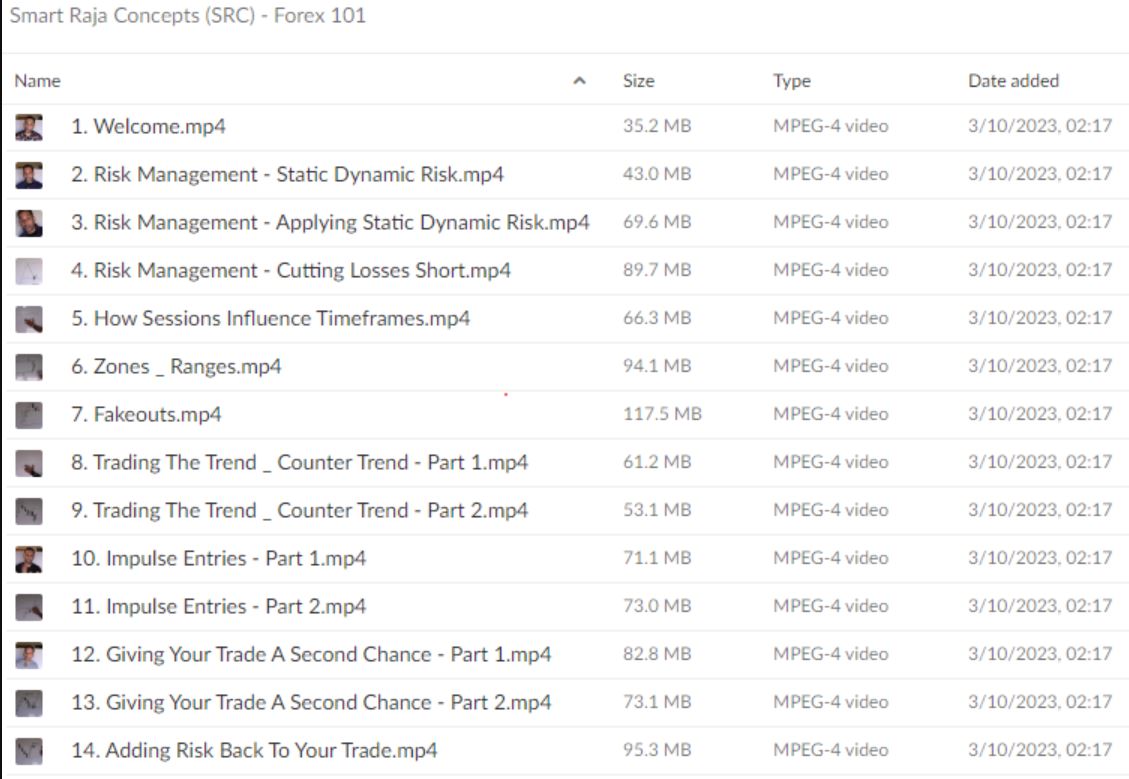

*** Proof of Product ***

Exploring the Essential Features of “Smart Raja Concepts (SRC) – Forex 101“

Topics Covered:

BASIC PRICE ACTION

- Understanding Zones: Exploring High Time Frame (HTF) vs. Low Time Frame (LTF) Zones and their significance.

- Rejections in Zones: Identifying rejections and continuations within these Zones.

- Break/Retest Strategy: Utilizing break/retest patterns for trading.

- Valid Range Identification: Spotting valid trading ranges and setting appropriate stops.

- Fake-Out vs. Continuation: Distinguishing between fake-outs and true continuations.

- Candlestick Reading: Understanding 4h/1h/30min/15min candles and using them for trading.

- Daily Candle Visualization: Translating Daily candles into Low Time Frame (LTF) trades.

CANDLESTICKS

- Candlestick Interpretation: What candlesticks represent in trading.

- Wick Analysis: Understanding wicks and trading wick fills.

- Predicting Wick Fills: Determining which wicks are likely to get filled.

- HTF vs. LTF Wickfills: Differentiating between High Time Frame and Low Time Frame wickfills.

- Candlestick Without Wicks: Trading based on candles with no wicks.

- Kangaroo Tails: Recognizing reversal candles vs. fake reversal candles.

- GLADIATOR Candle: How to use it effectively for entries and exits.

CHART TRAFFIC

- “Looking-Left” Analysis: Understanding the concept of looking left on a chart.

- Using Consolidation Areas: Utilizing consolidation areas for Take Profits.

- Predicting Clean Moves: Identifying areas with no traffic to predict smooth price movements.

- Chart Traffic Labeling: Labeling and understanding chart traffic.

CANDLE TRENDS

- Entry Points with Candles: Determining entry points, Stoplosses, and Take Profits using candle trends.

- Trailing Stops: Using candle trends to determine trailing stops.

- Scaling In and Exiting: Deciding when to scale in and exit early based on candle stories.

MARKET TIMING

- Volatility Timing: Knowing when to expect market volatility and trading with momentum.

- Session Trends: Identifying trends within trading sessions and making entries accordingly to avoid trading during consolidation.

ADVANCED TECHNICAL CONCEPTS

- HTF to LTF Breakdown: Transitioning from High Time Frame to Low Time Frame analysis.

- Impulse Entries: Strategies for entering trades during market impulses.

- Consistency and Discipline: Emphasizing the importance of maintaining discipline and adhering to self-imposed trading rules for overall life consistency.

Remember, successful trading requires both knowledge and discipline. This comprehensive guide covers various aspects of price action, candlesticks, chart analysis, and advanced technical concepts to help you become a more confident and consistent trader.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/