*** Proof of Product ***

Exploring the Essential Features of “Syndicated Lending – Lisa Dorian – CFI Education”

Syndicated Lending

Sometimes borrowers need credit facilities that are too large for a single bank’s balance sheet. This course explores how syndicated lending may work for these borrowers and their lenders.

- Appreciate the importance of syndicated lending to borrowers and banks

- Make the most of your institution’s risk appetite and put a syndicate to work

- Understand your role and fee structure in a lending syndicate

Overview

Syndicated Lending Course Overview

This Syndicated Lending course unpacks the core concepts behind syndicated lending. We will look at what syndicated lending is and why it is important for both clients and banks. By taking this course, you will examine and participate in the syndicated lending process from start to finish. This Syndicated Lending course will lead you through a case as you explore and apply the concepts of syndicated lending to a real example. This course prepares you for real lending situations as a credit analyst.

Syndicated Lending Learning Objectives

Upon completing this course, you will be able to:

- Understand what syndicated lending is and why it is important to borrowers

- Understand the importance and attractiveness of syndicated lending to banks

- Appreciate how credit risk can be transferred through syndicated lending

- Map the syndicated lending process from initiation through execution

- Explore how fees are structured and charged

Who Should Take This Course?

This Syndicated Lending course is created for credit analysts that aspire to work at a major financial institution. This course explores concepts that are used every day in lending institutions and provides realistic scenarios that you will encounter as a credit analyst. By covering the entire syndicated lending process, you will gain perspective on what it is like to work on some of the largest deals in the financial world. The exercises and tools explored in this course will be useful for any financial analyst that wishes to work in credit analysis, business banking, commercial banking, corporate banking, and other areas of lending and credit evaluation.

What you’ll learn

- Syndicated Lending

Introduction and Objectives

Downloadable Files

Structure and Participation – Bilateral Lending

Structure and Participation – Multilateral Lending

Structure and Participation – Why a Bank would Participate

Alternative Financing : Club Loans Pt 1

Alternative Financing : Club Loans Pt 2

Interactive Exercise

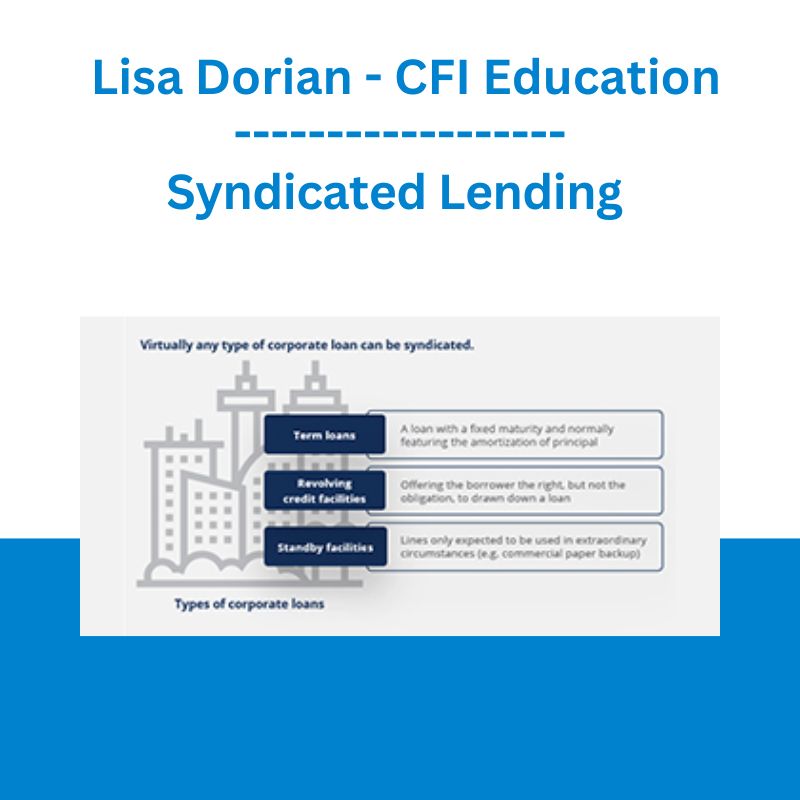

Types and Features of Syndicated Loans

Borrowers and Importance of Syndicated Lending - Syndicated Lending Credit Process

Syndicate Structure: Roles (‘Brackets’) Played

Syndicate Structure as Shown by Market Data Providers

Syndicated Lending Legal Structure and Credit Process

Credit Process: #1 Mandate Process

Credit Process: #2 Syndication Process Pt 1

Syndication Process – Offering Documents

Contents of an Information Memorandum

Syndication Meetings and Roadshows

Running the Books

Selecting Participating Banks

League Tables

Fees and Due Diligence

Documentation and Counsel

Closure: Signing Ceremony and Tombstone

Making the Facility Operational - Syndicated Lending Fee Structure

Syndicated Lending Fees

Upfront Fee Splitting

Case Study - Secondary Markets

Syndicated Loan Market Growth

Selling a Syndicated Loan in the Secondary Market - Course Summary and Conclusion

Course Summary and Conclusion - Qualified Assessment

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional.

Commercial Banking & Credit Analyst (CBCA)®

Syndicated Lending is part of the Commercial Banking & Credit Analyst (CBCA)®, which includes 58 courses.

- Skills Learned

Financial Analysis, Credit Structuring, Risk Management - Career Prep

Commercial Banking, Credit Analyst, Private Lending

All Capital Markets & Securities Analyst (CMSA)® Courses

Syndicated Lending is part of the Capital Markets & Securities Analyst (CMSA)®, which includes 41 courses.

- Skills Learned

Trading strategies used in the finance and capital markets - Career Prep

Work in capital markets, whether on the buy-side or the sell-side

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Disruptive Behaviors in the Classroom: Quick "On the Spot" Social-Emotional Learning and Behavior Interventions That Get Big Results! -Savanna Flakes - PESI

Disruptive Behaviors in the Classroom: Quick "On the Spot" Social-Emotional Learning and Behavior Interventions That Get Big Results! -Savanna Flakes - PESI  Oliver Velez - Essential Strategy Of Trade For Life

Oliver Velez - Essential Strategy Of Trade For Life  Language & Literacy Interventions for Engaging Young Children: Play, Art & Movement-Based Strategies to Strengthen Academic and Social Success - Barbara Culatta - PESI

Language & Literacy Interventions for Engaging Young Children: Play, Art & Movement-Based Strategies to Strengthen Academic and Social Success - Barbara Culatta - PESI  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  SMB - Options Training

SMB - Options Training  America and the New Global Economy - Timothy Taylor

America and the New Global Economy - Timothy Taylor  Simpler Trading - Bruce Marshall - The Options Defense Course

Simpler Trading - Bruce Marshall - The Options Defense Course  Atlas API Training - API 570 Exam Prep Training Course

Atlas API Training - API 570 Exam Prep Training Course  Hands-On Healing - William Bengston - Sounds True

Hands-On Healing - William Bengston - Sounds True