*** Proof of Product ***

Exploring the Essential Features of “Quantra Quantinsti – All Course Bundle“

8 LEARNING TRACKS | 50+ COURSES

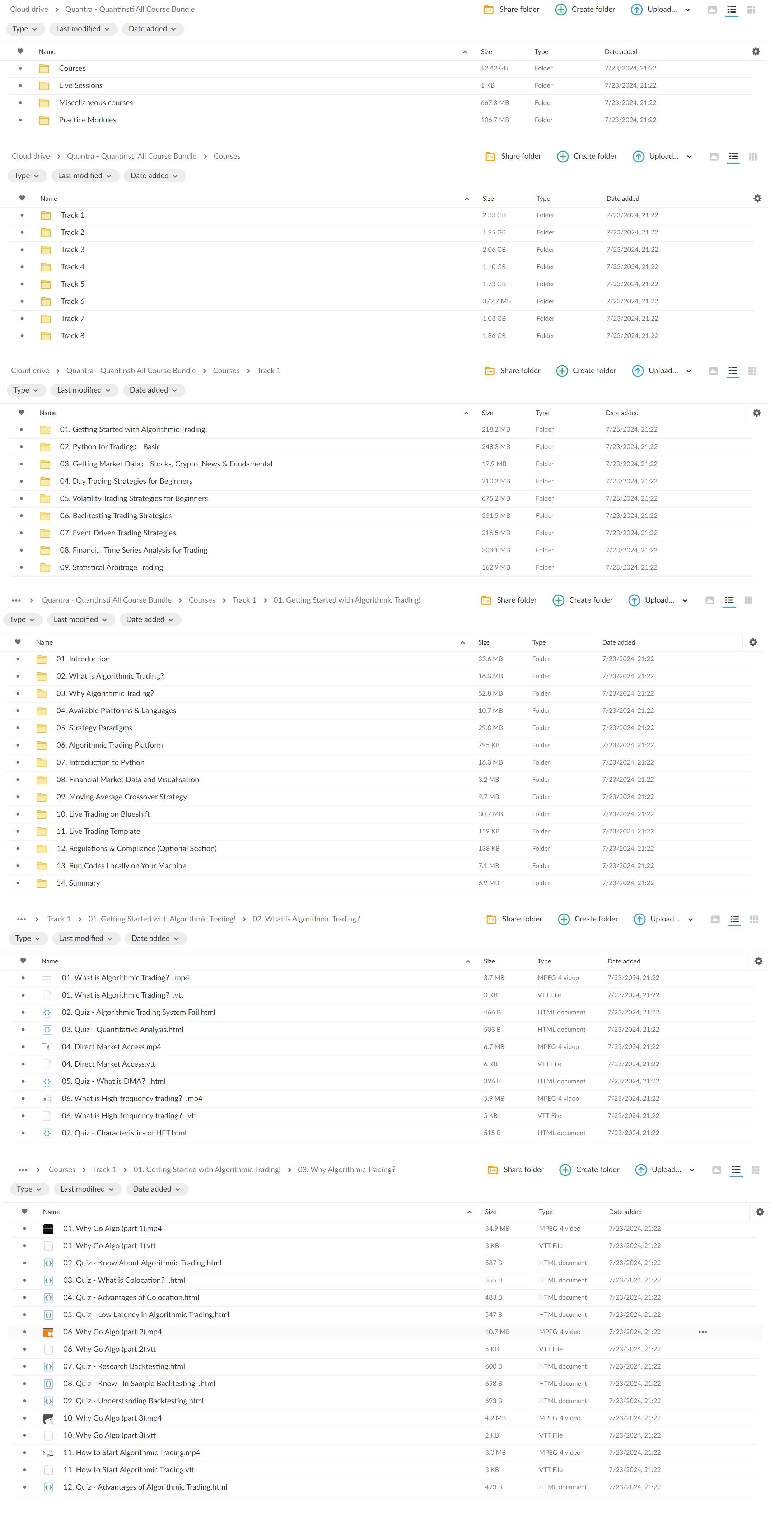

TRACK 1 : ALGORITHMIC TRADING FOR BEGINNERS

Use 25+ strategies like Intraday Trading, Machine Learning, and Quant techniques to optimize your trading portfolio.

