*** Proof of Product ***

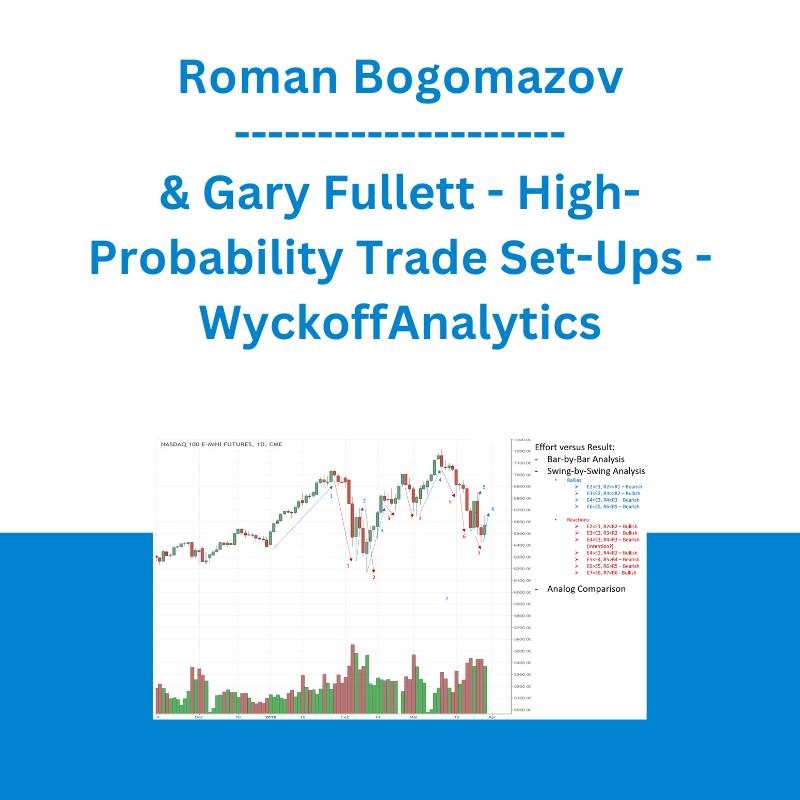

Exploring the Essential Features of “Roman Bogomazov & Gary Fullett – High-Probability Trade Set-Ups – WyckoffAnalytics”

COURSE DURATION

3 two-hour sessions

Please join veteran Wyckoff Method trader-educators Gary Fullett and Roman Bogomazov for three two-hour webinars on high-precision execution of Wyckoff trading strategies in today’s equities and futures markets. This course will focus on practical applications of key Wyckoff set-ups and analytical principles, particularly Volume-Price Analysis (Wyckoff’s Law of Effort vs Result) in different time frames and market structural environments.

The ability to analyze Price and Volume – i.e., tape reading – is at the heart of the Wyckoff Method. Accurately interpreting price-volume relationships is an essential skill – these metrics are LIVE and in REAL time and give you an up-to-the-minute picture of market activities; all other indicators are lagging. Gary and Roman will demonstrate how proper application of these Wyckoff analytical techniques can be profitable even in current volatile markets, if you know where to look for opportunities at the edges.

This course is designed to help Wyckoff traders identify, analyze and take advantage of common opportunities that large institutions (aka “the Smart Money”) create.

The 3 two-hour sessions include:

Gary and Roman’s favorite Wyckoff structural points of entry and exit. More specifically, in this first session they will present and discuss what they consider to be the highest probability structural points of entry and corresponding optimal exits, demonstrating potential strengths and challenges of each with illustrative charts of stocks and commodities. Gary will show you how to minimize risk by looking for potentially profitable trades at the edges.

Detailed, clear illustrations of Wyckoff’s Law of Effort vs Result in action. A profound understanding of this principle is critical to understanding institutional traders’ market operations and intentions. Honing your ability to conduct consistent bar-by-bar analysis of Effort (volume) vs Result (price action) in both consolidations and trends is an integral ingredient in Wyckoff trading success. During the second session of this series, Roman and Gary will walk you through a detailed Volume-Price Analysis case study, which will serve as a great “how-to” model to facilitate your own learning of this vital skill.

Outlook for current markets and the results of recent Wyckoff trades. The final session will focus on how Gary and Roman apply the principles highlighted in the previous two webinars to their analysis of the major indexes, sectors and futures markets, as well as to their own trading. Though both instructors are experienced Wyckoff traders and educators, they are also – like Wyckoff himself – perpetual students of the market, analyzing and learning from their trades. They therefore present post-analysis of some of their trades, providing you with practical, real-world examples not only of how to enter and manage Wyckoff trades in the current markets, but also how to learn from (and continuously improve) your trading.

Meet your Instructors

Roman Bogomazov

Roman Bogomazov is a trader and educator specializing in the Wyckoff Method of trading and investing, which he has taught for more than ten years as an Adjunct Professor at Golden Gate University and as the principal instructor at WyckoffAnalytics.com. He is the founder and President of Wyckoff Associates, LLC, an enterprise providing online Wyckoff Method education to traders throughout the world. Using WyckoffAnalytics.com as a thriving trading community platform, Roman has developed a comprehensive educational curriculum covering basic to advanced Wyckoff concepts and techniques, as well as visual pattern recognition and real-time drills to enhance traders’ skills and confidence. A dedicated and passionate Wyckoffian, he has used the Wyckoff Method exclusively for his own trading for more than 25 years. Roman has also served as a Board Member of the International Federation of Technical Analysts and as past president of the Technical Securities Analysts Association of San Francisco.

Gary Fullett

Gary Fullett has been involved in the commodities markets since 1981, when he started as a runner for the Lind-Waldock brokerage (now MF Futures). Observing order flow, price action and volume on the trading floor, he soon discovered and taught himself the trading principles and rules articulated by Richard Wyckoff, developing such technical skill that professional traders sponsored Gary in a CME S&P 500 seat in the mid-1980s. Leaving the trading floor after several years, he traded for several other firms and individuals, eventually founding his own commodity brokerage firm – LTG-Trading, LLC – in 1995. Since then he has taught the Wyckoff Method to thousands of traders, and co-taught seminars with renowned Wyckoff expert, David Weis. At Wyckoff Analytics, Gary co-taught the special topic series A Detailed Look Into Springboards and High-Probability Wyckoff Trade Set-Ups and presented at the Best Of Wyckoff Online Conferences in 2018, 2019 and 2020.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle

Julie Stoian & Cathy Olson - Launch Gorgeous - Funnel Gorgeous Bundle