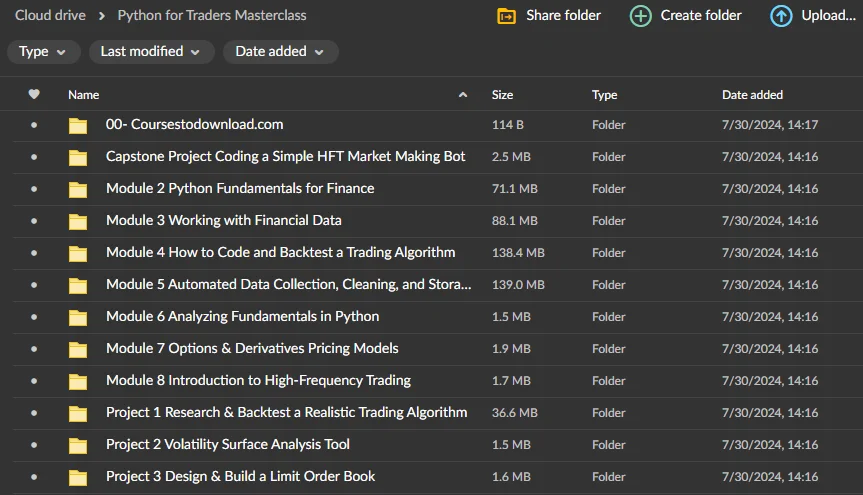

*** Proof of Product ***

Exploring the Essential Features of “Python for Traders Masterclass”

