*** Proof of Product ***

Exploring the Essential Features of “Meeyeon Park & Mark R – Alternative Investments for Wealth Advisors – CFI Education”

Alternative Investments for Wealth Managers

Whether you’re an aspiring Financial Planner or an experienced Portfolio Manager, Alternative Investments are a popular and essential part of modern Wealth Management that can give you—and your clients—an edge.

- Learn about Alternative Investment products, assets, and strategies, and what sets them apart from conventional asset classes

- Review best practice tips that detail how these products and strategies can be deployed in a retail investment portfolio

- Discuss how to integrate the use of these investment vehicles into your existing processes and practice

Overview

Alternative Investments for Financial Advisors Course Overview

Alternative Investments are one of the fastest-growing categories of investment products in the Wealth Management industry. From Hedge Funds to Commodities and Venture Capital, investors are looking to Alternatives now more than ever to protect their portfolios and provide them with performance enhancement. This course is full of information about Alternative Investments and what sets them apart from conventional asset classes. Learn why Alternatives are in-demand, how to deploy these strategies in a Wealth Management portfolio, and what the advantages and disadvantages of Alternative Investments are. Learners will test their knowledge with interactive exercises throughout this course to ensure they have a comprehensive understanding of how Alternative Investments can be deployed within a Full-Service Brokerage environment.

Alternative Investments for Financial Advisors Learning Objectives

Upon completing this course, you will be able to:

- Learn about a New Asset Class – understand the difference between Alternative and Traditional investment assets. Learn about the types of Alternative Investment and what benefits they can bring to an Investment Portfolio

- Build an Understanding of Best Practices for Alternative Investments within the Wealth Management context and how they can be deployed in a client account

- Write Investment Policy Statements that fully take into account a client’s financial needs and investment profile and integrate Alternative Investments into your existing book of business

Who Should Take This Course?

This course is relevant for anyone looking to improve their financial acumen and portfolio management skills in Retail Wealth Management. It does not matter whether you’re considering a career in Wealth Management or you’re a tenured Advisor that’s looking to take your practice to the next level; this course applies to anyone that wants to stay up-to-date on the latest industry knowledge, trends, and techniques.

What you’ll learn

Introduction

Introduction

Learning Objectives

Download Course Presentation

What Are Alternative Investments

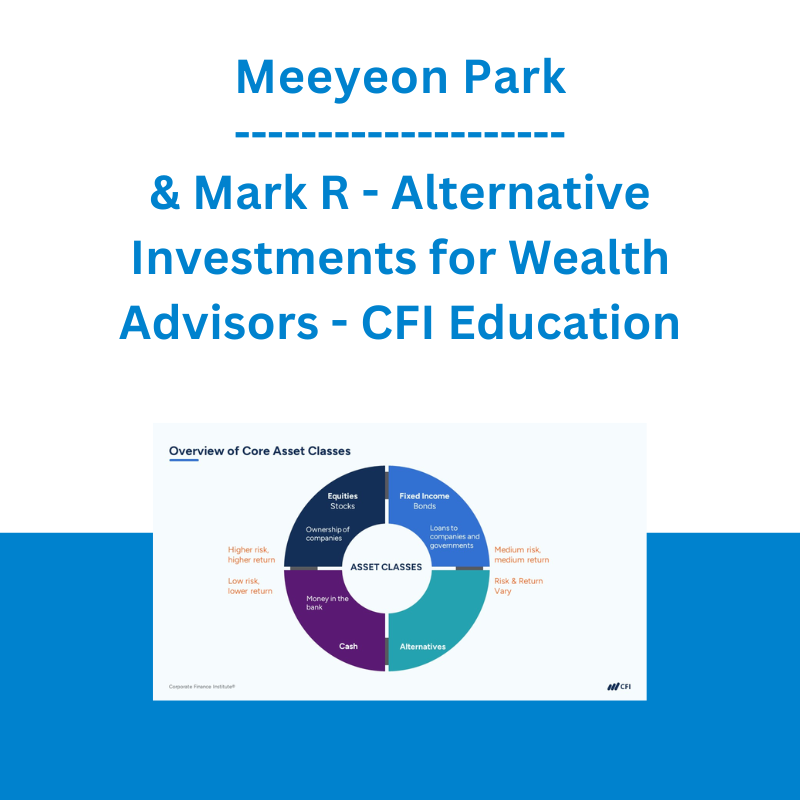

Overview of Core Asset Classes

Interactive Exercise 1

Hedge Funds

What Are Hedge Funds

Hedge Fund Strategies

How Advisors Invest Client Wealth in Hedge Funds

Pros and Cons of Investing in Hedge Funds for Advisors

Interactive Exercise 2

Commodities

What Are Commodities

Pros and Cons of Investing in Commodities

How Advisors Invest Client Wealth in Commodities

Interactive Exercise 3

Real Assets

What Are Real Assets

Real Estate

Infrastructure and Timberland

Interactive Exercise 4

Private Equity

What Is Private Equity

Why Invest in Private Equity

Interactive Exercise 5

Liquid Alternatives and Structured Notes

Liquid Alternatives

Structured Notes

Interactive Exercise 6

Interactive Exercise 7

Primary Goals of Alternative Investments

Why Use Alternative Investments

Adding Alternative Investments to an IPS

Personalized Client Profile

Personalized Client Profile Continued

Asset Allocation

Concentration Limits

Conclusion

Conclusion

Qualified Assessment

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Planning & Wealth Management (FPWM)™ Certification

Alternative Investments for Wealth Managers is part of the Financial Planning & Wealth Management (FPWM)™ certification, which includes 24 courses.

Skills Learned

Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

Career Prep

Financial Planner, Investment Advisor, Portfolio Manager

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle