*** Proof of Product ***

Welcome to “Options Mastery 5: Diagonals Spreads” by Rise2learn. In this comprehensive course, you will delve into the world of diagonal spreads and gain valuable insights into options trading strategies.

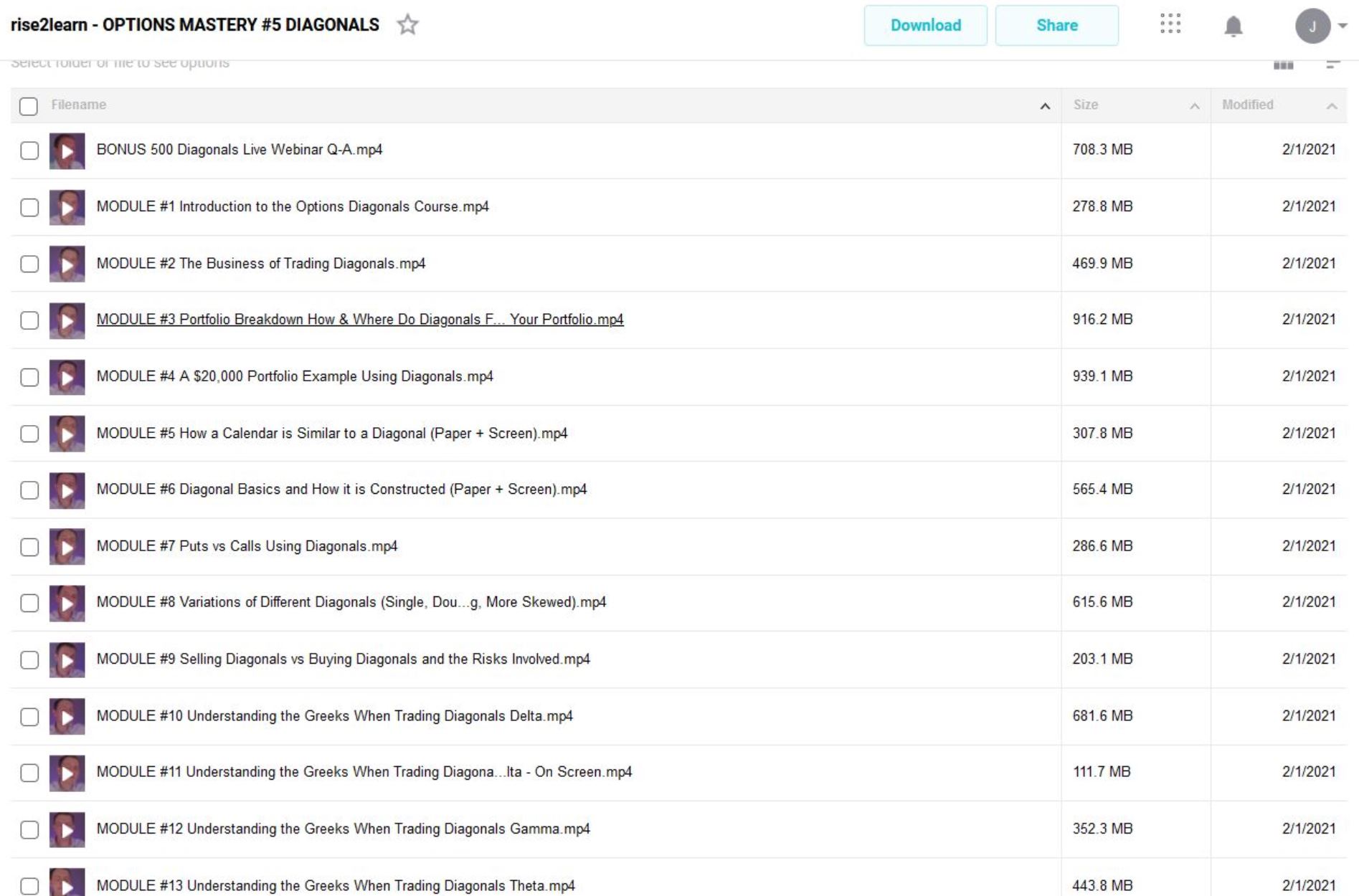

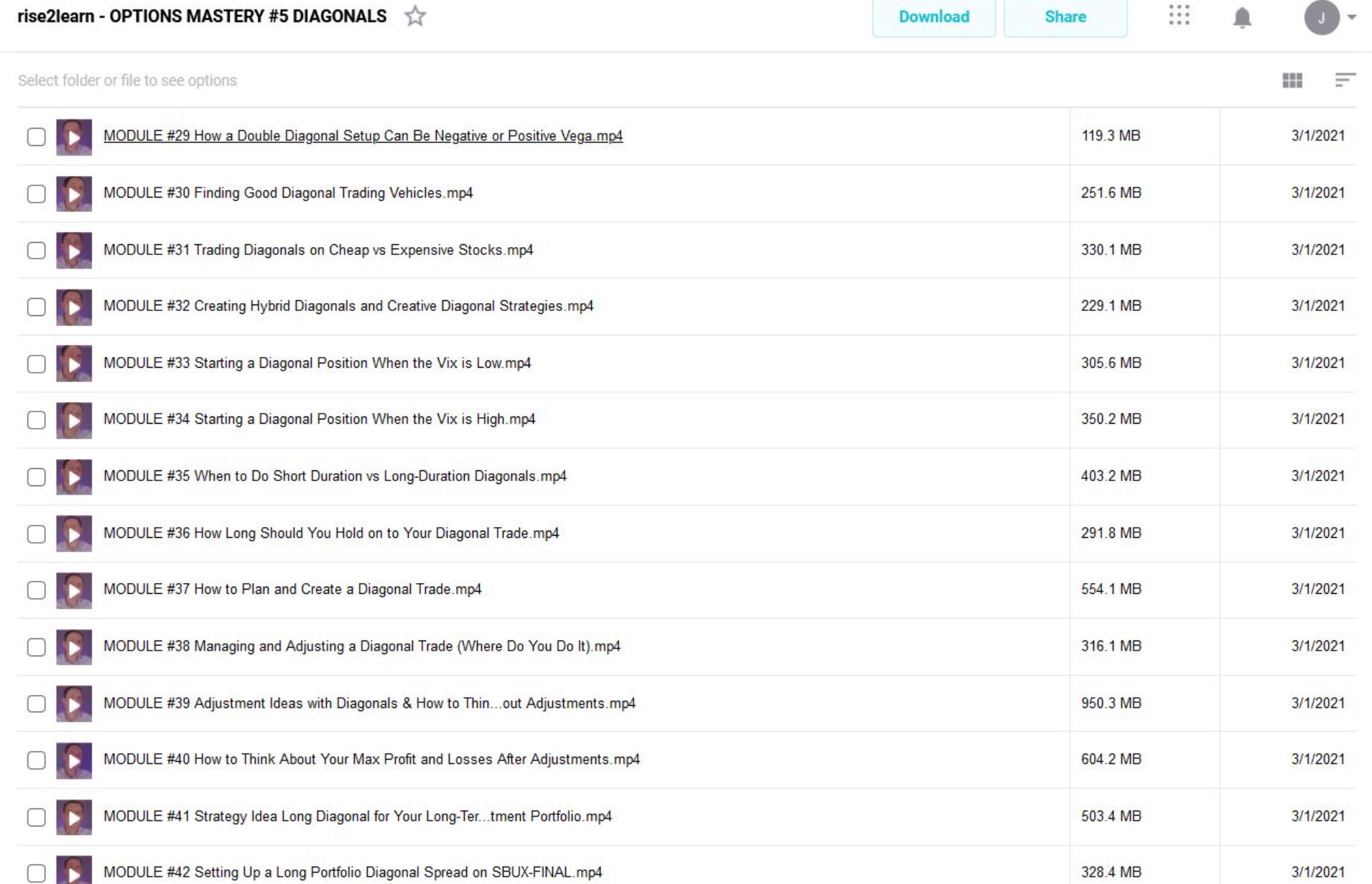

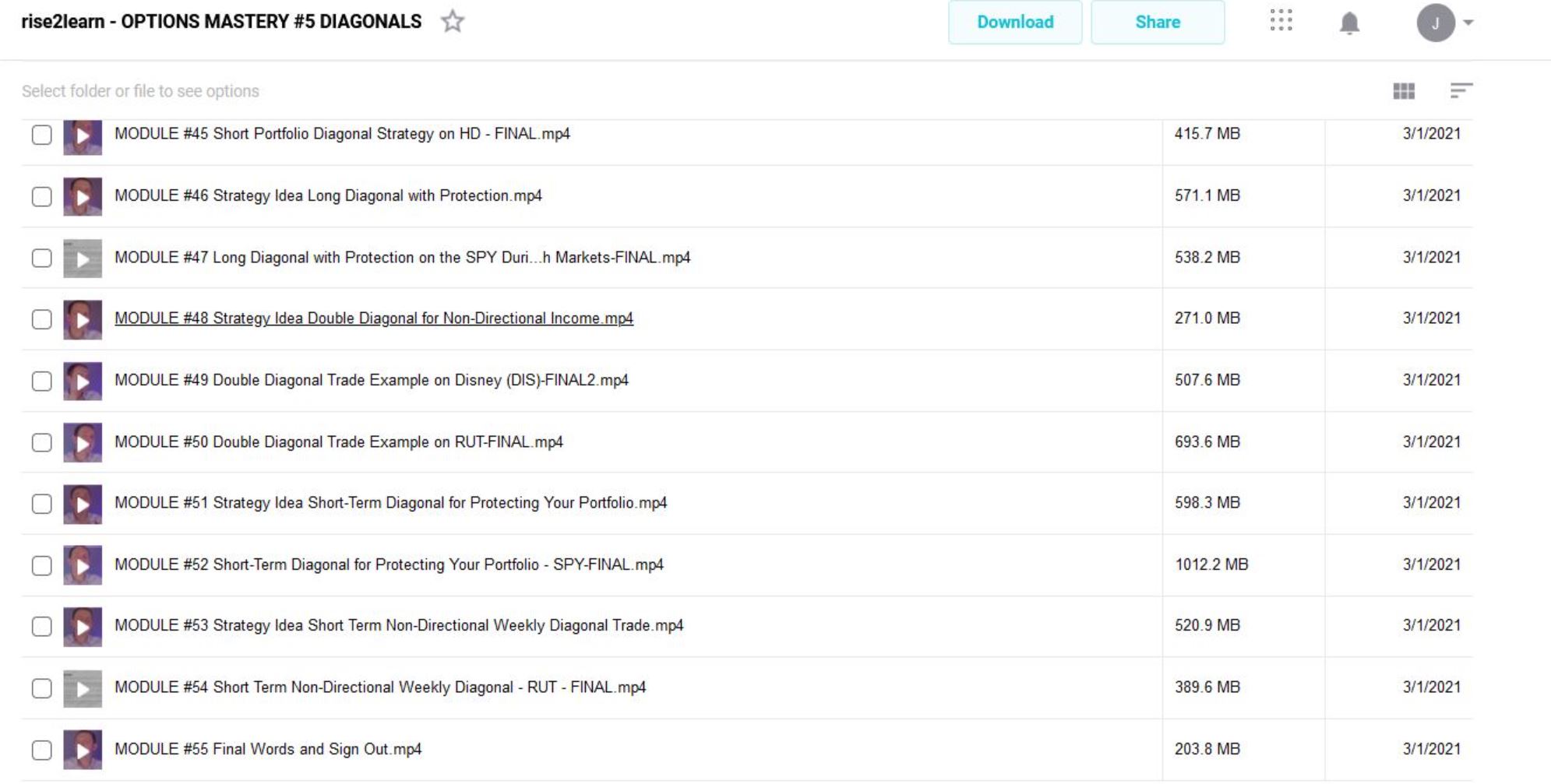

Exploring the Essential Features of “Rise2learn – Options Mastery 5: Diagonals Spreads“

Course Length: 18 hours and 41 minutes

1. Introduction to Trading Diagonals (9 mins 45 secs) Learn the basics of trading diagonals in under 10 minutes.

2. The Business of Trading Diagonals (18 mins 25 secs) Discover the ins and outs of the business aspect of trading diagonals.

3. Portfolio Breakdown: How & Where Do Diagonals Fit into Your Portfolio (23 mins 14 secs) Understand how to integrate diagonals into your investment portfolio.

4. A $20,000 Portfolio Example Using Diagonals (34 mins 45 secs) Explore a real-world portfolio example using diagonal strategies.

5. How a Calendar is Similar to a Diagonal (12 mins 7 secs) Uncover the similarities between calendar and diagonal spreads.

6. Diagonal Basics and How it is Constructed (26 mins 47 secs) Get a comprehensive overview of diagonal spread construction.

7. Puts vs Calls Using Diagonals and Which is Better? (14 mins 1 sec) Analyze the use of puts and calls in diagonal strategies.

