*** Proof of Product ***

Exploring the Essential Features of “Wall Street Prep – Premium Package (Self Study Programs)“

The Premium Package targets students and professionals aiming for careers in investment banking, private equity, corporate finance, and equity research. It’s an instructor-led program where participants build genuine financial models in Excel from scratch, employing actual case studies, current methodologies, and best practices. This comprehensive training covers financial statement modeling, DCF (Discounted Cash Flow), Comps (Comparables), M&A (Mergers & Acquisitions), and LBO (Leveraged Buyout) modeling. The goal is to provide an in-depth understanding of these critical finance areas, preparing individuals with the core skill set needed to excel in interviews and on the job, aligning with what top financial institutions use to train their analysts and associates.

What You’ll Learn

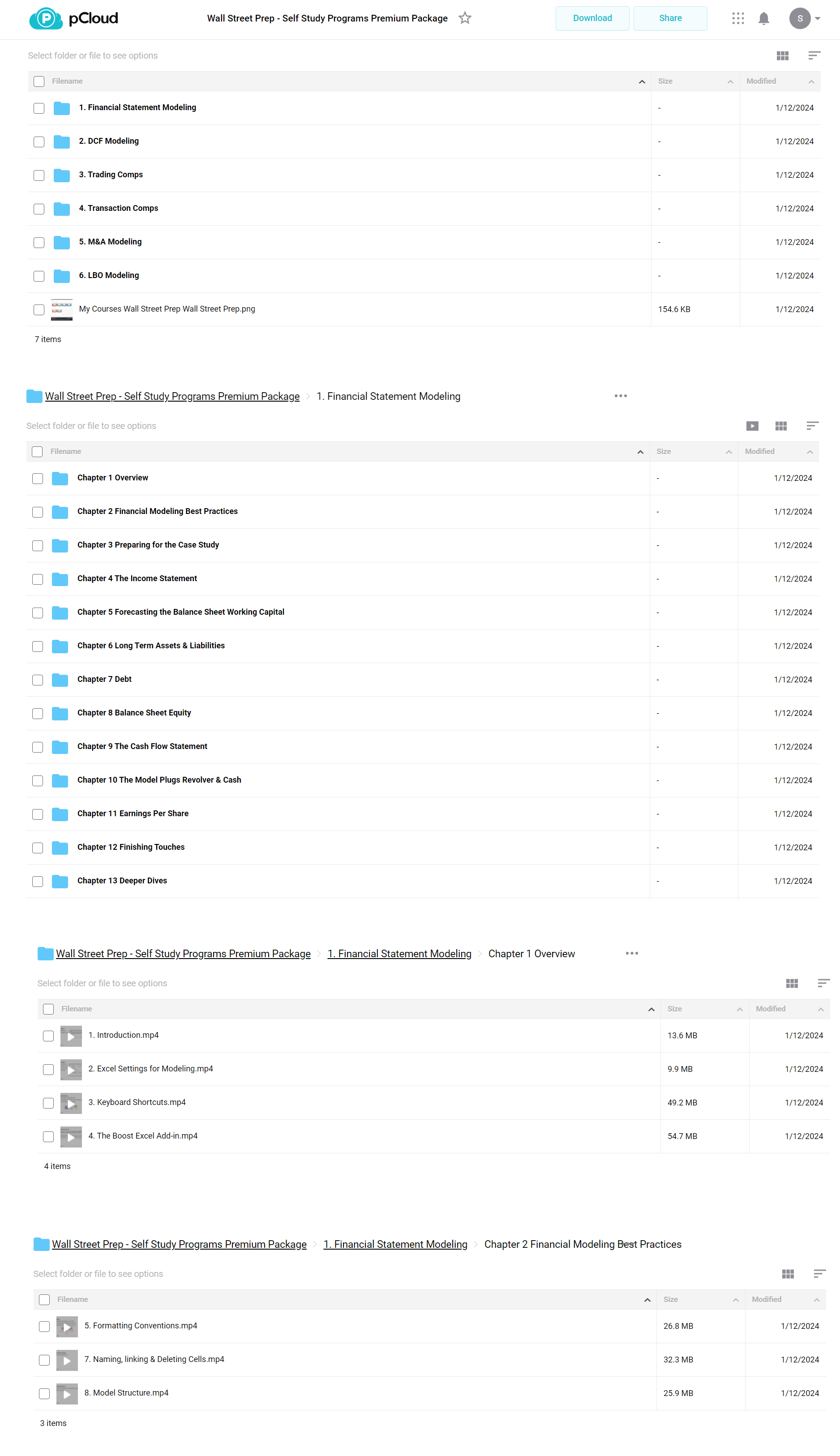

Financial Statement Modeling: Learn to construct dynamic financial statement projection models in Excel, starting from scratch, using industry best practices and real case studies. This module lays the foundation for subsequent valuation modeling.

DCF Modeling: Create a complete discounted cash flow (DCF) model in Excel from scratch. This method is both academically respected and commonly used on Wall Street for valuation purposes.

Trading Comps Modeling: Understand and master the commonly used “Comps” analysis for valuation. Build dynamic comps models from scratch using real case studies and industry best practices.

Transaction Comps Modeling: Learn to build transaction comps models by assessing the value of comparable companies recently acquired. Utilize real case studies and step-by-step guidance to master this valuation technique.

Accretion Dilution (M&A) Modeling: Understand how professionals analyze the impact of mergers and acquisitions. Construct real M&A models in Excel, including accretion/dilution, contribution, synergy analysis, and key M&A accounting concepts.

LBO Modeling: Build leveraged buyout (LBO) models from scratch using real case studies, widely utilized by investment banks and private equity firms to assess investor returns and business valuation in buyout scenarios.

By completing this program, participants will master financial and valuation modeling, gaining a competitive edge in both interviews and their professional roles.

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/