*** Proof of Product ***

Exploring the Essential Features of “Roli Jain – Swaps Fundamentals – CFI Education”

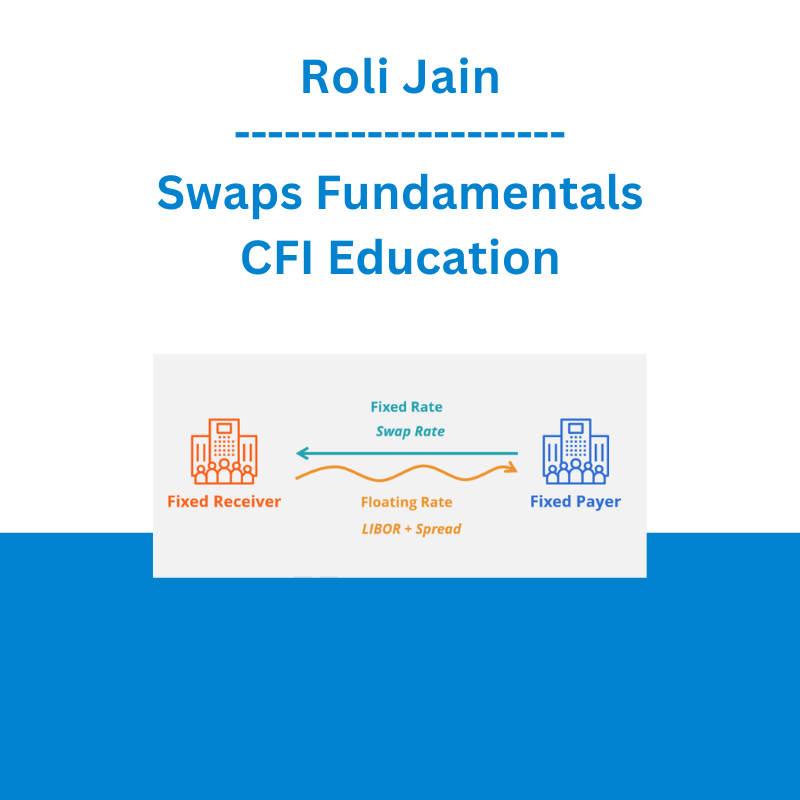

Swaps Fundamentals

Master the structure, uses, risks, pricing, and valuation of swaps

- Learn the structure of a swap, as well as how to price and value them

- Understand how different types of swaps help meet the needs of different parties

- Analyze swaps to determine their price

Overview

Swaps Fundamentals Course Overview

This course walks you through the overview of swaps and the different types of swaps traded by investors and institutions for various purposes. We will compare the structure and uses of the different swaps, as well as demonstrate the calculations of cash flows, pricing, and swap values using examples. We will define some of the most important terminology used in swap contracts, such as swap rate, swap spread, and swap curve. We will also show you how swap contracts would look using Refinitiv Workspace and the key information one could find.

Swaps Fundamentals Learning Objectives

Upon completing this course, you will be able to:

- Understand the overall mechanics and structure of swaps, who and why use different types of swaps, as well as pricing, payments, and valuation of swaps

- Compare and contrast the various types of swaps, including:

Interest rate swaps

Currency swaps

Equity swaps

Commodity swaps

Basis swaps

Swaptions

Variance swaps

Credit default swaps (CDS) - Explain the structure and key features of each type of swaps

- Identify the benefits and risks associated with each type of swaps

- Calculate the price and values of each type of swaps

Who Should Take This Course?

This Swaps Fundamentals course is perfect for anyone who would like to build up their understanding of capital markets. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and trading, or other areas of finance.

What you’ll learn

- Introduction

Introduction

Download Course Presentation

What is a Swap

Types of Swaps

Interactive Exercise 1 - Interest Rate Swaps

Interest Rate Swaps – Structure

Interest Rate Swaps – Key Features

Long Swap vs. Short Swap

The Underlying Motive of Interest Rate Swaps

Why Use Interest Rate Swaps

Interest Rate Swaps – Risks

Example – Swap in Action

Interactive Exercise 2

Quotation: Swap Rate and Swap Spread

Swap Curve

Calculating Swap Payments With The Same Frequency

Calculating Swap Payments With Two Different Frequencies

Interactive Exercise 3

Pricing vs. Valuation of Swaps

Example – Calculating Swap Rate

Valuing a Swap – Method 1

Valuing a Swap – Method 2

Valuing a Swap at T+1 – Method 2 Example

Discounting Methods LIBOR vs. OIS

Interest Rate Swaps Summary

Interactive Exercise 4 - Currency Swaps

Currency Swaps – Structure (3-Stage Process)