8. Variations of Different Diagonals Such as Single, Double, Short, Long, or More Skewed (24 mins 43 secs) Explore various diagonal spread variations.

9. Selling Diagonals vs Buying Diagonals and the Risks Involved (9 mins 59 secs) Compare the risks and benefits of selling and buying diagonals.

10. Understanding the Greeks When Trading Diagonals: Delta (19 mins 58 secs) Dive into the concept of Delta in diagonal trading.

11. Understanding the Greeks When Trading Diagonals: Delta Part 2 (9 mins 19 secs) Continue your exploration of Delta in diagonal spreads.

12. Greeks – Overall Big Picture: How They Work Together in a Diagonal Spread (21 mins 9 secs) Grasp the holistic view of Greeks in diagonal strategies.

13. Understanding the Greeks When Trading Diagonals: Theta (16 mins 30 secs) Learn about Theta’s role in diagonal trading.

14. Understanding the Greeks When Trading Diagonals: Vega (28 mins 58 secs) Master the concept of Vega in diagonal spreads.

15. Greeks Big Picture When Looking on Your Trade Screen (19 mins 27 secs) Understand how Greeks are displayed on your trade screen.

16. Delta Neutral Diagonal Setup (23 mins 23 secs) Learn how to set up a Delta-neutral diagonal spread.

17. Understanding the Greeks When Trading Diagonals: Gamma (12 mins 32 secs) Discover the importance of Gamma in diagonal trading.

18. Are You Losing Money on Diagonals and Don’t Know Why (13 mins 6 secs) Identify common mistakes and pitfalls in diagonal trading.

19. The Volatility Advantage to Trading Diagonals (28 mins 57 secs) Leverage volatility in your diagonal trading strategies.

20. Why Diagonals are Great Even if You Expect a Pull Back – Part 1 (10 mins 34 secs) Learn why diagonals can be beneficial in a pullback scenario.

21. Why Diagonals are Great Even if You Expect a Pull Back – Part 2 (3 mins 22 secs) Continuation of the discussion on using diagonals in pullback situations.

22. How Much Rotation Should You Give Your Diagonal? (16 mins 37 secs) Determine the appropriate rotation for your diagonal spreads.

23. Diagonal vs Vertical – Which One is Better? (24 mins 45 secs) Compare diagonal and vertical spreads to make informed decisions.

24. Double Diagonals vs Iron Condor (6 mins 40 secs) Explore the differences between double diagonals and iron condors.

25. Double Diagonal vs Iron Condor on Screen (8 mins 45 secs) See how double diagonals and iron condors look on your trading screen.

26. Why Diagonals are Great Even if You Expect a Pull Back – Part 3 (7 mins 52 secs) The final installment on using diagonals in pullback scenarios.

27. Why Diagonals are the Most Flexible Strategy When It Comes to Options Trading (11 mins 49 secs) Discover the flexibility of diagonal spreads in options trading.

And much more…

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Atlas API Training - API 570 Exam Prep Training Course

Atlas API Training - API 570 Exam Prep Training Course  Team NFT Money - Ultimate NFT Playbook

Team NFT Money - Ultimate NFT Playbook  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  Matan Feldman - The 13-Week Cash Flow Modeling - Wall Street Prep

Matan Feldman - The 13-Week Cash Flow Modeling - Wall Street Prep  Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025  George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)

George Fontanills & Tom Gentile - Optionetics 6 DVD Series Home Study Course (Digital Download)  Fred Haug - Virtual Wholesaling Simplified

Fred Haug - Virtual Wholesaling Simplified  David Dill - Affiliate Equation

David Dill - Affiliate Equation  Nilofer Safdar - Outcreation 101

Nilofer Safdar - Outcreation 101  Blake Rudis - Color Theory for Photographers

Blake Rudis - Color Theory for Photographers  Simpler Trading - Bruce Marshall - The Options Defense Course

Simpler Trading - Bruce Marshall - The Options Defense Course  Edward Cheng, Molly Bishop Shadel, Peter Smith & Joseph Hoffmann - Law School for Everyone

Edward Cheng, Molly Bishop Shadel, Peter Smith & Joseph Hoffmann - Law School for Everyone  Mark Lassoff - Android Development for Beginners

Mark Lassoff - Android Development for Beginners  Trade Like Mike - The TLM Playbook 2022

Trade Like Mike - The TLM Playbook 2022  Toshko Raychev - Profit System + ITF Assistant

Toshko Raychev - Profit System + ITF Assistant