FOUNDATION

- Getting Started with Algorithmic Trading!

- Python for Trading: Basic

- Getting Market Data: Stocks, Crypto, News & Fundamental

BEGINNER

- Day Trading Strategies for Beginners

- Volatility Trading Strategies for Beginners

- Backtesting Trading Strategies

INTERMEDIATE

- Event Driven Trading Strategies

- Financial Time Series Analysis for Trading

- Statistical Arbitrage Trading

TRACK 2 : TECHNICAL ANALYSIS USING QUANTITATIVE METHODS

Technical indicators and candlesticks, sentiment trading, swing trading, volatility trading and backtesting.

BEGINNER

- Candlestick Patterns based Automated Trading

- Swing Trading Strategies

- Technical Indicators Strategies in Python

INTERMEDIATE

- Price Action Trading Strategies Using Python

- Python For Trading!

- Quantitative Trading Strategies and Models

- Short Selling in Trading

TRACK 3 : QUANTITATIVE TRADING IN FUTURES AND OPTIONS MARKETS

Options pricing models and strategies such as gamma scalping, dispersion and delta hedging diversified futures trading strategies.

FOUNDATION

- Options Trading Strategies In Python: Basic

BEGINNER

- Futures Trading: Concepts & Strategies

INTERMEDIATE

- Options Trading Strategies In Python: Intermediate

- Systematic Options Trading

- Trading using Options Sentiment Indicators

ADVANCED

- Options Trading Strategies In Python: Advanced

- Options Volatility Trading: Concepts and Strategies

TRACK 4 : MACHINE LEARNING & DEEP LEARNING IN TRADING – I

From data cleaning aspects to optimising AI models, learn how to create your prediction algorithms using classification and regression techniques.

FOUNDATION

- Introduction to Machine Learning for Trading

BEGINNER

- Trading with Machine Learning: Regression

- Python for Machine Learning in Finance

INTERMEDIATE

- Data & Feature Engineering for Trading

- Decision Trees in Trading

- Trading with Machine Learning: Classification and SVM

TRACK 5 : MACHINE LEARNING & DEEP LEARNING IN TRADING – II

Step-wise training on the complete lifecycle of trading strategies and portfolio management using machine learning. Learn from experts!

INTERMEDIATE

- Natural Language Processing in Trading

- Unsupervised Learning in Trading

ADVANCED

- Neural Networks in Trading

- Deep Reinforcement Learning in Trading

- Machine Learning for Options Trading

TRACK 6 : ALGORITHMIC TRADING IN CRYPTOCURRENCY AND FOREX

8+ strategies such as Ichimoku Cloud, Aroon Indicator, unsupervised learning and pairs trading to trade cryptocurrencies & FX markets effectively.

BEGINNER

- Forex Trading using Python: Basics

INTERMEDIATE

- Value Strategy in Forex

- Crypto Trading Strategies: Intermediate

ADVANCED

- Crypto Trading Strategies: Advanced

TRACK 7 : PORTFOLIO MANAGEMENT AND POSITION SIZING USING QUANTITATIVE METHODS

Apply effective position sizing techniques and optimise your portfolio. Include machine learning to gain a competitive edge.

BEGINNER

- Quantitative Portfolio Management

INTERMEDIATE

- Position Sizing in Trading

- Factor Investing: Concepts and Strategies

ADVANCED

- Portfolio Management using Machine Learning: Hierarchical Risk Parity

- AI for Portfolio Management: LSTM Networks

TRACK 8 : ADVANCED ALGORITHMIC TRADING STRATEGIES

A series of courses where you will learn more than 18+ new strategies such as mean-reversion, index arbitrage, long-short, breakout, ARIMA, GARCH

BEGINNER

- News Sentiment Trading Strategies

INTERMEDIATE

- Mean Reversion Strategies In Python

- Momentum Trading Strategies

ADVANCED

- Trading Alphas: Mining, Optimisation, and System Design

- Trading in Milliseconds: MFT Strategies & Setup

- Advanced Momentum Trading: Machine Learning Strategies

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/