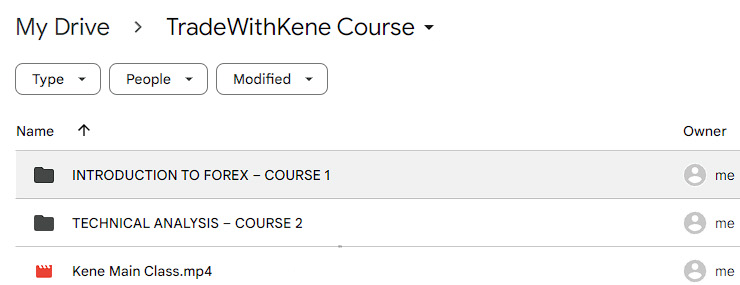

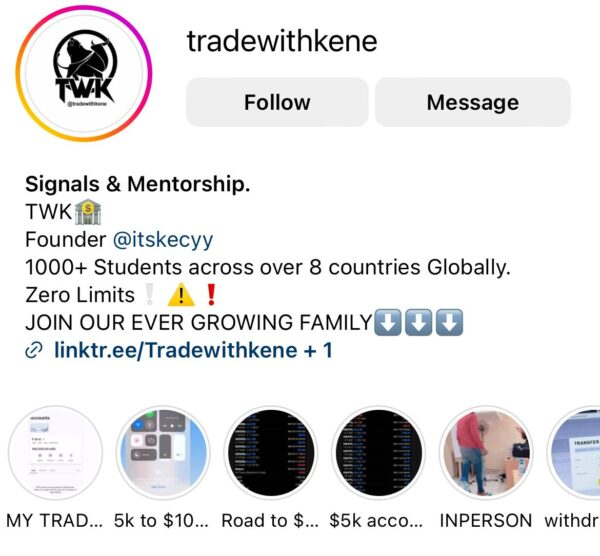

*** Proof of Product ***

Exploring the Essential Features of “TradeWithKene Course”

Forex trading, or foreign exchange trading, is an exciting and dynamic financial market that involves exchanging one currency for another, with the goal of profiting from changes in exchange rates. As the largest financial market globally, the Forex market boasts a daily trading volume exceeding $6 trillion. In this introductory lesson, we’ll explore key concepts, terminology, and strategies essential for understanding Forex trading.

What is Forex Trading?

Forex trading revolves around the exchange of currencies, aiming to make a profit based on fluctuations in exchange rates. Traders engage in this global market 24 hours a day, five days a week.

Key Concepts in Forex Trading

- Currency Pairs: In Forex, currencies are traded in pairs (e.g., EUR/USD), representing the exchange rate between two currencies.

- Exchange Rates: The price at which one currency can be exchanged for another.

- Leverage: The ability to control larger positions with a smaller amount of capital by borrowing funds, amplifying both potential gains and risks.

- Pips: The smallest price movement in a currency pair, usually 0.0001, used to measure changes in exchange rates.

Characteristics of the Forex Market

- High Liquidity: The Forex market is highly liquid due to the vast number of participants and market makers.

- Global Market: Trading occurs across different time zones, offering 24/5 accessibility.

- Market Makers: Financial institutions that provide liquidity by quoting both bid and ask prices for currencies.

Lesson Objectives

- Grasp the basics of Forex trading and essential terminology.

- Identify the unique characteristics of the Forex market.

- Establish a foundation for further learning and exploration.

Lesson Summary

This introductory lesson lays the groundwork for understanding Forex trading by covering essential concepts and market characteristics. With this foundation in place, you’re prepared to dive deeper into analyzing market structure in the next lesson.

Lesson 2: Understanding Market Structure

In this lesson, we’ll explore how market structure can be used to identify trends and patterns, which are crucial for making informed trading decisions.

What is Market Structure?

Market structure refers to the patterns and trends visible in price movements. Understanding these elements helps traders determine market direction and potential entry and exit points.

Key Components of Market Structure

- Trend Lines: Lines that connect a series of highs or lows, indicating the direction of a trend.

- Support and Resistance: Key levels where prices tend to halt or reverse, offering insights for trade setups.

- Channels: Areas within which prices tend to move, helping traders gauge the strength and direction of a trend.

Identifying Market Structure

- Visual Analysis: Utilize charts to spot patterns and trends.

- Technical Indicators: Tools like moving averages, RSI, and Bollinger Bands assist in identifying market behavior.

- Fundamental Analysis: Evaluate economic data and news events to understand the market’s driving forces.

Lesson Objectives

- Understand the elements of market structure and their significance.

- Learn to identify trend lines, support, resistance, and channels using charts and technical tools.

- Develop the skills to analyze market structure for better trading decisions.

Lesson Summary

Understanding market structure is crucial for any Forex trader. By mastering trend lines, support and resistance levels, and channels, traders can strategically time their entries and exits. In the upcoming lesson, we’ll explore advanced technical analysis techniques like Fibonacci, candlestick patterns, and more.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/