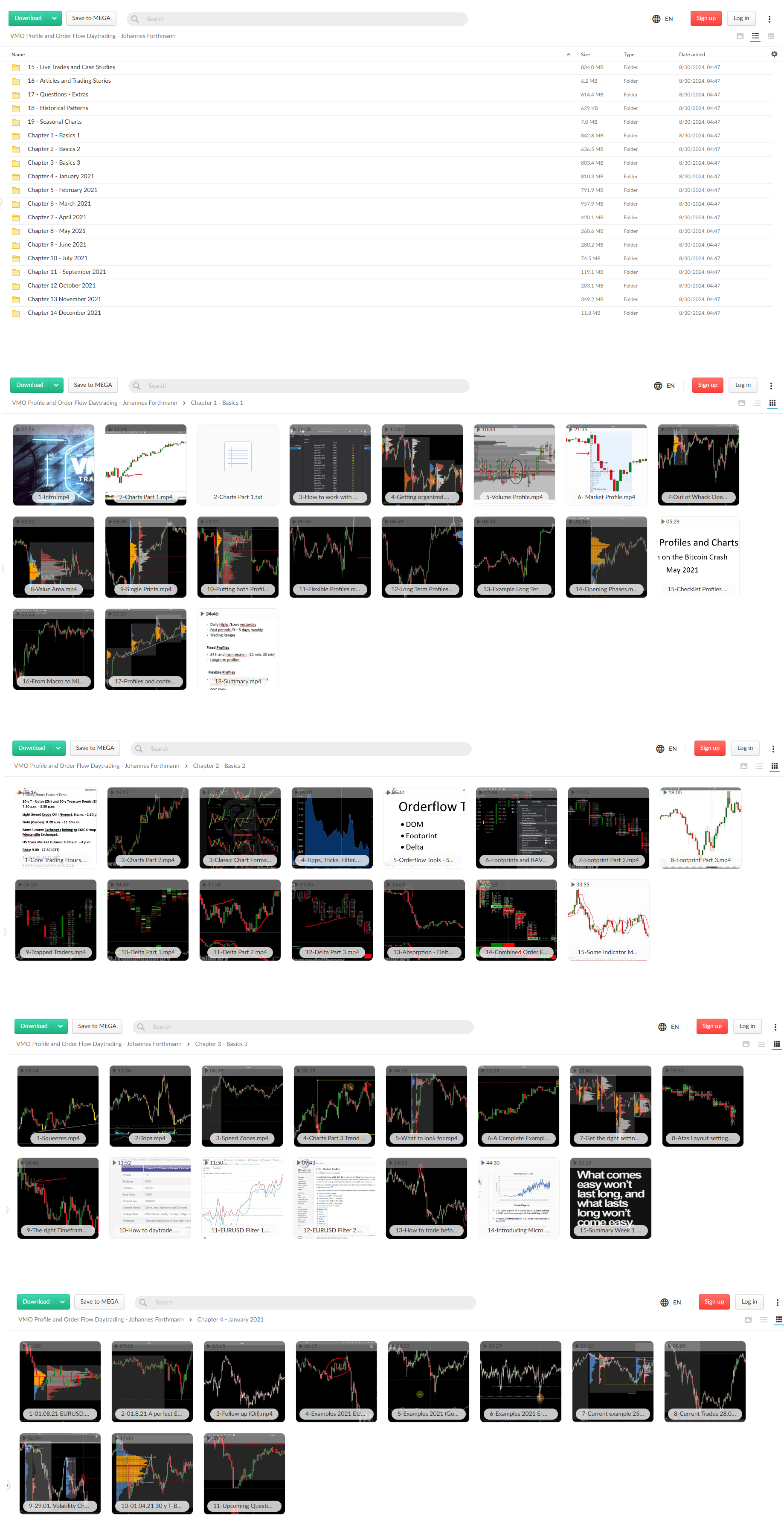

*** Proof of Product ***

Exploring the Essential Features of “Johannes Forthmann – VMO Profile and Order Flow Day Trading”

Introduction: Unveiling VMO Profile and Order Flow Daytrading

In the world of day trading, Johannes Forthmann stands out as a prominent figure, specializing in VMO (Volume Market Profile) and Order Flow strategies. His unique approach blends technical analysis with a deep understanding of market dynamics, offering traders invaluable insights into navigating the complexities of intraday trading.

VMO Profile: Decoding Market Volume Dynamics

Understanding Market Profile: Forthmann places significant emphasis on VMO Profile, a technique involving the analysis of volume distribution across different price levels. This method provides a visual representation of trading activity concentration within a specified time frame, going beyond traditional technical analysis.

Volume Clusters and Trading Opportunities: By pinpointing volume clusters, traders using VMO Profile gain insights into areas of high liquidity and potential price reversals. This detailed understanding facilitates informed decision-making, enabling traders to identify high-probability trading opportunities.

Order Flow Daytrading: Navigating the Market in Real-Time

Real-Time Market Dynamics: Forthmann excels in Order Flow Daytrading, which entails monitoring real-time buying and selling activities. This strategy enables traders to gauge the strength of price movements and make timely decisions based on live market data.

Reading Market Intentions: By closely tracking order flow, traders can interpret market intentions and pinpoint critical support and resistance levels. This real-time analysis is pivotal for adapting to rapidly changing market conditions, enhancing the precision and effectiveness of day trading strategies.

Advantages of Johannes Forthmann’s Approach:

Holistic Market Understanding: By integrating VMO Profile with Order Flow Daytrading, Forthmann offers traders a comprehensive view of market dynamics. This dual approach facilitates thorough analysis of historical data and real-time market movements, providing a nuanced perspective on potential trading opportunities.

Risk Management Strategies: Forthmann’s methodology emphasizes robust risk management. Traders are equipped with tools to evaluate risk-reward ratios for each trade, empowering them to make calculated decisions and minimize potential losses.

Adaptability in Dynamic Markets: Adaptability is crucial in fast-paced day trading environments. Forthmann’s approach equips traders with the skills to swiftly adjust to changing market conditions, ensuring they remain proactive and capitalize on emerging opportunities.

Elevating Day Trading Proficiency with Johannes Forthmann

Johannes Forthmann’s VMO Profile and Order Flow Daytrading strategies offer a dynamic framework for enhancing day trading proficiency. By delving into volume dynamics and real-time order flow intricacies, traders can navigate intraday complexities with confidence. For those seeking an effective and nuanced approach to day trading, Forthmann’s insights provide a valuable roadmap to success in today’s financial markets.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/