The Python for Traders Masterclass

8 Modules

4 Projects

105 Lessons

248 Code Examples

34 Hours of Content

ONE Program to Take You from Total Amateur to Algo Trader

Module 1: Introduction

1.1. Welcome to the Python for Traders Masterclass

1.2. Why learn to code as a trader?

1.3. Why should traders learn Python?

1.4. What will I gain from this course?

1.5. What topics will be covered?

1.6. Who is the intended audience for this course?

1.7. How much finance knowledge do I need?

1.8. How much coding knowledge do I need?

1.9. Placement Quiz: Am I a good fit for this course?

1.10. Module Quiz

Module 2: Python Fundamentals for Finance

2.1. Python Installation and Setup

2.2. Running Python Code

2.3. Basic Python

2.4. Intermediate Python

2.5. Advanced Python

2.6. Data Science in Python

2.7. Key library: Pandas

2.8. Key library: NumPy

2.9. Key library: Matplotlib

2.10. Key library: Statsmodels

2.11. Key library: Scikit-learn

Module 3: Working with Financial Data

3.1. Introduction to Financial Data: Time Series and Cross-Sections

3.2. Data Acquisition and Cleaning

3.3. Time Series Analysis

3.4. Understanding Stationarity

3.5. Time Series Forecasting

3.6. Exploratory Data Analysis

3.7. Section summary

Module 4: How to Code and Backtest a Trading Algorithm

4.1. So what is a trading algorithm?

4.2. Algorithm Design Principles

4.3. Data Management Module

4.4. Signal Generation Module

4.5. Risk Management Module

4.6. Trade Execution Module

4.7. Portfolio Management Module

4.8. Backtesting Basics

4.9. Backtesting Software

4.10. Advanced Backtesting Techniques

4.11. Optimization and Parameter Tuning

Project 1: Research & Backtest a Realistic Trading Algorithm

Project Overview

Step 1: Getting Started on QuantConnect

Step 2: Formulate a Strategy

Solution: Formulate a Strategy

Step 3: Develop the Algorithm

Solution: Develop the Algorithm

Step 4: Run a Backtesting Analysis

Solution 4: Run a Backtesting Analysis

Project Summary

Module 5: Automated Data Collection, Cleaning, and Storage

5.1. Sourcing financial data

5.2. Working with CSVs

5.3. Working with JSON

5.4. Scraping data from APIs

5.5. Scraping data from websites

5.6. Persisting data: files and databases

5.7. Section summary

Module 6: Analyzing Fundamentals in Python

6.1. Structured vs. Unstructured Data

6.2. Types of Fundamental Data

6.3. Gathering & Cleaning Fundamental Data

6.4. Automated Screening & Filtering

6.5. Statistical Analysis of Fundamental Data

6.6. Natural Language Processing on News Articles

6.7. Natural Language Processing on Annual Reports

6.8. Using LLMs for Natural Language Processing

Module 7: Options & Derivatives Pricing Models

7.1. Introduction to Options & Derivatives

7.2. Basics of Option Pricing

7.3. The Binomial Options Pricing Model

7.4. The Black-Scholes-Merton Model

7.5. Monte Carlo Simulation for Option Pricing

7.6. Introduction to Exotic Options

7.7. Interest Rate Derivatives and Term Structure

7.8. Implementing Finite Difference Methods for Option Pricing

7.9. Volatility and Implied Volatility

7.10. Advanced Topics and Modern Developments (Optional)

Project 2: Volatility Surface Analysis Tool

Project Overview

Step 1: Fetching Options Data

Solution: Fetching Options Data

Step 2: Calculating Implied Volatilities

Solution: Calculating Implied Volatilities

Step 3: Plot a 3D Volatility Surface

Solution: Plot a 3D Volatility Surface

Project Summary

Module 8: Introduction to High-Frequency Trading

8.1. What is High Frequency Trading (HFT)?

8.2. Handling High-Frequency Tick Data

8.3. Latency Measurement and Simulation

8.4. Understanding the HFT Market Making Strategy

8.5. Understanding Statistical Arbitrage with High-Frequency Data

8.6. Signal Processing for HFT

8.7. Real-time News Processing

8.8. Section summary

Project 3: Design & Build a Limit Order Book

Project Overview

Step 1: Design the Data Structure

Solution: Design the Data Structure

Step 2: Add Functionality

Solution: Add Functionality

Step 3: Simulate Live Orders

Solution: Simulate Live Orders

Project Summary

Capstone Project: Coding a Simple HFT Market Making Bot

Project Overview

Step 1: Define a System and Class Architecture

Solution: Define a System and Class Architecture

Step 2: Define the Event Loop

Solution: Define the Event Loop

Step 3: Implement the Data Feeds

Solution: Implement the Data Feeds

Step 4: Implement the Order Manager

Solution: Implement the Order Manager

Step 5: Add Alpha to the Pricing Strategy

Solution: Add Alpha to the Pricing Strategy

Project Summary

What You’ll Learn

Python Fundamentals for Finance

Starting with basic Python, you’ll progress to advanced concepts and dive into data science. Learn essential tools like pandas, numpy, matplotlib, statsmodels, and scikit-learn, key for data analysis and machine learning in finance. This course is your streamlined path to mastering Python in the financial industry.

Working with Financial Data in Python

You’ll learn about various financial data types, how to clean and acquire data, and dive into time series analysis. Understand stationarity, practice time series forecasting, and conduct exploratory data analysis to uncover insights.

Trading Algorithm Design Principles

You’ll learn what trading algorithms are and their core design principles. Explore modules on data management, signal generation, risk and trade execution, and portfolio management. Then, dive into backtesting, including basics, software, and advanced techniques, and finish with optimization and parameter tuning for enhancing your trading strategies.

Automation & Analysis

You’ll learn how to source financial data effectively. This includes working with common formats like CSVs and JSON. You’ll also gain skills in scraping data from APIs and websites, followed by techniques for persisting data using files and databases. The section concludes with a summary that reinforces these key data collection methods.

Analyzing Fundamentals

You’ll learn about fundamental data in finance, including its types and how to gather and clean it. The section covers automated methods for screening and filtering this data, techniques for statistical analysis, and using natural language processing to analyze annual reports.

Options & Derivatives Pricing

You’ll learn about options and derivatives, basic option pricing, and delve into models like Binomial and Black-Scholes-Merton. Explore Monte Carlo simulations, exotic options, interest rate derivatives, and finite difference methods for pricing. The section also covers volatility concepts, including implied volatility, and offers advanced topics for further exploration.

HFT and Market Making

You’ll explore ‘High Frequency Trading (HFT)’ and understand how to handle high-frequency tick data. Learn about latency measurement and simulation, the strategies behind HFT market making, and the concept of statistical arbitrage with high-frequency data. Dive into signal processing specific to HFT and real-time news processing.

Hands-On Learning with Applied Projects

Build & Backtest a Real Trading Algorithm

This project teaches practical skills in coding and understanding financial markets. By the end, students will have their own working trading algorithm that they’ve tested and can use in real trading.

Analyze Options & Plot a 3D Volatility Surface

A key part of the course is learning to plot a 3D volatility surface. This is a visual tool that shows how market uncertainty changes with different option prices and expiration dates. By the end of the project, students will be able to analyze options effectively and visualize market volatility in 3D, helping them make better trading decisions.

Design & Implement a Limit Order Book

The course will teach them step by step how to create their own book, focusing on how stock buy and sell orders are arranged. Students will also learn to make their Limit Order Book work using simple programming. By the end, they’ll know how to set up and use a Limit Order Book, helping them understand stock trading better and make smart trading choices.

Capstone Project

Build a Market Making Bot

In this final project, students will create their own Market Making Bot, a program used in trading stocks. Students will learn how these bots provide liquidity to markets by buying and selling stocks. They’ll then use their programming skills to build a bot that can make quick trading decisions. The project focuses on teaching how to balance risks and rewards, and how to make the bot respond to changing market conditions. By the end, students will have a working Market Making Bot that they’ve built themselves, giving them practical experience in finance and coding.

Meet Your Instructor

James is a quant trader and software engineer with years of experience in the world of algorithmic trading. With past experience at a major research lab and top tech company, he’s been independently trading equities and crypto using automated strategies since 2018. His passion for teaching and firsthand experience with the struggles that traders face when learning to code for the first time motivated him to create Python for Traders, knowing that there must be a better way to help his fellow traders turn better technology into better profits.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/