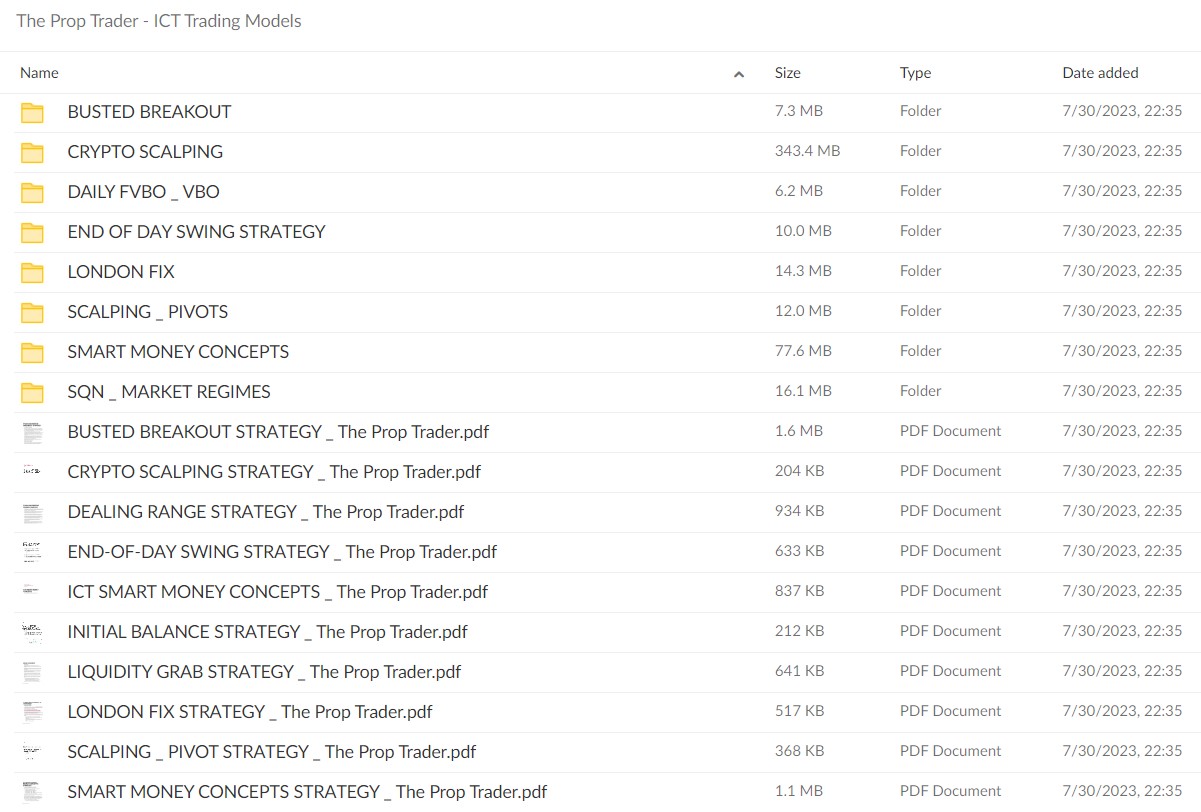

*** Proof of Product ***

Exploring the Essential Features of “The Prop Trader – ICT Trading Models“

Course Overview:

The course begins by introducing the concept of proprietary trading, also known as prop trading. Proprietary trading involves trading financial instruments using the firm’s capital, enabling traders to potentially earn substantial profits while effectively managing risk. This foundational section helps participants understand the unique opportunities and challenges associated with trading using proprietary funds.

Key Highlights:

A standout feature of “The Prop Trader – ICT Trading Models” is its emphasis on Institutional Order Flow Concepts (ICT). This approach centers around understanding the behavior of institutional traders and market makers, using this knowledge to gain a competitive edge in the markets. It involves analyzing price action, volume, and market depth to identify significant market moves and make informed trading decisions.

The course explores various trading models and strategies based on ICT principles, teaching participants how to:

- Interpret price charts.

- Recognize key support and resistance levels.

- Identify liquidity pockets in the market.

By comprehending how institutional players operate, participants can align their trades with the prevailing market sentiment, increasing the likelihood of profitable outcomes.

Risk Management and Trade Execution:

The course provides practical guidance on essential aspects of trading, such as risk management and trade execution. Participants will learn how to:

- Set appropriate stop-loss levels.

- Manage position sizes effectively.

- Optimize risk-reward ratios to protect capital and maximize potential returns.

Effective risk management is critical for success, and this course consistently emphasizes its importance.

Psychology of Trading:

“The Prop Trader – ICT Trading Models” delves into the psychology of trading and the impact of emotions on decision-making. Traders are equipped with techniques to maintain discipline and emotional control, essential traits for achieving consistent profitability in the markets.

Real-World Applications:

The course uses real-world case studies and live trading examples to illustrate the practical application of ICT concepts. Participants gain valuable insights into how experienced traders analyze the markets, spot trading opportunities, and manage trades in real-time. This experiential learning approach bridges the gap between theory and practice, preparing participants for real trading scenarios.

Flexible Learning:

The course is structured in a modular format, allowing participants to progress at their own pace. Interactive quizzes, assessments, and assignments are incorporated to reinforce learning and test participants’ understanding of the material.

Suitability:

As an advanced trading course, “The Prop Trader – ICT Trading Models” is best suited for individuals with prior trading experience and a solid understanding of financial markets. However, the course offers valuable resources and guidance for traders at all levels, helping them refine their skills and gain a competitive edge in the fast-paced world of trading.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/