Currency Swaps – Key Features

Why Use Currency Swaps

Example – Currency Swap in Action (Fixed-Fixed)

Example – Calculating Currency Swap Rate and Payments

Part 1: Calculate Fixed Rate in USD and EURO

Part 2: Calculate Cash Flows on Fixed-Fixed Currency Swap

Part 3: Calculate Cash Flows on Fixed-Floating Currency Swap

Part 4: Calculate Value for Fixed-Fixed Currency Swap

Currency Swaps Summary

Interactive Exercise 5 - Equity Swaps

Total Return Swaps

Equity Swaps – Structure

Long Equity Swap vs. Short Equity Swap

Equity Swaps – Key Features

Who and Why Use Equity Swaps

Equity Swaps – Risks

Delta One Desks

Interactive Exercise 6

Equity Swap Example – Pay Floating, Receive Return on Equity

Pricing of Equity Swaps

Valuation of Equity Swaps

Valuing Pay Fixed for Return on Equity Swap – Example

Valuing Return on One Equity, Pay on Another Equity Swap – Example

Equity Swaps Summary

Interactive Exercise 7 - Commodity Swaps

Commodity Swaps – Key Features

Commodity Swaps – Structure

Why Use Commodity Swaps

Commodity Swaps – Risks

Considerations in Pricing Commodity Swaps

Valuation of Commodity Swaps

Example – Valuing a Commodity Swap (Fixed-Floating)

Commodity Swaps Summary

Interactive Exercise 8 - Basis Swaps

What Are Basis Swaps

Basis Swaps – Key Features

Why Use Basis Swaps

USD Tenor Basis Swap – 1-month vs. 3-month

Cross Currency Basis Swaps (CCBS)

Cross Currency Basis Swaps (CCBS) Interpretations

Mark-to-Market and Non-Mark-to-Market

Interactive Exercise 9

Cross Currency Basis Swap (Floating-Floating) – Structure

Cross Currency Basis Swap Example – Non-Mark-to-Market

Cross Currency Basis Swap Example – Mark-to-Market

Pricing of Cross Currency Basis Swaps

Basis Swaps Summary

Interactive Exercise 10 - Swaptions

Swaptions

Swaptions – Key Features

Types of Swaptions

Why Use Swaptions and Example

Interactive Exercise 11 - Variance Swaps

Variance Swaps – Where Do They Come From

What Is Volatility

Generic Properties of Equity Market Volatility

Historical Volatility vs. Implied Volatility

Building Blocks of Variance Products

Realized Volatility and Implied Volatility – Uses of Variance Swaps

Variance Swaps – Structure

Interactive Exercise 12

Why Use Variance Swaps

Variance Swaps – Key Features

Notionals – Variance or Vega Notional

Variance Swaps Example – Calculating Profit and Loss

Variance Swaps Example – Maximum Losses

Variance Swaps – Bloomberg Example

Interactive Exercise 13 - Credit Default Swaps

Credit Default Swaps – Basic Terminology

Credit Default Swaps – Standard Maturity Dates

Credit Default Swaps – Structure

Credit Default Swaps – Key Features

Why Use Credit Default Swaps

Credit Default Swaps – Risks

CDS Settlement on Default – Physical vs. Cash

Recovery Rate and Payout Ratio

Interactive Exercise 14

Pricing Concepts – CDS Spread and Upfront Premium

Example 1 – Understand a CDS Quote

Example 2 – CDS via Bloomberg – Positive and Negative Upfront Premium

Interactive Exercise 15

Factors That Determine CDS Pricing

Example – Calculate Probability of Default and Expected Loss

Credit Curve

Profit and Loss From Change in Credit Spread

Credit Default Swaps Summary

Interactive Lesson 16 - Course Summary

Course Outro - Qualified Assessment

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional, specializations.

All Capital Markets & Securities Analyst (CMSA)® Courses

Swaps Fundamentals is part of the Capital Markets & Securities Analyst (CMSA)®, which includes 41 courses.

- Skills Learned

Trading strategies used in the finance and capital markets - Career Prep

Work in capital markets, whether on the buy-side or the sell-side

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Simpler Trading - Bruce Marshall - The Options Defense Course

Simpler Trading - Bruce Marshall - The Options Defense Course