at 113.775, so instead of losing a full 5lots, you lost 3lots. See what happened here ? Your risk was reduced. This is why some people prefer splitting their lots in multiple smaller lots.

Be very very careful while doing this, as most DONT understand risk, and will add positions blindly, and once it stops them out, they will cry “oh i lost more than what i was supposed too lose”. So dont be a dummy. ALWAYS know EXACTLY how much you will lose when your stops get hit, and you will be fine.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Joe Vitale and Steve Jones - Wealth Trigger 2.0: Reloaded

Joe Vitale and Steve Jones - Wealth Trigger 2.0: Reloaded  Kallzu Ads - Chris Winters

Kallzu Ads - Chris Winters  The Warriors Circle Shopify Mastermind - $52K Shopify Formula

The Warriors Circle Shopify Mastermind - $52K Shopify Formula  Jake Tran - Laptop Lifestyle Academy

Jake Tran - Laptop Lifestyle Academy  Alphonse Ambrosia - Management of Mitral Valve Disease

Alphonse Ambrosia - Management of Mitral Valve Disease  Steve Seidel - Instagram Accelerator: Platinum Package

Steve Seidel - Instagram Accelerator: Platinum Package  FullTime Filmmaker Team - Course Creator Pro (Preview) - Lifetime Updated

FullTime Filmmaker Team - Course Creator Pro (Preview) - Lifetime Updated  Ron Pevny - Transforming Your Journey of Aging - The Shift Network

Ron Pevny - Transforming Your Journey of Aging - The Shift Network  Donald Kalff - An Unamerican Business

Donald Kalff - An Unamerican Business  Daniel Gregory - Introduction to Black & White Film Photography

Daniel Gregory - Introduction to Black & White Film Photography ![Flutter & Dart - The Complete Guide [2020 Edition]](https://lunacourse.com/wp-content/uploads/2024/11/Flutter-Dart-–-The-Complete-Guide-2020-Edition-300x300.jpg) Flutter & Dart - The Complete Guide [2020 Edition]

Flutter & Dart - The Complete Guide [2020 Edition]  Ron Legrand - How To Structure And Protect Your Empire

Ron Legrand - How To Structure And Protect Your Empire  Treating Self-Destructive Behaviors in Trauma Survivors - Lisa Ferentz

Treating Self-Destructive Behaviors in Trauma Survivors - Lisa Ferentz  Secrets of Sexual Acceleration - Jon Sinn

Secrets of Sexual Acceleration - Jon Sinn  Kevin Zhang – Ecommerce Millionaire Mastery

Kevin Zhang – Ecommerce Millionaire Mastery  MindfulTricks - Manifested

MindfulTricks - Manifested  Addie Gray - The Wanderlust Photo Lab

Addie Gray - The Wanderlust Photo Lab  Mosh Hamedani - Complete Python Mastery

Mosh Hamedani - Complete Python Mastery  Jack Wood - Creating a Professional Sound

Jack Wood - Creating a Professional Sound  Meg Meeker - Real Solutions The Ask Dr. Meg Library

Meg Meeker - Real Solutions The Ask Dr. Meg Library  Wingfox - Cyberpunk Art and Drawing Course

Wingfox - Cyberpunk Art and Drawing Course  Master Teresa Yeung - Money Chi Gong

Master Teresa Yeung - Money Chi Gong  Dr. Alex Mehr - Alex Engine

Dr. Alex Mehr - Alex Engine  John Frazer - Double Youtube Millionaire System

John Frazer - Double Youtube Millionaire System  Valerie Vestal - Managing Challenging Patient Behaviors: 101 De-escalation Strategies for Healthcare Professionals - PESI

Valerie Vestal - Managing Challenging Patient Behaviors: 101 De-escalation Strategies for Healthcare Professionals - PESI  Stefano Santori - Efficace Come Un Navy Seal

Stefano Santori - Efficace Come Un Navy Seal  Courtney Armstrong - Hypnosis for Trauma and Chronic Pain: Protocols for Relieving Pain in Trauma Survivors

Courtney Armstrong - Hypnosis for Trauma and Chronic Pain: Protocols for Relieving Pain in Trauma Survivors  Richard Hodgson - The Greatest Direct Mail Sales Letters of All Time

Richard Hodgson - The Greatest Direct Mail Sales Letters of All Time  Gareth Soloway - Elite Keys To Unlimited Success

Gareth Soloway - Elite Keys To Unlimited Success  Jessica - The Mama’s Heart Journal

