*** Proof of Product ***

Exploring the Essential Features of “Convertible Bonds – Andrew Loo – CFI Education”

Enroll for a comprehensive overview of convertible bonds—a specialty area within capital markets that requires unique analysis and trading strategies.

- Understand the mechanics of convertible bonds

- Learn the unique math surrounding these instruments and their risk metrics

- Explore some of the common trading strategies of CBs

Overview

Convertible Bonds Course Overview

This course provides a comprehensive overview of convertible bonds. Students will learn convertible bonds’ benefits, risks, types, and issue processes. In addition, valuation methods will be discussed, including an Excel example for students to apply their learning.

Convertible Bonds Learning Objectives

By the end of this course, you will be able to:

- Understand what convertible bonds (CBs) are and their various structures

- Identify the buyers of CBs, as well as the benefits and risks of investing in CBs

- Comprehend the math of CBs and understand various Greeks

- Appreciate some methods used to trade CBs for arbitrage, hedging, and indexing

Who should take this course?

This Convertible Bonds course is perfect for students interested in learning about the fundamentals of convertible bonds. This course is essential for students pursuing a career in the capital markets since convertible bonds are a necessary type of convertible security issued by many firms and institutions.

What you’ll learn

Convertible Bond Basics

Course Introduction

Downloadable Files

Convertible Bonds Overview

Convertible Bond vs. Straight Bond

Convertible Bond Refinitiv Workspace Example

Conversion Price and Conversion Ratio

Parity Value

Interactive Exercise 1

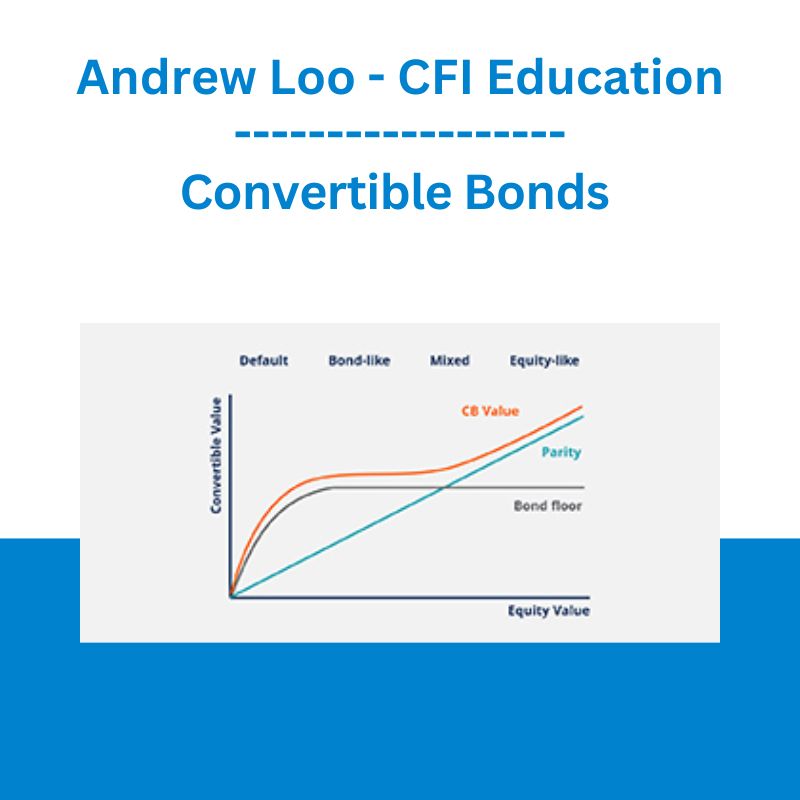

CB Value Diagram

CB vs. Share Price

Low, Medium, and High Premium

Interactive Exercise 2

CB Redemption

Types of CBs

Who Issues CBs and Why

The CB Market

Bank Capital

Interactive Exercise 3

CB Benefits

Who Invests in CBs and Why

Risks of CBs

How Are CBs Issued

Interactive Exercise 4

Midway Check-in

The Math of Convertible Bonds

Analyzing CBs Example

Analyzing CBs Example – Conversion Price and Conversion Ratio

Analyzing CBs Example – Parity and Conversion Premium

Analyzing CBs Example -Investment Value and Investment Premium

Analyzing CBs Example -Current Yield and Yield Advantage

Analyzing CBs Example – Break-Even Period and Break-Even Cash Flow

Trading Strategies

Bond Value Inputs and Option Value Inputs

Implied Volatility and Historical Volatility

How Options Are Priced

Delta and Gamma

Option Intrinsic and Extrinsic Values

Theta and Vega

Rho, Omicron, and Phi

Greek and BC Valuation Example

Interactive Exercise 5

Trading CBs

CB Indexes

CB Trading Strategy – Asset Swap

CB Trading Strategy – Arbitrage

Interactive Exercise 6

Course Summary

Qualified Assessment

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025

Crypto Dan - The Crypto Investing Blueprint To Financial Freedom By 2025  Ed Ponsi - Forex Trading

Ed Ponsi - Forex Trading  Sovereign Man Confidential - Renunciation Video

Sovereign Man Confidential - Renunciation Video