*** Proof of Product ***

Exploring the Essential Features of “Scott Powell – Account Monitoring and Warning Signs – CFI Education”

Account Monitoring and Warning Signs

Learn to spot emerging default risks and confidently handle corporate declines!

- Describe symptoms and causes of corporate decline

- Learn the drivers and models many lenders use for credit and default risk analysis

- Introduce strategies to address and recover from corporate declines

Overview

Account Monitoring and Warning Signs Overview

Looking to explore a career as a credit analyst? The Account Monitoring and Warning Signs course will teach you the symptoms and causes of corporate decline, how to predict the default risk for a company, different methods for handling problematic accounts (clients who are struggling to repay loans), and more.

This course starts with the warning signs for a company that is experiencing financial difficulties, as well as the typical symptoms and causes of corporate decline. It then dives into Altman’s Z-score and how it can be used to assess the credit risk of a company. Afterward, the default risk of a firm is predicted through different methods including options theory and the Expected Default Frequency (EDF) model. After assessing the likelihood of default, the course explores different strategies and tactics used to deal with deteriorating accounts, including the steps for developing an action plan and turning around a declining business.

This course is great for someone looking to enhance their ability to anticipate corporate decline, assess the credit risk of current companies, and understand how to implement strategies to improve a company’s weakening performance.

Account Monitoring and Warning Signs Learning Objectives

Upon completing this course, you will be able to:

- Identify and understand symptoms and causes of corporate decline

- Evaluate the drivers behind predicting default and credit risk

- Examine the various methods for handling problematic accounts

- Implement key turnaround strategies depending on the growth stage of the company

Who should take this course?

This Account Monitoring and Warning Signs course is perfect for any aspiring credit analyst working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.

What you’ll learn

Introduction

Introduction

Learning Objectives

Downloadable Files

Identifying Warning Signs

Annual Credit Review Process

Identifying Warning Signs

Most Common Warning Signs

Identifying Warning Signs Example Scenario

Interactive Exercise 1

Causes of Decline

Causes of Decline – Poor Management

Interactive Exercise 2

Financial Controls

Establishing Early Warning Signs for Corporate Clients

Interactive Exercise 3

Predictive Default Models

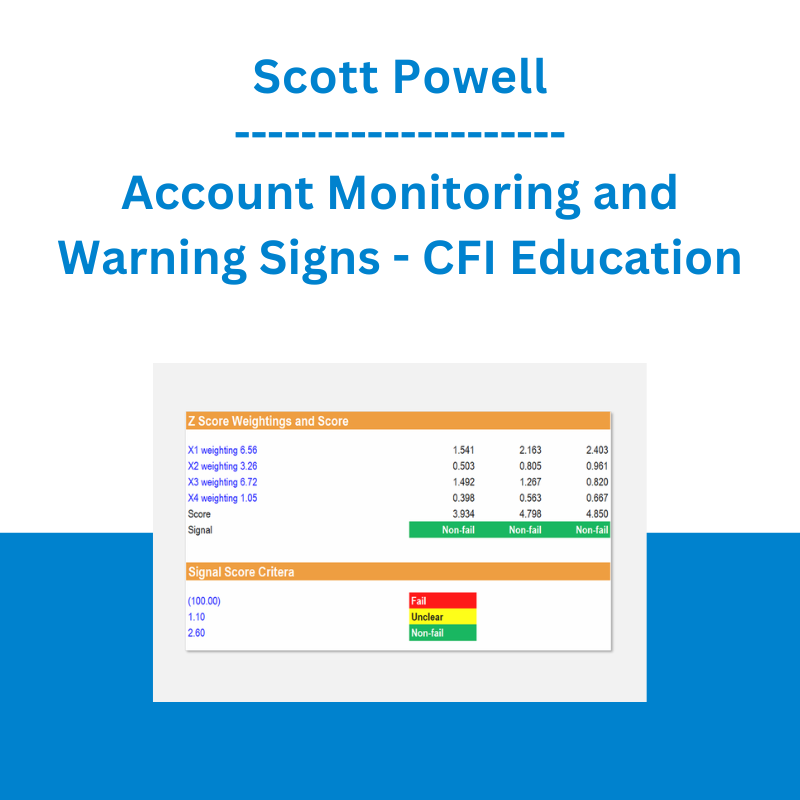

Altman’s Original Z-score Model

Z-score Variants

Interactive Exercise 4

Z-score Excel Calculation

Download Completed Z-score Model

The EDF Model Assumptions

The EDF Model Calculations

How Useful Is the EDF Model

Interactive Exercise 5

Dealing with Problem Accounts

Financial Statement Analysis

Cash Flows Analysis

Management Analysis

Interactive Exercise 6

What If You Can’t Resolve a Problem Account

Company Recovery Strategies

Turnaround Recovery Strategies

Interactive Exercise 7

Summary

Summary

Qualified Assessment

Qualified Assessment

Please see the full list of alternative group-buy courses available here: https://lunacourse.com/shop/

Paul van Loon - Classification - Fundamentals & Practical Applications - CFI Education

Paul van Loon - Classification - Fundamentals & Practical Applications - CFI Education  Money Miracle - George Angell - Use Other Peoples Money To Make You Rich

Money Miracle - George Angell - Use Other Peoples Money To Make You Rich  Emanuele Bonanni - My Trading Way

Emanuele Bonanni - My Trading Way