Jessica - The Mama’s Heart Journal  Ron Blehm - The Role of Rehab Professionals as Primary Care Providers

Ron Blehm - The Role of Rehab Professionals as Primary Care Providers  The First Time Investors Workbook - Joe Jonh Duran & Larry Chambers

The First Time Investors Workbook - Joe Jonh Duran & Larry Chambers  Victor Antonio - Tips & Scripts for Getting Past the Gatekeeper - Sales Gravy

Victor Antonio - Tips & Scripts for Getting Past the Gatekeeper - Sales Gravy  Richard Nongard - Scale Up Your Practice

Richard Nongard - Scale Up Your Practice  GunWitch - Seduction MMA

GunWitch - Seduction MMA  Master Chunyi Lin - 2020-01 7-Day Blessing Chanting Meditation Recordings

Master Chunyi Lin - 2020-01 7-Day Blessing Chanting Meditation Recordings  30 Days to Alpha: Become an Alpha Male in 30 Days. Mindset, Training, Fashion, Discipline, Health, Money and Dating Will Make You An Alpha Male

30 Days to Alpha: Become an Alpha Male in 30 Days. Mindset, Training, Fashion, Discipline, Health, Money and Dating Will Make You An Alpha Male  Don Kaufman - What Products to Watch and Why Class

Don Kaufman - What Products to Watch and Why Class  Medium Michael Mayo - Evidence-Based Mediumship to Confidently Connect With Loved Ones & the Spirit World - The Shift Network

Medium Michael Mayo - Evidence-Based Mediumship to Confidently Connect With Loved Ones & the Spirit World - The Shift Network  Guy de Maupassant - The Works of Guy de Maupassant Vol V

Guy de Maupassant - The Works of Guy de Maupassant Vol V  Chanti Zak - Grow with Quizzes

Chanti Zak - Grow with Quizzes  Stanley S. Bass - Energy Karezza

Stanley S. Bass - Energy Karezza  Scott Greene - Legendary Potency and Heat Yourself Hard

Scott Greene - Legendary Potency and Heat Yourself Hard  Esther Williams - Spirituality & Mental Health: Effective Strategies to Integrate Faith in Clinical Treatment - PESI

Esther Williams - Spirituality & Mental Health: Effective Strategies to Integrate Faith in Clinical Treatment - PESI  Yotam Ottolenghi - MasterClass - Teaches Modern Middle Eastern Cooking

Yotam Ottolenghi - MasterClass - Teaches Modern Middle Eastern Cooking  Charles Kirkland - Lead Agency Master Class + Auto Affiliate Funnel + 14 Bonuses

Charles Kirkland - Lead Agency Master Class + Auto Affiliate Funnel + 14 Bonuses  Michael Mithoefer - Psychedelic-Assisted Therapy In-depth: In-session demonstrations and real-world insight into MDMA & more

Michael Mithoefer - Psychedelic-Assisted Therapy In-depth: In-session demonstrations and real-world insight into MDMA & more  Catch Wrestling Megapack (Scientific Wrestling, Snake Pit USA, others)

Catch Wrestling Megapack (Scientific Wrestling, Snake Pit USA, others)  Jenkins and Mike Filsaime - Webinar Genesis 2022

Jenkins and Mike Filsaime - Webinar Genesis 2022  Guthrie Sayen & Brian Jaudon - Coaching for Self Leadership - An Introduction to Internal Family Systems

Guthrie Sayen & Brian Jaudon - Coaching for Self Leadership - An Introduction to Internal Family Systems  Sheila E. - Teaches Drumming & Percussion 2020

Sheila E. - Teaches Drumming & Percussion 2020  Caitlin Bacher - The Fab Facebook Group System 1.0

Caitlin Bacher - The Fab Facebook Group System 1.0  Cyndi Zarbano - 2-Day Critical Care Skills Boot Camp

Cyndi Zarbano - 2-Day Critical Care Skills Boot Camp  Centre of Excellence - Introduction to UK Law Diploma Course

Centre of Excellence - Introduction to UK Law Diploma Course  Michele Weiner-Davis - EP13 Conversation Hour 03

Michele Weiner-Davis - EP13 Conversation Hour 03  Introduction to the Mulligan Concept - Brian Folk, Brian Mulligan & Richard Crowell

Introduction to the Mulligan Concept - Brian Folk, Brian Mulligan & Richard Crowell  Scott Robert Lim - Crazy Stupid Light

