*** Proof of Product ***

Exploring the Essential Features of “Scott Powell – Credit Administration and Documentation – CFI Education”

Credit Administration and Documentation

Want to be an efficient lender? Learn to navigate credit administration and documentation requirements, and you’ll thank yourself later!

- Originate and fulfill credits on time and as agreed by using proper documentation

- Model your credit risk by conducting ongoing reviews

- Provide sound advice when taking the critical steps of credit reviews

Overview

Credit Administration and Documentation Overview

Credit administration and documentation are two of the critical components in managing credit and supporting the credit process. Following proper credit administrative and documentation process allow credit analysts to monitor accounts and identify ways to reduce default risk.

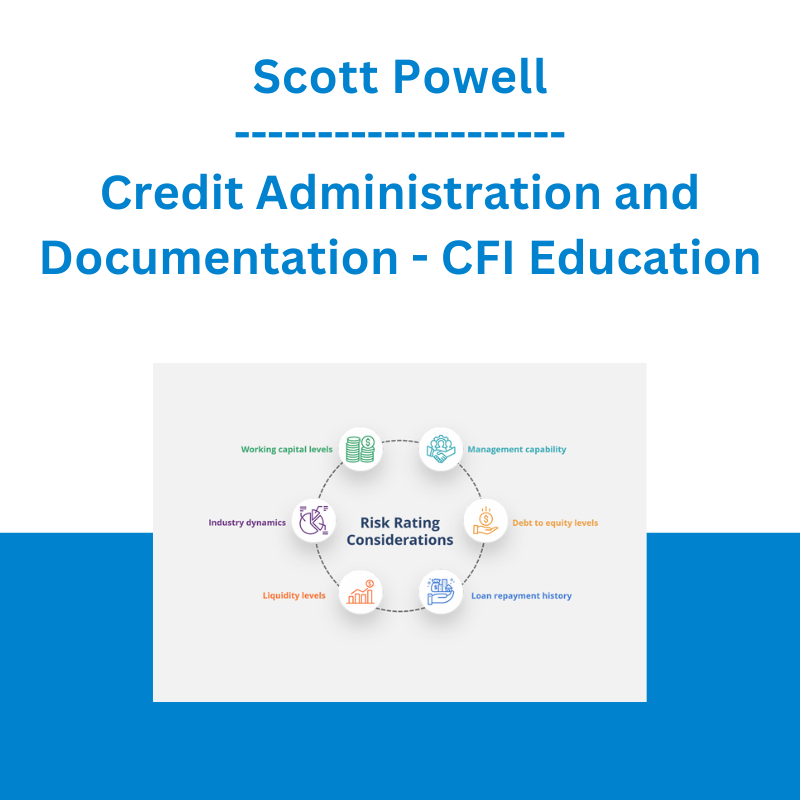

This course will explain the main components of credit administration and documentation. We will go through examples of credit documents to understand the basic format and layout. We will also explore the considerations that should be considered when assessing risk ratings.

Credit Administration and Documentation Learning Objectives

Upon completing this course, you will be able to:

- Explain the importance of credit administration

- Describe credit risk considerations and recognize warning signs

- Identify the steps taken when monitoring credit accounts

- Recognize the different types of documentation used to support the administrative process

- List the key steps in the annual review process

Who should take this course?

This Credit Administration and Documentation course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.

What you’ll learn

Introduction

Introduction

Downloadable Files

Credit Administration

Overview of Credit Administration

Why is Credit Administration Important

Interactive Exercise 1

Loan Approval Documentation

Loan Approval Documentation and Process

The Loan Application

Loan Application Example

Risk Rating Models

Interactive Exercise 2

Risk Rating Model Example

The Term Sheet

The Commitment Letter

The Loan Agreement

Interactive Exercise 3

Loan Monitoring Documentation and Annual Reviews

Monitoring Documents and Monthly & Quarterly Reports

Annual Reports and Reviews

Financial Statement Review

Security Review

Management Review

Business Review

Annual Reviews and Advisory Conversations

Interactive Exercise 4

Summary

Summary

Qualified Assessment

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Trade Like Mike - The TLM Playbook 2022

Trade Like Mike - The TLM Playbook 2022  Racing Workshop - Complete Online Package

Racing Workshop - Complete Online Package  Jesse Livermore Trading System - Joe Marwood

Jesse Livermore Trading System - Joe Marwood  Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025