*** Proof of Product ***

Exploring the Essential Features of “Budgeting and Forecasting – Tim Vipond – CFI Educatio”

This budgeting course covers the entire budgeting process from start to finish, including various methods for building budgets and forecasting results.

- Learn how to create a “budgeting culture” in your organization

- Analyze variances between budget and actual results

- Identify key areas to help improve your organization’s financial results

Overview

Recommended Prep Courses

These preparatory courses are optional, but we recommend you to complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:

- Accounting Fundamentals

- Excel Crash Course

Financial budgeting course description

This financial budgeting course will teach you about the entire budgeting process from start to finish, including how to create a disciplined culture of budgeting in your organization, the various methods for building budgets, techniques to analyze results, and how to increase the chances of organizational performance improvements.

This interactive and applied budgeting course enables participants to:

- Adopt a disciplined approach to developing budgets

- Forecast results with quantitative and qualitative methods

- Effectively use variance analysis to track performance

- Present results with charts and graphs

Who should take this budgeting class?

This online budgeting class is designed for those who are responsible for financial management, budgeting, and forecasting within their organizations. This may include professionals working in financial planning and analysis (FP&A), accounting, treasury, financial reporting, corporate development, etc.

What you will learn in this budgeting 101 course

By the end of this budgeting 101 class, participants are able to:

- Understand the principles behind best practice financial management

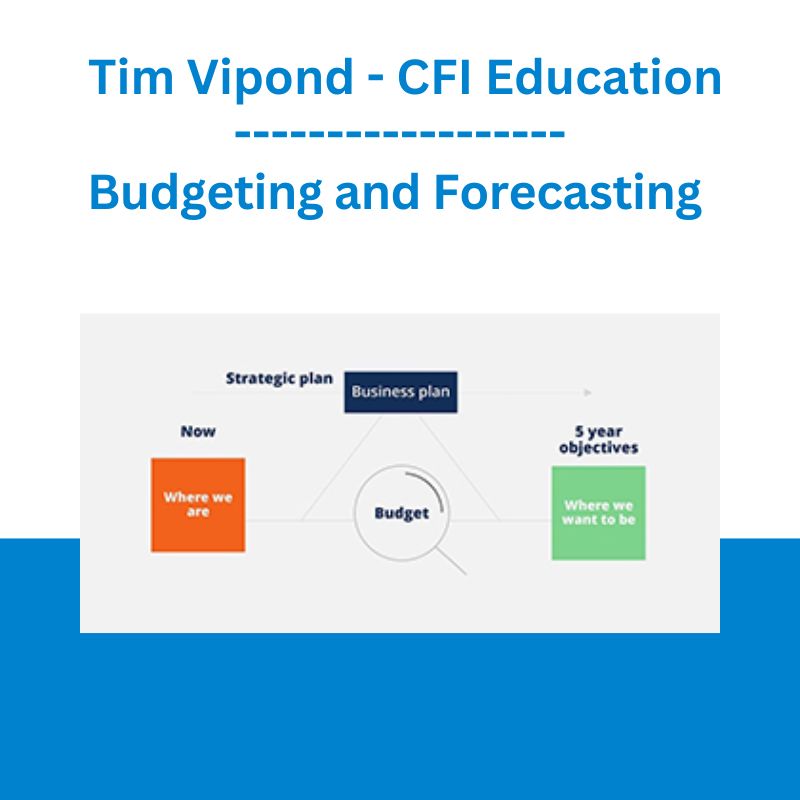

- Explain the importance of budgeting within a strategic framework

- Build a robust budgeting process within their organization

- Know when and where to use various budgeting approaches such as zero-based budgeting

- Forecast future performance by better analyzing revenue and cost drivers

- Use effective variance reporting to track organizational performance

- Make use of Excel functions and tools that are particularly suited to the budgeting process.

Financial budgeting class content

Topics covered will include:

- Budgeting within a strategic framework

- Building a robust budgeting process

- Managing budget psychology

- A practical guide to developing budgets

- Common budgeting approaches (e.g. Incremental, value-based, zero-based, etc.)

- Forecasting techniques (moving average, regression analysis, etc.)

- Tracking budget performance with variance analysis (waterfall charts, etc.)

- Applied budgeting tools and techniques (Excel, solver, pivot tables, etc.)

What you’ll learn

Introduction

Course introduction

Course learning objectives

Instructors

Download course presentation

Budgeting Within a Strategic Framework

Learning objectives

Barriers to strategy execution

Translating the strategy into a business plan

Interactive exercise 1

Balanced scorecards

Top reasons to budget

What to watch out for

Interactive exercise 2

Building a Robust Budgeting Process

Learning objectives

The master budget

3 categories of budgets

Interactive exercise 3

Manufacturing company example

Retail company example

Services company example

Where to start with budgeting

Steps in the budgeting process

Psychology and target setting

Top down vs. bottom up involvement

Interactive exercise 4

A Practical Guide to Developing Budgets

Learning objectives

4 approaches to budgeting

Incremental budgeting

Activity based budgeting

Value proposition budgeting

Zero based budgeting

Interactive exercise 5

Beyond budgeting

Forecasting Techniques

Learning objectives

Cost types

Modified cost types

Cost structure and earnings volatility

Cost structure exercise template

Cost analysis demonstration

Breakeven analysis and margin of safety demonstration

Sensitivity analysis with data table

Interactive exercise 6

Cost control matrix

Quantitative forecasting methods

Forecasting exercise template

Moving averages

Simple linear regression

Excel FORECAST function

Equation of a line regression

Multiple linear regression overview

Multiple regression Excel demonstration

Interpreting regression summary output

Using the multiple regression equation

Interactive exercise 7

PEST analysis

Porter’s 5 forces

Tracking Budget Performance with Variance Analysis

Learning objectives

What is variance analysis

Volume vs. price variance

Cost variance

Interactive exercise 8

Variance analysis exercise template

Variance analysis in Excel

Variance impact and waterfall chart data

Variance waterfall chart in Excel

Variance waterfall chart template

Root cause analysis

Presenting results of variance analysis

Interactive exercise 9

Applied Budgeting Tools and Techniques in Excel

Learning objectives

Budgeting tools exercise templates

Goal Seek tool in Excel

Solver tool in Excel

Consolidate function in Excel

Pivot tables overview

Setting up a pivot table in Excel

Beyond Excel

Interactive exercise 10

Conclusion

Conclusion and recap of objectives

Download appendices and bonus templates

Appendix models

Summary

Qualified Assessment

Qualified assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

The Daily Traders – Exclusive Trading Mentorship Group

The Daily Traders – Exclusive Trading Mentorship Group