Scott Robert Lim - Crazy Stupid Light  Tyler Durden - Plant And Stare Opener

Tyler Durden - Plant And Stare Opener  Donna Eden - Playing with the Frequencies

Donna Eden - Playing with the Frequencies  James Clear - Habits Academy

James Clear - Habits Academy  The Chad Fam - Instagram Mastery

The Chad Fam - Instagram Mastery  The Currency Pros - CurrencyPros

The Currency Pros - CurrencyPros  Testosterone & Erection Course - Jade Teta

Testosterone & Erection Course - Jade Teta  Emotional Abusive Behaviors and A Closer Look at Gaslighting: Clinical Tools to Break the Cycle of Manipulation and Regain Personal Power - Amy Marlow-MaCoy - PESI

Emotional Abusive Behaviors and A Closer Look at Gaslighting: Clinical Tools to Break the Cycle of Manipulation and Regain Personal Power - Amy Marlow-MaCoy - PESI  Pastor Ivor Myers - Escape from the Black Hole

Pastor Ivor Myers - Escape from the Black Hole  Saniel & Linda - White-Hot Yoga of the Heart (multimedia course)

Saniel & Linda - White-Hot Yoga of the Heart (multimedia course)  Karen Pattock - The Truth About Emotional Eating

Karen Pattock - The Truth About Emotional Eating  Dakota Wixom - Become a Quantitative Analyst

Dakota Wixom - Become a Quantitative Analyst  Dr. Dain Heer - Six Set of Processes to Change Your World

Dr. Dain Heer - Six Set of Processes to Change Your World  Marie Diamond - Diamond Healing Dowsing

Marie Diamond - Diamond Healing Dowsing  Talmadge Harper - Free from Fear & Free From Anxiety 2.0

Talmadge Harper - Free from Fear & Free From Anxiety 2.0  Vivienne Cass - The Elusive Orgasm

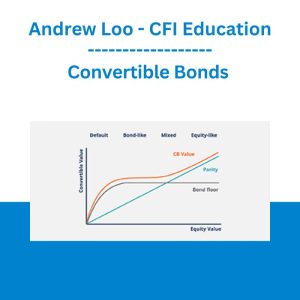

Vivienne Cass - The Elusive Orgasm  Convertible Bonds - Andrew Loo - CFI Education

Convertible Bonds - Andrew Loo - CFI Education  Tom Muzila - COMBAT SHOTOKAN KARATE Vol-1-2-3-4-5

Tom Muzila - COMBAT SHOTOKAN KARATE Vol-1-2-3-4-5  Evan Osar - Complete Core Conditioning

Evan Osar - Complete Core Conditioning  Modern Women's Portraiture - Sue Bryce, Lou Freeman, Lara Jade & Emily Soto

Modern Women's Portraiture - Sue Bryce, Lou Freeman, Lara Jade & Emily Soto  Bestselling Book Ads Mastery - Ivan Finn

Bestselling Book Ads Mastery - Ivan Finn  Shadow Dancing Home Study Program - Derek Rydall

Shadow Dancing Home Study Program - Derek Rydall  Jason Capital - The Millionaire Switch For Men

Jason Capital - The Millionaire Switch For Men  Anneke Odendaal - Reels Academy

Anneke Odendaal - Reels Academy  Bhaswati Bhattacharya - Creating Sacred Moments: Practical Skills from Ayurveda

Bhaswati Bhattacharya - Creating Sacred Moments: Practical Skills from Ayurveda  Tay Social - Man Mode Essentials

Tay Social - Man Mode Essentials  Jacqueline Joy - Opening Financial Flow Activation - Diamond Energy

Jacqueline Joy - Opening Financial Flow Activation - Diamond Energy  Kyle Peterdy - Venture Debt - CFI Education

Kyle Peterdy - Venture Debt - CFI Education  Duston McGroarty - 3 Minutes Ads

Duston McGroarty - 3 Minutes Ads  The Complete Brain Retraining System (4 in 1) - John Assaraf

The Complete Brain Retraining System (4 in 1) - John Assaraf  Olly Richards - Bulletproof Memory (Language Learning)

Olly Richards - Bulletproof Memory (Language Learning)  Nicholas Casolaro & Biron Bedard - Legal and Ethical Issues in Behavioral Health in New Hampshire - PESI

Nicholas Casolaro & Biron Bedard - Legal and Ethical Issues in Behavioral Health in New Hampshire - PESI